Earnings summaries and quarterly performance for STRYKER.

Executive leadership at STRYKER.

Board of directors at STRYKER.

Andrew Silvernail

Director

Emmanuel Maceda

Director

Giovanni Caforio

Director

Lisa Skeete Tatum

Director

Mary Brainerd

Director

Rachel Ruggeri

Director

Rajeev Suri

Director

Ronda Stryker

Director

Sherilyn McCoy

Lead Independent Director

Research analysts who have asked questions during STRYKER earnings calls.

Danielle Antalffy

UBS Group AG

8 questions for SYK

Travis Steed

Bank of America

8 questions for SYK

Vijay Kumar

Evercore ISI

8 questions for SYK

Joanne Wuensch

Citigroup Inc.

7 questions for SYK

Ryan Zimmerman

BTIG

7 questions for SYK

Richard Newitter

Truist Securities

6 questions for SYK

David Roman

Goldman Sachs Group Inc.

5 questions for SYK

Larry Biegelsen

Wells Fargo & Company

5 questions for SYK

Matthew O'Brien

Piper Sandler & Co.

5 questions for SYK

Matt Miksic

Barclays Investment Bank

5 questions for SYK

Michael Matson

Needham & Company

5 questions for SYK

Robert Marcus

JPMorgan Chase & Co.

5 questions for SYK

Shagun Singh Chadha

RBC Capital Markets

5 questions for SYK

Chris Pasquale

Nephron Research LLC

4 questions for SYK

Caitlin Cronin

Canaccord Genuity

3 questions for SYK

Jenny Rabinowitz

Goldman Sachs Group Inc.

3 questions for SYK

Matthew Miksic

Barclays PLC

3 questions for SYK

Mike Matson

Needham & Company, LLC

3 questions for SYK

Patrick Wood

Morgan Stanley

3 questions for SYK

Pito Chickering

Deutsche Bank

3 questions for SYK

Robbie Marcus

JPMorgan Chase & Co.

3 questions for SYK

Caitlin Roberts

Canaccord Genuity

2 questions for SYK

Drew Ranieri

TD Cowen

2 questions for SYK

Eric Anderson

TD Cowen

2 questions for SYK

Jeff Johnson

Robert W. Baird & Co.

2 questions for SYK

Kendall

Royal Bank of Canada

2 questions for SYK

Larry Beagleson

Wells Fargo

2 questions for SYK

Matthew Taylor

Jefferies

2 questions for SYK

Philip Chickering

Deutsche Bank AG

2 questions for SYK

Samantha Kurtz

Piper Sandler Companies

2 questions for SYK

Steven Lichtman

Oppenheimer & Co. Inc.

2 questions for SYK

Christopher Pasquale

Nephron Research

1 question for SYK

Jason Wittes

Roth Capital Partners, LLC

1 question for SYK

Jeffrey Johnson

Robert W. Baird & Co. Inc.

1 question for SYK

Joshua Jennings

TD Cowen

1 question for SYK

Kaitlin Cronin

Canaccord Genuity Group Inc.

1 question for SYK

Lawrence Biegelsen

Wells Fargo

1 question for SYK

Matthew Aspro

Jefferies

1 question for SYK

Matt O'Brien

Piper Sandler Companies

1 question for SYK

Michael Polark

Wolfe Research

1 question for SYK

Recent press releases and 8-K filings for SYK.

- Stryker announced the limited market release of Mako RPS (Robotic Power System), a handheld robotic system for Total Knee procedures, expanding its Mako robotics portfolio.

- Mako RPS integrates with Stryker’s Triathlon® Total Knee System and the Mako SmartRobotics™ platform, featuring intraoperative planning and an active-adjustment saw guided by a surgeon’s hand movements.

- The system operates without cutting blocks and connects to the Q Guidance System, aiming to deliver robotic precision with the familiarity of a manual power tool.

