Earnings summaries and quarterly performance for Ryman Hospitality Properties.

Executive leadership at Ryman Hospitality Properties.

Mark Fioravanti

President & Chief Executive Officer

Colin Reed

Executive Chairman of the Board of Directors

Jennifer Hutcheson

Executive Vice President & Chief Financial Officer

Patrick Chaffin

Executive Vice President & Chief Operating Officer – Hotels

Scott Lynn

Executive Vice President, General Counsel and Secretary

Board of directors at Ryman Hospitality Properties.

Research analysts who have asked questions during Ryman Hospitality Properties earnings calls.

Chris Woronka

Deutsche Bank AG

6 questions for RHP

Smedes Rose

Citigroup

6 questions for RHP

Duane Pfennigwerth

Evercore ISI

5 questions for RHP

Jay Kornreich

Wedbush Securities

5 questions for RHP

Shaun Kelley

Bank of America Merrill Lynch

5 questions for RHP

Chris Darling

Green Street

4 questions for RHP

David Katz

Jefferies Financial Group Inc.

4 questions for RHP

Ari Klein

BMO Capital Markets

3 questions for RHP

Cooper Clark

Wells Fargo

3 questions for RHP

John DeCree

CBRE

3 questions for RHP

Aryeh Klein

BMO Capital Markets

2 questions for RHP

Daniel Politzer

Wells Fargo

2 questions for RHP

Dori Kesten

Wells Fargo & Company

2 questions for RHP

Patrick Scholes

Truist Financial Corporation

2 questions for RHP

Rich Hightower

Barclays

2 questions for RHP

Stephen Grambling

Morgan Stanley

2 questions for RHP

Charles Scholes

Not Disclosed

1 question for RHP

Daniel Politzer

JPMorgan Chase & Co.

1 question for RHP

Max Marsh

CBRE Group, Inc.

1 question for RHP

Recent press releases and 8-K filings for RHP.

- Ryman Hospitality Properties, Inc. (RHP) announced the pricing of $700 million aggregate principal amount of 5.750% senior notes due 2034.

- The offering is expected to close on March 11, 2026, with estimated net proceeds of approximately $687 million.

- The company intends to use these net proceeds, along with available cash, to redeem in full its 4.750% senior notes due 2027.

- Ryman Hospitality Properties, Inc. (RHP) announced its intent to offer $700 million aggregate principal amount of senior notes due 2034 in a private placement.

- The net proceeds from this offering, along with available cash, are intended to redeem in full the Issuers' 4.750% senior notes due 2027.

- The new notes will be senior unsecured obligations of RHP Hotel Properties, LP and RHP Finance Corporation, guaranteed by RHP and its subsidiaries.

