Earnings summaries and quarterly performance for LOGITECH INTERNATIONAL.

Executive leadership at LOGITECH INTERNATIONAL.

Board of directors at LOGITECH INTERNATIONAL.

Christopher Jones

Director

Deborah Thomas

Director

Donald Allan

Director

Edouard Bugnion

Director

Guy Gecht

Chairperson of the Board

Kwok Wang Ng

Director

Marjorie Lao

Director

Neela Montgomery

Director

Owen Mahoney

Director

Sascha Zahnd

Director

Research analysts who have asked questions during LOGITECH INTERNATIONAL earnings calls.

Asiya Merchant

Citigroup Global Markets Inc.

7 questions for LOGI

Erik Woodring

Morgan Stanley

6 questions for LOGI

Samik Chatterjee

JPMorgan Chase & Co.

5 questions for LOGI

Ananda Baruah

Loop Capital Markets LLC

4 questions for LOGI

Didier Scemama

Bank of America

4 questions for LOGI

Martin Jungfleisch

Exane BNP Paribas

4 questions for LOGI

Joern Iffert

UBS

3 questions for LOGI

Michael Foeth

Vontobel Holding AG

3 questions for LOGI

Alek Valero

Loop Capital Markets

2 questions for LOGI

Dong Wang

Nomura Instinet

2 questions for LOGI

Joe Cardoso

JPMorgan Chase & Co.

2 questions for LOGI

Ananda

Loop Capital Markets

1 question for LOGI

Austin Baker

Loop Capital Markets

1 question for LOGI

Didier

Bank of America

1 question for LOGI

Didier Andrade

Bank of America

1 question for LOGI

George Brown

Deutsche Bank AG

1 question for LOGI

Joern

UBS

1 question for LOGI

Jörn Iffert

UBS

1 question for LOGI

Jorn Van derloop

UBS

1 question for LOGI

Martin

BNP Paribas

1 question for LOGI

Maya Neuman

Morgan Stanley

1 question for LOGI

Michael

TD Cowen

1 question for LOGI

Tim Long

Barclays

1 question for LOGI

Recent press releases and 8-K filings for LOGI.

- Logitech reported strong financial results for Q3 FY2026, with net sales of $1.4 billion, an increase of 4% year-over-year in constant currency, and non-GAAP operating income of $312 million, up 17% year-over-year.

- The company achieved a non-GAAP gross margin rate of 43.5% and generated approximately $500 million in operating cash flow, a 30% year-over-year increase.

- Growth was driven by superior product innovation, including the MX Master 4 and AI-powered devices, and a strong focus on B2B demand, which outpaced B2C in the quarter.

- For Q4 FY2026, Logitech expects net sales growth of 3%-5% year-over-year in constant currency and non-GAAP operating income between $155 million and $165 million, representing a 20% year-over-year increase at the midpoint.

- Logitech highlighted a significant opportunity in the existing PC installed base, noting that less than half of the 1.5 billion+ PCs globally have a mouse attached and less than 30% have an external keyboard.

- Logitech reported Q3 2026 net sales of $1.4 billion, a 4% year-over-year increase in constant currency, alongside record non-GAAP operating income of $312 million, up 17% year-over-year, and a non-GAAP gross margin rate of 43.5%.

- The company's performance was driven by strategic priorities including superior product innovation, such as the MX Master 4 mouse, and a strong focus on B2B, where Logitech for Business demand significantly outpaced B2C.

- Logitech generated approximately $500 million in operating cash flow, a 30% year-over-year increase, and maintained a strong cash balance of $1.8 billion.

- For Q4 2026, Logitech provided guidance for net sales growth of 3%-5% year-over-year in constant currency and non-GAAP operating income between $155 million and $165 million, expecting to exceed long-term model targets for non-GAAP gross and operating margins for fiscal year 2026.

- Logitech reported strong financial results for Q3 2026, with net sales of $1.4 billion, up 4% year-over-year in constant currency, and non-GAAP operating income of $312 million, a 17% increase.

- The company provided a positive outlook for Q4 2026, expecting net sales growth of 3%-5% year-over-year in constant currency and non-GAAP operating income between $155 million and $165 million, anticipating closing fiscal year 2026 above long-term model targets for non-GAAP gross and operating margins.

- Growth was fueled by strategic priorities such as superior product innovation, including the MX Master 4 and new AI-powered devices, and a focus on B2B demand, which significantly outpaced B2C.

- Operational excellence resulted in a non-GAAP gross margin of 43.5%, with product cost reduction and manufacturing diversification, including reducing U.S. products manufactured in China to less than 10%, offsetting tariff impacts.

- Logitech expressed confidence in the peripherals market's growth opportunities, noting its sales historically outpace PC sales by 300-500 basis points and highlighting the significant potential in the existing PC installed base.

