Earnings summaries and quarterly performance for Planet Fitness.

Executive leadership at Planet Fitness.

Colleen Keating

Chief Executive Officer

Bill Bode

Chief Operating Officer

Brian Povinelli

Chief Marketing Officer

Chip Ohlsson

Chief Development Officer

Jamie Medeiros

Chief Brand Officer

Jay Stasz

Chief Financial Officer

Jennifer Simmons

Chief Strategy Officer

Board of directors at Planet Fitness.

Research analysts who have asked questions during Planet Fitness earnings calls.

Rahul Krotthapalli

JPMorgan Chase & Co.

6 questions for PLNT

Sharon Zackfia

William Blair & Company

6 questions for PLNT

Jonathan Komp

Robert W. Baird & Co.

5 questions for PLNT

Joseph Altobello

Raymond James & Associates, Inc.

5 questions for PLNT

Randal Konik

Jefferies LLC

5 questions for PLNT

Simeon Siegel

BMO Capital Markets

5 questions for PLNT

John Heinbockel

Guggenheim Partners

4 questions for PLNT

Chris O'cull

Stifel Financial Corp

3 questions for PLNT

Maksim Rakhlenko

Cowen and Company

3 questions for PLNT

Max Rakhlenko

TD Cowen

3 questions for PLNT

Xian Siew

BNP Paribas

3 questions for PLNT

Alexander Perry

Bank of America

2 questions for PLNT

John Tsu

BNP Paribas

2 questions for PLNT

J.P. Scafidi

ROTH Capital Partners

1 question for PLNT

Korinne Wolfmeyer

Piper Sandler & Co.

1 question for PLNT

Logan Reich

RBC Capital Markets

1 question for PLNT

Lucas Hudson

Bank of America

1 question for PLNT

Madison Callinan

Canaccord Genuity

1 question for PLNT

Marni Lysaght

Macquarie Group

1 question for PLNT

Martin Mitela

Raymond James & Associates, Inc.

1 question for PLNT

Megan Christine Alexander

Morgan Stanley

1 question for PLNT

Megan Clapp

Morgan Stanley

1 question for PLNT

Randy Konik

Jefferies

1 question for PLNT

Stephen Grambling

Morgan Stanley

1 question for PLNT

Recent press releases and 8-K filings for PLNT.

