Earnings summaries and quarterly performance for BOSTON BEER CO.

Executive leadership at BOSTON BEER CO.

Michael Spillane

Chief Executive Officer

Annette Fritsch

Chief Product Design Officer

Carolyn O’Boyle

Chief People Officer

Diego Reynoso

Treasurer and Chief Financial Officer

Jim Koch

Chairman

Lesya Lysyj

Chief Marketing Officer

Matthew Murphy

Chief Accounting Officer and Vice President of Finance

Michael Crowley

Chief Sales Officer

Philip Hodges

Chief Supply Chain Officer

Sam Calagione

Founder and Brewer

Tara Heath

Chief Legal Officer & General Counsel

Board of directors at BOSTON BEER CO.

Research analysts who have asked questions during BOSTON BEER CO earnings calls.

Filippo Falorni

Citigroup Inc.

8 questions for SAM

Robert Ottenstein

Evercore ISI

8 questions for SAM

Peter Grom

UBS Group

7 questions for SAM

Bonnie Herzog

Goldman Sachs

6 questions for SAM

Eric Serotta

Morgan Stanley

6 questions for SAM

Michael Lavery

Piper Sandler & Co.

5 questions for SAM

Nadine Sarwat

Bernstein

5 questions for SAM

Bill Kirk

Roth Capital Partners, LLC

3 questions for SAM

Kaumil Gajrawala

Jefferies

3 questions for SAM

Dara Mohsenian

Morgan Stanley

2 questions for SAM

Nik Modi

RBC Capital Markets

2 questions for SAM

William Kirk

ROTH MKM

2 questions for SAM

Gerald Pascarelli

Needham & Company

1 question for SAM

Stephen Powers

Deutsche Bank

1 question for SAM

Recent press releases and 8-K filings for SAM.

- Boston Beer Co. reported FY 2025 revenue down 2.4% and shipments down 4.7%, with EPS of $9.89 (up 4.7% year-over-year, excluding prior year impairment and one-time contract settlement charges). The company achieved significant gross margin expansion of 410 basis points, reaching 48.5%.

- In Q4 2025, depletions decreased 6% and shipments decreased 7.5% year-over-year. While Twisted Tea volumes were soft (down 6% in dollar sales for FY 2025 in measured off-premise channels), Sun Cruiser saw strong growth, increasing volumes over 300% from 2024 to 2025 and quickly scaling into a top 5 RTD Spirits brand.

- For FY 2026, the company expects depletions and shipments to be flat to down mid-single digits, with gross margins between 48% and 50%, and EPS between $8.50 and $11.

- The company anticipates continued industry volume headwinds in 2026 due to economic uncertainty, moderation trends, and competition from hemp-derived beverages. Full-year tariff costs are estimated at $20 million-$30 million for 2026, up from $11 million in 2025.

- The Boston Beer Company reported a 2.4% decrease in 2025 revenue, with depletions down 4% and shipments down 4.7%.

- For fiscal year 2025, gross margin expanded by 410 basis points to 48.5% (or 50% excluding certain fees), and EPS increased 4.7% year-over-year to $9.89 (excluding prior year impairment and one-time contract settlement charges).

- The company generated $216 million in free cash flow and repurchased $200 million in shares in 2025, concluding the year with $223 million in cash and no debt.

- The 2026 volume outlook projects flat to down mid-single digits due to ongoing macroeconomic challenges, with tariff costs estimated between $20 million and $30 million.

- Strategic focus for 2026 includes scaling Sun Cruiser, which grew volumes over 300% from 2024 to 2025, and expanding Sinless Vodka Cocktails.

- The Boston Beer Company reported 2025 full-year revenue down 2.4% and EPS of $9.89, up 4.7% year-over-year (excluding certain charges). Gross margin expanded by 410 basis points to 48.5%.

