Earnings summaries and quarterly performance for VORNADO REALTY TRUST.

Executive leadership at VORNADO REALTY TRUST.

Steven Roth

Chairman and Chief Executive Officer

Barry S. Langer

Executive Vice President—Development and Co-Head of Real Estate

Deirdre Maddock

Chief Accounting Officer

Glen J. Weiss

Executive Vice President—Office Leasing and Co-Head of Real Estate

Haim Chera

Executive Vice President—Head of Retail

Michael J. Franco

President and Chief Financial Officer

Steven J. Borenstein

Secretary

Board of directors at VORNADO REALTY TRUST.

Beatrice Hamza Bassey

Trustee

Candace K. Beinecke

Lead Independent Trustee

Daniel R. Tisch

Trustee

David M. Mandelbaum

Trustee

Mandakini Puri

Trustee

Michael D. Fascitelli

Trustee

Raymond J. McGuire

Trustee

Russell B. Wight, Jr.

Trustee

William W. Helman IV

Trustee

Research analysts who have asked questions during VORNADO REALTY TRUST earnings calls.

John Kim

BMO Capital Markets

13 questions for VNO

Steve Sakwa

Evercore ISI

12 questions for VNO

Alexander Goldfarb

Piper Sandler

10 questions for VNO

Dylan Burzinski

Green Street Advisors, LLC

10 questions for VNO

Nicholas Yulico

Scotiabank

10 questions for VNO

Ronald Kamdem

Morgan Stanley

10 questions for VNO

Brendan Lynch

Barclays

8 questions for VNO

Michael Griffin

Citigroup Inc.

8 questions for VNO

Vikram Malhotra

Mizuho Financial Group, Inc.

8 questions for VNO

Anthony Paolone

JPMorgan Chase & Co.

7 questions for VNO

Floris Gerbrand van Dijkum

Compass Point Research & Trading, LLC

6 questions for VNO

Michael Lewis

Truist Securities, Inc.

6 questions for VNO

Caitlin Burrows

Goldman Sachs

5 questions for VNO

Floris van Dijkum

Compass Point Research & Trading

5 questions for VNO

Jeffrey Spector

BofA Securities

5 questions for VNO

Jana Galan

Bank of America

4 questions for VNO

Seth Bergey

Citi

4 questions for VNO

Annabelle Ayer

Barclays

2 questions for VNO

Camille Bonnel

Bank of America

2 questions for VNO

Connor Mitchell

Piper Sandler & Co.

2 questions for VNO

Matt

Western Standard

2 questions for VNO

Nick Yulico

Scotiabank

2 questions for VNO

Jing Xian Tan

Bank of America

1 question for VNO

Julien Blouin

The Goldman Sachs Group, Inc.

1 question for VNO

Seth [indiscernible]

Citigroup Inc.

1 question for VNO

Stephen Sakwa

Evercore ISI

1 question for VNO

Recent press releases and 8-K filings for VNO.

