Earnings summaries and quarterly performance for Paymentus Holdings.

Executive leadership at Paymentus Holdings.

Board of directors at Paymentus Holdings.

Research analysts who have asked questions during Paymentus Holdings earnings calls.

Darrin Peller

Wolfe Research, LLC

5 questions for PAY

David Koning

Robert W. Baird & Co.

4 questions for PAY

John Davis

Raymond James Financial

4 questions for PAY

Tien-tsin Huang

JPMorgan Chase & Co.

4 questions for PAY

Matthew O'Neill

Financial Technology Partners

3 questions for PAY

Andrew Bauch

Wells Fargo & Company

2 questions for PAY

Craig Maurer

FT Partners

2 questions for PAY

Madison Suhr

Raymond James

2 questions for PAY

Will Nance

Goldman Sachs

2 questions for PAY

Andrew Bauchwitz

JPMorgan Chase & Co.

1 question for PAY

Andrew Polkowitz

J.P. Morgan

1 question for PAY

Lemar Clarke

Wells Fargo & Company

1 question for PAY

William Nance

The Goldman Sachs Group, Inc.

1 question for PAY

Zachary Gunn

Financial Technology Partners

1 question for PAY

Recent press releases and 8-K filings for PAY.

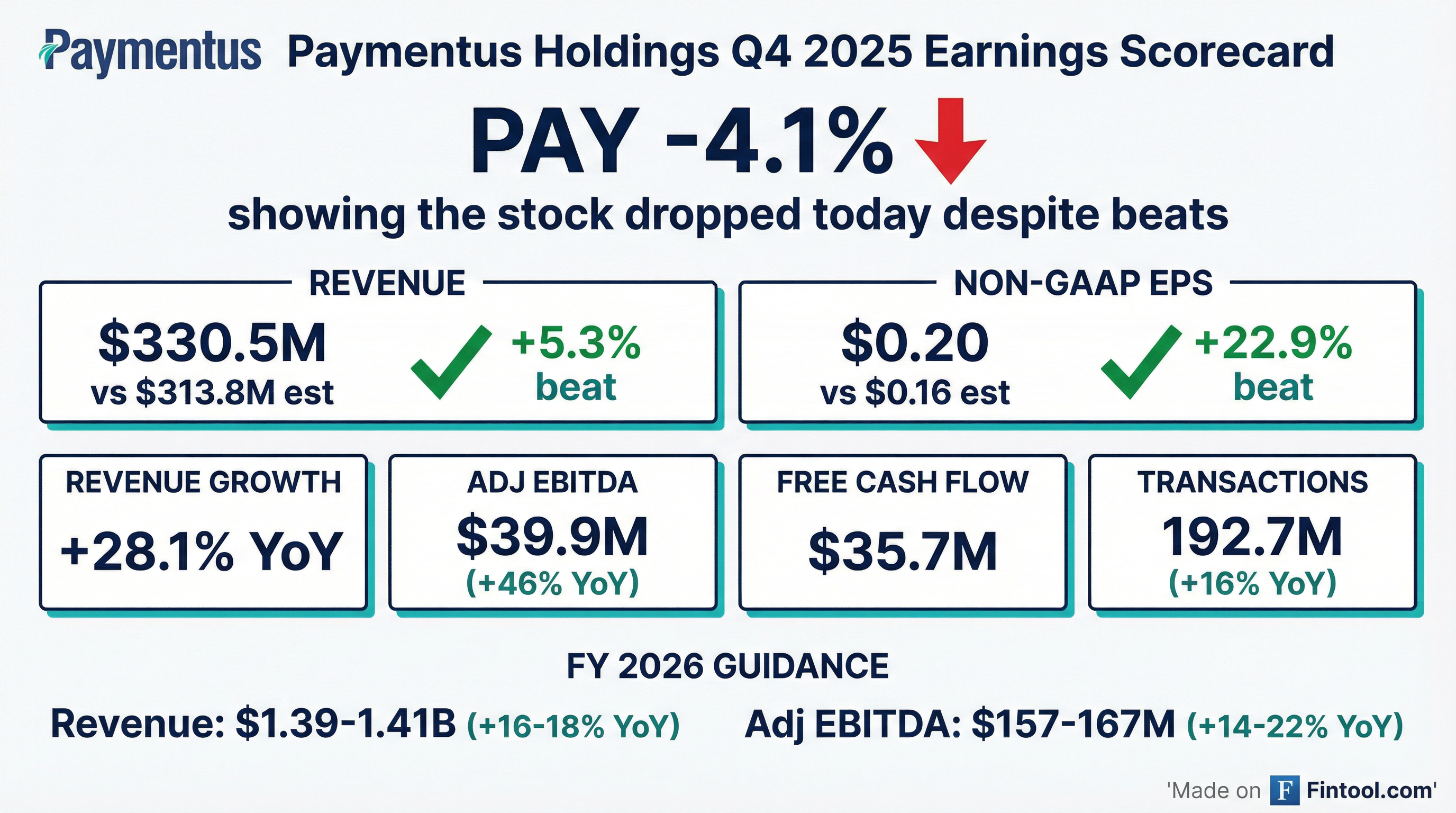

- Paymentus Holdings reported strong financial results for Q4 and full year 2025, with full-year revenue reaching $1.2 billion, a 37.3% year-over-year increase, and adjusted EBITDA of $137.4 million, up 45.9% year-over-year.

- The company provided full-year 2026 revenue guidance in the range of $1.39 billion to $1.41 billion and adjusted EBITDA guidance between $157 million and $167 million.

- Paymentus ended 2025 with a record $324.5 million in total cash and no debt, supported by $125 million in free cash flow generated during the year.

- This strong performance was attributed to the successful launch of new billers, increased same-store sales, and a growing mix of large enterprise customers, contributing to strong bookings and backlog for 2026.

- Paymentus Holdings reported strong financial results for Q4 and full-year 2025, with Q4 revenue reaching $330.5 million (up 28.1% year-over-year) and full-year revenue exceeding $1.2 billion (up 37.3% year-over-year).

- The company achieved record profitability, with Q4 Adjusted EBITDA of $39.9 million (up 46.3% year-over-year) and full-year Adjusted EBITDA of $137.4 million (up 45.9% year-over-year).

