Earnings summaries and quarterly performance for QUINSTREET.

Executive leadership at QUINSTREET.

Board of directors at QUINSTREET.

Research analysts who have asked questions during QUINSTREET earnings calls.

Patrick Sholl

Barrington Research

6 questions for QNST

Eric Martinuzzi

Lake Street Capital Markets

4 questions for QNST

Jason Kreyer

Craig-Hallum Capital Group LLC

4 questions for QNST

Zach Cummins

B. Riley Securities

4 questions for QNST

Cal Bartyzal

Craig-Hallum Capital Group LLC

2 questions for QNST

John Campbell

Stephens Inc.

2 questions for QNST

Joichi Sakai

Singular Research

2 questions for QNST

Zachary Cummins

B. Riley

2 questions for QNST

Chris Sakai

Singular Research

1 question for QNST

Christopher Sakai

Singular Research

1 question for QNST

Elle Niebuhr

Lake Street Capital Markets

1 question for QNST

Oscar Nieves Santana

Stephens Inc.

1 question for QNST

Recent press releases and 8-K filings for QNST.

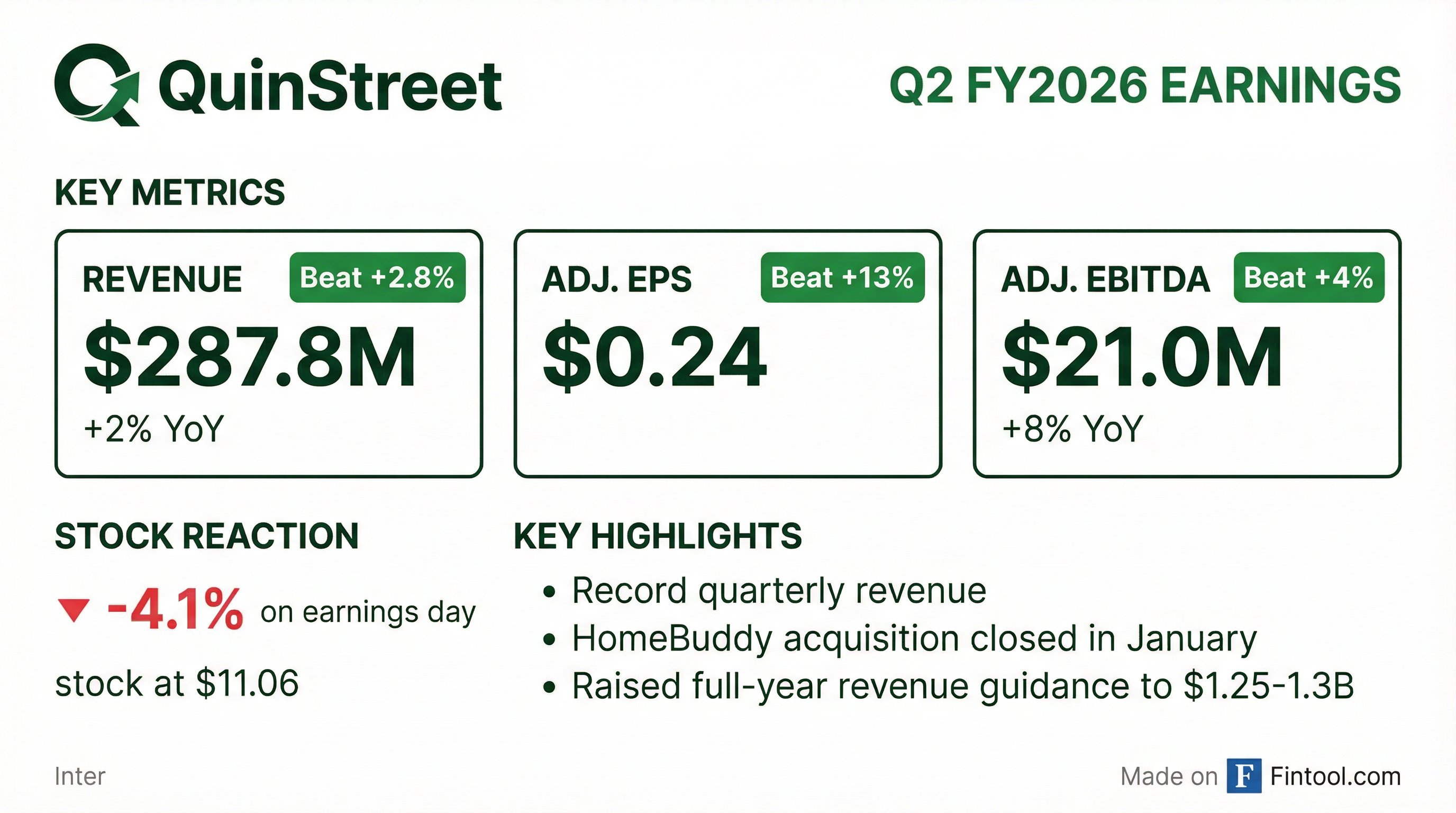

- QuinStreet reported Q2 2026 revenue of $287.8 million and Adjusted EBITDA of $21 million, marking its second consecutive quarter of record revenue.

- Subsequent to quarter end, the company completed the acquisition of HomeBuddy for $115 million at closing plus $75 million in future payments, with HomeBuddy expected to generate $30 million or more in Adjusted EBITDA in its first 12 months.

- For Fiscal Q3 2026, QuinStreet projects total revenue between $330-$340 million and Adjusted EBITDA between $26.5-$30.5 million.

- The company's full Fiscal Year 2026 outlook includes total revenue of $1.25-$1.3 billion and Adjusted EBITDA of $110-$115 million, while also expecting to reach a 10% quarterly Adjusted EBITDA margin this fiscal year, even excluding HomeBuddy.

- QuinStreet exceeded its outlook for both revenue and Adjusted EBITDA in fiscal Q2 2026, reporting $287.8 million in total revenue and $21 million in Adjusted EBITDA, with Adjusted net income of $14 million or $0.24 per share.

- Subsequent to quarter end, QuinStreet completed the acquisition of HomeBuddy for $115 million at closing and $75 million in post-closing payments, expecting it to generate $30 million or more of Adjusted EBITDA in the first 12 months and be purely additive and accretive to previous outlook.

