Earnings summaries and quarterly performance for Ferrari.

Research analysts who have asked questions during Ferrari earnings calls.

Stephen Reitman

Bernstein

10 questions for RACE

Thomas Besson

Kepler Cheuvreux

10 questions for RACE

Michael Binetti

Evercore ISI

9 questions for RACE

Henning Cosman

Barclays PLC

8 questions for RACE

Tom Narayan

RBC Capital Markets

8 questions for RACE

Anthony Dick

ODDO BHF

7 questions for RACE

Monica Bosio

Intesa Sanpaolo

7 questions for RACE

José Asumendi

JPMorgan Chase & Co.

5 questions for RACE

George Galliers-Pratt

Goldman Sachs

4 questions for RACE

Martino De Ambroggi

Equita

4 questions for RACE

Michael Tyndall

HSBC

4 questions for RACE

Adam Jonas

Morgan Stanley

3 questions for RACE

Nicolai Kempf

Deutsche Bank AG

3 questions for RACE

Susy Tibaldi

UBS

3 questions for RACE

Andrea Balloni

Mediobanca

2 questions for RACE

Christian Frenes

Goldman Sachs

2 questions for RACE

Edouard Aubin

Morgan Stanley

2 questions for RACE

Flavio Cereda

GAM

2 questions for RACE

Gianluca Bertuzzo

Intermonte

2 questions for RACE

Horst Schneider

Bank of America

2 questions for RACE

James Kluznik

Jefferies International

2 questions for RACE

Michael Filatov

Berenberg

2 questions for RACE

Robert Karofsky

UBS

2 questions for RACE

Samuel Perry

BNP Paribas

2 questions for RACE

Flavio Cereda-Parini

GAM Investments

1 question for RACE

John Babcock

Bank of America

1 question for RACE

John Murphy

Bank of America

1 question for RACE

Recent press releases and 8-K filings for RACE.

- Ferrari N.V. is executing a multi-year share buyback program of approximately Euro 3.5 billion expected by 2030, with a first tranche of Euro 250 million announced on December 16, 2025.

- Between February 16, 2026, and February 20, 2026, the company purchased 31,000 common shares on Euronext Milan for a total consideration of Euro 9,705,104.20.

- Since the start of the multi-year program on January 5, 2026, until February 20, 2026, Ferrari has purchased a total of 307,643 common shares for Euro 91,680,851.19.

- As of February 20, 2026, Ferrari held 16,952,249 common shares in treasury, representing 8.74% of total issued common shares, or 9.19% including special voting shares.

- Ferrari N.V. is executing a Euro 250 million share buyback program, announced on December 16, 2025, which serves as the first tranche of a larger multi-year share buyback program totaling approximately Euro 3.5 billion expected to be completed by 2030.

- From the start date of the multi-year program on January 5, 2026, until February 13, 2026, the company purchased a total of 276,643 common shares for a consideration of Euro 81,975,746.99.

- As of February 13, 2026, Ferrari N.V. held 16,921,249 common shares in treasury, representing 8.73% of the total issued common shares.

- Ferrari N.V. is executing the First Tranche of its Euro 250 million share buyback program, which is part of a larger Euro 3.5 billion multi-year program expected to be completed by 2030.

- Between February 9, 2026, and February 13, 2026, Ferrari purchased 30,293 common shares on Euronext Milan for a total consideration of Euro 9,235,865.37.

- Since the multi-year share buyback program's start on January 5, 2026, until February 13, 2026, the company has acquired a total of 276,643 common shares for Euro 81,975,746.99.

- As of February 13, 2026, Ferrari held 16,921,249 common shares in treasury, corresponding to 8.73% of the total issued common shares.

- Prenetics Global Limited (NASDAQ: PRE) announced Formula 1 driver Ollie Bearman as its newest Global Ambassador and a shareholder for its IM8 premium health and longevity brand.

- IM8, co-founded by David Beckham, has achieved US$100 million in Annual Recurring Revenue within 11 months of its launch in December 2024, and is now sold in over 30 countries worldwide.

- Bearman's partnership with IM8 was initiated after he experienced significant performance benefits from the brand's flagship product, Daily Ultimate Essentials.

