Earnings summaries and quarterly performance for Unum.

Executive leadership at Unum.

Richard McKenney

President and Chief Executive Officer

Christopher Pyne

Executive Vice President, Group Benefits

Lisa Iglesias

Executive Vice President, General Counsel

Steven Zabel

Executive Vice President and Chief Financial Officer

Timothy Arnold

Executive Vice President, Voluntary Benefits and President, Colonial Life

Board of directors at Unum.

Cynthia Egan

Director

Gale King

Director

Joseph Echevarria

Director

Kevin Kabat

Chair of the Board and Lead Independent Director

Mojgan Lefebvre

Director

Ronald O'Hanley

Director

Susan Cross

Director

Susan DeVore

Director

Theodore Bunting

Director

Timothy Keaney

Director

Research analysts who have asked questions during Unum earnings calls.

Elyse Greenspan

Wells Fargo

7 questions for UNM

Ryan Krueger

KBW

7 questions for UNM

Wesley Carmichael

Autonomous Research

7 questions for UNM

Suneet Kamath

Jefferies

6 questions for UNM

Alex Scott

Barclays PLC

5 questions for UNM

Joel Hurwitz

Dowling & Partners Securities, LLC

5 questions for UNM

John Barnidge

Piper Sandler

5 questions for UNM

Jamminder Bhullar

JPMorgan Chase & Co.

4 questions for UNM

Mark Hughes

Truist Securities

4 questions for UNM

Thomas Gallagher

Evercore

4 questions for UNM

Jack Matten

BMO Capital Markets

3 questions for UNM

Tom Gallagher

Evercore ISI

3 questions for UNM

Francis Matten

BMO Capital Markets

2 questions for UNM

Josh Shanker

Bank of America

2 questions for UNM

Joshua Shanker

Bank of America Merrill Lynch

2 questions for UNM

Michael Ward

Citi Research

2 questions for UNM

Taylor Scott

BofA Securities

2 questions for UNM

Tracy Benguigui

Wolfe Research

2 questions for UNM

Wilma Burdis

Raymond James Financial

2 questions for UNM

Jack Matson

BMO Capital Markets

1 question for UNM

Jimmy Bhullar

JPMorgan Chase & Co.

1 question for UNM

Joe Hurwitz

Dowling

1 question for UNM

Maxwell Fischer

Truist

1 question for UNM

Maxwell Fisher

Truist Securities

1 question for UNM

Mike Ward

UBS

1 question for UNM

Recent press releases and 8-K filings for UNM.

