Earnings summaries and quarterly performance for OLIN.

Executive leadership at OLIN.

Kenneth T. Lane

President and Chief Executive Officer

Angela M. Castle

Vice President, Chief Legal Officer

Brett A. Flaugher

Vice President and President, Winchester

Deon A. Carter

Vice President and President, Chlor Alkali Products and Vinyls

Florian J. Kohl

Vice President and President, Epoxy & International

Randee N. Sumner

Vice President and Controller

Teresa M. Vermillion

Vice President and Treasurer

Todd A. Slater

Senior Vice President and Chief Financial Officer

Board of directors at OLIN.

Research analysts who have asked questions during OLIN earnings calls.

Aleksey Yefremov

KeyBanc Capital Markets

8 questions for OLN

Arun Viswanathan

RBC Capital Markets

8 questions for OLN

David Begleiter

Deutsche Bank

8 questions for OLN

Frank Mitsch

Fermium Research

8 questions for OLN

Hassan Ahmed

Alembic Global Advisors

8 questions for OLN

John Ezekiel Roberts

Mizuho Securities

8 questions for OLN

Kevin McCarthy

Vertical Research Partners

8 questions for OLN

Patrick Cunningham

Citigroup

8 questions for OLN

Peter Osterland

Truist Securities

7 questions for OLN

Jeffrey Zekauskas

JPMorgan Chase & Co.

6 questions for OLN

Josh Spector

UBS Group

5 questions for OLN

Matthew Blair

Tudor, Pickering, Holt & Co.

5 questions for OLN

Vincent Andrews

Morgan Stanley

5 questions for OLN

Michael Sison

Wells Fargo

4 questions for OLN

Mike Sison

Wells Fargo

4 questions for OLN

Bhavesh Lodaya

BMO Capital Markets

3 questions for OLN

Steve Byrne

Bank of America

3 questions for OLN

Jeff Zekauskas

JPMorgan

2 questions for OLN

Joshua Spector

UBS

2 questions for OLN

Matthew Boyer

PPH

2 questions for OLN

Matthew Deyoe

Bank of America

2 questions for OLN

Michael Leithead

Barclays

2 questions for OLN

Patrick Fischer

Goldman Sachs

2 questions for OLN

Roger Smith

Bank of America

2 questions for OLN

Salvator Tiano

Bank of America

2 questions for OLN

Christopher Perrella

UBS Group AG

1 question for OLN

Duffy Fischer

Goldman Sachs

1 question for OLN

Roger Spitz

Bank of America

1 question for OLN

Recent press releases and 8-K filings for OLN.

- Olin Corporation will record a one-time, pre-tax charge of $75 million in the fourth quarter 2025 following an unfavorable verdict in the Shintech v. Olin litigation.

- This charge will be reflected in the December 31, 2025 consolidated financial statements, but fourth quarter 2025 adjusted EBITDA will exclude this non-recurring charge.

- The company expects to pay approximately $185 million, including previously accrued reserves, during the first half of 2026 related to this legal matter.

- Olin Corporation announced a jury verdict on February 10, 2026, in favor of Shintech Incorporated in a litigation matter concerning a pricing dispute and a force majeure event.

- As a result of the verdict, Olin will record a one-time, pre-tax charge of $75 million in the fourth quarter 2025, which will be reflected in its December 31, 2025 consolidated financial statements.

- The company expects to pay approximately $185 million, including previously accrued reserves, during the first half of 2026 related to this matter.

- Olin generated $321 million of operating cash flow in Q4 2025 and held net debt flat compared to year-end 2024.

- The company delivered $44 million in structural cost savings in 2025 and anticipates an additional $100 million to $120 million of annual Beyond250 savings in 2026, expecting to exceed its $250 million savings commitment.

- For Q1 2026, Olin expects lower earnings sequentially compared to Q4 2025, primarily due to seasonally weaker demand, higher costs in the CAPV business, and increased turnaround expenses, including a major VCM turnaround.

- Olin projects 2026 to be an essentially cash-free tax year, with a potential range of plus or minus $20 million, a significant improvement from the $167 million spent in cash taxes in 2025.

- The Epoxy business is expected to see sequentially higher results in Q1 2026 and become EBITDA positive for the full year 2026, while the Winchester business experienced significant growth in military revenue in 2025, which is expected to continue in 2026.