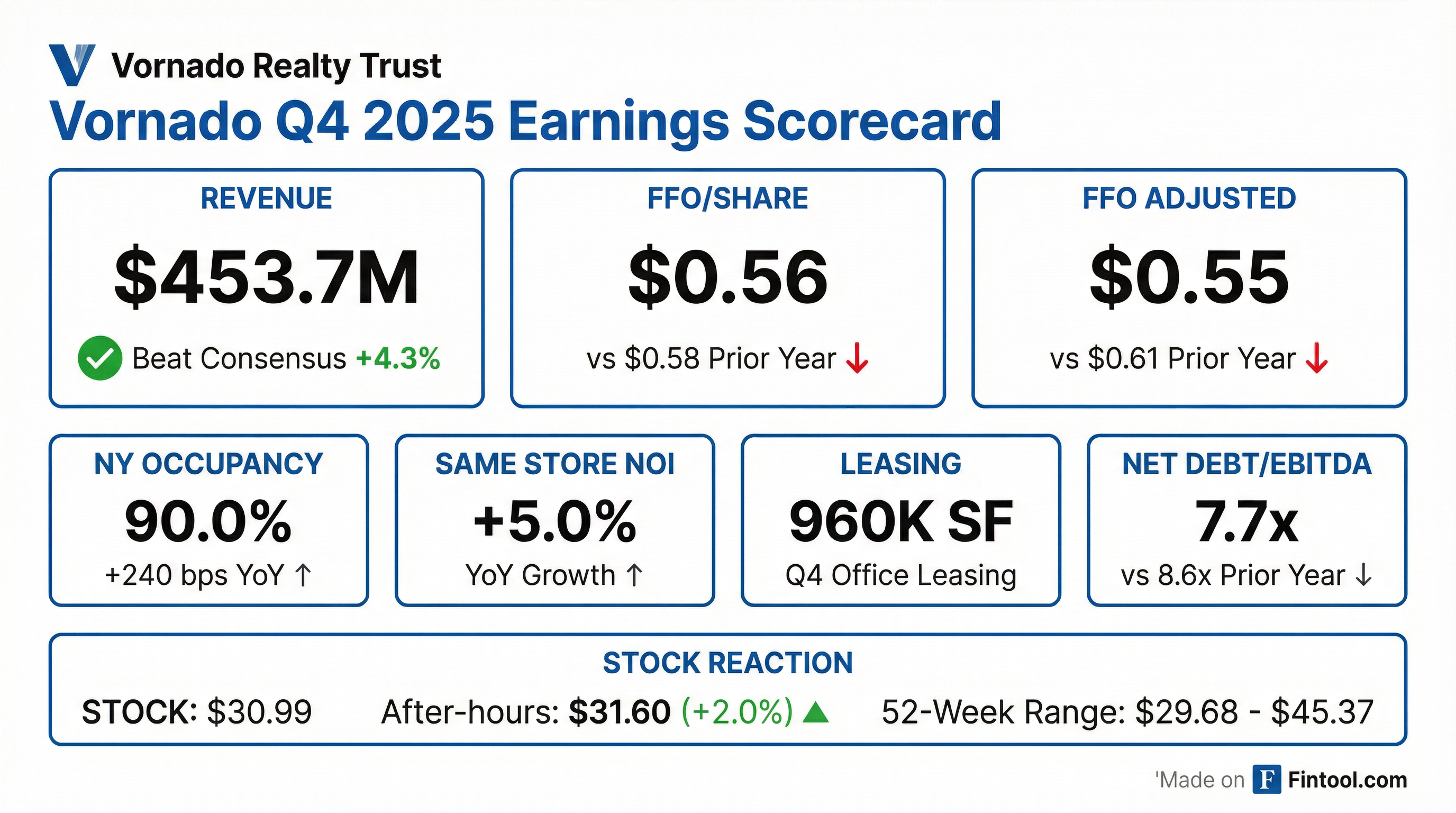

- Vornado Realty Trust reported Q4 2025 comparable FFO of $0.55 per share and full-year 2025 comparable FFO of $2.32 per share. The company expects 2026 comparable FFO to be in line with 2025, with significant earnings growth anticipated in 2027.

- In 2025, Vornado achieved its highest Manhattan leasing volume in over a decade, totaling 3.7 million sq ft, with average starting rents of $98 per sq ft and mark-to-markets of +10.4% GAAP and +7.8% cash. Office occupancy increased from 88.8% to 91.2% during 2025.

- The company maintains $2.39 billion in liquidity, including $978 million in cash, and has refinanced nearly $3.5 billion of debt through 2031. Vornado also bought back 2,352,000 shares for $80 million in recent months, indicating a belief in stock undervaluation.

- Construction for the 1.85 million sq ft 350 Park Avenue new build will commence in April. The recent acquisition of 623 Fifth Avenue for $218 million is projected to add $0.11 to FFO upon completion.

- Vornado reported an "industry-leading" Q4 and full year 2025, with 4.6 million sq ft of office space leased overall and 3.7 million sq ft in Manhattan, marking the highest Manhattan leasing volume in over a decade.

- The company maintains strong liquidity of $2.39 billion, comprising $978 million in cash and $1.41 billion in undrawn credit lines, and has improved its net debt to EBITDA to 7.7 times from 8.6 times at the start of the year, leading S&P to change its credit outlook from negative to stable.

- Vornado bought back 2,352,000 shares for $80 million at an average price of approximately $34 in recent months, with management indicating a willingness to be more aggressive given the perceived undervaluation of the stock.

- The Manhattan office market is described as the "best landlord's market in 20 years" with "extremely robust" tenant demand, and the company expects cash Net Operating Income (NOI) to turn positive in the second half of 2026.

- Vornado Realty Trust reported Q4 2025 comparable FFO of $0.55 per share and full-year 2025 comparable FFO of $2.32 per share. New York office occupancy increased from 88.8% to 91.2% in 2025.

- The company achieved its highest Manhattan leasing volume in over a decade, leasing 3.7 million sq ft in Manhattan and 4.6 million sq ft overall in 2025. The PENN District saw strong performance, with PENN 2 reaching 80% occupancy.

