Earnings summaries and quarterly performance for Brixmor Property Group.

Executive leadership at Brixmor Property Group.

James M. Taylor Jr.

Chief Executive Officer

Brian T. Finnegan

President, Chief Operating Officer

Mark T. Horgan

Executive Vice President, Chief Investment Officer

Steven F. Siegel

Executive Vice President, General Counsel and Secretary

Steven T. Gallagher

Executive Vice President, Chief Financial Officer and Treasurer

Board of directors at Brixmor Property Group.

Daniel B. Hurwitz

Director

JP Suarez

Director

Julie Bowerman

Director

Michael Berman

Director

Sandra A.J. Lawrence

Director

Sheryl M. Crosland

Chair of the Board

Thomas W. Dickson

Director

William D. Rahm

Presiding Independent Director

Research analysts who have asked questions during Brixmor Property Group earnings calls.

Caitlin Burrows

Goldman Sachs

10 questions for BRX

Craig Mailman

Citigroup

10 questions for BRX

Haendel St. Juste

Mizuho Financial Group

10 questions for BRX

Juan Sanabria

BMO Capital Markets

10 questions for BRX

Samir Khanal

Bank of America

10 questions for BRX

Todd Thomas

KeyBanc Capital Markets

10 questions for BRX

Paulina Rojas Schmidt

Green Street Advisors

8 questions for BRX

Linda Tsai

Jefferies

7 questions for BRX

Michael Mueller

JPMorgan Chase & Co.

7 questions for BRX

Alexander Goldfarb

Piper Sandler

6 questions for BRX

Floris van Dijkum

Compass Point Research & Trading

6 questions for BRX

Greg McGinniss

Scotiabank

6 questions for BRX

Ki Bin Kim

Truist Securities

6 questions for BRX

Michael Griffin

Citigroup Inc.

6 questions for BRX

Cooper Clark

Wells Fargo

5 questions for BRX

Michael Goldsmith

UBS

5 questions for BRX

Connor Mitchell

Piper Sandler & Co.

4 questions for BRX

Dori Kesten

Wells Fargo & Company

4 questions for BRX

Viktor Fediv

Scotiabank

3 questions for BRX

Andrew Reale

Bank of America

2 questions for BRX

Conor Peaks

Deutsche Bank

2 questions for BRX

Floris Gerbrand van Dijkum

Compass Point Research & Trading, LLC

2 questions for BRX

Hong Zhang

JPMorgan Chase & Co.

2 questions for BRX

Jeffrey Spector

BofA Securities

2 questions for BRX

Omotayo Okusanya

Deutsche Bank AG

2 questions for BRX

Tayo Okusanya

M Science

2 questions for BRX

Jamie Feldman

Wells Fargo & Company

1 question for BRX

JPMorgan Analyst

JPMorgan Chase & Co.

1 question for BRX

Linda Yu Tsai

Jefferies Financial Group Inc.

1 question for BRX

Paulina Rojas

Green Street

1 question for BRX

Wells Fargo Analyst

Wells Fargo Securities, LLC

1 question for BRX

Recent press releases and 8-K filings for BRX.

