Earnings summaries and quarterly performance for Reynolds Consumer Products.

Executive leadership at Reynolds Consumer Products.

Scott Huckins

President and Chief Executive Officer

Carlen Hooker

Chief Commercial Officer

Chris Mayrhofer

Senior Vice President and Corporate Controller

Christopher Corey

President, Presto Products

David Watson

Legal Counsel and Corporate Secretary

Judith Buckner

President, Reynolds Cooking & Baking

Lisa Smith

President, Hefty Waste and Storage

Mark Swartzberg

Vice President, Investor Relations

Michael McMahon

Senior Vice President, Key Accounts Sales

Nathan Lowe

Chief Financial Officer

Rita Fisher

Chief Information Officer and Executive Vice President, Supply Chain

Ryan Clark

President, Hefty Tableware

Steve Estes

Chief Administrative Officer

Valerie Miller

Executive Vice President of Human Resources

Board of directors at Reynolds Consumer Products.

Research analysts who have asked questions during Reynolds Consumer Products earnings calls.

Andrea Teixeira

JPMorgan Chase & Co.

8 questions for REYN

Brian McNamara

Canaccord Genuity - Global Capital Markets

8 questions for REYN

Peter Grom

UBS Group

8 questions for REYN

Kaumil Gajrawala

Jefferies

6 questions for REYN

Lauren Lieberman

Barclays

6 questions for REYN

Robert Ottenstein

Evercore ISI

3 questions for REYN

Rob Ottenstein

Evercore

3 questions for REYN

Mark Astrachan

Stifel

2 questions for REYN

Davis Holcombe

Truist Securities, Inc.

1 question for REYN

James Abbott

Barclays

1 question for REYN

Javier Escalante Manzo

Evercore ISI

1 question for REYN

Jim Abbott

Barclays PLC

1 question for REYN

Nik Modi

RBC Capital Markets

1 question for REYN

Rob Ottstein

Evercore ISI

1 question for REYN

Recent press releases and 8-K filings for REYN.