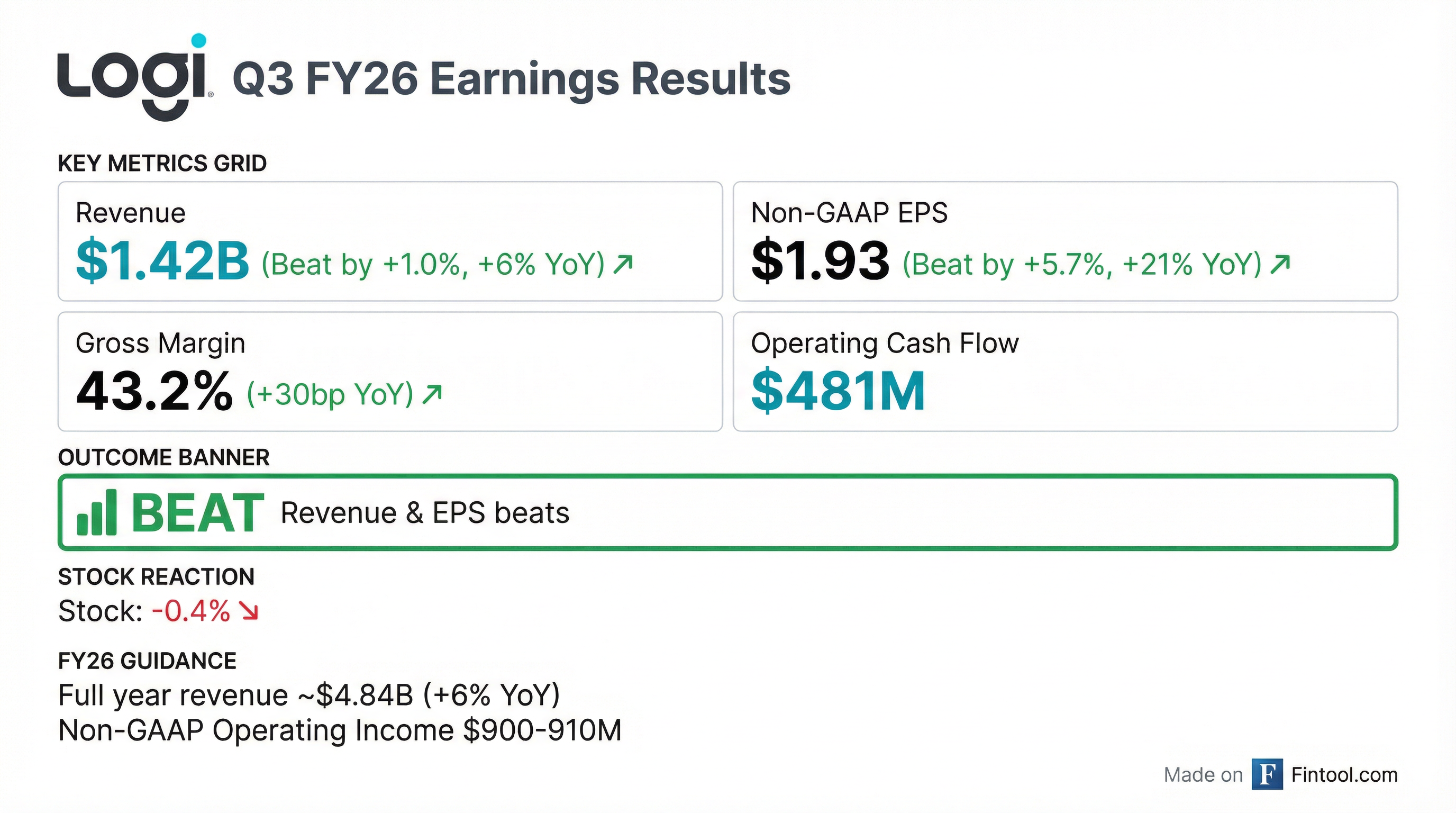

- Logitech International reported Q3 Fiscal Year 2026 sales of $1.42 billion, an increase of 6 percent in US dollars and 4 percent in constant currency compared to the prior year.

- GAAP operating income was $286 million (up 22 percent) and Non-GAAP operating income was $312 million (up 17 percent) for Q3 FY26. GAAP EPS was $1.69 (up 28 percent) and Non-GAAP EPS was $1.93 (up 21 percent).

- The company generated $481 million in cash flow from operations and ended the quarter with a cash balance of $1.8 billion.

- For Q4 FY26, Logitech forecasts sales between $1,070 million and $1,090 million and Non-GAAP operating income between $155 million and $165 million. The full Fiscal Year 2026 outlook projects sales of $4,825 million to $4,845 million and Non-GAAP operating income of $900 million to $910 million.

- Logitech International reported Q3 Fiscal Year 2026 sales of $1.42 billion, an increase of 6% in US dollars and 4% in constant currency compared to the prior year.

- GAAP earnings per share (EPS) was $1.69, up 28%, and Non-GAAP EPS was $1.93, up 21% for the quarter.