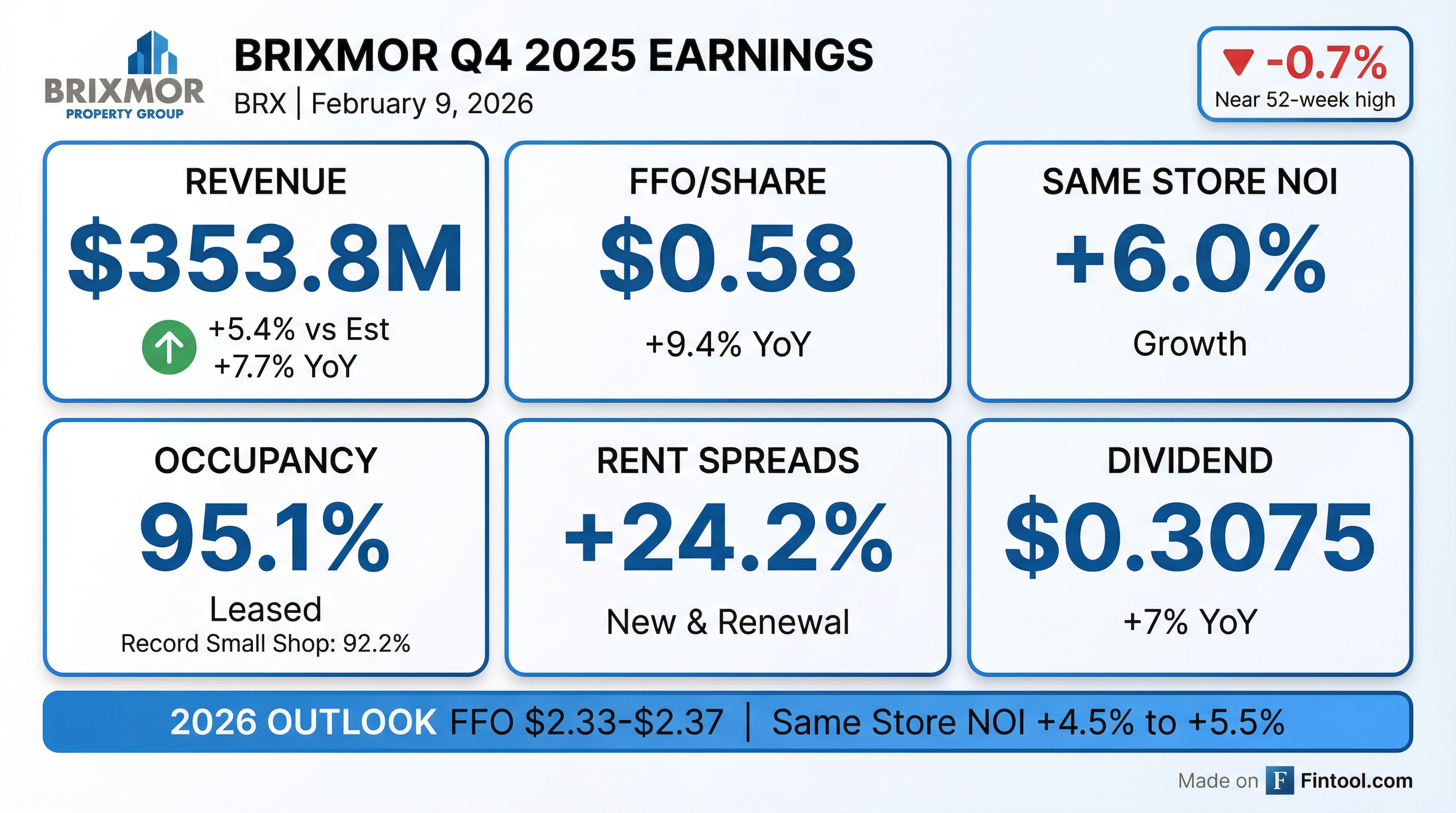

- Brixmor Property Group reported Q4 2025 NAREIT FFO of $0.58 per share and FY 2025 NAREIT FFO of $2.25 per share, representing a 5.6% increase from the previous year.

- The company achieved 4.2% Same Property NOI growth for FY 2025 and 6% in Q4 2025, driven by strong base rent growth and asset management initiatives.

- Operational highlights include a record leasing year with $70 million of new rent executed, small shop occupancy reaching a new high of 92.2%, and overall occupancy increasing to 95.1%. New lease rent growth was 39%, and renewal rent growth was 15%.

- For 2026, Brixmor is guiding to NAREIT FFO of $2.33-$2.37 per share, representing 4.4% growth at the midpoint, and 4.5%-5.5% Same Property NOI growth. The outlook for revenues deemed uncollectable (bad debt) has improved to 75-100 basis points.

- The company ended the period with $1.6 billion of available liquidity and a debt to EBITDA ratio of 5.4 times. They also stabilized $183 million of projects in 2025 at a 10% incremental yield and completed $170 million in dispositions.

- Brian Finnegan has been appointed as the permanent CEO of Brixmor Property Group.

- For fiscal year 2025, the company reported FFO of $2.25 per share, marking a 5.6% increase year-over-year, and achieved Same Property NOI growth of 4.2%.

- Brixmor provided 2026 NAREIT FFO guidance of $2.33-$2.37 per share, representing 4.4% growth at the midpoint, and anticipates 4.5%-5.5% Same Property NOI growth.

- The company had a record leasing year with $70 million of new rent executed, increasing overall occupancy by 100 basis points to 95.1% and small shop occupancy to 92.2%. New lease rent growth was 39% and renewal rent growth was 15% for the year.

- In 2025, Brixmor acquired approximately $420 million of assets and completed $170 million in dispositions during Q4 2025, while maintaining $1.6 billion in available liquidity.

- Brian Finnegan has been appointed as the permanent CEO of Brixmor, with other key management promotions including Stacy Slater to Executive Vice President, Capital Markets, Corporate Strategy and Investor Relations, and Matt Ryan to South Region President and National Property Operations.

- For the full year 2025, Brixmor reported FFO of $2.25 per share, marking a 5.6% increase year-over-year, and achieved 4.2% Same Property Net Operating Income (NOI) growth. The company also executed a record $70 million in new rent and increased overall occupancy by 100 basis points to 95.1%.

- The company provided a positive outlook for 2026, guiding to NAREIT FFO of $2.33-$2.37 per share, representing 4.4% growth at the midpoint, and expects 4.5%-5.5% Same Property NOI growth.

- Brixmor was active in capital allocation during 2025, acquiring approximately $420 million of assets and completing $170 million of dispositions in the fourth quarter. The company ended the period with $1.6 billion of available liquidity and a Debt to EBITDA ratio of 5.4 times.

