Earnings summaries and quarterly performance for ASBURY AUTOMOTIVE GROUP.

Executive leadership at ASBURY AUTOMOTIVE GROUP.

David W. Hult

President & Chief Executive Officer

Daniel Clara

Chief Operating Officer

Dean Calloway

Senior Vice President, General Counsel & Secretary

Jed M. Milstein

Senior Vice President & Chief Human Resources Officer

Michael Welch

Senior Vice President & Chief Financial Officer

Board of directors at ASBURY AUTOMOTIVE GROUP.

Bridget Ryan-Berman

Director

Hilliard C. Terry, III

Director

Joel Alsfine

Director

Juanita T. James

Director

Maureen F. Morrison

Director

Philip F. Maritz

Director

Shamla Naidoo

Director

Thomas J. Reddin

Non-Executive Board Chair

William D. Fay

Director

Research analysts who have asked questions during ASBURY AUTOMOTIVE GROUP earnings calls.

Rajat Gupta

JPMorgan Chase & Co.

8 questions for ABG

Jeff Lick

Stephens Inc.

7 questions for ABG

Bret Jordan

Jefferies

6 questions for ABG

David Whiston

Morningstar, Inc.

5 questions for ABG

Ryan Sigdahl

Craig-Hallum Capital Group

5 questions for ABG

Glenn Chin

Seaport Research Partners

4 questions for ABG

John Murphy

Bank of America

3 questions for ABG

John Babcock

Bank of America

2 questions for ABG

Matthew Raab

Craig-Hallum Capital Group

2 questions for ABG

Daniela Haigian

Morgan Stanley

1 question for ABG

Federico Merendi

Bank of America

1 question for ABG

Jeff Liquid

Stephens Inc.

1 question for ABG

Matthew Robb

Craig-Hallum

1 question for ABG

Recent press releases and 8-K filings for ABG.

- Asbury Automotive Group sold three dealerships (Porsche of Greenville, Land Rover Greenville, and Crown Nissan of Greenville) in Greenville, S.C., to RBM of Atlanta.

- The transaction, which included related real estate, closed on February 23.

- This sale is part of Asbury's broader portfolio management initiative and long-term growth strategy to optimize its footprint.

- This marks the second transaction in 2026 where Presidio advised Asbury on a dealership divestiture.

- Asbury Automotive Group completed the sale of ten dealerships, generating approximately $210 million in net proceeds.

- These sold dealerships contributed an annualized revenue of approximately $610 million.

- The company's board of directors approved an increase of $424 million in the share repurchase authorization, bringing the total availability to $500 million as of February 25, 2026.

- Proceeds from the sale are expected to be invested to accelerate the reduction of the leverage ratio to below 3.0x and continue deploying capital to share repurchases.

- Asbury Automotive Group completed the sale of six Plaza Motors luxury dealerships and a collision center in St. Louis to MileOne Autogroup on February 23.

- This divestiture is part of Asbury's broader portfolio management initiative following a period of significant growth, which included a 2025 acquisition of 33 dealerships.

- The Presidio Group provided M&A advisory services to Asbury for this transaction.

