Earnings summaries and quarterly performance for Schneider National.

Executive leadership at Schneider National.

Mark B. Rourke

President and Chief Executive Officer

Darrell G. Campbell

Executive Vice President, Chief Financial Officer

James S. Filter

Executive Vice President, Group President, Transportation & Logistics

Robert M. Reich

Executive Vice President, Chief Administrative Officer

Shaleen Devgun

Executive Vice President, Chief Innovation and Technology Officer

Board of directors at Schneider National.

James L. Welch

Chairman of the Board

James R. Giertz

Director

John A. Swainson

Director

Julie K. Streich

Director

Jyoti Chopra

Director

Kathleen M. Zimmerman

Director

Mary P. DePrey

Director

Robert M. Knight, Jr.

Director

Robert W. Grubbs

Director

Research analysts who have asked questions during Schneider National earnings calls.

Ken Hoexter

BofA Securities

6 questions for SNDR

Brian Ossenbeck

JPMorgan Chase & Co.

5 questions for SNDR

Jonathan Chappell

Evercore ISI

5 questions for SNDR

Ravi Shanker

Morgan Stanley

5 questions for SNDR

Christian Wetherbee

Wells Fargo

4 questions for SNDR

Ariel Rosa

Citigroup

3 questions for SNDR

Daniel Imbro

Stephens Inc.

3 questions for SNDR

J. Bruce Chan

Stifel

3 questions for SNDR

Jordan Alliger

Goldman Sachs

3 questions for SNDR

Tom Wadewitz

UBS Group

3 questions for SNDR

Andrew Cox

Stifel

2 questions for SNDR

Bascome Majors

Susquehanna Financial Group

2 questions for SNDR

Chris Wetherbee

Wells Fargo & Company

2 questions for SNDR

David Hicks

Raymond James

2 questions for SNDR

Jason Seidl

TD Cowen

2 questions for SNDR

Scott Group

Wolfe Research

2 questions for SNDR

Thomas Wadewitz

UBS

2 questions for SNDR

Ari Rosa

Citigroup Inc.

1 question for SNDR

Dan Moore

B. Riley Securities

1 question for SNDR

Joe Enderlin

Stephens

1 question for SNDR

Ravi Shankar

Morgan Stanley

1 question for SNDR

Recent press releases and 8-K filings for SNDR.

