Earnings summaries and quarterly performance for Polaris.

Executive leadership at Polaris.

Michael T. Speetzen

Chief Executive Officer

James Williams

Senior Vice President – Chief Human Resources Officer

Mike Dougherty

President – On Road and International

Robert Mack

Chief Financial Officer and Executive Vice President – Finance and Corporate Development

Board of directors at Polaris.

Bernd F. Kessler

Director

Darryl R. Jackson

Director

Gary E. Hendrickson

Director

George W. Bilicic

Director

Gwenne A. Henricks

Director

Gwynne E. Shotwell

Director

John P. Wiehoff

Chair of the Board

Kevin M. Farr

Director

Lawrence D. Kingsley

Director

Research analysts who have asked questions during Polaris earnings calls.

Craig Kennison

Robert W. Baird & Co. Incorporated

7 questions for PII

Joseph Altobello

Raymond James & Associates, Inc.

7 questions for PII

Noah Zatzkin

KeyBanc Capital Markets

7 questions for PII

Tristan Thomas-Martin

BMO Capital Markets

7 questions for PII

James Hardiman

Citigroup

5 questions for PII

Robin Farley

UBS

5 questions for PII

Alexander Perry

Bank of America

3 questions for PII

Scott Stember

ROTH MKM

3 questions for PII

Sean Wagner

Citigroup

3 questions for PII

Frederick Wightman

Wolfe Research, LLC

2 questions for PII

Garrick Johnson

Seaport Research Partners

2 questions for PII

Alice Wycklendt

Robert W. Baird & Co.

1 question for PII

Arthur Nagorny

RBC Capital Markets

1 question for PII

Artina

UBS

1 question for PII

Joe Altobello

Raymond James

1 question for PII

Joe Nolan

Longbow Research

1 question for PII

Joseph Nolan

Longbow Research

1 question for PII

Megan Alexander

Morgan Stanley

1 question for PII

Megan Christine Alexander

Morgan Stanley

1 question for PII

Megan Clapp

Morgan Stanley

1 question for PII

Sabahat Khan

RBC Capital Markets

1 question for PII

Stephen McGregor

David McGregor

1 question for PII

Recent press releases and 8-K filings for PII.