- For Fiscal Q3 2026, the company projects total revenue to be between $330-$340 million and total Adjusted EBITDA between $26.5-$30.5 million, including HomeBuddy.

- Full Fiscal Year 2026 guidance includes total revenue between $1.25-$1.3 billion and total Adjusted EBITDA between $110-$115 million, including HomeBuddy.

- QuinStreet continues to expect to achieve a 10% quarterly Adjusted EBITDA margin in the current fiscal year, even excluding the accretive impact of HomeBuddy.

- QuinStreet reported Q2 2026 total revenue of $287.8 million and Adjusted EBITDA of $21 million, exceeding their outlook.

- The company completed the acquisition of HomeBuddy, which is expected to generate $30 million or more of Adjusted EBITDA in its first 12 months and is purely additive to their previous outlook.

- For Fiscal Q3 2026, QuinStreet expects total revenue between $330 million-$340 million and total Adjusted EBITDA between $26.5 million-$30.5 million.

- The full Fiscal Year 2026 guidance projects total revenue between $1.25 billion-$1.3 billion and total Adjusted EBITDA between $110 million-$115 million.

- The company anticipates reaching a 10% quarterly Adjusted EBITDA margin in the current fiscal year, even excluding HomeBuddy.

- QuinStreet, Inc. reported record quarterly revenue of $287.8 million, an increase of 2% year-over-year, for the fiscal second quarter ended December 31, 2025.

- For Q2 fiscal 2026, GAAP net income was $50.2 million or $0.87 per diluted share, and adjusted EBITDA grew 8% year-over-year to $21.0 million.

- The company acquired HomeBuddy in January, significantly expanding its Home Services footprint.

- QuinStreet provided guidance for fiscal Q3 2026, expecting total revenue between $330 million and $340 million and adjusted EBITDA between $26.5 million and $30.5 million.

- For the full fiscal year 2026, total revenue is projected to be between $1.25 billion and $1.3 billion, with total adjusted EBITDA between $110 million and $115 million.

- QuinStreet reported record quarterly revenue of $287.8 million for the fiscal second quarter ended December 31, 2025, representing a 2% increase year-over-year.