- The company achieved GAAP operating income of $286 million, a 22% increase, and Non-GAAP operating income of $312 million, up 17%.

- Cash flow from operations was $481 million, with a quarter-ending cash balance of $1.8 billion.

- For Q4 Fiscal Year 2026, Logitech forecasts sales between $1,070 million and $1,090 million and Non-GAAP operating income between $155 million and $165 million.

- Logitech is executing a multi-pronged strategy focused on superior product innovation, expanding its B2B segment into a $14 billion addressable market, implementing a "China for China" strategy to regain share, and strengthening its brand.

- The company boasts a strong financial position with $1.5 billion in cash and no debt. Its capital allocation priorities include organic growth, increasing dividends, disciplined tuck-in M&A, and a three-year $2 billion share buyback program.

- Logitech reported a 43% gross margin in the last quarter and anticipates 42% to 43% for the quarter ahead, with a long-term target of 40% plus, driven by cost savings, premiumization, and a favorable mix shift towards higher-margin video conferencing.

- To mitigate tariff impacts, Logitech proactively adjusted pricing and relocated 40% of its U.S. product manufacturing from China, aiming to reduce China's share to 10% by year-end.

- Operational efficiency gains, particularly a 200 basis point reduction in OPEX in Q2, have been significantly aided by the internal deployment of over 1,000 AI agents.

- Logitech's CEO, Hanneke Faber, outlined key strategic initiatives including a focus on superior products and innovation (launching approximately 35 new products annually), doubling down on the B2B market (which represents a $14 billion addressable opportunity), and a successful "China for China" strategy that has stabilized and grown the business.

- The company maintains a strong financial position with $1.5 billion in cash and no debt, supporting its capital allocation priorities of organic growth, increasing dividends (up $0.10 this year), and a new three-year $2 billion share buyback program.

- Logitech has proactively managed tariffs by implementing a 10% price increase in the U.S. and significantly diversifying its supply chain, reducing U.S. products sourced from China from 40% to 10% by year-end, contributing to sustainable gross margins of 40%+.

- Internally, Logitech has leveraged AI, creating over 1,000 AI agents since January, which contributed to a 200 basis point reduction in OPEX in Q2.

- Logitech's CEO, Hanneke Faber, detailed key strategic initiatives including doubling down on B2B (targeting a $14 billion addressable market, with $5 billion in verticals like education and healthcare), implementing a successful "China for China" strategy that has stabilized and grown market share, and maintaining a high pace of innovation by launching approximately 35 new products a year.

- The company boasts a strong financial position with $1.5 billion in cash and no debt, prioritizing organic growth, increasing dividends (up by $0.10 this year), and executing a three-year $2 billion share buyback program.

- Logitech has significantly diversified its supply chain, reducing the percentage of U.S. products manufactured in China from 40% to 10% by year-end, which contributes to the sustainability of gross margins (projected at 42%-43% for the quarter ahead and 40% plus long-term).

- Internally, Logitech is leveraging AI, having created over 1,000 AI agents since January, which played a significant role in a 200 basis point reduction in OpEx in Q2.

- The company is actively developing products for emerging technologies like VR/AR, including the Muse stylus for Apple Vision Pro and MX Ink for Meta Quest, and plans to ship the new Pro Mouse Superstrike gaming mouse in January.

- Logitech's CEO, Hanneke Faber, highlighted key strategic initiatives including doubling down on B2B, which represents an addressable market of approximately $14 billion, implementing a "China for China" strategy, and maintaining a high pace of innovation with about 35 new product launches annually.

- The company maintains a strong financial position with $1.5 billion in cash and no debt, supporting a capital allocation strategy focused on organic growth, increasing dividends, disciplined tuck-in M&A, and a three-year $2 billion share buyback program.

- Logitech successfully adjusted its supply chain, reducing the percentage of U.S. products sourced from China from 40% in April to 10% by the end of the year, which contributes to sustainable gross margins guided at 42% to 43% for the upcoming quarter.

- The company reported 8% year-on-year sales growth in the recent quarter, with strong trends expected to continue in Asia-Pacific and EMEA, and leveraged over 1,000 internally created AI agents to achieve a 200 basis point reduction in OPEX in Q2.

- Logitech's CEO outlined a clear strategy focused on superior products and innovation, doubling down on B2B, a "China for China" approach, and building an iconic brand, targeting an addressable market of $25 billion.

- The company maintains a strong financial position with $1.5 billion in cash and no debt, prioritizing organic growth, increasing dividends by $0.10 this year, and initiating a three-year $2 billion share buyback program.

- Logitech successfully mitigated tariff impacts by reducing U.S. product manufacturing from China from 40% to 10%, contributing to sustainable gross margins targeted at 40%+ long-term and 42%-43% for the quarter ahead.

- AI initiatives, including the creation of over 1,000 AI agents, led to a 200 basis point reduction in Q2 OpEx, enhancing operational efficiency.

Quarterly earnings call transcripts for LOGITECH INTERNATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more