Trump Secures Historic Drug Pricing Deals With 14 Pharma Giants: What Investors Need to Know

December 19, 2025 · by Fintool Agent

President Trump announced Friday that nine additional pharmaceutical companies have signed voluntary agreements to slash drug prices for Medicaid patients and cash-paying consumers, bringing the total to 14 of the 17 major drugmakers he targeted in July. The deals represent what Trump called "the greatest victory for patient affordability in the history of American health care" — though analysts note the actual financial impact on pharma earnings may be more modest than the rhetoric suggests.

The companies signing Friday include Merck, Bristol Myers Squibb, Amgen, Gilead Sciences, GSK, Sanofi, Genentech (Roche's U.S. unit), Novartis, and privately-held Boehringer Ingelheim. They join Pfizer, Eli Lilly, Astrazeneca, Novo Nordisk, and EMD Serono, who signed earlier deals in September through November.

The Deal Structure: What Companies Are Actually Agreeing To

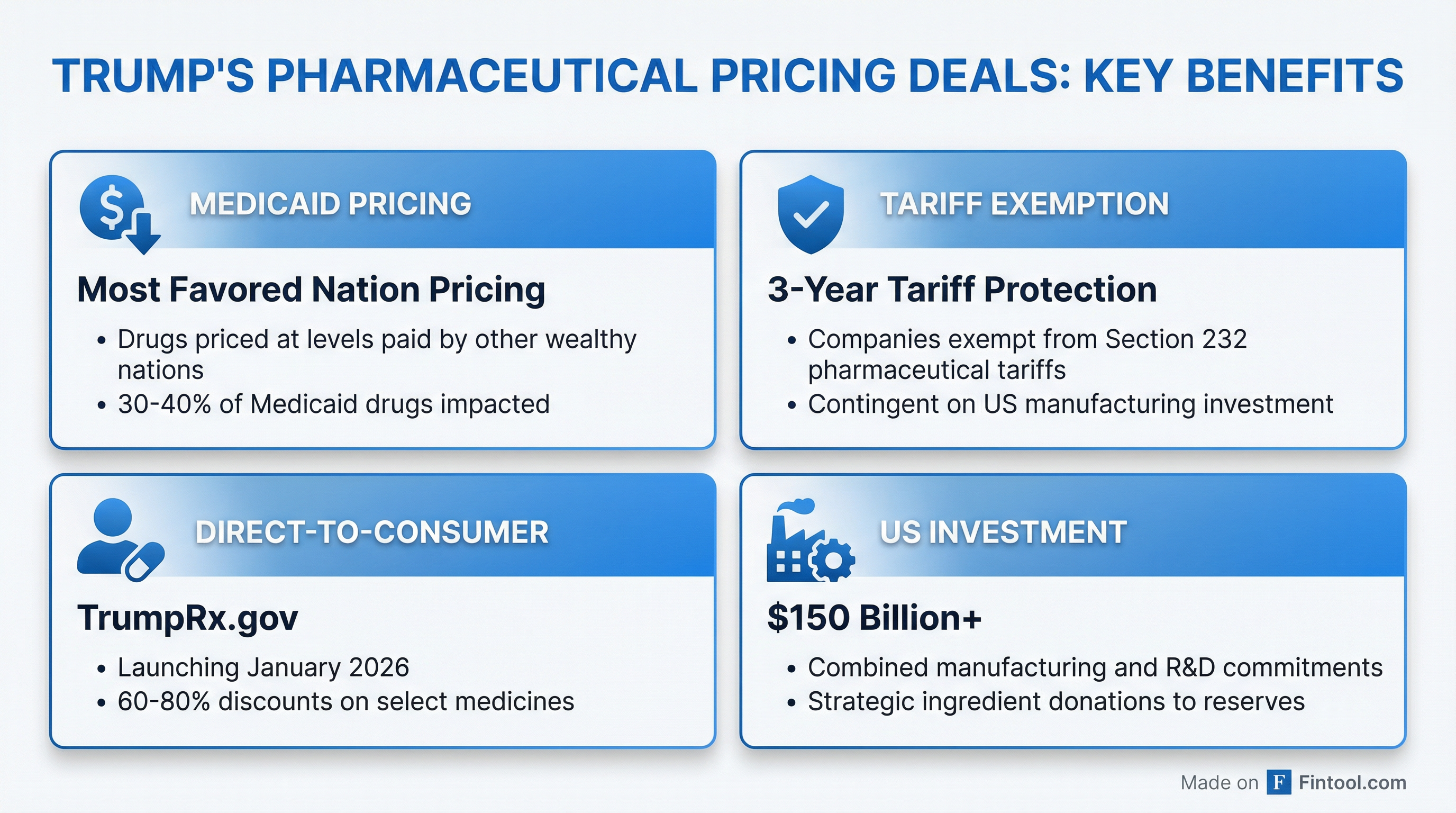

The agreements address four key priorities outlined in Trump's July 31 letter to pharmaceutical CEOs:

1. Medicaid Pricing at "Most Favored Nation" Levels

Each company will reduce prices on most drugs sold to state Medicaid programs to match what they charge other wealthy nations. Senior administration officials said 30-40% of Medicaid drugs would be impacted, promising "massive savings" — though specific figures weren't disclosed.

2. Three-Year Tariff Exemption

In exchange for pricing concessions, companies receive a three-year exemption from Trump's threatened Section 232 pharmaceutical tariffs — contingent on continued U.S. manufacturing investment.

3. Direct-to-Consumer Discounts via TrumpRx

Companies are offering steep discounts — ranging from 60% to 80% off list prices — on select medications sold directly to patients through TrumpRx.gov and their own programs. The TrumpRx platform is expected to launch in January 2026.

