Earnings summaries and quarterly performance for Triumph Financial.

Executive leadership at Triumph Financial.

Aaron P. Graft

Chief Executive Officer and President

Adam D. Nelson

Executive Vice President, General Counsel and Secretary

David Vielehr

President, LoadPay

Edward J. Schreyer

Executive Vice President and Chief Operating Officer

Kim Fisk

President, Factoring

Todd Ritterbusch

President, Payments and Banking

W. Bradley Voss

Executive Vice President and Chief Financial Officer

Board of directors at Triumph Financial.

C. Todd Sparks

Director

Carlos M. Sepulveda, Jr.

Chairman of the Board

Charles A. Anderson

Director

Davis Deadman

Director

Debra A. Bradford

Director

Harrison B. Barnes

Director

Laura K. Easley

Director

Maribess L. Miller

Director

Melissa K. McSherry

Director

Michael P. Rafferty

Director

Richard L. Davis

Director

Research analysts who have asked questions during Triumph Financial earnings calls.

Gary Tenner

D.A. Davidson & Co.

7 questions for TFIN

Joseph Yanchunis

Raymond James

6 questions for TFIN

Matt Olney

Stephens Inc.

5 questions for TFIN

Tim Switzer

Keefe, Bruyette & Woods (KBW)

4 questions for TFIN

Donald Broughton

Broughton Capital LLC

2 questions for TFIN

Hal Goetsch

B. Riley Securities

2 questions for TFIN

Harold Goetsch

B. Riley Securities

2 questions for TFIN

Matthew Olney

Stephens

2 questions for TFIN

Timothy Switzer

KBW

2 questions for TFIN

Joe Yanchunas

Raymond James

1 question for TFIN

Recent press releases and 8-K filings for TFIN.

- Triumph (TFIN) discussed its Q4 2025 results, highlighting progress on revenue growth and lean operations, with some non-recurring items contributing positively.

- The LoadPay segment exited Q4 2025 with $1.5 million in annualized revenue and is projected to triple this amount in 2026, expecting to open 7,000 to 12,000 new accounts.

- The core payments business achieved a 29.5% EBITDA margin in Q4 2025 and is expected to trend above 30% in 2026, with a long-term goal of 50% or greater. The percentage of payments charged a fee increased to 35% in Q4 2025 and 38% in December, with further significant increases anticipated in Q1 2026.

- The factoring business saw its pre-tax margin improve to approximately 33% in Q4 2025, driven by technology, automation, and headcount reduction, with a long-term target of over 40%.

- The company anticipates $6 million in annual savings from the sale of a building and airplane, which is factored into the Q1 2026 expense estimate.

- Triumph (TFIN) discussed its Q4 2025 results, highlighting progress on revenue growth and lean operations, with positive contributions from non-recurring items.

- The company's core payments business generated a 30% EBITDA margin in Q4 2025 and is expected to trend higher in 2026, with a long-term target for the overall payments segment (including LoadPay) of 50% or better.

- LoadPay exited Q4 2025 with $1.5 million in annualized revenue and is projected to triple this amount in 2026, aiming to open 7,000 to 12,000 new accounts.

- The factoring segment's pre-tax margin was around 33% in Q4 2025, driven by technology, automation, and headcount reduction, with a long-term target of over 40%.

- TFIN anticipates $6 million in annual savings from the sale of a building and airplane, which is factored into the Q1 2026 expense estimates and future run rates.

- Triumph reported on its Q4 2025 results, emphasizing progress in revenue growth and lean operations.

- LoadPay's annualized revenue is projected to triple in 2026 from $1.5 million at the end of Q4 2025, with plans to open 7,000 to 12,000 new accounts.

- The core payments business achieved a 29.5% EBITDA margin in Q4 2025 and is expected to trend above 30% in 2026, aiming for 50% or greater long-term, supported by an increase in the percentage of payments charged a fee to 35% in Q4 2025 and 38% in December.

- The factoring business improved its pre-tax margin to 33% in Q4 2025, with a long-term core operating margin target of over 40%.

- The company expects $6 million in annual expense savings from the sale of a building and an airplane, which is factored into the Q1 2026 estimates and future run rate.