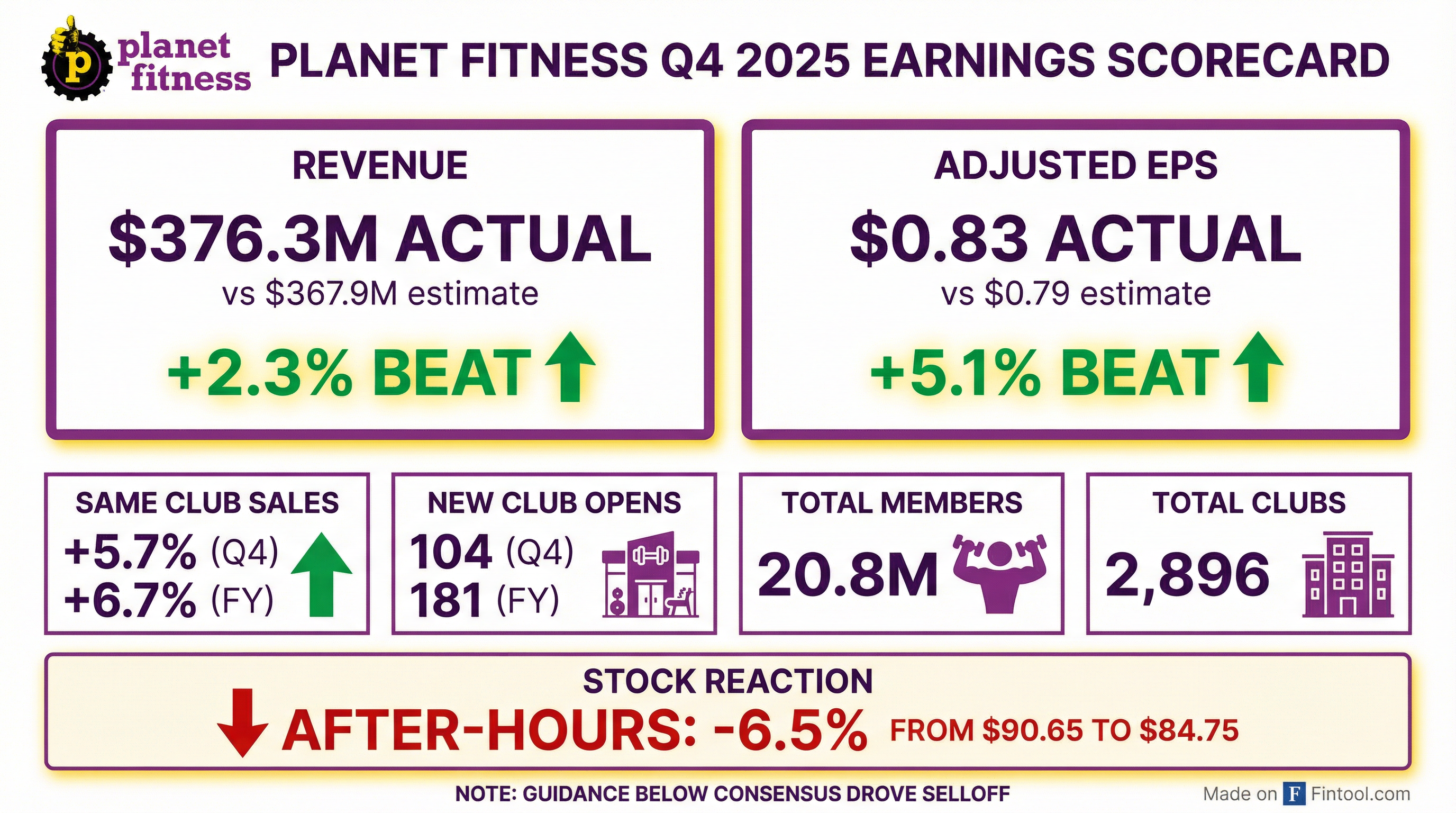

- Planet Fitness reported strong financial performance for Q4 2025, with total revenue of $376.3 million, adjusted diluted EPS of $0.83, and adjusted EBITDA of $146.3 million. System-wide same-club sales grew 5.7%, and Black Card penetration reached an all-time high of 66.5%.

- For the full year 2025, revenue increased 12%, adjusted EBITDA grew 13%, and adjusted diluted EPS increased 19%, driven by 6.7% same-club sales growth. The company ended the year with approximately 20.8 million members and opened 181 new clubs.

- The company provided 2026 guidance, expecting system-wide same-club sales growth of 4%-5%, total revenue growth of approximately 9%, adjusted EBITDA growth of approximately 10%, and adjusted diluted EPS growth of 9%-10%. They anticipate opening 180-190 new clubs.

- The 2026 guidance reflects the lowest growth year in their three-year algorithm due to an extended equipment replacement cycle and the sale of 8 corporate-owned clubs in California, which had an estimated 300 basis point impact to top line and 200 basis point impact to EBITDA. A Black Card price increase is planned for after the peak join season, likely in Q3.

- Planet Fitness reported strong Q4 2025 financial results, with total revenue of $376.3 million, adjusted diluted EPS of $0.83, and adjusted EBITDA of $146.3 million.

- For the full year 2025, the company achieved 12% revenue growth, 13% adjusted EBITDA growth, and 19% adjusted diluted EPS growth, ending the year with approximately 20.8 million members and 181 new club openings.

- The company executed a $350 million accelerated share repurchase and refinanced approximately $400 million of debt, upsizing it to $750 million at a 5.4% blended coupon.

- For 2026, Planet Fitness anticipates a 4-5% comp guide, with lower comparable store sales in the first half and higher in the second half, and plans a Black Card price increase after the peak join season.

- Planet Fitness reported strong full-year 2025 financial results, with revenue increasing 12%, adjusted EBITDA up 13%, and adjusted diluted EPS growing 19%, alongside 6.7% same-club sales growth.

- In Q4 2025, the company opened 104 new clubs and achieved an all-time high Black Card penetration of 66.5%, ending the year with approximately 20.8 million members.

- For 2026, Planet Fitness provided guidance including total revenue growth of approximately 9%, adjusted EBITDA growth of approximately 10%, and adjusted diluted EPS growth of 9%-10%, with expected system-wide same-club sales growth of 4%-5% and 180-190 new club openings.

- The company returned nearly $800 million to shareholders through buybacks over the last two years and plans to repurchase approximately $150 million worth of shares in 2026.

- Planet Fitness reported total revenue of $376.3 million for Q4 2025, an increase of 10.5% from the prior year period, and $1.3 billion for the full year 2025, up 12.1%.