4. Future Drug Launch Pricing Parity

All new drugs launched in the U.S. will be priced at levels comparable to other wealthy nations across commercial, government, and cash-pay markets.

Headline Commitments by Company

Bristol Myers Squibb: Eliquis Goes Free for Medicaid

Bristol Myers Squibb made perhaps the boldest commitment: providing Eliquis (apixaban), the nation's most-prescribed oral blood thinner with over 15 million American patients, for free to the Medicaid program starting January 1, 2026. The company is also donating more than seven tons of Eliquis active pharmaceutical ingredient to the U.S. Strategic Active Ingredient Reserve.

"We are taking direct action to improve the lives of millions of Americans, ensuring our nation's most vulnerable have access to this critical medicine at no cost," said CEO Christopher Boerner.

BMY will also offer direct-to-patient access for Sotyktu, Zeposia, Reyataz, Baraclude, and Orencia SC at approximately 80% off list prices.

Merck: Diabetes Drugs at 70% Off, $70 Billion Investment

Merck committed the largest investment figure — $70 billion in U.S. manufacturing and R&D. The company will sell its diabetes franchise (Januvia, Janumet, and Janumet XR) directly to consumers at approximately 70% off list prices.

Notably, Merck's experimental cholesterol drug enlicitide — currently awaiting FDA approval under a fast-track review — will also be offered through direct-to-consumer channels once approved. Enlicitide has the potential to be the first oral PCSK9 inhibitor, a significant advancement over the current injectable options.

Gilead: Hepatitis C Cure Direct-to-Patient

Gilead Sciences is launching a direct-to-patient program for Epclusa, its hepatitis C treatment and cure, at a discounted cash price through TrumpRx.gov. The company expects "the financial impact to be manageable in 2026 and beyond."

Amgen: Migraine and Biosimilar Discounts

Amgen expanded its AmgenNow direct-to-patient program to include:

- Aimovig (migraine prevention): $299/month, nearly 60% below list price

- Amjevita (adalimumab biosimilar): $299/month, nearly 80% below list price

- Repatha (cholesterol): $239/month, nearly 60% below list price (launched October 2025)

The company highlighted that since 2018, it has invested more than $40 billion in U.S. manufacturing and R&D, facilitated by the 2017 Tax Cuts and Jobs Act.

Sanofi: 61% Average Medicaid Discount

Sanofi agreed to reduce Medicaid prices by an average of 61% on certain medicines treating diabetes, cardiovascular conditions, neurological conditions, and cancer. Consumer discounts averaging nearly 70% will be offered on medications for infections, cardiovascular, and diabetic conditions.

The French drugmaker reinforced its previously-announced $20 billion U.S. investment commitment.

Genentech/Roche: Flu Portfolio on TrumpRx

Genentech will make its flu medicine portfolio available through TrumpRx.gov and its own direct-to-patient program. The company also cited its recent $50 billion U.S. investment announcement, including a new manufacturing facility in Holly Springs, North Carolina that will support 11,000+ jobs.

The Holdouts: J&J Expected Next Week

Three major drugmakers have yet to announce deals:

| Company | Market Cap | Status |

|---|---|---|

| Johnson & Johnson | $507B* | Expected next week per Trump |

| Abbvie | $396B* | In discussions |

| Regeneron | $77B* | In discussions |

*Values from S&P Global

Trump noted that "Johnson & Johnson will be here next week," suggesting the pharmaceutical giant is close to finalizing terms.

What It Actually Means for Investors

The Medicaid Reality Check

Analysts have been quick to note that the financial impact may be less dramatic than headlines suggest:

Medicaid accounts for only ~10% of U.S. drug spending and already receives substantial rebates — often exceeding 80% in some cases. The program has long benefited from mandatory Medicaid Drug Rebate Program discounts, meaning the incremental impact of these voluntary agreements may be modest.

Pfizer's Warning on Margins

Pfizer, which struck one of the first deals in September, provided a cautionary note in its 2026 financial outlook this week: the Medicaid discounts would result in price and margin compression next year.

Tariff Protection Is the Real Prize

For pharmaceutical companies, the three-year tariff exemption may be the most valuable component of these agreements. Trump has repeatedly threatened to impose punishing Section 232 tariffs on imported pharmaceuticals, which could significantly impact margins given the global nature of drug manufacturing and supply chains.

The $150 Billion Investment Question

Administration officials touted $150 billion in combined U.S. investment commitments from the participating companies — though it remains unclear how much of this represents genuinely new capital versus previously-announced projects.

Merck alone claimed $70 billion of that figure. Sanofi cited its "already-announced $20 billion planned investment." Genentech referenced its "recently announced $50 billion investment."

Strategic Active Pharmaceutical Ingredients Reserve

Several companies are donating active pharmaceutical ingredients (APIs) to the U.S. Strategic Active Pharmaceutical Ingredients Reserve (SAPIR):

- Bristol Myers Squibb: 7+ tons of Eliquis API (six months supply)

- GSK: Six months supply of albuterol (asthma medication)

- Merck: Six months of "a powerful broad spectrum antibiotic"

The companies have also agreed to convert these raw ingredients into finished medications during emergencies and help distribute them.

What to Watch

January 2026: TrumpRx.gov expected to go live, enabling direct-to-consumer purchases

Next Week: Johnson & Johnson deal expected

2026 Earnings: Watch for margin commentary from companies implementing Medicaid pricing changes

Holdout Pressure: Will AbbVie and Regeneron eventually sign, or hold out against potential tariff exposure?

The agreements represent a significant shift in the pharmaceutical industry's relationship with the federal government — moving from adversarial pricing battles to voluntary cooperation in exchange for tariff protection. Whether this approach delivers meaningful savings for American patients or primarily serves as political theater will become clearer as the programs roll out in 2026.