Earnings summaries and quarterly performance for Aramark.

Research analysts who have asked questions during Aramark earnings calls.

Jaafar Mestari

BNP Paribas

8 questions for ARMK

Jasper Bibb

Truist Securities

8 questions for ARMK

Neil Tyler

Redburn Atlantic

8 questions for ARMK

Andrew J. Wittmann

Robert W. Baird & Co.

7 questions for ARMK

Andrew Steinerman

JPMorgan Chase & Co.

7 questions for ARMK

Joshua Chan

UBS Group AG

6 questions for ARMK

Leo Carrington

Citi

6 questions for ARMK

Toni Kaplan

Morgan Stanley

6 questions for ARMK

Ian Zaffino

Oppenheimer & Co. Inc.

5 questions for ARMK

Stephanie Moore

Jefferies

5 questions for ARMK

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

4 questions for ARMK

Harold Antor

Jefferies Financial Group Inc.

3 questions for ARMK

Faiza Alwy

Deutsche Bank

2 questions for ARMK

Josh Shan

UBS

2 questions for ARMK

Karl Green

RBC Capital Markets

2 questions for ARMK

Yehuda Silverman

Morgan Stanley

2 questions for ARMK

Alexander EM Hess

JPMorgan Chase & Co.

1 question for ARMK

Elizabeth Dove

Goldman Sachs

1 question for ARMK

Ian Defina

Oppenheimer

1 question for ARMK

Ian Difina

Oppenheimer

1 question for ARMK

Isaac Saulson

Oppenheimer & Co. Inc.

1 question for ARMK

Ryan Davis

Goldman Sachs

1 question for ARMK

Recent press releases and 8-K filings for ARMK.