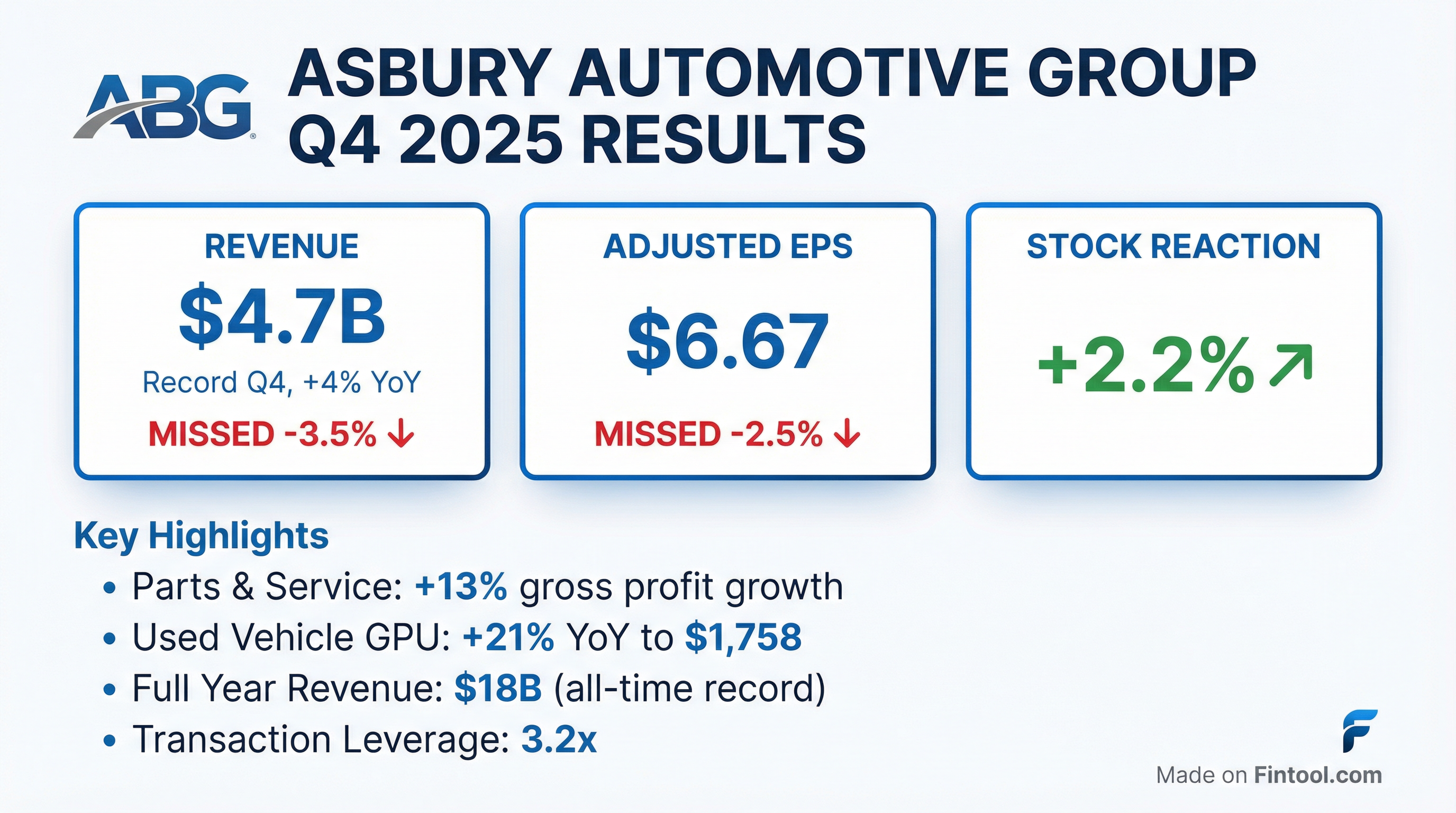

- Asbury reported record Q4 results with $4.7 billion in revenue and $793 million in gross profit, delivering adjusted EPS of $6.67 and an adjusted operating margin near 5.4%.

- The company's adjusted EBITDA was $250 million for Q4, and its gross profit margin expanded by 31 basis points to 17%.

- Strategic actions include $50 million in share repurchases during Q4 and the completion of four store divestitures, with a further 13-store divestiture program underway expected to total roughly $750 million of annualized revenue.

- Management noted strength in used-vehicle operations but anticipates near-term pressures in the first half of 2026 from softer new-vehicle demand and rising operating costs, expecting improvement in the second half.

- Asbury Automotive Group reported a fourth-quarter record of $4.7 billion in revenue and $793 million in gross profit for Q4 2025, with an adjusted earnings per share of $6.67.

- In 2025, the company acquired $2.9 billion in revenue, divested four stores in Q4 2025, and plans to divest nine more by the end of Q1 2026, collectively representing $750 million of annualized revenue.

- The company repurchased $100 million in shares for the full year 2025 and ended the year with a Net Leverage Ratio of 3.2x, with a goal to reduce it to below 3x by summer 2026.