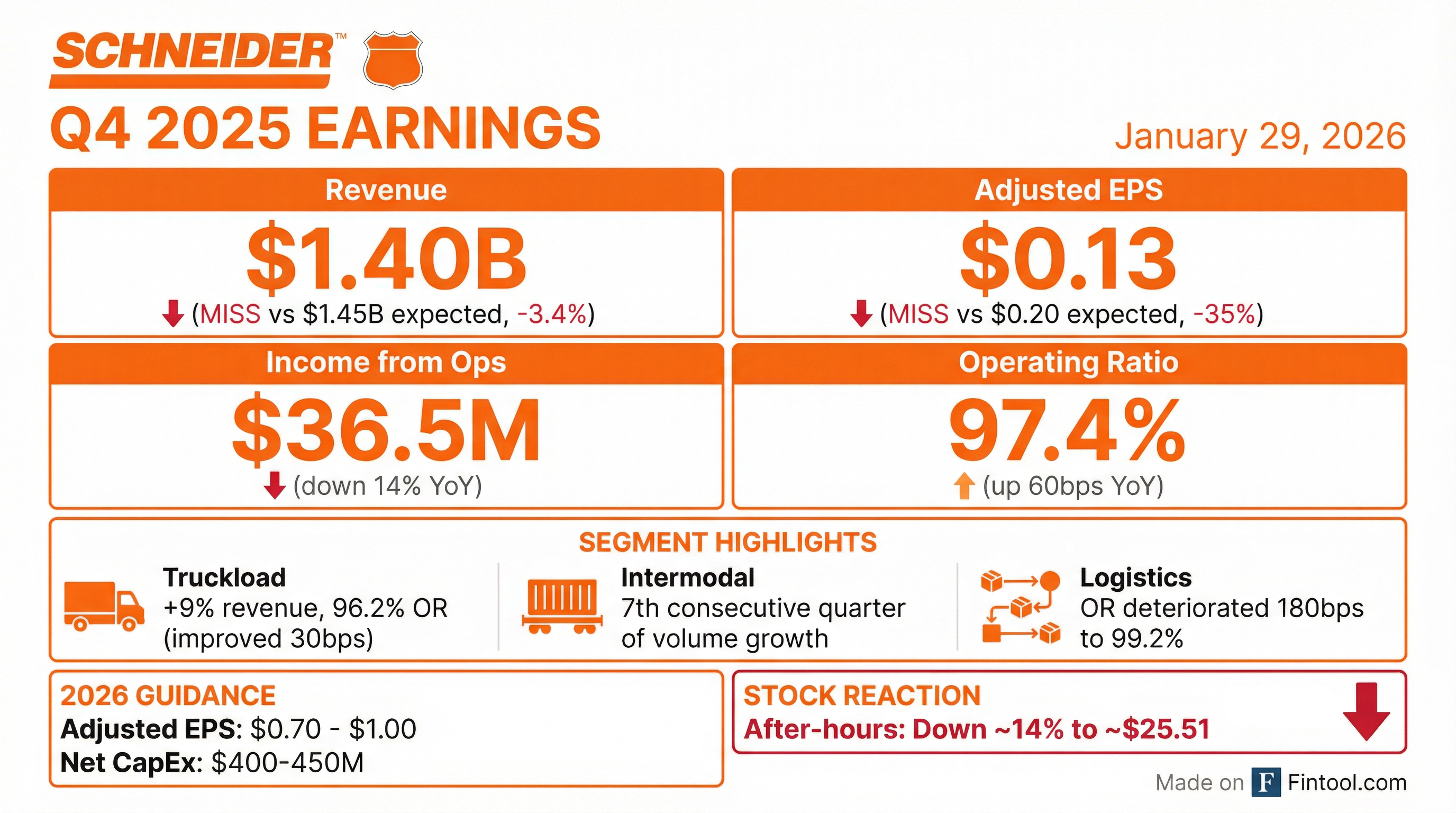

- Schneider National reported Q4 2025 Truckload revenue (excluding fuel surcharge) of $610 million, up 9% year-over-year, with operating income of $23 million, up 16%. Intermodal operating income increased 5% to $18 million, while Logistics income from operations decreased to $3 million. The company achieved its targeted $40 million in cost savings for 2025.

- For the full year 2026, the company issued adjusted earnings per share guidance of $0.70-$1.00. They anticipate an additional $40 million in cost savings for 2026 and project net CapEx between $400 million-$450 million, primarily for fleet replacement.

- As of December 31, 2025, net debt leverage improved to 0.3 times. The Board of Directors authorized a new $150 million stock repurchase program over the next three years.

- Q4 2025 was impacted by sluggish demand, unplanned auto production shutdowns, and elevated healthcare costs. Effective July 1, 2026, Mark Rourke will transition to Executive Chairman, and Jim Filter will become President and CEO.

- For Q4 2025, Schneider National reported revenues (excluding fuel surcharge) of $1.3 billion, a 4% increase year-over-year, with adjusted income from operations at $38 million (a 15% decline), and adjusted diluted earnings per share of $0.13.

- The company provided full-year 2026 adjusted EPS guidance of $0.70-$1 and expects net CapEx to be in the range of $400 million-$450 million. They also anticipate an additional $40 million in cost savings for 2026.

- Net debt leverage improved to 0.3x by the end of Q4 2025, and the Board authorized a new $150 million stock repurchase program over the next three years. Mark Rourke will transition to Executive Chairman, and Jim Filter will be appointed President and CEO, effective July 1, 2026.

- Schneider reported Q4 2025 revenues, excluding fuel surcharge, of $1.3 billion, an increase of 4% year-over-year, with adjusted income from operations at $38 million, a 15% decline, and adjusted diluted earnings per share of $0.13.

- The company achieved $40 million in cost savings in 2025 and expects to deliver an additional $40 million in cost savings in 2026.

- As of December 31, 2025, Schneider's net debt leverage was 0.3 times, and its Board of Directors authorized a new $150 million stock repurchase program over the next three years, effective January 26, 2026.

- Market conditions in Q4 2025 were more challenging than anticipated, with sluggish demand and unplanned auto production shutdowns, but the company expects capacity attrition to continue into 2026 due to regulatory actions.

- Schneider reported Q4 2025 operating revenues of $1,400 million and adjusted diluted earnings per share of $0.13, with adjusted income from operations declining 15% year-over-year.

- For full-year 2026, the company issued adjusted diluted earnings per share guidance of $0.70 to $1.00 and net capital expenditure guidance of $400 million to $450 million.

- In January 2026, Schneider announced a new $150 million, 3-year share repurchase program and declared a quarterly cash dividend of $0.10 per share, a 5% increase.

