Earnings summaries and quarterly performance for SUN COMMUNITIES.

Executive leadership at SUN COMMUNITIES.

Charles Young

Chief Executive Officer

Aaron Weiss

Executive Vice President of Corporate Strategy and Business Development

Bruce Thelen

Executive Vice President and Chief Operating Officer

Fernando Castro-Caratini

Executive Vice President, Chief Financial Officer, Treasurer and Secretary

John McLaren

President

Marc Farrugia

Executive Vice President and Chief Administrative Officer

Board of directors at SUN COMMUNITIES.

Brian Hermelin

Director

Clunet Lewis

Director

Craig Leupold

Director

Gary Shiffman

Non-Executive Chairman of the Board

Jeff Blau

Director

Jerome Ehlinger

Director

Mark Denien

Director

Meghan Baivier

Lead Independent Director

Tonya Allen

Director

Research analysts who have asked questions during SUN COMMUNITIES earnings calls.

John Kim

BMO Capital Markets

6 questions for SUI

Michael Goldsmith

UBS

6 questions for SUI

Brad Heffern

RBC Capital Markets

5 questions for SUI

Jana Galan

Bank of America

5 questions for SUI

Wesley Golladay

Robert W. Baird & Co.

5 questions for SUI

David Segall

Green Street

4 questions for SUI

Eric Wolfe

Citi

4 questions for SUI

Steve Sakwa

Evercore ISI

4 questions for SUI

Anthony Hau

Truist Securities

3 questions for SUI

Jamie Feldman

Wells Fargo & Company

3 questions for SUI

Jason Wayne

Barclays

3 questions for SUI

David Siegel

Green Street Advisors

2 questions for SUI

James Feldman

Wells Fargo

2 questions for SUI

Linda Tsai

Jefferies

2 questions for SUI

Nicholas Joseph

Citigroup

2 questions for SUI

Omotayo Okusanya

Deutsche Bank AG

2 questions for SUI

Peter Abramowitz

Jefferies

2 questions for SUI

Adam Kramer

Morgan Stanley

1 question for SUI

Joshua Dennerlein

BofA Securities

1 question for SUI

Keegan Carl

Wolfe Research, LLC

1 question for SUI

Samir Khanal

Bank of America

1 question for SUI

Recent press releases and 8-K filings for SUI.

