Earnings summaries and quarterly performance for BRISTOL MYERS SQUIBB.

Executive leadership at BRISTOL MYERS SQUIBB.

Christopher Boerner

Chief Executive Officer

Cristian Massacesi

Executive Vice President, Chief Medical Officer and Head of Development

David Elkins

Executive Vice President and Chief Financial Officer

Karin Shanahan

Executive Vice President, Global Product Development & Supply

Sandra Leung

Executive Vice President and General Counsel

Board of directors at BRISTOL MYERS SQUIBB.

Deepak Bhatt

Director

Derica Rice

Director

Julia Haller

Director

Karen Vousden

Director

Manuel Hidalgo

Director

Michael McMullen

Director

Paula Price

Director

Peter Arduini

Director

Phyllis Yale

Director

Theodore Samuels

Lead Independent Director

Research analysts who have asked questions during BRISTOL MYERS SQUIBB earnings calls.

Courtney Breen

AllianceBernstein

8 questions for BMY

David Risinger

Leerink Partners

8 questions for BMY

Mohit Bansal

Wells Fargo & Company

7 questions for BMY

Steve Scala

Cowen

7 questions for BMY

Asad Haider

Goldman Sachs

6 questions for BMY

Christopher Schott

JPMorgan Chase & Co.

6 questions for BMY

Evan Seigerman

BMO Capital Markets

6 questions for BMY

Luisa Hector

Berenberg

6 questions for BMY

Seamus Fernandez

Guggenheim Partners

6 questions for BMY

Terence Flynn

Morgan Stanley

6 questions for BMY

Akash Tewari

Jefferies

5 questions for BMY

Carter L. Gould

Barclays

5 questions for BMY

David Amsellem

Piper Sandler Companies

5 questions for BMY

Geoff Meacham

Citigroup Inc.

5 questions for BMY

James Shin

Analyst

4 questions for BMY

Matthew Phipps

William Blair

3 questions for BMY

Sean McCutcheon

Raymond James

3 questions for BMY

Chris Schott

JPMorgan Chase & Company

2 questions for BMY

Chris Shibutani

Goldman Sachs Group, Inc.

2 questions for BMY

Geoffrey Meacham

Citi

2 questions for BMY

Jason Gerberry

Bank of America Merrill Lynch

2 questions for BMY

Malcolm Hoffman

BMO Capital Markets

2 questions for BMY

Michael Yee

Jefferies

2 questions for BMY

Olivia Brayer

Cantor

2 questions for BMY

Tim Anderson

Bank of America

2 questions for BMY

Timothy Anderson

BofA Securities

2 questions for BMY

Alexandria Hammond

Wolfe Research

1 question for BMY

Chun Chen

UBS

1 question for BMY

Crypta Devarakonda

Truist Securities

1 question for BMY

Kripa Devarakonda

Truist Securities

1 question for BMY

Srikripa Devarakonda

Truist Financial Corporation

1 question for BMY

Steven Scala

TD Cowen

1 question for BMY

Trang Han

UBS

1 question for BMY

Trung Huynh

UBS Group AG

1 question for BMY

Recent press releases and 8-K filings for BMY.

- Bayer’s oral FXIa inhibitor asundexian 50 mg QD reduced recurrent ischemic stroke by 26% vs placebo without increasing ISTH major bleeding

- The OCEANIC-STROKE Phase III trial randomized 12,327 noncardioembolic ischemic stroke or high-risk TIA patients (mean age 68; 33% female)

- Benefits were consistent across age, sex, stroke subtype and antiplatelet regimens, representing a potential paradigm shift for secondary stroke prevention

- Bayer has received FDA Fast Track designation and plans to submit the data to regulators, highlighting a major commercial opportunity if approved