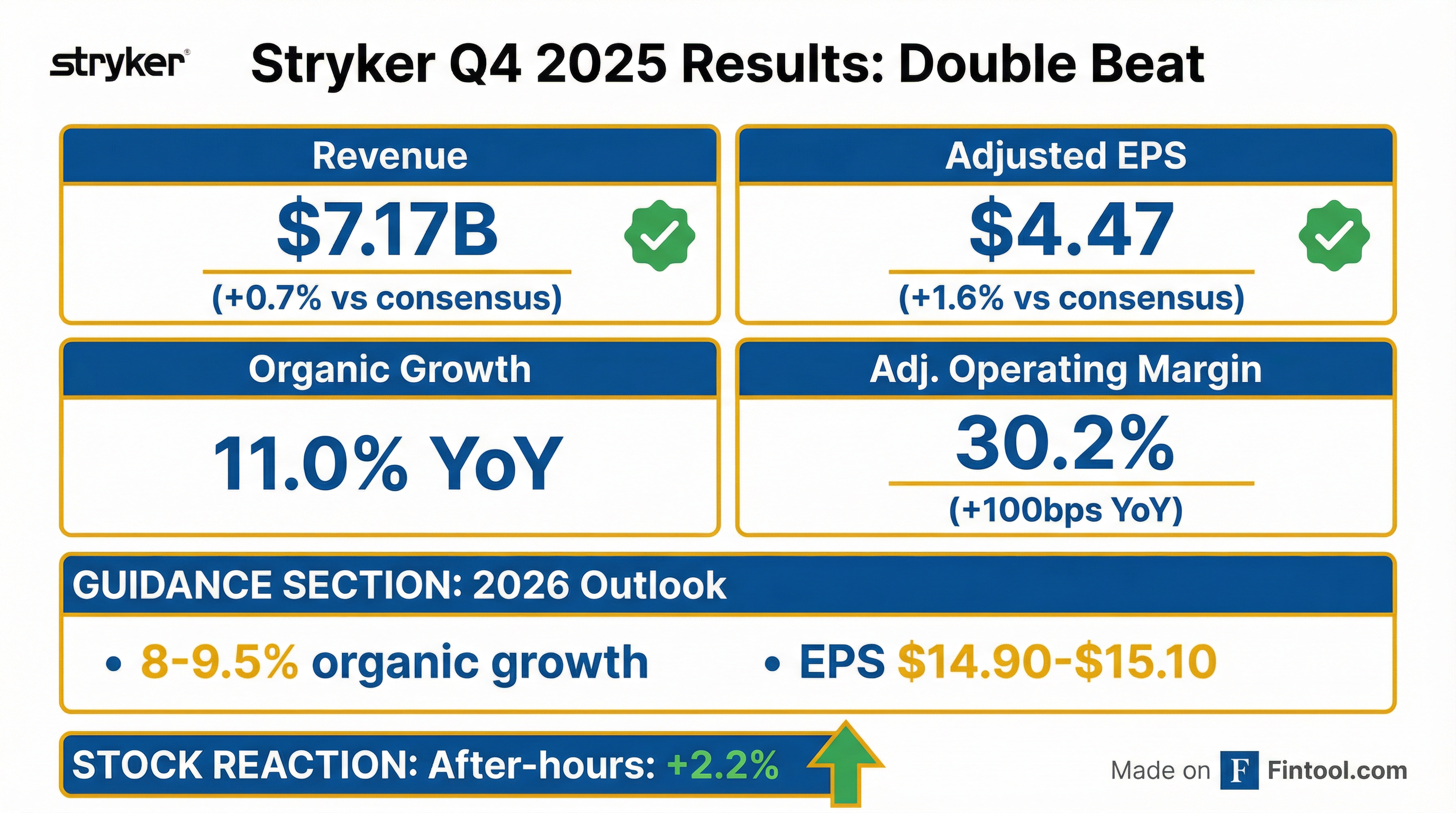

- Adjusted EPS of $4.47 and revenue of $7.17 billion topped expectations; GAAP profit was $849 million ($2.20 per share), reflecting an 11% year-over-year revenue gain.

- Organic sales rose about 11%, driven by MedSurg & neurotechnology (up ~17.5%); segment revenues were $4.6 billion for MedSurg & neuro and $2.6 billion for orthopaedics.

- Adjusted operating margin expanded by roughly 100 basis points to 30.2%, supporting full-year 2025 sales of $25.1 billion.

- For 2026, management guides 8.0–9.5% organic net sales growth and $14.90–15.10 in adjusted EPS, above Wall Street forecasts.

- 11% organic sales growth in Q4 and 10.3% for the full year, driving total sales past $25 billion in 2025

- Q4 adjusted EPS of $4.47 (up 11.5%) and full-year adjusted EPS of $13.63 (up 11.8%)

- Strong Q4 segment performances: MedSurg & Neuro +12.6%, Instruments +19.1%, Endoscopy +11.1%, Medical +13.6%; Vascular +4.3%

- Operating cash flow of $5 billion and free cash flow at 81% of adjusted net earnings, above 2024’s 75%

- 2026 guidance: 8%–9.5% organic net sales growth, adjusted EPS of $14.90–$15.10, and approximately $400 million in tariff impacts

- Stryker delivered 11% organic sales growth in Q4 2025, up from 10.2% a year ago, and 10.3% full-year organic growth, supported by favorable pricing (+0.4%) and FX (+0.5%) impacts.