- For Q2 FY2026, GAAP net income was $50.2 million ($0.87 per diluted share), and Adjusted EBITDA increased 8% year-over-year to $21.0 million.

- The company generated $21.6 million in operating cash flow and ended the quarter with $107.0 million in cash and cash equivalents and no bank debt.

- QuinStreet completed the acquisition of HomeBuddy in January, significantly expanding its Home Services footprint.

- For fiscal Q3, the company expects total revenue between $330 million and $340 million and total adjusted EBITDA between $26.5 million and $30.5 million. Full fiscal year 2026 guidance includes total revenue between $1.25 billion and $1.3 billion and total adjusted EBITDA between $110 million and $115 million.

- QuinStreet (NASDAQ: QNST) announced on January 5, 2026, that it has closed the acquisition of SIREN GROUP AG d/b/a HomeBuddy.

- The acquisition terms include $115 million in cash at closing and $75 million in post-closing payments payable equally over four years.

- QuinStreet has also entered into a new $150 million revolving credit facility with a syndicate of commercial banks.

- The company expects the acquisition to be accretive to its adjusted EBITDA and EPS, adding an anticipated $30 million or more to adjusted EBITDA in the first twelve months following closing.

- HomeBuddy will be integrated into QuinStreet's Modernize Home Services business, aiming to significantly extend its platform, market footprint, and growth opportunity.

- QuinStreet, Inc. entered into a Credit Agreement dated January 2, 2026, with MUFG Bank, Ltd. as Administrative Agent, to finance the acquisition of SIREN GROUP AG d/b/a HomeBuddy.

- The acquisition of HomeBuddy was executed under a Share Purchase Agreement dated November 30, 2025.

- The Credit Agreement specifies Consolidated Adjusted EBITDA for recent fiscal quarters: $19,800,000 for Q4 2024, $19,460,000 for Q1 2025, $23,942,000 for Q2 2025, and $23,415,000 for Q3 2025.

- The company is subject to financial covenants, including maintaining a Consolidated Total Net Leverage Ratio of not more than 2.25 to 1.00 for certain investments.

- QuinStreet, Inc. entered into a definitive agreement on November 30, 2025, to acquire HomeBuddy, a digital marketplace platform that connects homeowners with home services professionals.

- HomeBuddy generated approximately $141 million in revenue for the twelve months ended September 30, 2025.

- QuinStreet expects the acquisition to be accretive to its adjusted EBITDA and EPS, projecting an additional $30 million or more of adjusted EBITDA in the first twelve months following closing.

- Further details about the transaction are anticipated during QuinStreet's FY2026 Q2 earnings call in February 2026.

- QuinStreet, Inc. has entered into a definitive agreement to acquire HomeBuddy (operating under Siren Group AG) for a total of $190 million, comprising $115 million in cash and $75 million in contingent payments.

- The acquisition is expected to close in early 2026, pending regulatory approvals and financing through a new credit facility, and aims to expand QuinStreet's Modernize Home Services business.

- HomeBuddy reported approximately $141 million in revenue for the year ending September 30, 2025.

- QuinStreet anticipates the deal will be accretive to revenue and adjusted EBITDA, projecting at least a $30 million increase in adjusted EBITDA within the first year.

- QuinStreet delivered record revenue of $285.9 million in Q1 2026, exceeding its outlook, with adjusted EBITDA of $20.5 million and adjusted net income of $13.1 million, or 22 cents per share.

- For Q2 2026, the company anticipates revenue between $270 million and $280 million and adjusted EBITDA between $19 million and $20 million. Full fiscal year 2026 guidance projects revenue growth of at least 10% year over year and adjusted EBITDA growth of at least 20% year over year.

- The Board of Directors authorized a new $40 million share repurchase program, following $7 million in share repurchases during Q1 and an additional $10 million subsequent to quarter-end.

- The company is focused on margin expansion, with a near-term goal of reaching a 10% quarterly adjusted EBITDA margin this fiscal year, driven by growth in higher-margin products and operating efficiencies. Auto insurance margins are expected to expand five percentage points this fiscal year.

- QuinStreet highlighted strong auto insurance demand, 15% year-over-year growth in home services revenue to a record $78.4 million, and aggressive investments in new media capacity, product expansion, and artificial intelligence (AI).

Quarterly earnings call transcripts for QUINSTREET.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more