- This performance was driven by the successful launch of new large enterprise billers and increased same-store sales, resulting in a higher average price and contribution profit per transaction.

- For 2026, Paymentus provided revenue guidance of $1.39 billion to $1.41 billion and Adjusted EBITDA guidance of $157 million to $167 million, indicating continued growth momentum supported by a strong backlog and pipeline.

- Paymentus Holdings reported strong financial results for Q4 2025, with revenue of $330.5 million , a 28.1% year-over-year increase , and non-GAAP diluted EPS of $0.20 , up 53.8%.

- For full-year 2025, the company achieved revenue of $1,196.5 million, representing 37.3% year-over-year growth , and Adjusted EBITDA of $137.4 million, a 45.9% increase.

- The company provided Q1 2026 revenue guidance of $330 million to $340 million and full-year 2026 revenue guidance of $1,390 million to $1,410 million.

- Paymentus Holdings ended Q4 2025 with a strong balance sheet, including $324.5 million in cash and cash equivalents and no debt.

- Paymentus reported a record full year 2025 revenue of $1.2 billion, marking a 37.3% year-over-year increase, with Q4 2025 revenue at $330.5 million, up 28.1% year-over-year.

- The company achieved $137.4 million in Adjusted EBITDA for full year 2025, a 45.9% year-over-year growth, and generated $125 million in free cash flow, ending the year with over $320 million in cash and no debt.

- For full year 2026, Paymentus forecasts revenue between $1.39 billion and $1.41 billion and Adjusted EBITDA in the range of $157 million to $167 million.

- Management highlighted quadrupling the business in the last five years and views AI as a significant opportunity for continued disruption and innovation, despite already being a "large-scale billion-dollar company".

- Paymentus reported strong fourth-quarter results, with revenue of approximately $330.5 million, an increase of 28.1% year-over-year, and adjusted non-GAAP EPS of $0.20, which was 22.9% above analysts' consensus.

- The company's contribution profit rose 24.0% and adjusted EBITDA climbed 46.3% year-over-year.

- Management guided Q1 revenue to approximately $335 million, about 0.7% above analysts' estimates.