- Q4 adjusted EPS was $4.47, up 11.5% y/y; full-year adjusted EPS reached $13.63, a 11.8% increase.

- Q4 segment performance was highlighted by MedSurg & Neurotechnology organic growth of 12.6% (US +13%), Instruments US growth of 19.1%, and Endoscopy US growth of 11.1%.

- Year-to-date cash from operations totaled $5.0 billion, driving free cash flow at 81% of adjusted net earnings versus 75% in 2024.

- 2026 guidance calls for 8–9.5% organic net sales growth, adjusted EPS of $14.90–$15.10, and a tariff headwind of approximately $400 million.

- Stryker delivered 11% organic sales growth in Q4 and 10.3% for full-year 2025, surpassing $25 billion in sales, with 11.2% U.S. growth and 7.5% international growth.

- The company achieved a record quarter of Mako 4 installations, exceeding 3,000 systems worldwide, with over two-thirds of U.S. knee and one-third of hip procedures performed on Mako.

- For 2026, Stryker expects 8–9.5% organic sales growth, modest positive pricing, a slight FX benefit, and approximately $400 million in tariff headwinds (including $200 million in H1).

- Spencer Stiles was promoted to President and Chief Operating Officer in December to lead global commercial operations and enable executive succession.

- Fourth quarter net sales increased 11.4% to $7.2 billion, with organic growth of 11.0%; reported EPS of $2.20 (+56.0%) and adjusted EPS of $4.47 (+11.5%); adjusted operating margin expanded 100 bps to 30.2%.

- Full year net sales grew 11.2% to $25.1 billion, organic growth of 10.3%; reported EPS of $8.40 (+8.2%) and adjusted EPS of $13.63 (+11.8%); adjusted operating margin up 100 bps to 26.3%.

- Net cash from operating activities was $5.0 billion in FY 2025, while acquisitions (net of cash acquired) totaled $5.0 billion.

- 2026 guidance includes 8.0%–9.5% organic net sales growth and adjusted EPS of $14.90–$15.10, with a modestly positive impact from pricing and foreign exchange.

- Forma Medical is prioritizing its strategic focus on OptimalMTP™, which has treated over 650 patients, to accelerate surgeon adoption and deepen clinical evidence.

- The company secured U.S. Patent No. 12,521,157 covering minimally invasive joint fixation methods with low-profile plating constructs.

- Aaron Smith, former CEO of Artelon (acquired by Stryker), was appointed to the Board of Directors to leverage his two decades of orthopedic leadership.

- Forma Medical will present its advances at the ACFAS Annual Scientific Conference in Las Vegas from February 23–27, 2026.

- Continued fast growth driven by prioritized M&A in high-growth areas (e.g., healthcare IT with Vocera, Care.ai and Inari) to raise the weighted average market growth rate

- Decentralized operating model with specialized business units (GM-led sales, marketing, R&D) complemented by Customer Solutions for pricing, contracting and ASC programs to deliver comprehensive offerings

- Financial commitment to double-digit EPS growth in 2026–2028, with ~70% of capital allocated to acquisitions, moderate dividend increases and no share buybacks planned

- Emphasis on innovation across power brands—including robotics, 3D-printed implants, the virtual nurse (Care.ai) and the newly FDA-cleared MAKO RPS handheld robotic system for joint replacement’s standard-of-care segment

- Third-quarter net sales rose 10.3% to $6.1 billion, and adjusted EPS increased 11.1% to $3.19, outperforming expectations.

- Full-year outlook raised to 9.8%–10.2% organic net sales growth and $13.50–$13.60 adjusted EPS.

- Operating income margin was 18.7% (adjusted 25.6%), while free cash flow margin declined to 22.3% from 23.7%, indicating some margin pressure.

- Innovation pipeline advanced with the FDA-cleared Incompass total ankle system launch and a neurovascular robotics partnership with Siemens Healthineers.

- Delivered 9.5% organic sales growth and $3.19 adjusted EPS (+11.1% y/y) in Q3 2025

- Raised full-year 2025 guidance to 9.8%–10.2% organic sales growth and $13.50–$13.60 EPS

- Achieved 65% adjusted gross margin (+50 bps) and 25.6% adjusted operating margin (+90 bps) despite ~$200 million tariff impact

- Completed tuck-in acquisitions of Guard Medical NP Seal and Advanced Medical Balloons and advanced Inari integration with $590 million pro forma sales in 10 months

Quarterly earnings call transcripts for STRYKER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more