- Brixmor Property Group reported Nareit FFO of $0.58 per diluted share for the three months ended December 31, 2025, and $2.25 per diluted share for the twelve months ended December 31, 2025.

- The company saw an increase in same property NOI of 6.0% for the three months ended December 31, 2025, and 4.2% for the twelve months ended December 31, 2025.

- Brixmor achieved record annual operating results, including a record 92.2% small shop leased occupancy and executing a record $70 million of new lease ABR in 2025.

- The company provided 2026 Nareit FFO per diluted share expectations of $2.33 - $2.37 and same property NOI growth expectations of 4.50% - 5.50%.

- A quarterly cash dividend of $0.3075 per common share was declared, and the company renewed its $400.0 million share repurchase program.

- Brixmor Property Group reported record annual operating results for the full year ended December 31, 2025, with net income attributable to Brixmor Property Group Inc. of $1.25 per diluted share and Nareit FFO of $2.25 per diluted share.

- For the three months ended December 31, 2025, the company achieved net income of $0.44 per diluted share and Nareit FFO of $0.58 per diluted share, with same property NOI increasing by 6.0%.

- The company provided 2026 Nareit FFO per diluted share expectations of $2.33 - $2.37 and same property NOI growth expectations of 4.50% - 5.50%.

- During 2025, Brixmor executed a record $70 million of new lease ABR, increased total leased occupancy to 95.1%, and completed $416.8 million of acquisitions and $296.5 million of dispositions.

- The company renewed its $400.0 million share repurchase program and $400.0 million at-the-market (ATM) equity offering program.

- Brixmor Property Group acquired two shopping centers and one land parcel for a combined $190.7 million during the three months ended December 31, 2025, and a total of three shopping centers and two land parcels for $416.8 million for the full year 2025.

- Key acquisitions in Q4 2025 included the Chino Spectrum Towne Center for $138.0 million and Broomfield Town Center for $51.2 million, both grocery-anchored assets.

- The company generated $170.2 million from the disposition of eight shopping centers and two partial properties in Q4 2025, and $296.5 million from 18 shopping centers and six partial properties for the full year 2025.

- This investment activity reflects Brixmor's strategy to cluster its portfolio in attractive markets and leverage its platform for long-term value and earnings growth.

- Brixmor Property Group Inc. authorized a new share repurchase program for up to $400 million of its common stock, replacing a previous program and set to expire on October 28, 2028.

- On October 28, 2025, the company also entered into Equity Distribution Agreements, allowing it to sell up to an aggregate gross sales price of $400 million of common stock through various sales agents.

- Brixmor Property Group reported NAREIT FFO of $0.56 per share and same-property NOI growth of 4% for the third quarter of 2025.

- The company executed 1.5 million square feet of new and renewal leases at a blended cash spread of 18%, with new leases signed at a record rate of $25.85 per square foot. Small shop occupancy reached a record 91.4%.

- A record high of $22 million of new ABR commenced during the quarter, contributing to a signed but not yet commenced rent pipeline totaling $60 million.

- Brixmor increased its annual dividend by 7% to $1.23 and updated its full-year FFO guidance to $2.23 to $2.25.

- The company closed on a $223 million acquisition and has approximately $190 million of value-add acquisitions under control, expecting to be net acquirers by year-end, while year-to-date dispositions totaled $148 million.

- Brixmor Property Group reported NAREIT FFO of $0.56 per share in the third quarter of 2025, driven by same-property NOI growth of 4%.

- The company executed 1.5 million square feet of new and renewal leases at a blended cash spread of 18%, with new leases signed at a record rate of $2,585 per square foot. Small shop occupancy reached a record 91.4%.

- Brixmor increased its annual dividend by 7% to $1.23 and updated its FFO guidance to $2.23 to $2.25 for the year, while affirming its same-property NOI range of 3.9% to 4.3%.

- The company closed on the $223 million acquisition of LaCenterra at Cinco Ranch, recorded $148 million in disposition volume year to date, and has approximately $190 million of value-add acquisitions under control, expecting to be net acquirers at year-end.

- Brixmor Property Group reported NAREIT FFO of $0.56 per share and 4% same-property NOI growth for the third quarter of 2025.

- The company executed 1.5 million sq ft of new and renewal leases at a blended cash spread of 18%, with new leases signed at a record rate of $2,585 per square foot. The signed but not yet commenced rent pipeline totals $60 million.

- Brixmor announced a 7% increase in its annual dividend to a rate of $1.23 per share.

- The company updated its FFO guidance to $2.23-$2.25 and affirmed its same-property NOI range of 3.9%-4.3% for the full year.

- Brixmor closed on a $223 million acquisition of LaCenterra at Cinco Ranch and has approximately $190 million of value-add acquisitions under control, expecting to be a net acquirer by year-end.

Quarterly earnings call transcripts for Brixmor Property Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more