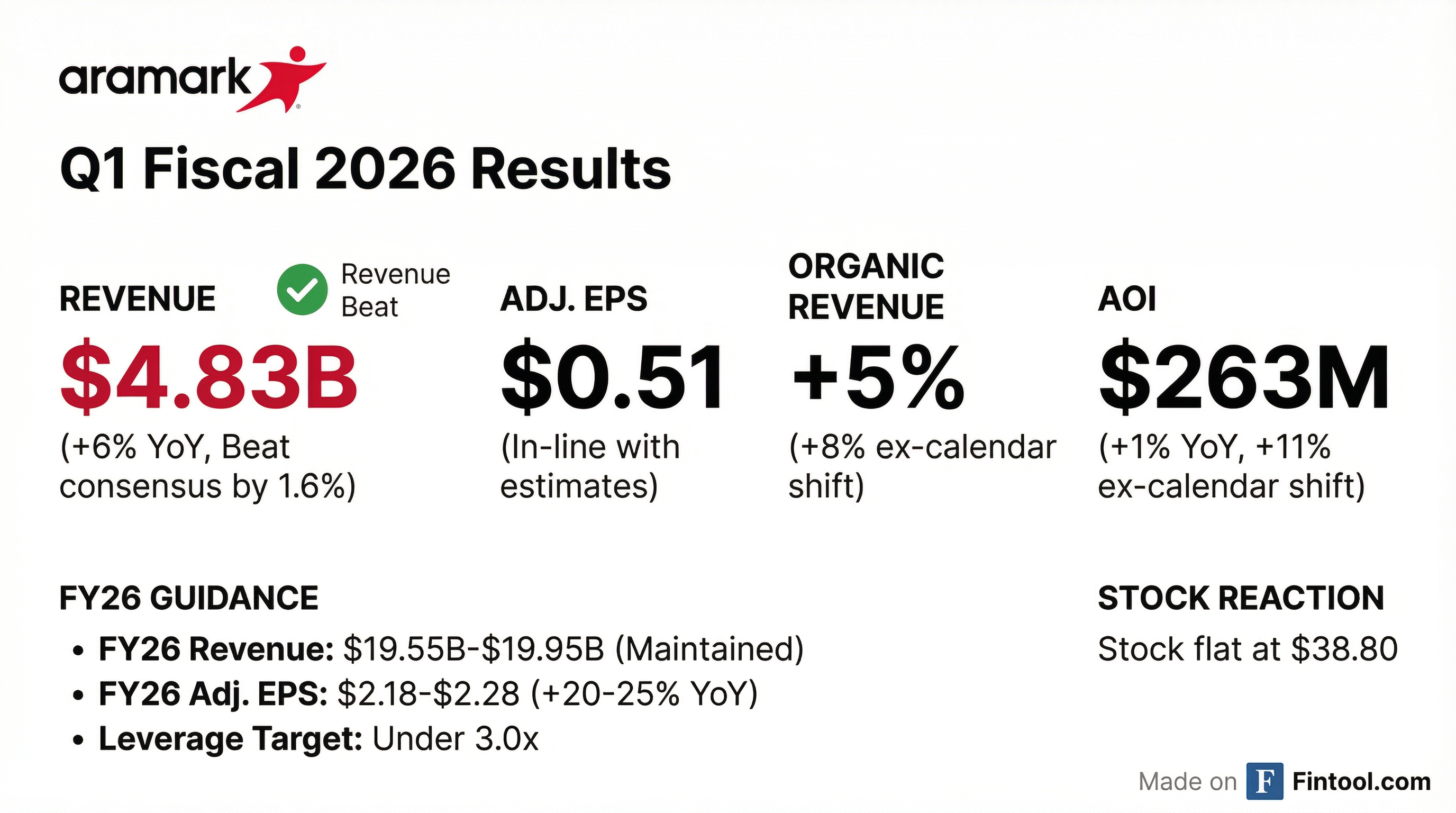

- Aramark reported Q1 2026 organic revenue growth of 5% to $4.8 billion, which would have been approximately 8% excluding a calendar shift that negatively impacted revenue by an estimated $125 million. Adjusted EPS for the quarter was $0.51.

- The company reaffirmed its full-year fiscal 2026 guidance, anticipating organic revenue growth of 7%-9%, Adjusted Operating Income (AOI) to increase 12%-17%, and adjusted EPS growth of 20%-25%.

- Key growth drivers include extraordinary client retention and significant new client wins, such as Penn Medicine and RWJBarnabas Health in the U.S., alongside continued double-digit organic revenue growth in the International segment, which increased over 13% in Q1.

- Aramark repurchased $30 million of shares and proactively repriced $2.4 billion of 2030 term loans, resulting in 25 basis points of interest expense savings.

- Aramark reported Q1 2026 organic revenue growth of 5% to $4.8 billion, which would have been approximately 8% without a calendar shift that unfavorably impacted revenue by about $125 million.

- Adjusted Operating Income (AOI) grew 1% on a constant currency basis to $263 million, but would have increased approximately 11% without the $25 million impact from the calendar shift. Adjusted EPS was $0.51.

- The company reaffirmed its full-year fiscal 2026 outlook, projecting organic revenue growth of 7%-9%, AOI increasing 12%-17%, and adjusted EPS growth of 20%-25%.

- Operational highlights include extraordinary client retention and significant new client wins, particularly in healthcare, education, and corrections, with the company well on track to meet or exceed its 4%-5% net new target for fiscal 2026.

- Aramark repurchased $30 million of shares and repriced $2.4 billion of 2030 term loans, resulting in 25 basis points of interest expense savings.

- Aramark reported Q1 2026 organic revenue growth of 5% to $4.8 billion, which would have been approximately 8% without a calendar shift that unfavorably impacted revenue by about $125 million.

- Adjusted Operating Income (AOI) for Q1 2026 was $263 million, an increase of 1% on a constant currency basis, but would have grown approximately 11% without the estimated $25 million impact from the calendar shift.

- The company reaffirmed its full-year fiscal 2026 guidance, expecting organic revenue growth of 7%-9%, AOI increasing 12%-17%, and adjusted EPS growth of 20%-25%.

- Aramark secured significant new business wins, including Penn Medicine and RWJBarnabas Health, and repurchased $30 million of shares while optimizing its debt structure by repricing $2.4 billion of term loans.

- Aramark reported Q1 Fiscal 2026 revenue growth of +6% and organic revenue growth of +5%, which would have been approximately +8% without the calendar shift.

- Adjusted Operating Income (AOI) grew +1%, or approximately +11% without the calendar shift, and Adjusted EPS was unchanged, but would have grown approximately +13% without the calendar shift.

- The company repurchased $30 million of stock in fiscal 2026 and increased its quarterly dividend by 14% to $0.12 per share in November 2025.