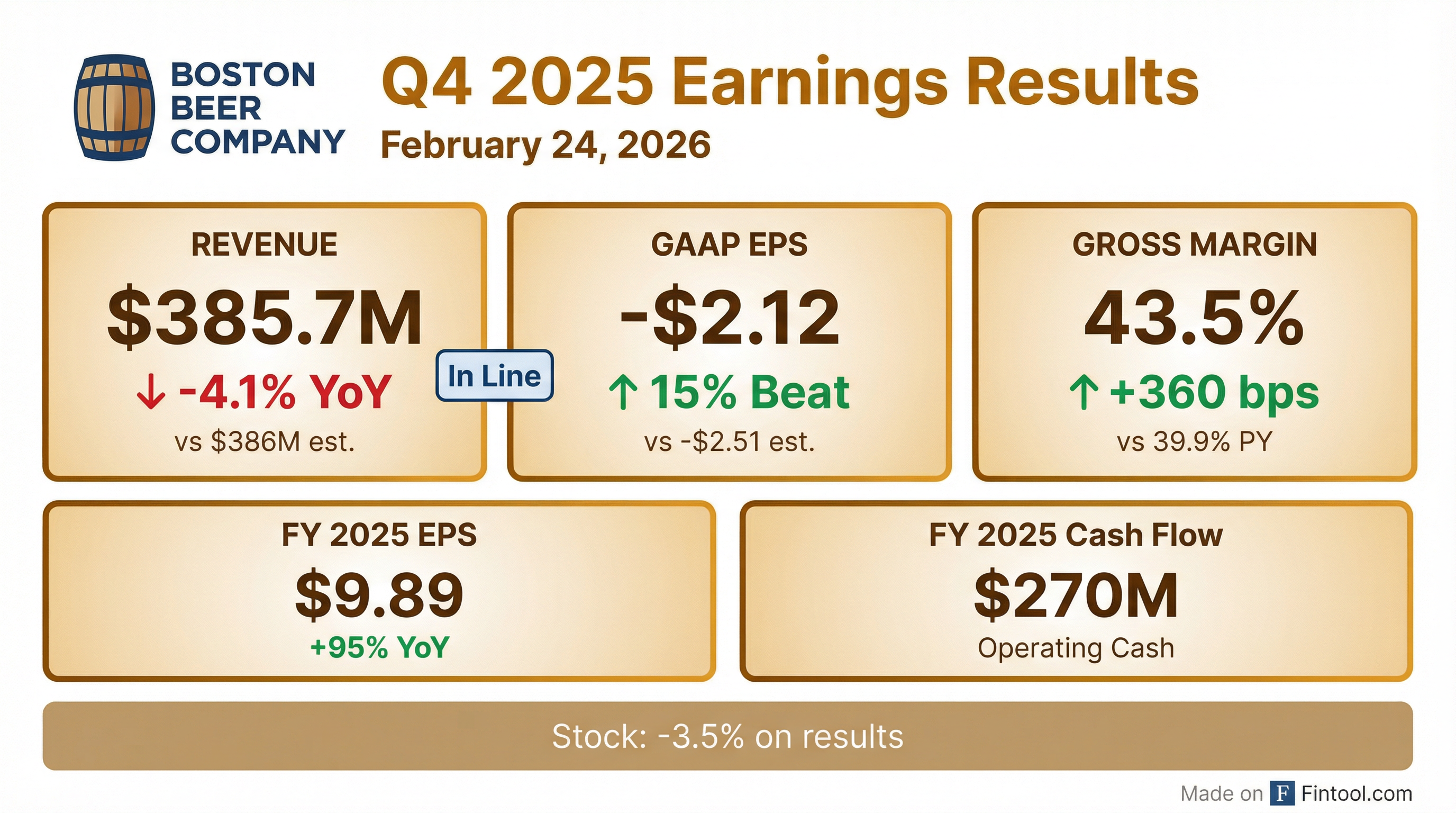

- For Q4 2025, depletions decreased 6% and shipments decreased 7.5%, leading to a 4.1% decrease in revenue. Gross margin for the quarter was 43.5%, an increase of 360 basis points year-over-year.