- A substantial backlog provides clear visibility into 2026, with analysts noting a 31.7% five-year revenue CAGR, underscoring sustained demand for its cloud bill-pay platform.

- Paymentus Holdings, Inc. reported fourth quarter 2025 revenue of $330.5 million, an increase of 28.1% year-over-year, with contribution profit of $106.9 million, up 24.0%, and Adjusted EBITDA of $39.9 million, a 46.3% increase.

- For the full year 2025, revenue reached $1,196.5 million, growing 37.3% year-over-year, with contribution profit at $386.3 million, up 23.8%, and Adjusted EBITDA at $137.4 million, an increase of 45.9%.

- The company processed 192.7 million transactions in Q4 2025, up 16.1% year-over-year, and 724.0 million transactions for the full year 2025, an increase of 21.3% year-over-year.

- Paymentus provided financial guidance for Q1 2026, projecting revenue between $330 million and $340 million, contribution profit between $103 million and $105 million, and Adjusted EBITDA between $36 million and $38 million.

- For fiscal year 2026, the company expects revenue in the range of $1,390 million to $1,410 million, contribution profit between $442 million and $452 million, and Adjusted EBITDA between $157 million and $167 million.

- Paymentus Holdings reported strong financial results for Q4 and Full Year 2025, with Q4 revenue reaching a record $330.5 million, up 28.1% year-over-year, and full year revenue of $1,196.5 million, an increase of 37.3% year-over-year.

- For Q4 2025, diluted GAAP earnings per share was $0.16 and diluted non-GAAP earnings per share was $0.20. For the full year 2025, diluted GAAP earnings per share was $0.52 and diluted non-GAAP earnings per share was $0.66.

- Adjusted EBITDA increased by 46.3% year-over-year to $39.9 million in Q4 2025 and by 45.9% to $137.4 million for the full year 2025.

- The company provided financial guidance for Q1 2026, projecting revenue between $330 million and $340 million, and for Fiscal Year 2026, projecting revenue between $1,390 million and $1,410 million.

- Paymentus is experiencing 35%+ gross revenue growth and over 40% EBITDA growth this year, driven by its scalable platform and strategy.

- The company has diversified beyond utilities into new verticals like government, insurance, and property management, and sees B2B as a significant new TAM expansion opportunity.

- Paymentus aims for a long-term compound annual growth rate (CAGR) of 20% for top-line revenue and 20%-30% for bottom-line EBITDA, with current EBITDA margins around 35%. The company generates strong free cash flow, exceeding $100 million in the last 12 months with approximately 140% conversion, and prioritizes organic growth and potential M&A.

- Despite its current success, Paymentus holds only about 4%-5% market share in the traditional C2B bill pay market, indicating significant future growth potential.

- Paymentus (PAY) is on track for 35%+ gross revenue growth and over 40% EBITDA growth this year, attributing its success to a highly scalable platform and strategic market penetration.

- The company has expanded its market reach beyond utilities into new verticals like government, insurance, and B2B, with B2B representing a multifold larger market opportunity ,.

- Financially, Paymentus has improved its EBITDA margins to approximately 35% (from 30% in 2024) and aims for a long-term 20% top-line CAGR and 20%-30% bottom-line CAGR ,.

- The business demonstrates strong operational efficiency, evidenced by faster implementation times for large clients and over $100 million in free cash flow generated in the last 12 months with a 140% conversion rate.

- Paymentus attributes its 35%+ gross revenue growth and over 40% EBITDA growth to its scalable platform and strategy, enabling it to serve diverse customers and verticals.

- The company has successfully diversified beyond utilities into sectors like government, insurance, and property management, and is now expanding into B2B, which represents a significant Total Addressable Market (TAM) expansion opportunity.

- Paymentus maintains a long-term CAGR of 20% for top-line growth and 20%-30% for bottom-line growth, driven by new customer implementations and growth within existing customers.

- The business demonstrates strong operating leverage, with EBITDA margins around 35% and incremental EBITDA margins over 60% in the last quarter, generating over $100 million in free cash flow in the last 12 months.

- Management prioritizes organic growth and maintaining a strong balance sheet, considering M&A if accretive, but share buybacks are not currently on the cards.

Quarterly earnings call transcripts for Paymentus Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more