- Asbury transitioned 15 additional stores onto Tekion in Q4 2025, bringing the total to 38, with the full rollout across all stores expected by fall 2026. New vehicle profitability is anticipated to stabilize in the $2,500-$3,000 range, and a renewed strategy for parts and service aims for mid-single-digit customer pay growth.

- Asbury Automotive Group (ABG) reported record fourth quarter 2025 revenue of $4.7 billion and gross profit of $793 million, with adjusted earnings per share (EPS) of $6.67.

- For the full year 2025, ABG acquired $2.9 billion in revenue and repurchased $100 million in shares, including $50 million in Q4 2025.

- The company's transaction-adjusted Net Leverage Ratio improved to 3.2x at year-end 2025, with a target to reduce it below 3x by summer/end of 2026.

- ABG continued its Tekion DMS rollout, transitioning 15 additional stores in Q4 2025 to reach 38 stores by year-end, with the full rollout expected by Q3 2026. This initiative is anticipated to cause a "front-half hit" to SG&A in 2026 due to duplicated costs, followed by "back-half benefit" from savings.

- For 2026, the company forecasts a slight contraction in SAR, expecting the first half to be more challenging and the second half to improve.

- Asbury Automotive Group reported $18 billion in total revenue and $1,006 million in Adjusted EBITDA for the full year 2025.

- As of Q4 2025, the company's Transaction Adjusted Net Leverage was 3.2x, with $927 million in available liquidity, and the company targets leverage under 3.0x.

- In 2025, ABG acquired $2.9 billion in revenue and divested ~$800 million in revenue, while also repurchasing $100 million in shares. The company plans organic investments of approximately $250 million per year in 2026 and 2027.

- For Q4 2025, total same-store revenue decreased by 6% year-over-year, primarily due to a 10% decline in used vehicle retail revenue and a 6% decline in new vehicle revenue, though parts and service revenue increased by 2%.

- Asbury Automotive Group reported a record fourth quarter 2025 revenue of $4.7 billion and gross profit of $793 million, delivering an adjusted earnings per share of $6.67.

- The company strategically managed its portfolio, acquiring $2.9 billion in revenue in 2025 and divesting 4 stores in Q4, with plans to divest 9 additional stores by the end of Q1 2026, collectively representing $750 million of annualized revenue.

- Asbury achieved a transaction-adjusted Net Leverage Ratio of 3.2x by year-end 2025, better than its 3.5x forecast, and repurchased $50 million in shares during the quarter, contributing to $100 million for the full year.

- The rollout of the Tekion Dealer Management System advanced, with 38 stores operating on the new system by year-end 2025, and the company expects to complete the rollout by fall 2026, anticipating future efficiencies.

- Asbury Automotive Group reported record fourth quarter Revenue of $4.7 billion, an increase of 4%, contributing to an all-time record annual Revenue of $18 billion for 2025.

- For the fourth quarter of 2025, Net Income was $60 million ($3.10 per diluted share), while adjusted Net Income, a non-GAAP measure, was $129 million ($6.67 per diluted share).

- The company repurchased approximately 212,000 shares for $50 million during the fourth quarter of 2025, bringing the full-year 2025 share repurchases to $100 million.

- During 2025, Asbury acquired $2.9 billion in annualized revenue and divested four stores in Q4 2025 with an estimated annualized revenue of $150 million.

- As of December 31, 2025, the company's transaction adjusted net leverage ratio was 3.2x, and it had $927 million in total liquidity.

- Asbury Automotive Group reported record fourth quarter Revenue of $4.7 billion, a 4% increase, and record Gross Profit of $793 million, a 6% increase for Q4 2025, contributing to an all-time record annual Revenue of $18 billion for the full year.

- For the fourth quarter of 2025, the company reported EPS of $3.10 per diluted share and adjusted EPS of $6.67 per diluted share.

- The company repurchased approximately 212,000 shares for $50 million during Q4 2025, bringing the full-year 2025 share repurchases to $100 million.

- As of December 31, 2025, Asbury had $927 million in total liquidity and a transaction adjusted net leverage ratio of 3.2x.

Quarterly earnings call transcripts for ASBURY AUTOMOTIVE GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more