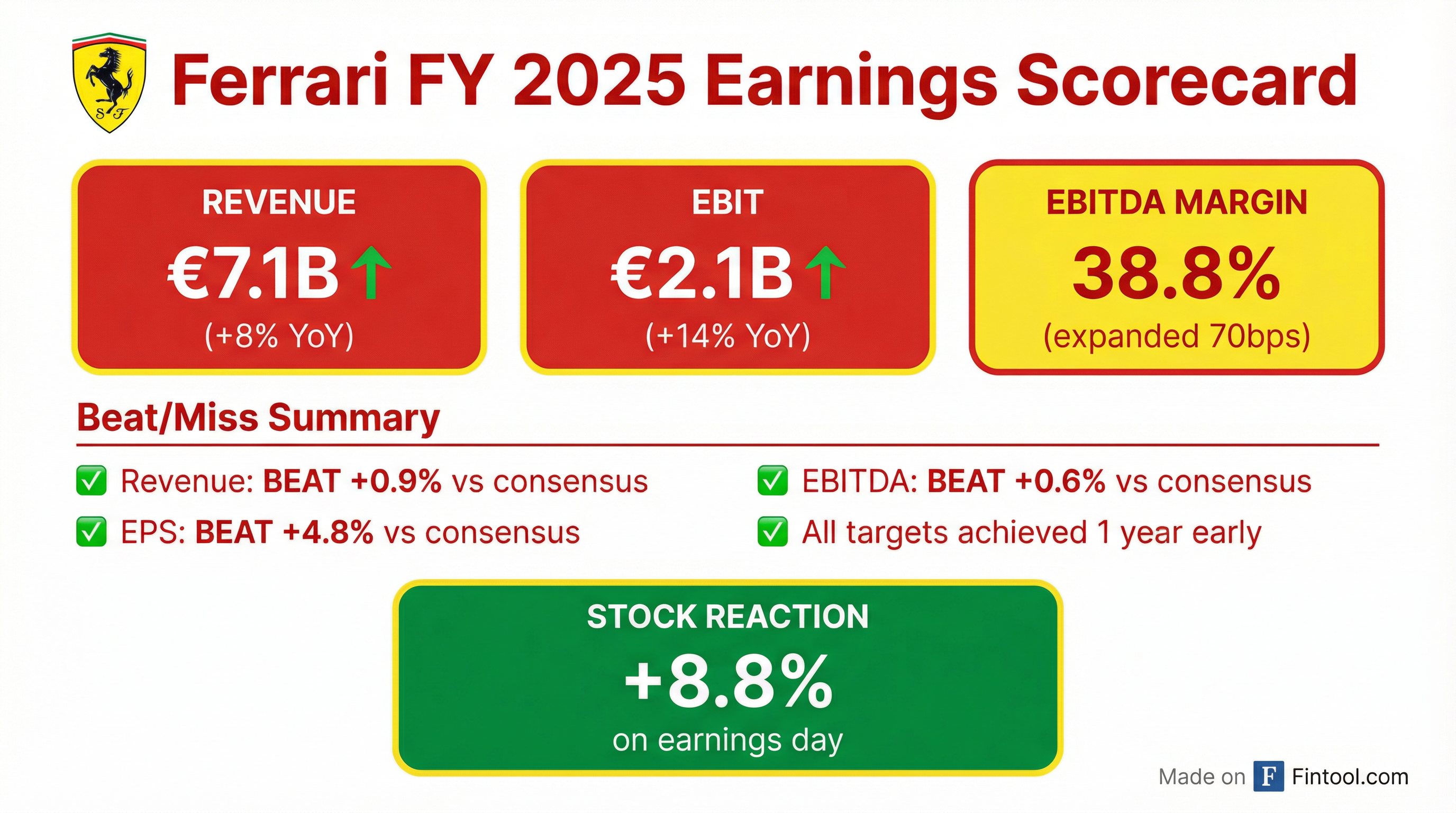

- Ferrari reported solid growth in 2025, with net revenues up 7% (including currency headwind) and achieving an EBITDA margin of 38.8% and EBIT margin of 29.5%. The company reached its 2026 financial targets one year ahead of schedule and completed its EUR 2 billion share buyback program.

- In 2025, Ferrari launched six new sports cars, including the Ferrari Luce, its new full electric sports car, with deliveries starting in Q4 2026. Seven new models are slated for production and distribution in 2026, contributing to a positive product mix.