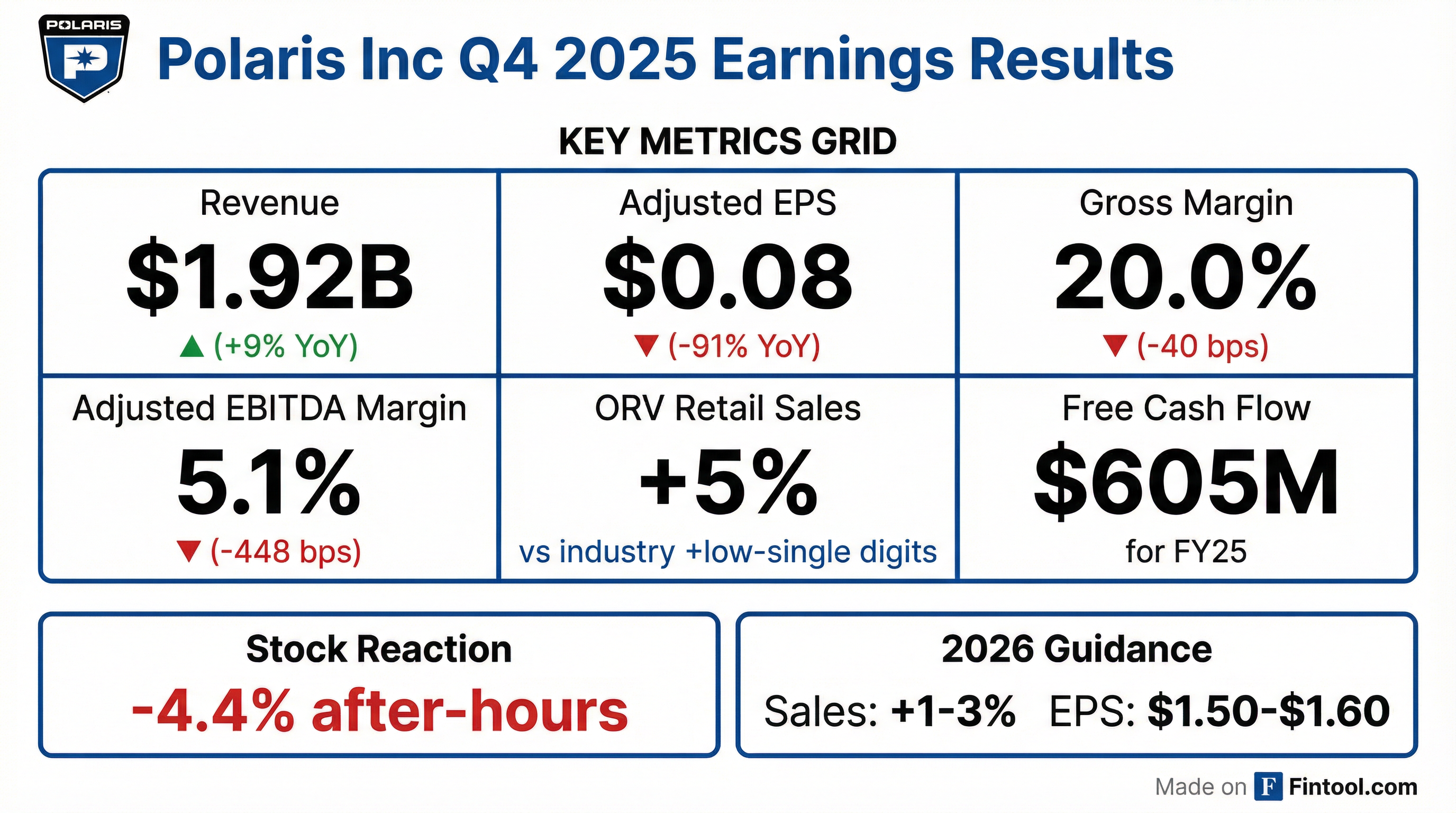

- Polaris Inc. reported Q4 2025 adjusted sales of $1,921 million, up 9% year-over-year, with full-year 2025 adjusted sales flat at $7,143 million. Adjusted EPS for Q4 2025 was $0.08, and ($0.01) for the full year.

- The company gained market share in ORV, Snow, and Marine in Q4 2025 and across all segments for the full year, while navigating $82 million in new tariffs for FY 2025 and realizing over $60 million in operational benefits.

- The Indian Motorcycle separation is on track to close by the end of Q1 2026. Polaris also reduced China spend by over $100 million in 2025 and aims to reduce COGS from China to under 5% by year-end 2027.

- For FY 2026, Polaris expects sales of $7.2 billion to $7.4 billion (up 1% to 3%) and adjusted EPS between $1.50 and $1.60, anticipating a ~$90 million tariff headwind.

- Polaris reported Q4 2025 adjusted sales growth of 9% and North American retail growth of 9% (excluding youth) , despite a $37 million impact from tariffs on adjusted gross margin , resulting in an Adjusted EPS of approximately $0.08.

- For the full year 2025, the company achieved share gains in all segments , generated $605 million in free cash flow , and reduced China-based spend to approximately 14% of material cost of goods sold, targeting below 5% by year-end 2027.

- The separation of Indian Motorcycle is on track to close by the end of Q1 2026 , which is expected to provide a $0.75 to $0.80 Adjusted EPS benefit in 2026.

- Polaris issued full year 2026 guidance, expecting total company sales growth of 1%-3% (or 7%-9% organic sales growth excluding Indian Motorcycle) and Adjusted EBITDA margin expansion of 80-120 basis points, despite an anticipated $90 million in incremental tariffs.

- Dealer inventory is considered healthy at just under 100 days of inventory on hand , with the company planning to align build, shipments, and retail in 2026, anticipating continued strength in utility segments while recreational demand remains pressured by macro factors.

- Polaris (PII) reported Q4 2025 sales growth of 9% and Adjusted EPS of $0.08, despite incurring $37 million in tariff costs during the quarter.

- The separation of Indian Motorcycle is on track to close by the end of Q1 2026, expected to be immediately accretive to EBITDA margins and adjusted EPS, contributing an estimated $0.75 to $0.80 to Adjusted EPS in 2026.

- For full year 2026, Polaris projects total company sales growth of 1%-3% (or 7%-9% organic sales growth excluding Indian Motorcycle) and an 80-120 basis point expansion in Adjusted EBITDA margin, even with an anticipated $90 million in incremental tariffs.

- The company generated $605 million in free cash flow for full year 2025, reduced $530 million of debt, and achieved over $60 million in manufacturing savings and a $25 million reduction in warranty expense.

- Polaris Inc. (PII) reported a 9% increase in sales for Q4 2025, with North American retail also up 9% excluding youth, and an Adjusted EPS of approximately $0.08.

- For the full year 2025, the company generated $605 million in free cash flow and reduced debt by approximately $530 million.

- The separation of Indian Motorcycle is anticipated to close by the end of Q1 2026, projected to be immediately accretive to EBITDA margins and Adjusted EPS, contributing an estimated $0.75 to $0.80 to Adjusted EPS in 2026.