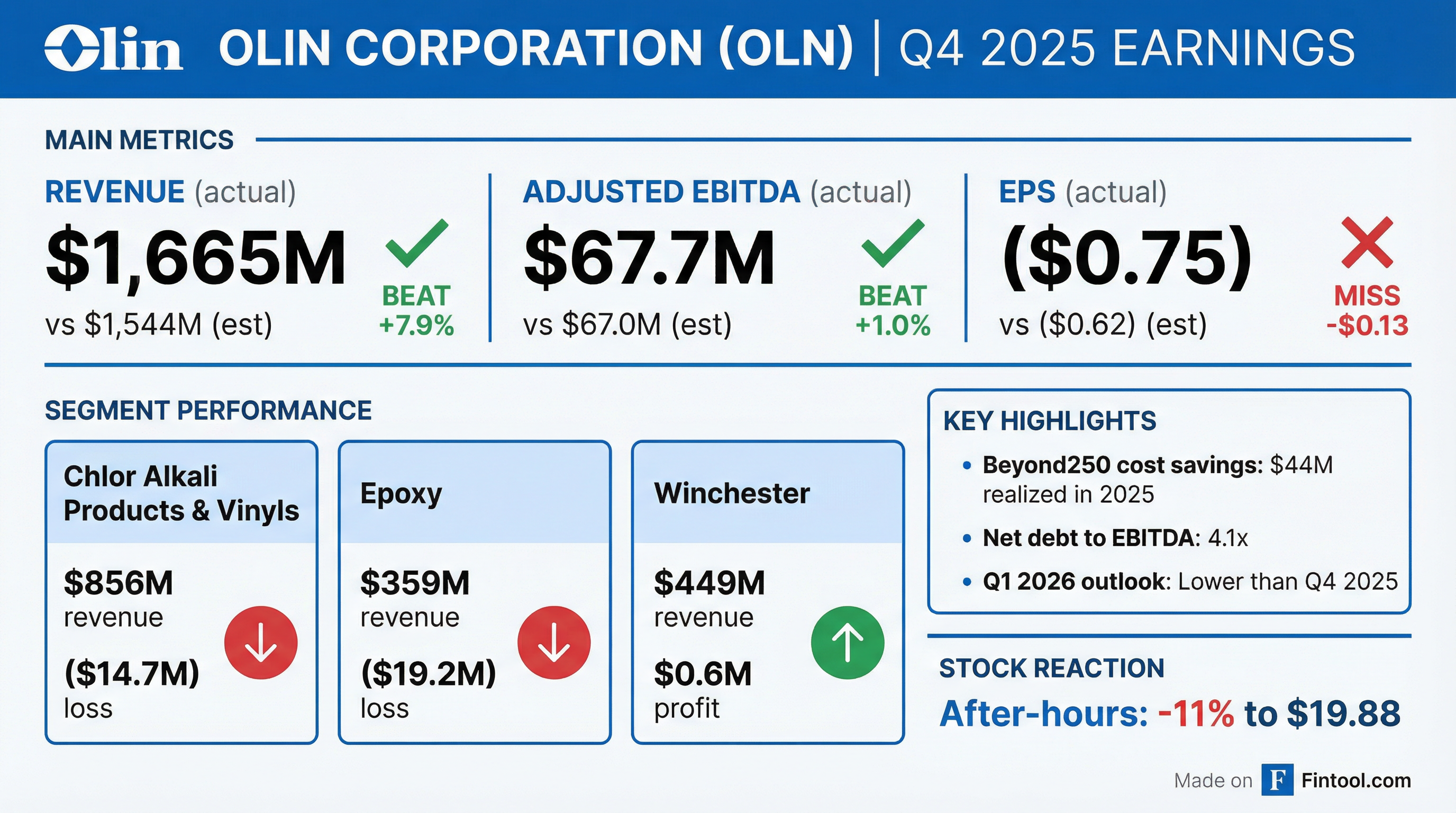

- Olin reported Adjusted EBITDA of $67.7 million for Q4 2025 and $651.8 million for the full year 2025.

- The company generated $321 million of operating cash flow in Q4 2025, maintaining net debt flat year-over-year at $2,659.7 million.

- For Q1 2026, Olin anticipates Adjusted EBITDA to be lower than Q4 2025, citing continued seasonally weak demand and higher raw material and turnaround costs.

- In 2025, Olin's capital spending was $226 million, with $51 million in stock repurchases, and 2026 capital spending is forecast at ~$200 million.

- Olin's Q4 2025 earnings were significantly below expectations due to operational issues, raw material constraints, and a sharp decline in chlorine pipeline demand. Despite these challenges, the company generated $321 million in operating cash flow and held net debt flat compared to year-end 2024.

- The company anticipates Q1 2026 earnings to be lower than Q4 2025, primarily driven by continued seasonally weaker demand and higher costs in its Chloralkali Products and Vinyls (CAPV) business, including impacts from Winter Storm Fern and increased turnaround expenses.