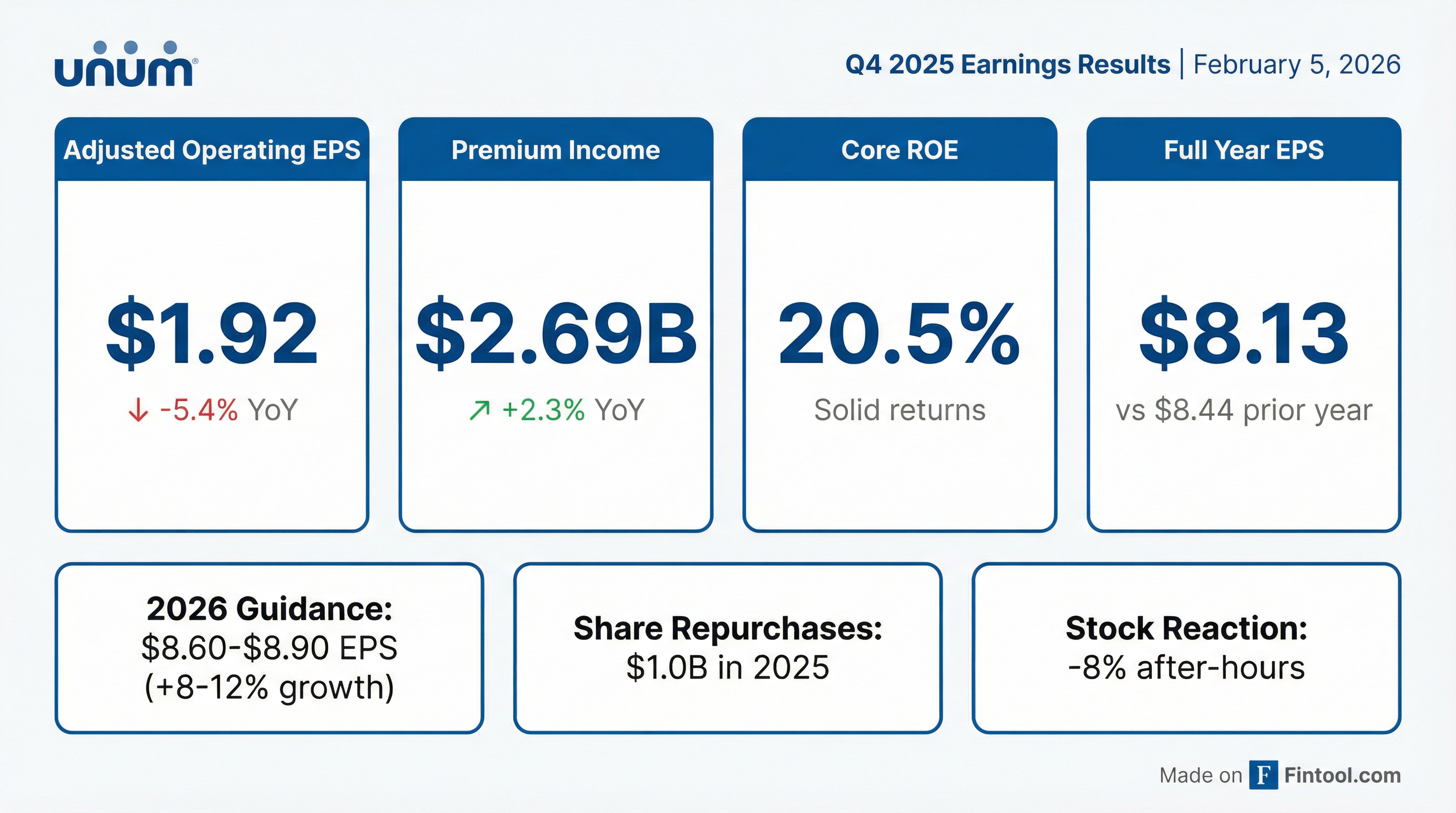

- Unum Group reported adjusted EPS of $8.13 for full year 2025, which was down year-over-year and below expectations, primarily due to higher than expected benefits experience.

- Core operations premium grew by nearly 4.5% in 2025, and the company expects 4%-7% top-line growth in 2026.

- For 2026, Unum anticipates adjusted EPS growth of 8%-12% over a redefined 2025 base of $7.93, reflecting a change to exclude Closed Block earnings from Adjusted Operating Earnings measurements starting in Q1 2026.

- In 2025, the company increased its dividend by 10% and repurchased $1 billion of shares, ending the year with 440% risk-based capital and $2.3 billion in holding company cash.

- Unum significantly de-risked its Closed Block in 2025 by completing an external reinsurance transaction and an internal reinsurance action, reducing long-term care reserves by over $4 billion.

- Unum Group reported full year 2025 adjusted EPS of $8.13, which was below expectations primarily due to higher than expected benefits experience.

- Core operations premium grew nearly 4.5% in 2025, with Colonial Life growing 3.1% and International 10%, contributing to an approximate 20% return on equity.

- In 2025, the company increased its dividend by 10% and repurchased $1 billion of shares, while also significantly de-risking its closed block by ceding approximately 20% of long-term care reserves and reducing total LTC reserves by over $4 billion.

- For 2026, Unum expects adjusted EPS growth of 8%-12% from a redefined 2025 base of $7.93, targeting an EPS range of $8.60-$8.90, alongside top-line growth of 4%-7% and plans to repurchase approximately $1 billion in shares.

- Beginning in Q1 2026, Unum will exclude Closed Block earnings from its Adjusted Operating Earnings measurements, redefining its 2025 adjusted EPS base to $7.93 for comparative purposes.

- For full year 2025, Unum reported adjusted EPS of $8.13, which was lower than expected due to higher benefits experience, though core operations maintained an approximate 20% return on equity.

- The company projects adjusted after-tax operating EPS for 2026 to be in the range of $8.60-$8.90, representing 8%-12% growth over the redefined 2025 base of $7.93 per share, with top-line growth expected between 4%-7%.

- Unum returned approximately $1.3 billion to shareholders in 2025 through a 10% dividend increase and $1 billion in share repurchases, and plans similar capital deployment for 2026, including approximately $1 billion in share repurchases and a 10% dividend increase.

- Significant progress was made in de-risking the closed block, including a reinsurance transaction that reduced long-term care reserves by over $4 billion and the discontinuation of new employee coverage, effectively placing the block in full runoff.

- Beginning Q1 2026, Closed Block earnings will be excluded from Adjusted Operating Earnings measurements to sharpen focus on the core business, resulting in a redefined 2025 base EPS of $7.93 for future comparisons.

- Unum Group reported net income of $174.1 million ($1.04 per diluted common share) and after-tax adjusted operating income of $322.3 million ($1.92 per diluted common share) for the fourth quarter of 2025.

- For the full year 2025, core operations achieved premium growth of 4.4% and an adjusted operating return on equity of 20.5%.

- The company returned approximately $1.3 billion to shareholders in 2025, including $1.0 billion in share repurchases and $307.2 million in common stock dividends.

- Unum Group maintains a robust balance sheet with $2.3 billion in holding company liquidity and a weighted average risk-based capital ratio of approximately 440%.

- The outlook for 2026 projects core operations premium growth of 4% to 7% and after-tax adjusted operating income per share in the range of $8.60 to $8.90, with a change in reporting methodology to exclude the Closed Block segment.

- Unum Group completed an offering of $300 million aggregate principal amount of 5.250% Senior Notes due 2035 on November 14, 2025.