- The company repurchased $200 million in shares in 2025, supported by $216 million in free cash flow.

- Looking into 2026, the company expects volume to be flat to down mid-single digits due to persistent macroeconomic headwinds. They anticipate $20 million-$30 million in tariff costs.

- Sun Cruiser volumes grew over 300% from 2024 to 2025, becoming revenue and margin accretive, while Twisted Tea dollar sales were down 6% in measured off-premise channels for the full year 2025.

- Jim Koch has returned as CEO, with Phil Hodges appointed Chief Operating Officer, to focus on innovation, brand investment, and margin improvement initiatives.

- For Q3 2025, depletions decreased 3% and shipments decreased 13.7% year-over-year, resulting in an 11.2% decrease in revenue. Gross margin improved significantly to 50.8%, the highest since 2018, driven by procurement savings, improved brewery efficiencies, and price increases.

- The company updated its full-year 2025 guidance, narrowing volume expectations to down mid-single digits. Gross margin guidance was raised to 47%-48% (from 46%-47.3%), and EPS guidance was revised to $7.80-$9.80 (from $6.72-$9.54). Advertising, promotional, and selling expenses are now expected to increase by $50 million-$60 million.

- Despite industry headwinds like economic uncertainty and moderation trends, Sun Cruiser was a top volume gainer in RTD spirits and is expected to see strong double-digit or even triple-digit growth in 2026. However, Twisted Tea dollar sales are down 5% year-to-date in measured off-premise channels, impacted by macroeconomic factors and competition.

- The company repurchased over $160 million in shares year-to-date , including $50 million during the 13-week period ended September 27, 2025, and an additional $12.1 million through October 17, 2025.

- Jim Koch has stepped back into the CEO role, with Phil Hodges named Chief Operating Officer.

- For Q3 2025, depletions decreased 3%, shipments decreased 13.7%, and revenue decreased 11.2% year-over-year, while gross margin increased to 50.8%.

- Year-to-date (first nine months of 2025), depletions were down 3%, gross margin was 49.7%, and EPS was $11.82.

- The company updated its full-year 2025 guidance, narrowing volume to down mid-single digits, raising gross margin to 47% to 48%, and revising EPS to $7.80 to $9.80.

- The company repurchased over $160 million in shares year to date , including $50 million in the 13 weeks ended September 27, 2025, and an additional $12.1 million through October 17, 2025.

- 2025 Annual Meeting: The company held its Annual Meeting on May 14, 2025, where new Class A and Class B directors were elected and an advisory vote approved executive compensation policies.

- Board & Trading Developments: On May 13, 2025, board committee appointments were announced, including the reappointment of the Lead Director, alongside the adoption of a 10b5-1 trading plan and a $50 million share repurchase plan.

- Net revenue increased 6.5% to $453.9 million and net income surged by 93.8% to $24.4 million in Q1 2025, indicating strong performance compared to the prior year.

- Gross margin improved to 48.3%, up by 460 basis points, with operational efficiencies augmented by a year-to-date share repurchase of $61 million.

- The report, released via Form 8-K on April 24, 2025, underscores a robust balance sheet and positive earnings momentum.

- The Boston Beer Company reported 31% non-GAAP EPS growth for fiscal year 2024, reaching $9.43 per share, alongside $173 million in free cash flow. The company also repurchased $239 million in shares during 2024.

- For 2025, the company projects depletions and shipments to be between a low single-digit decrease and a low single-digit increase year over year, with full-year non-GAAP EPS guidance set between $8.00 and $10.50.

- Gross margin for 2024 was 44.4%, and is expected to be between 45% and 47% in 2025, driven by ongoing multi-year productivity initiatives.

- The company plans to increase advertising, promotional, and selling expenses by $30 million to $50 million in 2025, primarily to support core brands and the national launch of Sun Cruiser.

Quarterly earnings call transcripts for BOSTON BEER CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more