- Olin is advancing its Beyond250 structural cost reduction program, delivering $44 million in savings in 2025 and projecting an additional $100 million-$120 million in annual savings for 2026. This includes $10 million in annual structural savings from the closure of its Brazil Epoxy plant and $40 million-$50 million in savings from a new supply agreement at its Stade, Germany, site.

- For 2026, Olin expects to be a cash-free tax year (\u00b1$20 million) due to clean hydrogen production tax credit refunds and plans approximately $200 million in capital spending, with any remaining excess cash flow prioritized for debt reduction.

- Olin's fourth quarter 2025 results were significantly below expectations due to operational issues related to an extended turnaround of its Freeport, Texas, chlorinated organics asset, third-party raw material supply constraints, and a sharp decline in chlorine pipeline demand.

- The company generated $321 million of operating cash flow in Q4 2025, holding net debt flat compared to year-end 2024, and delivered $44 million in structural cost savings in 2025, with an additional $100 million-$120 million expected in 2026.

- Q1 2026 earnings are projected to be lower than Q4 2025 due to continued seasonally weaker demand, higher costs in the CAPV business, impacts from Winter Storm Fern, and a VCM turnaround.

- Olin anticipates 2026 to be an essentially cash-free tax year (±$20 million) due to refunds from clean hydrogen production tax credits and plans approximately $200 million in capital spending.

- A long-term EDC supply agreement with Braskem was announced, which is expected to provide higher value for Olin's EDC and lead to a meaningful increase in caustic sales into Latin America in 2026.

- Olin Corporation reported a net loss of ($85.7) million, or ($0.75) per diluted share, for Q4 2025, compared to net income of $10.7 million or $0.09 per diluted share in Q4 2024. For the full year 2025, the company recorded a net loss of ($42.8) million, or ($0.37) per diluted share.

- Adjusted EBITDA for Q4 2025 was $67.7 million, a decrease from $193.4 million in Q4 2024. Full year 2025 Adjusted EBITDA was $651.8 million. This performance was impacted by a trough market environment, customer destocking, and operational challenges.

- The company generated $321.2 million of operating cash flow in Q4 2025 and ended the year with net debt comparable to year-end 2024 at approximately $2.7 billion. The Net Debt to Adjusted EBITDA ratio stood at 4.1 times as of December 31, 2025.

- Olin repurchased approximately 0.5 million shares of common stock at a cost of $10.1 million during Q4 2025, contributing to a total of 2.2 million shares repurchased for $50.5 million in full year 2025. Approximately $1.9 billion remains available under share repurchase authorizations.

- For Q1 2026, Olin anticipates overall adjusted EBITDA to be lower than Q4 2025 levels, primarily due to sequentially higher planned maintenance turnaround costs and increased raw material costs in its Chemicals businesses.

- Olin Corporation reported a net loss of ($85.7) million, or ($0.75) per diluted share, for the fourth quarter ended December 31, 2025, compared to net income in the prior year period. The full year 2025 also resulted in a net loss of ($42.8) million, or ($0.37) per diluted share.

- Adjusted EBITDA for Q4 2025 was $67.7 million, a significant decrease from $193.4 million in Q4 2024, with sales of $1,665.1 million.

- The company ended 2025 with net debt of approximately $2.7 billion, comparable to year-end 2024, and $1.0 billion in available liquidity. Olin generated $321.2 million of operating cash flow in Q4 2025.

- For the first quarter of 2026, Olin expects adjusted EBITDA to be lower than Q4 2025 levels, primarily due to anticipated higher planned maintenance turnaround costs and increased raw material costs in its Chemicals businesses.

- Olin Corporation has updated its outlook for the fourth quarter of 2025, now expecting adjusted EBITDA to be approximately $67 million.

- This revised outlook is significantly lower than the previous expectation of $110 to $130 million.

- The earnings shortfall is primarily attributed to the Chlor Alkali Products and Vinyls business, due to an extended planned maintenance turnaround, unplanned downtime at its Freeport, Texas operations, and lower-than-expected pipeline chlorine demand.

- Olin Corporation (NYSE: OLN) has updated its outlook for fourth quarter 2025, now expecting adjusted EBITDA to be approximately $67 million.

- This revised outlook is significantly lower than the previous expectation of $110 to $130 million.

- The earnings shortfall is primarily due to an extended planned maintenance turnaround, unplanned downtime at the Freeport, Texas operations, and lower-than-expected pipeline chlorine demand within the Chlor Alkali Products and Vinyls business.

- The Freeport, Texas site has since returned to normal operations.

Quarterly earnings call transcripts for OLIN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more