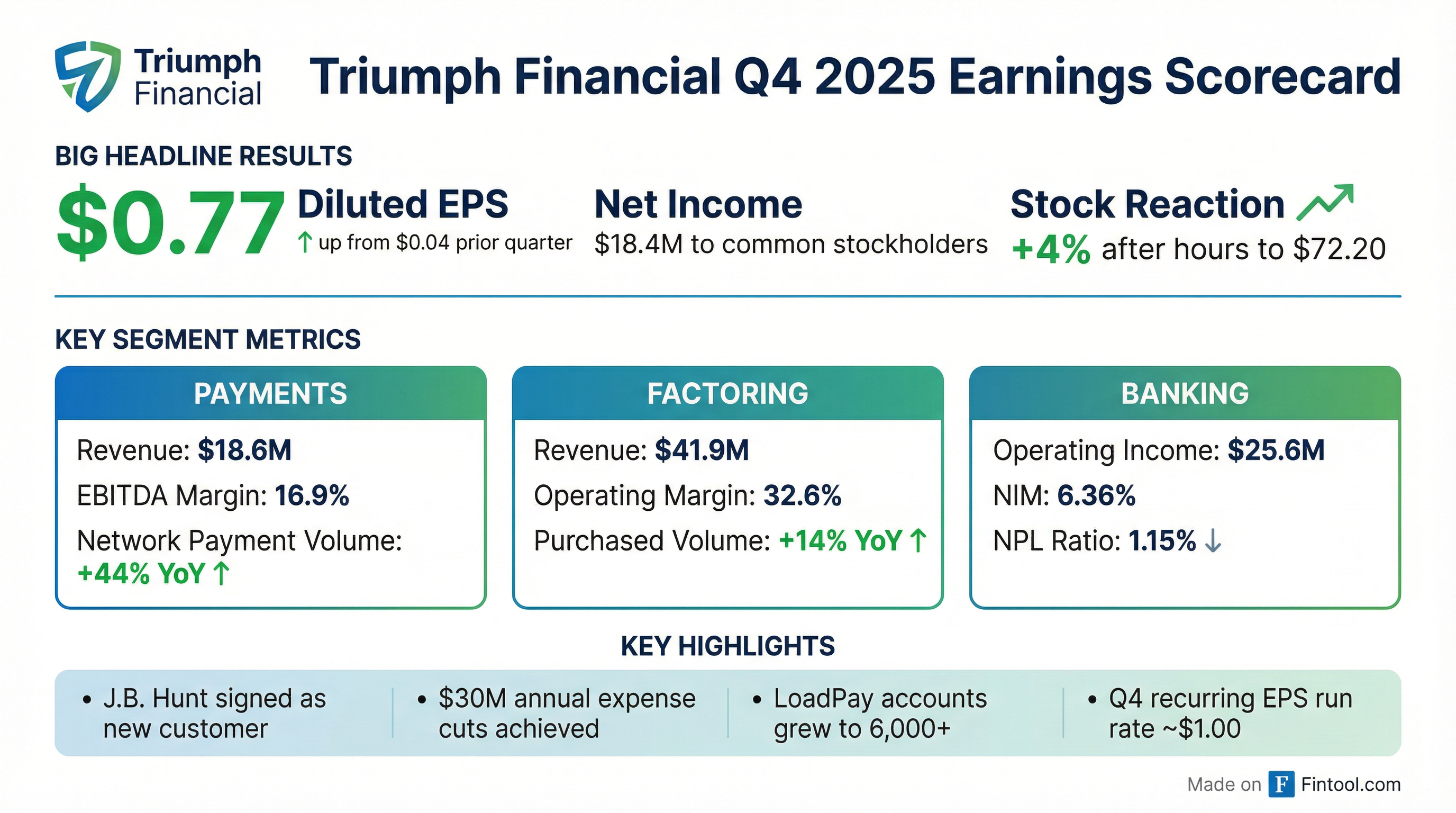

- Triumph Financial, Inc. recorded net income to common stockholders of $18.4 million, or $0.77 per diluted share, for the fourth quarter of 2025.

- The company achieved total transportation revenue growth of 4.1% in Q4 2025, with Factoring revenue up 5.8% and Payments total revenue up 0.7% quarter-over-quarter.

- Significant positive impacts on earnings included $14.3 million in cumulative gains on asset sales and a $(1.8) million net benefit from credit loss expense.

- Triumph Financial expects to reduce ongoing annual operating expenses by over $30 million by the end of Q1 2026 and aims for approximately 20% transportation revenue growth in 2026, while maintaining expense discipline.

- The company expanded its network by signing BlueGrace and J.B. Hunt, now serving 67 of the top 100 freight brokers and 8 of the top 10.

- Triumph Financial (TFIN) is a financial and technology company focused on modernizing freight transactions, auditing approximately 65-70% of all invoices and paying half of them on behalf of freight brokers and shippers.