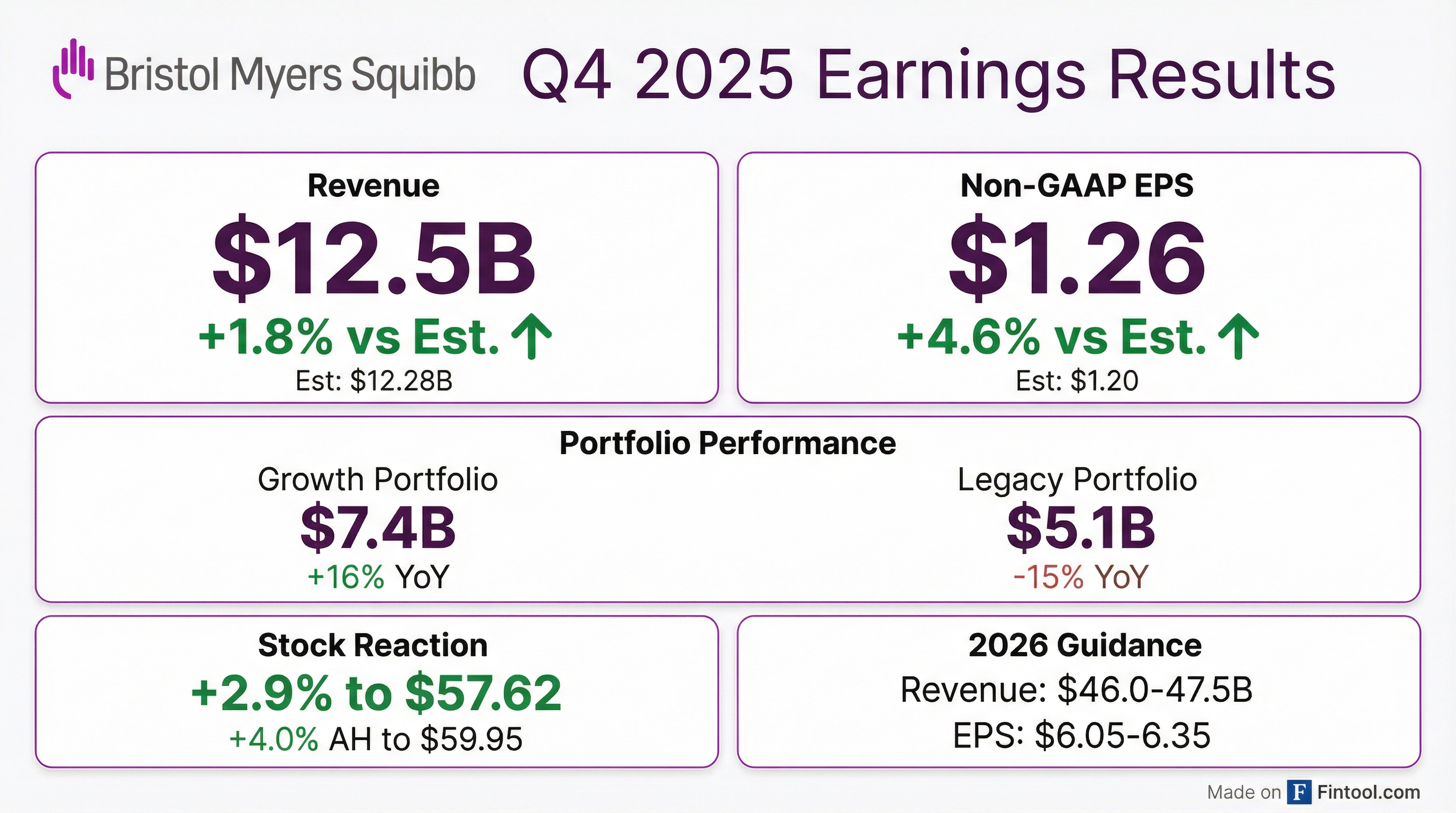

- Q4 2025 net revenues were $12.5 B, up from $12.3 B YoY, driven by Growth Portfolio revenues of $7.4 B (+16% YoY; +15% Ex-FX) while Legacy Portfolio revenues fell 15% to $5.1 B.

- Q4 non-GAAP diluted EPS was $1.26, versus GAAP EPS of $0.53.

- FY 2025 net revenues reached $48.2 B with non-GAAP EPS of $6.15.

- 2026 guidance calls for total revenues of $46.0 B–$47.5 B and non-GAAP EPS of $6.05–$6.35.

- Q4 revenue was flat year-over-year at $12.5 billion, with the growth portfolio up 15% to $7.4 billion (≈60% of total revenue).

- For full-year 2025, the growth portfolio rose 17%, nearly offsetting a $4 billion decline in the legacy portfolio.

- Newer products Opdualag, Breyanzi, and Camzyos each surpassed $1 billion in 2025 sales, while Reblozyl delivered over $2 billion.

- 2026 guidance projects revenue of $46 billion–$47.5 billion and adjusted EPS of $6.05–$6.35.

- Delivered $1 billion in cost savings in 2025 (on track for $2 billion by 2027); full-year operating expenses were $16.6 billion, down $1.2 billion y-o-y.