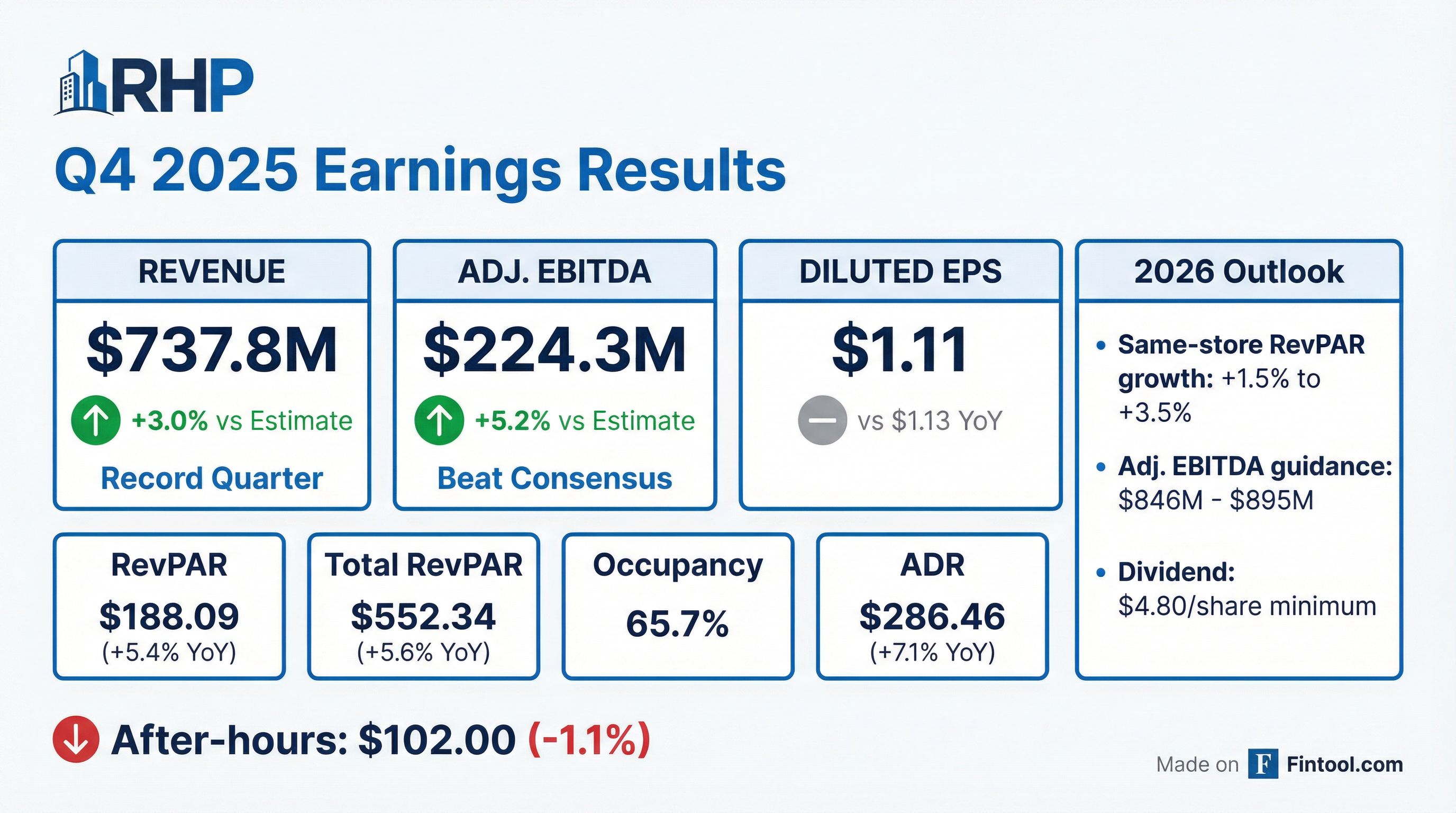

- Ryman Hospitality Properties reported full-year results above the midpoints of guidance ranges for the entertainment segment, AFFO, and AFFO per share, with the fourth quarter exceeding expectations due to strong holiday programming and downtown Nashville entertainment venues. The same-store hospitality segment achieved its highest total revenue of any quarter and highest Adjusted EBITDAre of any fourth quarter.

- For 2026, the company expects same-store hospitality RevPAR growth of 2.5% and same-store total RevPAR growth of 2.5% at the midpoint, with Adjusted EBITDAre growth of nearly 10% for the entertainment business. However, the first quarter of 2026 is anticipated to be challenging, with roughly flat RevPAR and total RevPAR for same-store hospitality and a decline in entertainment Adjusted EBITDAre.

- RHP continues to advance its long-term strategy through investments, including the acquisition of JW Desert Ridge, ongoing multi-year investment plans for Gaylord Opryland, and expansion of its entertainment platform with new venues and the Category Ten brand.

- The company ended Q4 2025 with $471 million of unrestricted cash and total available liquidity of nearly $1.3 billion, which increased to approximately $1.4 billion after refinancing its corporate revolving credit facility in January 2026. Fitch upgraded RHP's corporate family rating to double B from double B minus, and a first-quarter dividend of $1.20 was declared.

- Ryman Hospitality Properties reported full year 2025 results above the midpoints of guidance for the entertainment segment and AFFO and AFFO per share above the high ends of guidance, with Q4 2025 performance ahead of expectations due to strong holiday programming and better-than-expected volumes in downtown Nashville entertainment venues. The same-store hospitality segment delivered its highest total revenue of any quarter and highest adjusted EBITDAre of any fourth quarter.

- For 2026, initial guidance includes 2.5% RevPAR growth and 2.5% total RevPAR growth at the midpoint for same-store hospitality, and nearly 10% adjusted EBITDAre growth for the entertainment business. The company anticipates Q1 2026 RevPAR and total RevPAR to be roughly flat for same-store hospitality, with adjusted EBITDAre margin declining approximately 100 basis points.