- Polaris Inc. forecasts 2026 total company sales growth of 1%-3% (or 7%-9% organic growth excluding Indian Motorcycle) and Adjusted EPS between $1.50 and $1.60.

- The company is reducing China-based spend from 14% in 2025 to below 5% by year-end 2027, while anticipating approximately $90 million in incremental tariffs for 2026.

- Polaris Inc. reported full year 2025 sales of $7,152 million, which were approximately flat compared to the previous year, and fourth quarter 2025 sales of $1,922 million, an increase of nine percent year-over-year.

- For Q4 2025, the company reported a diluted loss per share of $5.34, with an adjusted diluted net income per share of $0.08. For the full year 2025, the reported diluted loss per share was $8.18, and the adjusted diluted net loss per share was $0.01.

- Fourth quarter sales growth was primarily driven by higher shipments and a favorable mix within off-road vehicles (ORV), partially offset by lower net price. Polaris also gained market share in all segments for full-year 2025.

- Operating expenses in Q4 2025 significantly increased to $724.0 million, largely due to $288 million in charges associated with the Indian Motorcycle business being classified as held for sale and $54 million in non-cash impairment charges related to Off Road segment intangible assets.

- The company provided full year 2026 guidance, expecting sales to be up one to three percent versus 2025 and adjusted diluted EPS to be between $1.50 and $1.60.

- Windward Bio AG announced a licensing agreement with Qyuns Therapeutics for WIN027, a bispecific antibody targeting TSLP and IL-13, which is currently in Phase 1.

- The total deal value is up to $700 million, including upfront payment, equity, and milestones, for exclusive development, manufacturing, and commercialization rights outside of China.

- WIN027 is designed to provide enhanced efficacy and convenience for respiratory and dermatology diseases, deepening Windward Bio's immunology pipeline.

- This marks the second licensing deal for Windward Bio in 2025, complementing their lead program WIN378, a long-acting anti-TSLP monoclonal antibody currently in a global Phase 2 trial for asthma.

Polaris Inc. issued Senior Notes due 2031 on November 13, 2025, pursuant to an underwriting agreement dated November 5, 2025. The key terms of the notes are as follows:

| Metric | Q3 2025 |

|---|---|

| Principal Amount ($USD) | $500,000,000 |

| Coupon (Interest Rate) (%) | 5.600% |

| Maturity Date | March 1, 2031 |

| Yield to Maturity (%) | 5.615% |

| Price to Public (%) | 99.941% |

- The interest rate on the Notes is subject to adjustments based on credit rating downgrades by Moody's or S&P, with a maximum total increase of 2.00% above the initial interest rate.

- BofA Securities, Inc., Wells Fargo Securities, LLC, MUFG Securities Americas Inc., and U.S. Bancorp Investments, Inc. acted as representatives of the underwriters for the offering.

- Polaris Inc. announced the pricing of an underwritten public offering of $500 million aggregate principal amount of its 5.600% senior notes due 2031.

- The sale of the notes is expected to close on November 13, 2025.

- Polaris intends to use the net proceeds from the offering to repay its incremental term loan facility in full, with any remaining proceeds for general corporate purposes, including potential repayment of its revolving loan facility.

- Halcones Precious Metals Corp. has initiated a legal process in Chile to secure surface access for diamond drilling at its Polaris Project after nine months of unsuccessful negotiations with surface rights holders.

- The company has extended key deadlines for the Polaris Project, pushing the completion of 2,000 meters of drilling to October 23, 2026, and a NI 43-101 compliant mineral resource estimate to October 23, 2028.

- The Polaris Project is described as a large, highly prospective gold project in Northern Chile, with extensive gold mineralization identified in surface bedrock over a 3.9 km strike length and select assays up to 55 g/t Au.

- Polaris reported Q3 2025 sales of $1,838 million, a 7% year-over-year increase, with adjusted EPS of $0.41. The adjusted EBITDA margin was 7.6%, a 160 basis point decrease year-over-year.

- North America retail sales grew 9% year-over-year, and Polaris gained approximately 3 points of market share in Off Road. Dealer inventory is now aligned with demand, being 21% lower year-over-year.

- New tariffs impacted Q3 2025 by $35 million. The estimated new full-year 2025 tariff P&L impact is ~$90 million, with ~$40 million anticipated in Q4 2025.

- For FY 2025, adjusted sales are projected to be $6.9 billion to $7.1 billion, and adjusted EPS is expected to be approximately ($0.05). The company also announced the sale of Indian Motorcycle, with the transaction expected to close in Q1 2026.

- Polaris generated $142 million in Free Cash Flow during Q3 2025.

Quarterly earnings call transcripts for Polaris.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more