- Total Q4 revenue was flat YoY at $12.5 B; the growth portfolio rose 15% to $7.4 B, accounting for ~60% of sales.

- Major product performance: Opdivo up 7% to $2.7 B; Eliquis up 6% to $3.5 B; Breyanzi +47%; Camzyos +57% to $353 M; Reblozyl +21%; Cobenfy $51 M.

- Achieved $1 B of cost savings in 2025 and on track for $2 B by 2027; Q4 EPS $1.26, FY 2025 EPS $6.15.

- 2026 guidance: revenue of $46–47.5 B; adjusted EPS $6.05–6.35; gross margin 69–70%; operating expenses ~$16.3 B.

- Zolgensma gene therapy achieved $1.2 billion in sales last year.

- Yescarta CAR-T therapy recorded $1.498 billion in global sales.

- The FDA has 46 approved cell & gene therapy products in the U.S..

- Strategic deals exceed $2 billion, including Quell Therapeutics’ £2 billion partnership with AstraZeneca.

- Q4 revenue was flat YoY at $12.5 billion, with the growth portfolio up 15% to $7.4 billion, representing ~60% of total sales.

- Full-year growth portfolio rose 17%, nearly offsetting a $4 billion decline in legacy brands; Opdualag, Breyanzi, and Camzyos each exceeded $1 billion in sales, while Reblozyl delivered over $2 billion.

- 2026 revenue is guided at $46–47.5 billion with adjusted EPS of $6.05–6.35 and gross margin of 69–70%, reflecting continued growth portfolio strength and legacy LOE headwinds.

- Strategic productivity initiative achieved $1 billion in savings in 2025, with another $1 billion targeted over 2026–27; operating expenses expected to decline to $16.3 billion in 2026.

- Strong financial position with $11 billion in cash, completion of $10 billion debt paydown, and $2 billion of Q4 operating cash flow; continues to return capital via dividends.

- Q4 total revenues of $12.5 billion, up 1%, with Growth Portfolio revenues rising 16% to $7.4 billion; GAAP EPS of $0.53 and non-GAAP EPS of $1.26.

- Full-year revenues were $48.2 billion, flat year-over-year, with Growth Portfolio up 17% to $26.4 billion; GAAP EPS $3.46 and non-GAAP EPS $6.15.

- 2026 guidance calls for revenues of $46.0 – $47.5 billion and non-GAAP EPS of $6.05 – $6.35.

- Increased quarterly dividend to $0.63 per share, marking the 17th consecutive annual increase.

- OXB and Bristol Myers Squibb have expanded their strategic partnership by signing a new Commercial Supply Agreement for the manufacture and supply of lentiviral vectors for BMS’ CAR-T programmes.

- The deal spans an initial five-year term with an option to extend.

- Commercial manufacturing is slated to begin in 2026, pending regulatory approval, at OXB’s Oxford (UK) and Durham (NC, US) facilities.

- The agreement is expected to deliver significant multi-year revenue, supporting OXB’s existing medium-term financial guidance.

- Oxford BioMedica signed a Commercial Supply Agreement to manufacture lentiviral vectors for BMS’s CAR-T programmes, with an initial five-year term and extension option.

- Commercial manufacturing is set to begin in 2026 at OXB’s Oxford, UK, and Durham, NC sites, subject to regulatory approval.

- OXB projects the agreement will generate meaningful multi-year revenue and support its medium-term financial guidance.

- Oxford BioMedica shares rose 2.4% to 838 pence on the announcement, while analysts maintain a Hold rating, noting persistent financial weaknesses despite revenue growth.

- TGCT treatment market in the US, EU4, UK, and Japan is expected to grow significantly by 2034 due to rising awareness, improved diagnosis via advanced imaging, and uptake of targeted CSF1R therapies.

- The United States currently holds the largest market share for TGCT treatments among leading markets.

- There were over 630,000 prevalent TGCT cases across the 7MM in 2024, with case numbers projected to rise by 2034.

- Emerging CSF1R-targeted therapies such as SynOx’s emactuzumab, Abbisko’s pimicotinib, and AmMax Bio’s AMB-051 are anticipated to drive the next wave of TGCT treatments.

Fintool News

In-depth analysis and coverage of BRISTOL MYERS SQUIBB.

Quarterly earnings call transcripts for BRISTOL MYERS SQUIBB.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more