- The notes have a stated maturity date of December 15, 2035, with interest payable semi-annually on June 15 and December 15, commencing June 15, 2026.

- The net proceeds from the offering will be used for general corporate purposes, including the repayment of $275 million aggregate principal amount of the company's 3.875% senior notes due 2025 that matured on November 5, 2025.

- The public offering price for the notes was 99.321% of the principal amount, resulting in proceeds before expenses of $296,013,000.

- Unum Group reported a significant decrease in Net Income to $39.7 million in Q3 2025, down from $645.7 million in Q3 2024, with Diluted Net Income Per Common Share falling to $0.23 from $3.46.

- Total Revenue for Q3 2025 increased to $3,378.4 million compared to $3,217.0 million in Q3 2024.

- After-tax Adjusted Operating Income decreased to $357.1 million in Q3 2025 from $398.0 million in Q3 2024.

- The company repurchased 3.2 million shares for $253.3 million in Q3 2025. The Leverage Ratio increased to 23.4% as of September 30, 2025, from 21.3% as of September 30, 2024.

- Unum Group reported Q3 2025 adjusted after-tax operating income per share of $2.09, with core operations premium growing 2.9% and sales increasing 12.2%, while maintaining an ROE near 20% for core businesses.

- An annual reserve assumption review resulted in a net increase in reserves of $478.5 million pre-tax or $377.8 million after-tax, primarily due to the removal of morbidity and mortality improvement assumptions and the discontinuation of new employee coverage on existing group long-term care cases, partially offset by an expanded premium rate increase program. This resulted in an approximate $0.10 impact on Q3 EPS.

- The company's capital position remains robust, with holding company liquidity at $2 billion and an RBC ratio of 455%. Unum Group returned nearly $1 billion to shareholders in the first nine months of 2025, comprised of $750 million in share repurchases and $230 million in dividends, projecting a total capital return of approximately $1.3 billion for the full year.

- Management expressed confidence that no future capital contributions will be necessary for the closed block, following strategic actions including a long-term care reinsurance transaction and active management of the block.

- Unum reported Q3 2025 earnings per share of $2.09, which fell below overall expectations primarily due to volatility in the closed block, while core businesses exceeded expectations.

- Core operations demonstrated strong performance with year-to-date premium growth of 4% and Q3 sales growth of 12.2%, contributing to a return on equity for core operations near 20%.

- The company undertook significant strategic actions related to its closed block, including a net increase in reserves of $377.8 million after tax from an annual assumption review, and the successful closing of a long-term care (LTC) reinsurance transaction that ceded 20% of LTC reserves.

- Key changes in closed block assumptions included removing the morbidity and mortality improvement assumption (adding approximately $850 million to reserves) and discontinuing new employee coverage on existing group LTC cases effective February 1, 2026 (adding approximately $200 million to reserves), partially offset by an expanded rate increase program (reducing reserves by approximately $525 million). Despite these GAAP reserve impacts, the company is confident that no future capital contributions will be necessary for LTC reserves.

- Unum maintains a robust capital position with $2 billion in holding company liquidity and an RBC ratio of 455%, having returned nearly $1 billion to shareholders year-to-date through $750 million in share repurchases and $230 million in dividends. The company expects to return approximately $1.3 billion to shareholders in 2025.

- Unum Group reported Q3 2025 adjusted after-tax operating income per share of $2.09. Core operations demonstrated strength with 2.9% premium growth (over 4% adjusted) and 12.2% sales growth.

- The annual reserve assumption review resulted in a net increase in reserves of $478.5 million pre-tax ($377.8 million after-tax), including a $640.5 million increase in closed block reserves primarily for long-term care. This was influenced by strategic actions such as removing the morbidity and mortality improvement assumption and discontinuing new employee coverage, partially offset by expanded rate increase plans.

- The company reported a robust capital position in Q3 2025, with holding company liquidity of $2 billion and an RBC ratio of 455%, both exceeding targets.

- Through the first nine months of 2025, Unum returned nearly $1 billion to shareholders, comprising $750 million in share repurchases and $230 million in dividends. The company anticipates a total capital return of approximately $1.3 billion for the full year 2025.

- Unum Group reported Q3 2025 adjusted after-tax operating income per share of $2.09, with core businesses exceeding expectations and delivering a return on equity near 20%.

- The company completed its annual reserve assumption review, leading to an overall net increase in reserves of $478.5 million pre-tax or $377.8 million after-tax, primarily driven by a $640.5 million increase in closed block long-term care reserves.

- Core operations showed strong growth in Q3 2025, with premium up 2.9% (over 4% adjusted) and sales up 12.2%.

- Unum maintains a robust capital position with $2 billion in holding company liquidity and 455% traditional RBC, and anticipates returning approximately $1.3 billion to shareholders in 2025 through share repurchases and dividends.

- Strategic actions in the closed block included the successful closing of a long-term care reinsurance transaction, ceding 20% of LTC reserves, and a decision to curtail new lives onto LTC group contracts to reduce the block's size.

Quarterly earnings call transcripts for Unum.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more