- The company ended Q4 2025 with nearly $1.3 billion in total available liquidity and a pro forma net leverage ratio of 4.3x. In January 2026, the corporate revolving credit facility was refinanced, increasing its size from $700 million to $850 million and extending maturity to January 2030, which increased total available liquidity to approximately $1.4 billion. RHP expects to invest between $350 million and $450 million in capital expenditures in 2026 and declared a Q1 2026 dividend of $1.20.

- Ryman Hospitality Properties reported full year 2025 results above the midpoints of guidance for the entertainment segment and AFFO and AFFO per share above the high ends of guidance. The fourth quarter exceeded expectations due to strong holiday programming and downtown Nashville entertainment venues.

- For 2026, the company provided initial guidance, projecting 2.5% RevPAR growth and 2.5% total RevPAR growth (midpoints) for same-store hospitality, alongside nearly 10% year-over-year growth in Adjusted EBITDAre for the entertainment business.

- The company ended Q4 2025 with $471 million in unrestricted cash and $1.3 billion in total available liquidity, which increased to approximately $1.4 billion after refinancing its corporate revolving credit facility in January 2026. Fitch upgraded its corporate family rating to BB from BB minus.

- Strategic initiatives include the acquisition of JW Desert Ridge, ongoing multi-year investments at Gaylord Opryland, and expansion of the entertainment platform with new venues and the Category Ten brand. A Q1 2026 dividend of $1.20 was declared.

- Ryman Hospitality Properties reported total revenue of $737.8 million for Q4 2025, a 13.9% increase from Q4 2024, and $2.58 billion for the full year 2025, up 10.2% from the previous year.

- Adjusted EBITDA re increased by 18.9% to $224.3 million in Q4 2025 and by 4.9% to $794.7 million for the full year 2025.

- The same-store Hospitality segment's RevPAR grew by 3.9% to $185.41 and Total RevPAR by 5.2% to $550.58 in Q4 2025.

- For 2026, the company issued guidance with a midpoint of $870.5 million for consolidated Adjusted EBITDA re and $8.75 for Adjusted FFO per diluted share/unit.

- RHP anticipates capital expenditures between $350 million and $450 million in 2026 for projects including renovations at Gaylord Texan and new developments like Category 10 Las Vegas and Orlando.

- Ryman Hospitality Properties reported record consolidated revenue of $737.8 million for the fourth quarter of 2025 and $2.6 billion for the full year 2025, with net income of $74.5 million and $247.3 million for the respective periods.

- The company refinanced its corporate revolving credit facility, increasing its size from $700 million to $850 million and extending the maturity from May 2027 to January 2030.

- RHP declared a cash dividend of $1.20 per share for the first quarter of 2026 and intends to pay aggregate minimum dividends of $4.80 per share for the full year 2026.

- For the full year 2025, the company booked nearly 3.0 million same-store Hospitality Gross Definite Room Nights for all future periods at a record estimated average daily rate (ADR) of $292.

- Ryman Hospitality Properties, Inc. (RHP) successfully refinanced its revolving credit facility, increasing the total capacity from $700 million to $850 million.

- The maturity date of the facility was extended from May 2027 to January 2030, with an option for a maximum of one additional year of extension.

- The amended facility maintained the same pricing and largely similar terms as the previous credit facility, and the revolver was undrawn at closing.

- The refinancing also included the removal of the SOFR Adjustment and modifications to certain financial covenants.

- Ryman Hospitality Properties, Inc. (RHP) refinanced its revolving credit facility, increasing its capacity and extending its maturity.

- The facility's size was increased from $700 million to $850 million.

- The maturity date was extended from May 2027 to January 2030, with an option for a maximum of one additional year.

- The pricing terms remained consistent, and the revolver was undrawn at closing.

- On December 4, 2025, Ryman Hospitality Properties, Inc. declared a cash dividend of $1.20 per common share.

- This dividend is scheduled for payment on January 15, 2026, to stockholders of record as of December 31, 2025.

- The $1.20 dividend represents an increase from the $1.15 per common share paid in each of the four preceding quarters of fiscal year 2025.

- A subsidiary, RHP Hotel Properties, LP, also declared a corresponding cash distribution of $1.20 per OP Unit, payable on the same dates.

Quarterly earnings call transcripts for Ryman Hospitality Properties.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more