- The company achieved $40 million in cost savings in 2025 and identified an additional $40 million for 2026, maintaining a net debt leverage of 0.3x at quarter-end.

- Schneider National, Inc. reported operating revenues of $1.4 billion for the fourth quarter of 2025, an increase from $1.3 billion in the same period of 2024. However, income from operations decreased to $36.5 million from $42.4 million, and diluted earnings per share were $0.13, down from $0.18 in Q4 2024.

- The company provided full year 2026 Adjusted Diluted Earnings per Share guidance of $0.70 - $1.00 and Net Capital Expenditures guidance of $400 - $450 million.

- Management attributed the Q4 results falling short to softer than expected market conditions beginning in November, particularly for volume, and spiking third-party carrier capacity costs. The company is focusing on its cost savings program, Intermodal Fast Track service, Dedicated start-up activity, and Network earnings improvement efforts.

- In January 2026, the Board of Directors authorized a new $150.0 million stock repurchase program, replacing the existing one, and declared a $0.10 dividend payable in April 2026.

- Schneider National, Inc. reported operating revenues of $1.4 billion and diluted earnings per share of $0.13 for the fourth quarter of 2025, with full year 2025 operating revenues reaching $5,674.3 million and diluted earnings per share at $0.59.

- The company provided full year 2026 Adjusted Diluted Earnings per Share guidance of $0.70 - $1.00 and Net Capital Expenditures guidance of $400 - $450 million.

- Fourth quarter results were negatively impacted by softer than expected market conditions, a truncated peak season, spiking third-party carrier capacity costs, and unplanned auto production shutdowns.

- The Board of Directors authorized a new $150.0 million stock repurchase program in January 2026, replacing the existing program, and declared a $0.10 dividend payable in April 2026.

- Schneider National, Inc. (SNDR) declared a quarterly cash dividend of $0.10 per share on its Class A and Class B common stock, representing a 5% increase over the previous quarterly dividend of $0.095 per share.

- The dividend is payable to shareholders of record as of March 13, 2026, and is expected to be paid on April 8, 2026.

- The Board of Directors approved a new stock repurchase program, effective immediately, authorizing the acquisition of up to $150 million of the Company’s outstanding Class A and/or Class B common stock over the next three years.

- This new program supersedes and replaces a prior $150 million stock repurchase authorization, under which the Company repurchased 4.4 million shares for a total of $110.1 million.

- Schneider National, Inc. declared a quarterly cash dividend of $0.10 per share, representing a 5% increase over the previous quarterly dividend of $0.095 per share.

- The Board of Directors approved a new stock repurchase program authorizing the acquisition of up to $150 million of the Company’s common stock over the next three years.

- This new program supersedes a prior authorization under which 4.4 million shares were repurchased for a total of $110.1 million.

- Schneider observes a stable but sub-seasonal demand environment in Q4 2025, with customers showing caution due to economic uncertainties, but anticipates a more constructive market in 2026 driven by supply-side rationalization and potential industrial economic momentum.

- The company is pursuing differentiated growth, particularly in its dedicated truckload business with a strong pipeline for specialty equipment and acquisitions, and reported 10% year-over-year growth in intermodal volume in Q3 2025.

- Schneider has achieved $40 million in annual savings from cost-to-serve initiatives, including a 6% reduction in non-driver headcount and leveraging automation and AI to improve efficiency, with plans to continue these efforts into 2026.

- With a strong balance sheet, reflected by 0.4x leverage as of the end of September, Schneider plans to prioritize organic growth, pursue opportunistic acquisitions, and is considering share repurchases due to perceived undervaluation.

- Schneider (SNDR) reported Q3 2025 enterprise revenues (excluding fuel surcharge) of $1.3 billion, a 10% increase year-over-year, but adjusted income from operations decreased 13% to $38 million, and adjusted diluted EPS was $0.12. These results were impacted by $16 million more in claims-related costs than anticipated, which are not expected to recur in Q4.

- The company updated its full-year 2025 adjusted EPS guidance to approximately $0.70 and reduced its net CapEx guidance to approximately $300 million.

- Despite a softer freight market with sub-seasonal trends expected to persist, Schneider anticipates significant supply-side rationalization in 2026 due to regulatory changes and truck production trends, potentially exceeding the impact of the 2017 ELD mandate.

- Operational improvements include 10% volume growth in Intermodal and a 6% reduction in non-driver headcount since the start of the year, contributing to a $40 million structural cost savings target.

Fintool News

In-depth analysis and coverage of Schneider National.

Quarterly earnings call transcripts for Schneider National.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more