- For 2026, Ferrari anticipates another year of consistent growth, with mix and price expected to more than offset costs. However, the company projects an approximately EUR 200 million headwind from currency exchange rates and higher SG&A due to increased investments.

- Shipments in 2025 were deliberately kept flat year-over-year as Ferrari prioritizes quality of revenues and exclusivity over volume. The company's order book remains strong, extending towards the end of 2027.

- Ferrari reported record financial results for 2025, with revenues exceeding EUR 7.1 billion, EBIT over EUR 2.1 billion, and industrial cash flow surpassing EUR 1.5 billion. The company also achieved its 2026 financial targets one year ahead of schedule and concluded its EUR 2 billion share buyback program.

- In 2025, Ferrari launched six new sports cars, including the visionary full-electric Ferrari Luce, whose interiors were revealed in San Francisco, with its world premiere scheduled for May 25, 2026, in Rome.

- The company anticipates consistent growth in 2026, driven by a planned model changeover leading to a positive product mix, with mix and pricing expected to more than offset costs. This outlook is supported by a solid order book extending towards the end of 2027.

- Strategic investments continue in 2026, including the opening of two new flagship stores in London and New York, and ongoing efforts in racing and digital transformation.

- Ferrari achieved record financial results in 2025, with revenues exceeding EUR 7.1 billion, EBIT over EUR 2.1 billion, and industrial cash flow generation surpassing EUR 1.5 billion. The company also reached its 2026 financial targets a year in advance and concluded a EUR 2 billion share buyback program.

- For 2026, Ferrari anticipates another year of consistent growth, driven by a planned model changeover and a positive product mix. The company expects mix and price to more than offset costs, despite an estimated EUR 200 million headwind from foreign exchange rates.

- The company's order book remains strong, extending towards the end of 2027. Seven new models are entering production and distribution in 2026, including the Ferrari Luce which will begin deliveries in Q4 2026.

- Ferrari reported strong margins in 2025, with an EBITDA margin of 38.8% and an EBIT margin of 29.5%. Shareholder remuneration increased by approximately 30% to over EUR 1.3 billion.

- Ferrari N.V. achieved strong financial results in fiscal year 2025, with net revenues of Euro 7,146 million (up 7% versus prior year), operating profit (EBIT) of Euro 2,110 million (up 12%), and diluted EPS of Euro 8.96 (up 6%).

- The company's performance was supported by a rich product mix, personalizations, and increased sponsorships and lifestyle activities, leading to industrial free cash flow of Euro 1,538 million, a 50% increase from the prior year.

- For 2026, Ferrari N.V. provided guidance targeting net revenues of approximately Euro 7.50 billion, EBITDA of at least Euro 2.93 billion (with a margin of at least 39.0%), and diluted EPS of at least Euro 9.45.

- Ferrari also announced a new multi-year share buyback program of approximately Euro 3.5 billion expected to be executed by 2030, with the first tranche of up to Euro 250 million commencing in January 2026.

- Ferrari N.V. is executing a Euro 250 million share buyback program, which is the first tranche of a larger Euro 3.5 billion multi-year program expected to be completed by 2030.

- From February 2 to February 6, 2026, Ferrari purchased 53,150 common shares on Euronext Milan for a total consideration of Euro 15,107,008.88, at an average price of Euro 284.2335 per share.

- Since the multi-year share buyback program commenced on January 5, 2026, until February 6, 2026, the company has purchased a total of 246,350 common shares for Euro 72,739,881.62.

- As of February 6, 2026, Ferrari held 16,890,956 common shares in treasury, representing 8.71% of the total issued common shares.

- Ferrari N.V. is currently executing a Euro 250 million share buyback program, announced on December 16, 2025, which represents the first tranche of a larger Euro 3.5 billion multi-year program anticipated to conclude by 2030.

- As of January 30, 2026, the company had invested a total of Euro 57,632,872.74 to purchase 193,200 common shares since the announcement of the first tranche.

- By January 30, 2026, Ferrari N.V. held 16,837,806 common shares in treasury, which corresponds to 8.68% of its total issued common shares.

Quarterly earnings call transcripts for Ferrari.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more