- The company is undergoing a customer-centric reorganization to achieve cost efficiencies and aims for 20% top-line growth with flat to decreasing expenses, driven by its existing factoring, payments, and intelligence businesses.

- TFIN does not intend to grow its balance sheet, views M&A as unlikely, and plans to accrete capital by focusing on internal product enhancement and revenue growth/expense management, even amidst a prolonged freight recession.

- Triumph Financial (TFIN) operates as a financial and technology company, modernizing freight transactions by auditing and paying more truckers than any other entity globally, touching 70% of all transactions and paying half.

- The company targets 20% top-line growth, with its intelligence and payments segments (payments grew 25%-30% last quarter) expected to exceed this, while the largest factoring business ($155 million last quarter) aims for low double-digit growth.

- TFIN is implementing a customer-centric reorganization to achieve cost efficiencies and reduce expenses, with a goal of flat to decreasing expenses, demonstrating profitability despite the ongoing freight recession.

- The company's capital strategy emphasizes not growing its balance sheet, avoiding shareholder dilution, and is unlikely to pursue M&A, instead focusing on accreting income back into capital to enhance capital ratios.

- TFIN's core community bank provides stability, generating $110 million in operating income, which has helped the company navigate the longest freight recession since 1980.

- TFIN is committed to operating margin expansion and revenue growth, having cut 5% of its expense base with the majority of savings commencing in Q4 2025. The company expects expenses to be flat at the current level by Q3 2026 while revenue grows.

- The company targets 20% annual growth in transportation revenue, implying roughly $50 million of growth in 2026 from the $240 million annualized transportation revenue in Q3 2025. This growth is expected across segments, including 20% growth in factoring and substantial growth from the Intelligence segment's $10 million run rate in 2026.

- The Payments segment's LodePay, which doubled over last quarter, is evolving into a full-service banking account and business companion by 2026, with per-unit revenue expected to significantly increase from the current $750 per LinkedIn funded account.

- Regarding the Tricolore credit, TFIN believes it remains adequately secured, with more information expected in three weeks based on the bankruptcy timeline, and liquidation potentially starting relatively soon.

- TFIN has a new share buyback in place, which it intends to use with earnings as part of its overall capital planning strategy.

- Triumph Financial implemented restructuring efforts, reducing its expense base by 5%, with the majority of savings expected in Q4 2025. The company expects expenses to be flat at approximately $96.5 million in Q4 2025 and Q4 2026.

- The company targets 20% annual growth in transportation revenue, including a 20% growth target for its factoring segment.

- Triumph Financial believes it remains adequately secured in the Tricolor credit, with more information expected in three weeks due to the bankruptcy timeline, and collateral liquidation could begin relatively soon.

- The fully integrated Intelligence product is now in the market, and LoadPay is expected to evolve into a full-service banking account by Q1 2026 and a business companion by the end of 2026.

- The company is winding down non-transportation liquid credit and other non-core community banking activities to focus on traditional community banking and its transportation business.

- Triumph (TFIN) reported a market capitalization of $1.1 billion as of October 13, 2025, with trailing twelve-month (TTM) revenue of $422 million and net income to common shareholders of $6.8 million as of September 30, 2025.

- The company's Transportation Platform achieved positive operating income in Q3 2025, demonstrating a trailing 24-month revenue CAGR of 27.8% and an EBITDA Margin of 16.8%.

- For Q3 2025, annualized revenues (excluding intracompany noninterest revenue) for its segments were $155 million for Payments, $73 million for Intelligence, and $9 million for Factoring, with the Payments segment showing 23.1% year-to-date revenue growth.

- Kim Fisk was appointed President of Triumph Factoring, and Dawn Salvucci-Favier was appointed President of Triumph Intelligence.

- The Payments segment demonstrated significant improvement in Q3 2025, with revenue growing 7.4% quarter-over-quarter and its EBITDA margin improving to 16.8%, achieving positive pretax operating income for the first time. Total transportation revenue grew 3.7% quarter-over-quarter.

- The company reduced total expenses by approximately 5% in Q3 2025 through efficiency efforts, with 90% of these savings now in the run rate for Q4, and projects Q4 expenses to be $96.5 million, which is 4.5% below adjusted Q2 2025 numbers.

- The board authorized a $30 million share repurchase program on October 15, 2025, valid for up to one year, reflecting confidence in the company's intrinsic value.

- Triumph Financial, Inc. expects its transportation revenue to grow 20% annually and plans to continue shrinking its non-transportation footprint.

Quarterly earnings call transcripts for Triumph Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more