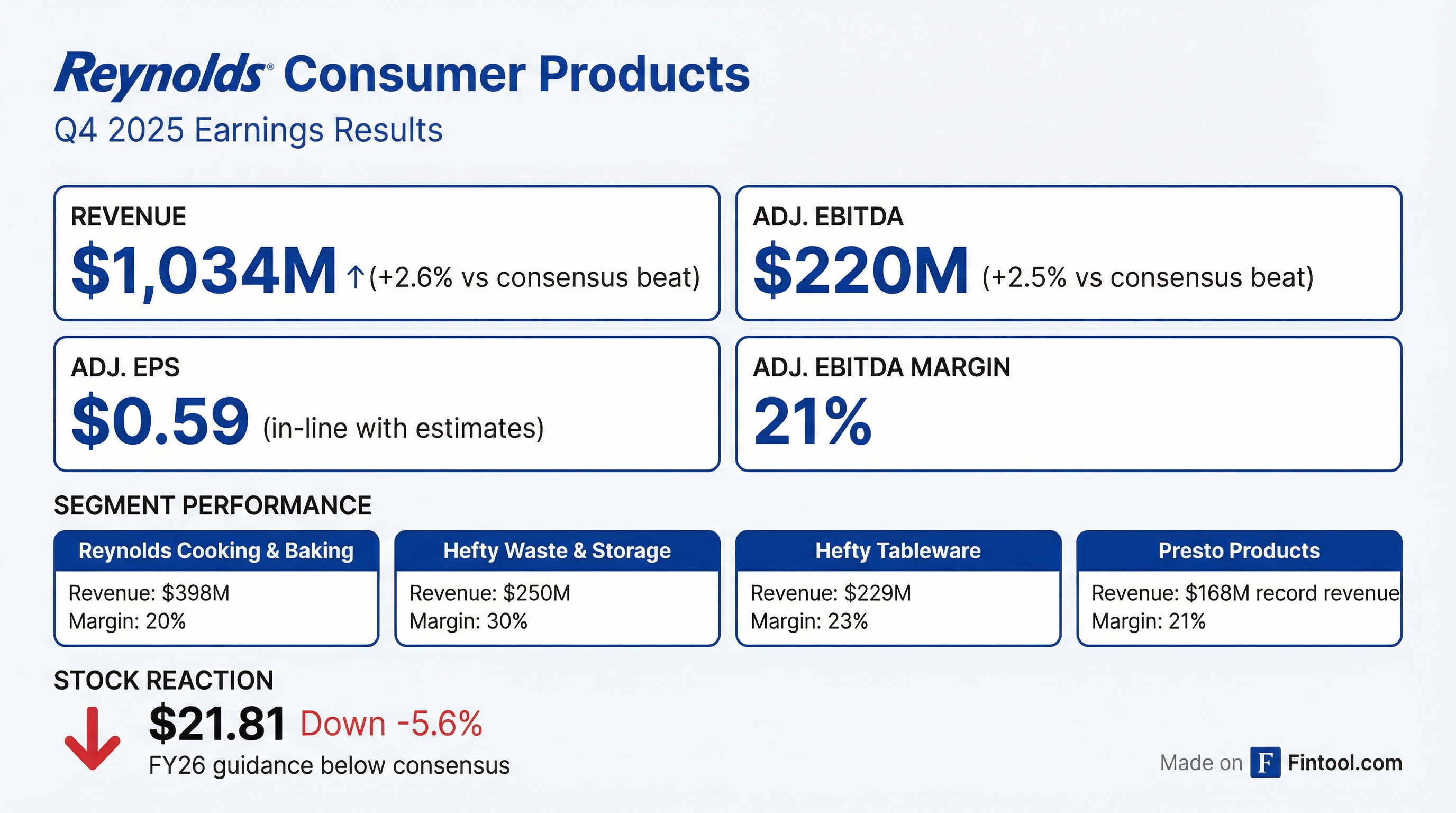

- Reynolds Consumer Products (REYN) reported Q4 2025 net revenues of $1.03 billion, a 1% increase year-over-year, and Adjusted EBITDA of $220 million, a 3% increase. For the full year 2025, net revenues were $3.7 billion (1% growth), Adjusted EBITDA was $667 million, and Adjusted EPS was $1.64.

- The company delivered share gains across the majority of its categories, outperforming them by over 1 point in 2025 and 2 points in Q4, supported by innovation and enhanced revenue growth management capabilities.

- For 2026, REYN anticipates net revenues to range from -3% to +1% compared to 2025, with Adjusted EBITDA projected between $660 million and $675 million, and Adjusted EPS between $1.57 and $1.63.

- The 2026 outlook factors in expected category headwinds, particularly in foam and foil, and pressure from navigating losses in a portion of its store brand business. The company is also realigning its Hefty Waste and Storage and Presto segments for increased efficiency and focus starting Q1 2026.

- Reynolds Consumer Products (REYN) reported net revenues of $1.03 billion for Q4 2025, a 1% increase compared to Q4 2024, with adjusted EBITDA of $220 million, up 3%. For the full year 2025, net revenues were $3.7 billion, adjusted EBITDA was $667 million, and adjusted EPS was $1.64.

- The company achieved share gains across the majority of its core categories in Q4 2025, outperforming categories by 2 points in the quarter and 1 point for the full year, driven by innovation and revenue growth management capabilities.

- For 2026, REYN anticipates net revenues to be -3% to +1% compared to 2025, with adjusted EBITDA expected in the range of $660 million-$675 million. Adjusted EPS is projected to be between $1.57-$1.63.

- The 2026 outlook includes anticipated category headwinds primarily from declines in foam and foil and pressure in the store brand business due to increased bid activity. The company expects to continue facing sustained headwinds in 2026, particularly from rising aluminum costs and intensified competitive dynamics.

- Reynolds Consumer Products (REYN) reported Q4 2025 net revenues of $1.03 billion, a 1% increase year-over-year, and Adjusted EBITDA of $220 million, up 3% from the prior year.

- For the full year 2025, net revenues were $3.7 billion, representing 1% growth year-over-year, with the company outperforming its categories by over 1 point for the year and 2 points in Q4.

- The company provided Q1 2026 guidance, expecting net revenues to range from down 3% to up 1% compared to Q1 2025, and Adjusted EBITDA for Q1 2026 is projected to be between $120 million and $125 million. For the full year 2026, Adjusted EBITDA is anticipated to be roughly flat year-over-year.

- REYN is implementing a category organization realignment for Hefty Waste and Storage and Presto segments in Q1 2026 to drive efficiency and growth, while navigating continued pressure in the tableware category and competitive dynamics in waste bags.

- Reynolds Consumer Products (REYN) reported Q4 2025 Net Revenues of $1,034 million and Adjusted EBITDA of $220 million, achieving an Adjusted EBITDA margin of 21%.

- For the full year 2025, Net Revenues were $3,721 million and Adjusted EBITDA totaled $667 million, with an Adjusted EBITDA margin of 18%.

- The company provided a Q1 2026 outlook projecting Net Revenues to range from -3% to +1%, Adjusted EBITDA between $120 million and $125 million, and Adjusted EPS between $0.23 and $0.25.

- The FY 2026 outlook forecasts Net Revenues to be -3% to +1%, Adjusted EBITDA between $660 million and $675 million, and Adjusted EPS between $1.57 and $1.63.

- REYN's strategy for accelerating growth and driving elevated financial results includes focusing on revenue growth, margin expansion through cost reduction initiatives, and a returns-based mindset with disciplined capital allocation.

- Reynolds Consumer Products Inc. reported Q4 2025 Net Revenues of $1,034 million and Adjusted EBITDA of $220 million, with Adjusted EPS of $0.59. For the full fiscal year 2025, Net Revenues were $3,721 million and Adjusted EBITDA was $667 million, with Adjusted EPS of $1.64.