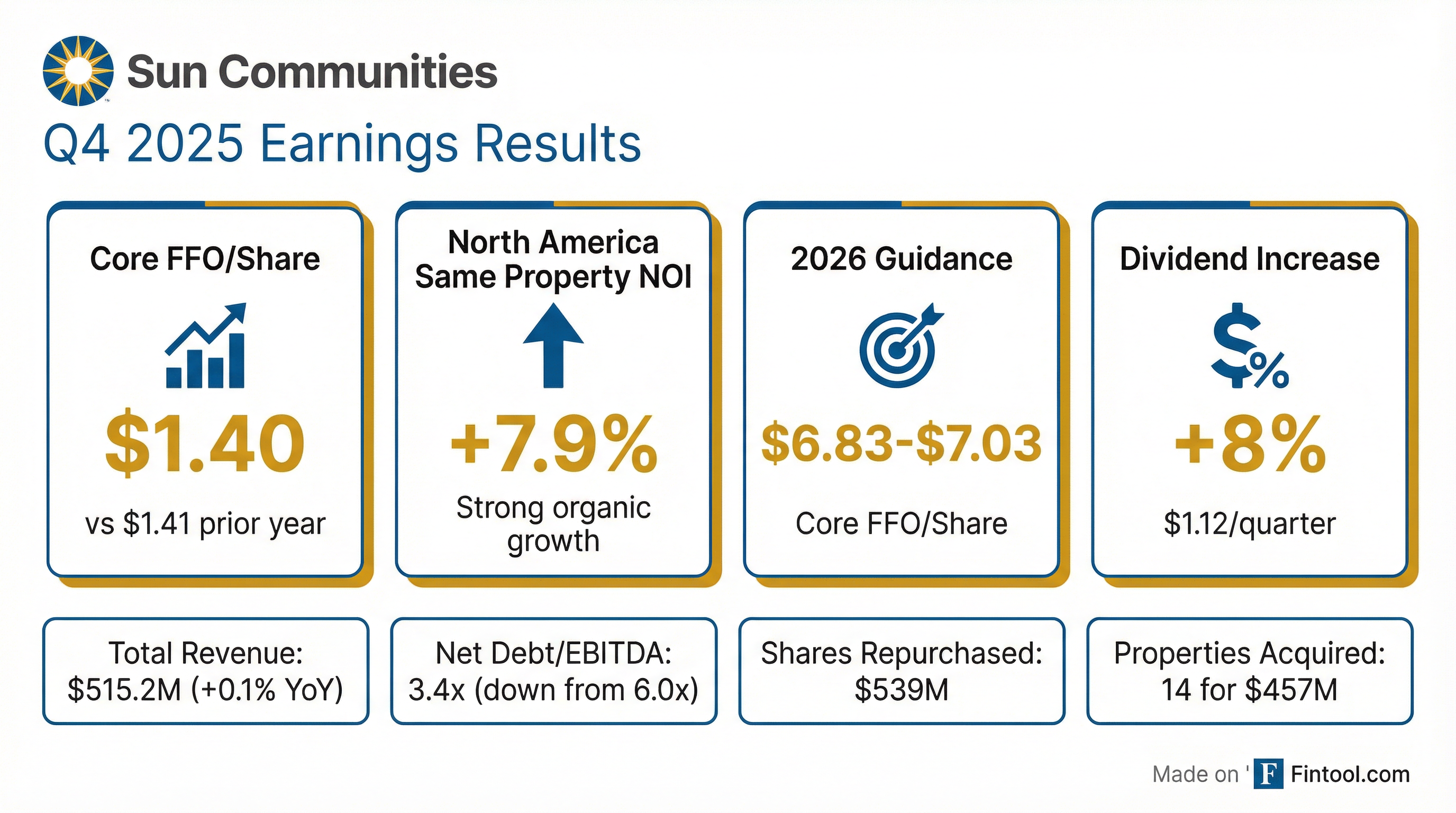

- For the year ended December 31, 2025, Sun Communities, Inc. reported a Total Portfolio NOI of $1,059 million and Net Income Attributable to SUI Common Shareholders of $1,361.2 million.

- The company's balance sheet as of December 31, 2025, shows $4,259 million in total debt with a Net Debt / TTM EBITDA of 3.4x, characterized by 80% unencumbered and 100% fixed rate debt.

- Sun Communities anticipates preliminary 2026 MH site rental rate increases of 5.0%, RV site rental rate increases of 4.0%, and Same Property NOI Growth of 5.0% for North America MH and RV only.

- The company operates approximately 179,000 sites across 513 communities and achieved a Same Property MH occupancy of 98.1% as of December 31, 2025.

- Sun Communities reported Core FFO per share of $1.40 for Q4 2025 and $6.68 for the full year 2025, both exceeding the high end of their guidance ranges. North American same-property Net Operating Income (NOI) grew 7.9% for Q4 and 5.7% for the full year 2025.

- The company significantly strengthened its balance sheet in 2025, reducing net debt to EBITDA to 3.4 times and repaying over $3.3 billion of total debt. This led to credit rating upgrades from S&P to BBB+ and Moody's to Baa2.

- Sun Communities returned over $1.5 billion of capital to shareholders in 2025, including repurchasing 4.3 million shares for approximately $539 million and increasing its quarterly distribution rate by approximately 8%.

- For 2026, the company established full-year Core FFO per share guidance with a midpoint of $6.93 and anticipates North American same-property NOI growth of approximately 4.5%.

- Sun Communities reported Q4 2025 Core FFO per share of $1.40 and full-year Core FFO per share of $6.68, both exceeding the high end of guidance by $0.01. North American same-property NOI increased 7.9% in Q4 and 5.7% for the full year.

- The company significantly strengthened its balance sheet in 2025 by repaying over $3.3 billion of total debt, achieving a net debt to trailing 12-month recurring EBITDA of 3.4x, and receiving credit rating upgrades to BBB+ from S&P and Baa2 from Moody's.

- Strategic capital allocation in 2025 included selling over $200 million in non-strategic assets, acquiring 14 communities for $457 million, purchasing 32 U.K. ground leases for $387 million, and repurchasing 4.3 million shares totaling approximately $539 million.

- For 2026, Sun Communities is guiding to a full-year Core FFO per share midpoint of $6.93 and expects North American same-property NOI growth of approximately 4.5%, with manufactured housing projected to grow by 5.9% and RV by 0.9%.

- Sun Communities concluded 2025 with strong operational momentum, delivering Q4 2025 core FFO per share of $1.40 and full-year 2025 core FFO per share of $6.68, both exceeding the high end of their guidance ranges.

- The company achieved robust North American same-property NOI growth of 7.9% for Q4 2025 and 5.7% for the full year 2025.

- For 2026, Sun Communities is guiding to a full-year core FFO per share midpoint of $6.93 (range of $6.83-$7.03) and a Q1 2026 midpoint of $1.28.

- The balance sheet was significantly strengthened, ending 2025 with net debt to trailing 12-month recurring EBITDA of 3.4x.

- Sun Communities returned over $1.5 billion of capital to shareholders in 2025, including repurchasing 4.3 million shares for approximately $539 million, and the board approved an approximately 8% increase to the quarterly distribution rate.

- Sun Communities reported FY25 Core FFO per Share of $6.68 and 4Q25 Core FFO per Share of $1.40.