- For fiscal 2026, Aramark anticipates organic revenue growth of +7% to +9%, Adjusted Operating Income growth of +12% to +17%, and Adjusted EPS growth of +20% to +25%. The company is also committed to reducing its leverage ratio to under 3.0x by the end of fiscal 2026.

- Aramark reported Q1 fiscal 2026 revenue of $4.8 billion, an increase of 6% year-over-year, with organic revenue growing 5%.

- Adjusted EPS remained unchanged at $0.51 for Q1 fiscal 2026, while GAAP EPS decreased 8% to $0.36. The company noted that a calendar shift reduced growth across key metrics, with Adjusted EPS growth estimated at +13% without this impact.

- During the quarter, Aramark repurchased $30 million of stock and favorably repriced $2.4 billion of 2030 Term Loans by 25 basis points.

- The company reaffirmed its fiscal 2026 outlook, projecting revenue between $19.55 billion and $19.95 billion (organic growth of +7% to +9%), Adjusted Operating Income between $1.1 billion and $1.15 billion (organic growth of +12% to +17%), and Adjusted EPS between $2.18 and $2.28 (growth of +20% to +25%).

- Aramark reported first quarter fiscal 2026 revenue of $4,831,549 thousand, a 6% increase year-over-year, with organic revenue growth of 5%. Adjusted EPS remained unchanged at $0.51, though the company noted a calendar shift negatively impacted Q1 growth but is expected to provide a favorable impact in Q2.

- For fiscal year 2026, Aramark anticipates revenue between $19,550 million and $19,950 million and Adjusted EPS between $2.18 and $2.28. The company also expects its Leverage Ratio to be under 3x by the end of fiscal 2026.

- The company continued its capital allocation priorities by repurchasing $30 million of stock and favorably repricing $2.4 billion of 2030 Term Loans. A quarterly dividend of $0.12 per share was also approved.

- Aramark reported Q1 revenue of approximately $4.83 billion and adjusted EPS of $0.51, slightly topping estimates.

- The company reaffirmed its fiscal 2026 revenue guidance of $19.55 billion–$19.95 billion.

- Management emphasized record-high client retention, strong net new business, and major multi-year contract wins, including Penn Medicine and RWJBarnabas.

- FSS International achieved over 13% organic growth, marking its nineteenth consecutive quarter of double-digit international growth.

- A calendar shift reduced reported organic revenue growth by about 3% (approximately $125 million) and adjusted operating income by about $25 million.

- Aramark Sports + Entertainment has expanded its multi-venue partnership with Venu Holding Corporation (VENU).

- Under the expanded agreement, Aramark will now support five of VENU’s premium multi-seasonal and outdoor venues.

- Aramark will deliver elevated food and beverage, premium club dining, facilities management, and retail services for these venues.

- The partnership also includes an additional equity investment by Aramark in VENU.

- The U.S. Contract Catering Market was valued at $73.31 billion in 2024 and is projected to grow to $110.17 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 7.02%.

- The market is consolidated, with Compass Group PLC, Aramark, and Sodexo leading and collectively contributing over 50% of the market share.

- Major trends driving market growth include Digitalization & Tech Integration (e.g., AI-driven menu planning, contactless payment) and Ethical Sourcing & Sustainability (e.g., zero-waste kitchens, local sourcing).

- The market faces a significant challenge from intense competition coupled with pricing pressure, making it difficult for smaller players to compete with the scale and purchasing power of larger companies.

- Aramark Services, Inc., an indirect wholly owned subsidiary of Aramark, entered into Amendment No. 19 to its Credit Agreement on December 11, 2025.

- This amendment provides for the repricing of all previously outstanding U.S. Term B-8 Loans by refinancing them with new U.S. Term B-10 Loans in an aggregate principal amount of $2,384,140,862.90.

- The new U.S. Term B-10 Loans are due in June 2030 and bear interest at a rate equal to Term SOFR plus 1.75% or a base rate plus 0.75%.

- Principal repayments for the U.S. Term B-10 Loans are required in quarterly installments of $6,290,609.14, commencing December 31, 2028, and continuing through March 31, 2030.

Fintool News

In-depth analysis and coverage of Aramark.

Quarterly earnings call transcripts for Aramark.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more