- Net Income for Q4 2025 was $118 million and for FY 2025 was $301 million, impacted by after-tax CEO transition costs of $7 million in Q4 2025 and $34 million for the full year 2025.

- The company provided its 2026 outlook, expecting full-year Net Revenues to be -3% to +1% compared to 2025, and full-year Adjusted EBITDA to be between $660 million and $675 million. Full-year Adjusted EPS is projected to be between $1.57 and $1.63.

- Reynolds' Board of Directors approved a quarterly dividend of $0.23 per common share, to be paid on February 27, 2026.

- Reynolds Consumer Products reported Net Revenues of $1,034 million for the fourth quarter of 2025, an increase from $1,021 million in Q4 2024, and Adjusted EBITDA of $220 million, up from $213 million in Q4 2024.

- For the full fiscal year 2025, the company achieved Net Revenues of $3,721 million compared to $3,695 million in 2024, with Adjusted Net Income of $345 million and Adjusted Earnings Per Share of $1.64.

- The company provided a 2026 outlook, expecting full-year Net Revenues to be -3% to +1% compared to 2025, and Adjusted EBITDA between $660 million and $675 million.

- Reynolds' Board of Directors approved a quarterly dividend of $0.23 per common share, payable on February 27, 2026.

- Reynolds Consumer Products reported Q3 2025 net revenues of $931 million, an increase of over 2% from the prior year, and adjusted EPS of $0.42.

- The company achieved strong retail performance, gaining market share overall and in the majority of its categories, including Hefty Waste Bags and Reynolds Wrap aluminum foil.

- Reynolds increased its full-year 2025 guidance, now expecting net revenues to be flat to down 1% compared to 2024's $3.7 billion, adjusted EBITDA between $655 million and $665 million, and adjusted EPS between $1.60 and $1.64.

- Strategic initiatives include driving manufacturing and supply chain costs out of the business, supported by the recent hiring of Scott Vail as Chief Operations Officer, and a $50 million voluntary principal payment on its term loan facility.

- Reynolds Consumer Products reported Q3 2025 net revenues of $931 million, an increase of over 2% from the prior year, and adjusted EPS of $0.42, up from $0.41 in Q3 2024.

- The company achieved strong retail performance, gaining market share in categories such as Hefty Waste Bags, Reynolds Wrap aluminum foil, and store-brand food bags, driven by pricing actions and cost discipline.

- Reynolds increased its full-year 2025 guidance, now expecting net revenues to be flat to down 1% (compared to $3.7 billion in 2024), adjusted EBITDA between $655 million and $665 million, and adjusted EPS between $1.60 and $1.64.

- The operating environment remains challenging due to consumer pressure and retailer cost inflation, but the company is leveraging its U.S.-centric manufacturing and strategic initiatives, including new hires for commercial and operations leadership, to drive growth and manage costs.

- The company made a voluntary principal payment of $50 million on its term loan and anticipates a $30 million to $40 million increase in capital spending for high-return projects and accelerated onshoring.

- For Q3 2025, Reynolds Consumer Products reported Net Revenues of $931 million and Adjusted EBITDA of $168 million, achieving an Adjusted EBITDA margin of 18%.

- Year-to-date 2025 (YTD 2025), the company's Net Revenues reached $2,687 million and Adjusted EBITDA was $447 million, with an Adjusted EBITDA margin of 17%.

- The company provided a full-year 2025 outlook, expecting Net Revenues to be flat to down 1%, Adjusted EPS between $1.60 and $1.64, and Adjusted EBITDA between $655 million and $665 million.

- For Q4 2025, Reynolds anticipates Net Revenues to be down 1% to down 5%, Adjusted EPS between $0.56 and $0.60, and Adjusted EBITDA between $208 million and $218 million.

- Strategic priorities for 2025 include accelerating growth through distribution wins and product innovation, executing cost savings for margin expansion, and investing in people.

- Reynolds Consumer Products reported Q3 2025 net revenues of $931 million, a 2% increase from the prior year, and adjusted EPS of $0.42. The company also increased its full-year 2025 guidance, now expecting net revenues to be flat to down 1% compared to 2024, adjusted EBITDA between $655 million and $665 million, and adjusted EPS between $1.60 and $1.64.

- The company achieved strong retail performance, gaining market share across most categories, including Hefty Waste Bags, Reynolds Wrap aluminum foil, and store-brand food bags. Reynolds Wrap retail sales were up 7%, with volumes outperforming the category.

- Strategic initiatives include driving down manufacturing and supply chain costs through technology and automation, and investing an anticipated $30 million to $40 million more in capital spending for growth and accelerated onshoring. The company also made a voluntary principal payment of $50 million on its term loan facility.

- The operating environment remains challenging due to consumer pressure and cost inflation for retailers, but the company is managing profitability effectively and leveraging its U.S.-centric manufacturing footprint.

Quarterly earnings call transcripts for Reynolds Consumer Products.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more