- For the full year 2025, net membership grew by 1.1 million, bringing the total to approximately 20.8 million members, and the company opened 181 new clubs system-wide, reaching 2,896 total clubs as of December 31, 2025.

- The company provided a 2026 outlook, expecting system-wide same club sales growth in the 4% to 5% range, revenue to increase approximately 9%, and adjusted net income per share, diluted, to increase in the 9% to 10% range.

- Planet Fitness reported strong financial results for 2025, with total revenue increasing 12.1% to $1.3 billion and net income attributable to Planet Fitness, Inc. reaching $219.1 million ($2.62 per diluted share) for the full year.

- Operational highlights for 2025 include a 6.7% increase in system-wide same club sales and 1.1 million net membership growth, bringing total members to approximately 20.8 million.

- For the fourth quarter of 2025, total revenue grew 10.5% to $376.3 million, and Adjusted EBITDA increased $15.4 million to $146.3 million.

- The company issued a positive 2026 outlook, projecting revenue to increase approximately 9%, Adjusted EBITDA to increase approximately 10%, and system-wide same club sales growth in the 4% to 5% range.

- Planet Fitness reported strong 2025 results, including 20.8 million members and 181 new unit openings, with comparable store sales increasing by 6.7%.

- The company plans to raise the Black Card membership price from $24.99 to $29.99, supported by an all-time high Black Card penetration of over 66% by Q3 2025.

- For 2026, Planet Fitness anticipates 6%-7% unit growth over the planning horizon, expecting to open under 200 units in 2026 and exceeding 200 in 2027 and 2028.

- Capital allocation priorities include investing in business growth, returning value to shareholders through buybacks (including a $350 million Accelerated Share Repurchase and $150 million in prior buybacks), and maintaining a leverage profile in the 4-6x range.

- Real estate availability is improving, with vacancy rates increasing to 4.3%-4.4%, and rent growth moderated below the rate of inflation in the first two quarters of 2025.

- Planet Fitness reported strong 2025 results, including 20.8 million members, 181 new unit openings, and 6.7% comparable sales.

- The company plans to raise the Black Card membership price from $24.99 to $29.99, supported by increased Black Card penetration (over 66% by Q3 2025) and perceived value.

- Planet Fitness reiterated its long-term outlook for 6%-7% unit growth, projecting under 200 new unit openings in 2026 and over 200 in 2027 and 2028.

- Capital allocation priorities include investing in growth, returning value to shareholders via buybacks (including a $350 million ASR and $150 million in prior buybacks), and maintaining a 4-6x leverage profile.

- International expansion is progressing, with the first club in Spain showing strong performance, and plans to refranchise Spain while targeting one to two new international markets annually.

- Planet Fitness reported strong 2025 results, including 20.8 million members, 181 new unit openings, and 6.7% comparable store sales. The company also saw a significant increase in High School Summer Pass participation, reaching 3.7 million participants in 2025.

- The company plans a Black Card price increase from $24.99 to $29.99, supported by an all-time high Black Card penetration of over 66% by Q3 2025. Planet Fitness maintains a 6%-7% unit growth outlook over the planning horizon, with 2026 expected to be under 200 new openings and exceeding 200 in 2027 and 2028.

- Planet Fitness emphasizes a capital-light model and has returned value to shareholders through $150 million in buybacks and a $350 million Accelerated Share Repurchase (ASR). For 2026, the company anticipates revenue increases from a 1% shift from LAF to NAF, offset by a headwind in the equipment segment, and an impact to interest expense partially mitigated by the ASR.

- Planet Fitness ended 2025 with approximately 20.8 million members.

- The company reported a full year System-Wide Same Club Sales increase of 6.7% for 2025.

- In 2025, Planet Fitness opened 181 new clubs, bringing the system-wide total to 2,896 clubs.

- Planet Fitness plans to release its full fiscal year 2025 results and 2026 outlook on February 24, 2026.

- Planet Fitness ended 2025 with approximately 20.8 million total members.

- Full year System-Wide Same Club Sales increased by 6.7% in 2025.

- The company opened 181 new clubs and placed equipment in 152 new franchised clubs in 2025, bringing the total system-wide clubs to 2,896 as of December 31, 2025.

- Planet Fitness plans to release its full fiscal year 2025 results and 2026 outlook on February 24, 2026.

Quarterly earnings call transcripts for Planet Fitness.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more