- The company provided FY26E Core FFO per Share guidance of $6.93 (midpoint) and FY26E North America Same Property NOI Growth guidance of 4.5% (midpoint).

- Key accomplishments in 2025 included the $5.65 billion sale of Safe Harbor Marinas, repayment of ~$3.3 billion of debt, achieving a 3.4x Net debt/TTM EBITDA, and an upgrade to BBB+ (S&P) and Baa2 (Moody's) credit ratings.

- The company deployed ~$844 million in acquisitions and UK ground lease purchases, and returned over $1 billion of capital to shareholders while increasing the quarterly dividend by approximately 11%.

- For 2025, Average MH Site Rental Rate Increases were 6.1% and Same Property MH Occupancy was 98.1%.

- Sun Communities, Inc. reported Net Income per Diluted Share of $0.99 for the fourth quarter of 2025 and $10.84 for the full year 2025, with Core FFO per Share of $1.40 for the fourth quarter and $6.68 for the full year 2025.

- The company's North America Same Property Net Operating Income (NOI) increased by 7.9% for the fourth quarter of 2025 and 5.7% for the full year 2025.

- In 2025, Sun Communities acquired 14 MH and RV Communities for $457.0 million and distributed over $1.5 billion of capital to shareholders, inclusive of cash distributions and share repurchases.

- For 2026, the company is establishing guidance for Core FFO per Share of $6.83 to $7.03 and expects North American Same Property NOI Growth of 4.5% at the midpoint.

- The Board of Directors approved an 8% increase in the quarterly distribution rate to $1.12 per common share and unit, equating to an annual rate of $4.48, expected to commence with the first quarter distribution in April 2026.

- Sun Communities, Inc. made an investor presentation available on December 1, 2025, detailing its Q3 2025 performance and strategic updates.

- For Q3 2025, the company reported Core FFO per Share of $2.28 and North America Same Property NOI Growth of 5.4%.

- The company projects FY2025 Core FFO per Share to be between $6.59 and $6.67 and North America Same Property NOI Growth between 4.6% and 5.6%.

- Strategic initiatives included the sale of Safe Harbor for $5.65 billion, a $3.3 billion debt reduction in 2025, and credit rating upgrades to BBB+ (S&P) and Baa2 (Moody’s).

- Charles Young was appointed CEO and Board Member effective October 1, 2025.

- Sun Communities (SUI) reported Core FFO per share of $2.28 for Q3 2025, exceeding the high end of its guidance range.

- The company raised its full-year 2025 Core FFO per share guidance by $0.04 at the midpoint, to a range of $6.59 to $6.67.

- North American same property NOI growth guidance for full-year 2025 was increased to 5.1% at the midpoint, with manufactured housing expected to grow by 7.8% and RV same property NOI guidance raised to a 1% decline. UK same property NOI guidance was also increased to approximately 4%.

- SUI was active in capital deployment, acquiring 14 communities for approximately $457 million and purchasing 28 UK ground leases for approximately $324 million year-to-date. The company also repurchased approximately 4 million shares for $500 million year-to-date at an average price of $125.74 per share.

- Sun Communities, Inc. reported Core FFO of $2.28 per Share and net income attributable to common shareholders of $0.07 per diluted share for the quarter ended September 30, 2025.

- The company raised its full-year 2025 Core FFO per Share guidance by $0.04 to a range of $6.59 to $6.67 and increased its North American Same Property NOI growth guidance to 4.6% - 5.6%.

- Preliminary 2026 full-year rental rate guidance was established at 5.0% for MH, 4.0% for Annual RV, and 4.1% for UK.

- North America Same Property adjusted blended occupancy for MH and RV increased by 130 basis points year-over-year to 99.2% as of September 30, 2025.

- The company completed the sale of the remaining Safe Harbor Marinas Delayed Consent Properties for $117.5 million, finalizing the divestment for total net cash proceeds of approximately $5.5 billion. Subsequent to quarter-end, 14 communities were acquired for $457.0 million, and 2.3 million shares were repurchased for $297.5 million during Q3 2025.

- Charles Young has been appointed CEO and Board member, effective October 1, 2025, with Gary Shiffman transitioning to Non-Executive Chairman.

- The company reported strong 2Q25 results with Core FFO per share of $1.76 and updated its FY25 Core FFO guidance to $6.51 to $6.67 per share.

- Proceeds from the Safe Harbor Marinas sale were used to repay ~$3.3 billion of debt, repurchase ~$400 million of stock, pay a ~$520 million special cash distribution, increase the quarterly dividend by ~10%+, and acquire UK properties for ~$199 million.

- The company received credit rating upgrades to BBB+ from S&P and Baa2 from Moody's, reflecting substantial de-leveraging and a fully eliminated floating rate debt exposure.

Quarterly earnings call transcripts for SUN COMMUNITIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more