- Vornado maintains $2.39 billion in liquidity, comprising $978 million in cash and $1.41 billion in undrawn credit lines, and has refinanced nearly $3.5 billion of debt through 2031. The company also bought back 2,352,000 shares for $80 million in recent months.

- For 2026, comparable FFO is expected to be in line with 2025, with significant growth projected for 2027. Construction on the 1.85 million sq ft 350 Park Avenue new build will commence in April, and the $218 million acquisition of 623 5th Avenue was completed in September.

- Vornado Realty Trust reported Net Income attributable to common shareholders of $842,851,000 ($4.20 per diluted share) for the year ended December 31, 2025, significantly boosted by an $803,248,000 gain from the 770 Broadway master lease with NYU.

- Funds From Operations (FFO) attributable to common shareholders plus assumed conversions (non-GAAP) for FY 2025 was $486,826,000 ($2.42 per diluted share).

- Total revenues for the year ended December 31, 2025, reached $1,810,425,000.

- The company declared a $0.74 per common share dividend for 2025 and repurchased 1,462,360 common shares for $50,962,000 during the year.

- As of December 31, 2025, Vornado maintained total liquidity of $2,397,000,000 and had a Net Debt to EBITDAre, as adjusted ratio of 7.7x for FY 2025.

- Vornado Realty Trust (VNO) completed a $525 million refinancing for its One Park Avenue property, a 945,000 square foot Class A Manhattan office building.

- The new interest-only loan carries a rate of SOFR plus 1.78% and matures in February 2031, replacing a previous $525 million loan with a rate of SOFR plus 1.22% that was scheduled to mature in March 2026.

- New York University leases approximately 74% of the space at the One Park Avenue property.

- Vornado Realty Trust's 53% owned joint venture completed a $250 million refinancing of 7 West 34th Street, a 477,000 square foot Class A Manhattan office building where Amazon leases all office space.

- The new loan is non-recourse, has a five-year interest-only term, matures in February 2031, and carries a fixed interest rate of 5.79%.

- This refinancing involved paying down $50 million from the prior $300 million loan, which was fully recourse to Vornado and had a 3.65% interest rate.

- Vornado Realty Trust, as a joint venture partner, announced that Paramount Television Studios has signed the first lease for 70,000 square feet at Sunset Pier 94 Studios, Manhattan's first purpose-built studio facility, ahead of its opening this month.

- The leased space will be utilized for filming the second season of Dexter: Resurrection, encompassing two sound stages, production support, and office spaces.

- Sunset Pier 94 Studios, which totals 232,000 square feet of leasable space, has experienced robust pre-leasing interest, with this inaugural lease highlighting strong demand.

- The project is anticipated to generate 400 permanent jobs and contribute $6.4 billion to the local economy over the next 30 years.

- Vornado Realty L.P., the operating partnership of Vornado Realty Trust, issued and sold $500,000,000 aggregate principal amount of 5.750% Notes due 2033 in an underwritten public offering on January 14, 2026.

- The notes were sold at a public offering price of 99.824% per note, resulting in net proceeds of $495,370,000 after deducting the underwriting discount and before expenses.

- The offering was managed by several underwriters, with BofA Securities, Inc., PNC Capital Markets LLC, U.S. Bancorp Investments, Inc., and Wells Fargo Securities, LLC acting as representatives.

- These notes are unsecured and unsubordinated obligations of Vornado Realty L.P., ranking equally with its other unsecured and unsubordinated indebtedness.

- Vornado Realty Trust announced on January 7, 2026, the acquisition of 3 East 54th Street for $141 million.

- The acquired property is a demolition-ready asset on 18,400 square feet of land, zoned for approximately 232,500 buildable square feet.

- The purchase price was offset by a $107 million loan balance that Vornado had previously acquired in 2024 and 2025, which was credited towards the purchase.

- Vornado intends to promptly demolish the existing buildings on the site, which strategically complements its nearby Plaza District and Park Avenue holdings.

- Vornado Realty L.P. priced an offering of $500 million aggregate principal amount of 5.75% senior unsecured notes due February 1, 2033.

- The notes were priced at 99.824% of their face amount to yield 5.78%.

- The approximately $494 million net proceeds will be used to repay $400 million of unsecured notes due June 1, 2026, with the remaining funds allocated for general corporate purposes.

- The offering is anticipated to close on January 14, 2026.

Quarterly earnings call transcripts for VORNADO REALTY TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more