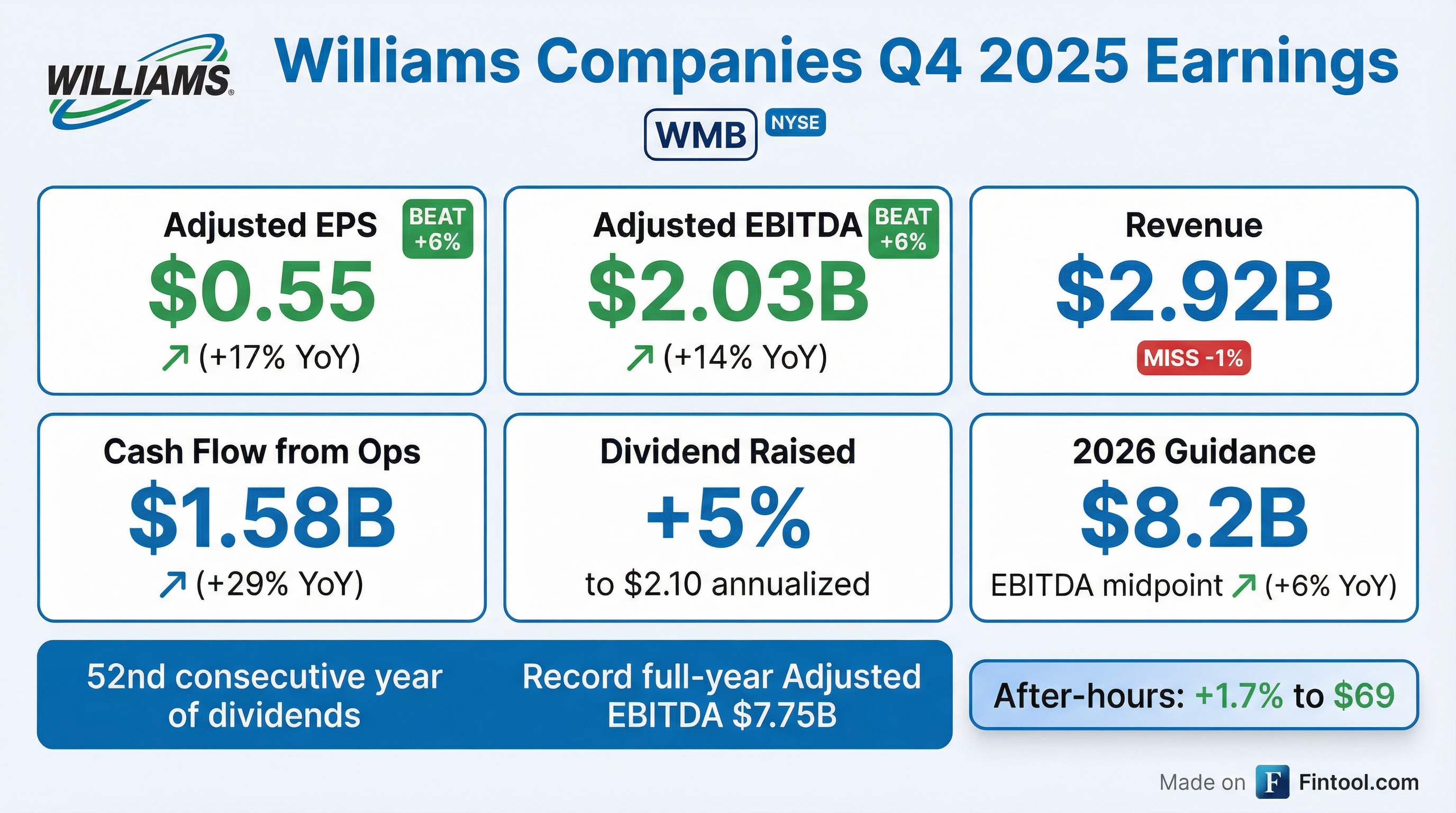

Earnings summaries and quarterly performance for WILLIAMS COMPANIES.

Executive leadership at WILLIAMS COMPANIES.

Board of directors at WILLIAMS COMPANIES.

Carri A. Lockhart

Director

Jesse J. Tyson

Director

Michael A. Creel

Director

Peter A. Ragauss

Director

Richard E. Muncrief

Director

Rose M. Robeson

Director

Scott D. Sheffield

Director

Stacey H. Doré

Director

Stephen W. Bergstrom

Lead Independent Director

William H. Spence

Director

Research analysts who have asked questions during WILLIAMS COMPANIES earnings calls.

Jeremy Tonet

JPMorgan Chase & Co.

7 questions for WMB

John Mackay

Goldman Sachs Group, Inc.

7 questions for WMB

Manav Gupta

UBS Group

7 questions for WMB

Praneeth Satish

Wells Fargo

7 questions for WMB

Theresa Chen

Barclays PLC

7 questions for WMB

Jean Ann Salisbury

Bank of America

5 questions for WMB

Keith Stanley

Wolfe Research, LLC

5 questions for WMB

Robert Catellier

CIBC Capital Markets

5 questions for WMB

Spiro Dounis

Citigroup Inc.

5 questions for WMB

Amit Sarkar

BMO Capital Markets Corp.

2 questions for WMB

Burke Sansiviero

Wolfe Research, LLC

2 questions for WMB

Elvira Scotto

RBC Capital Markets

2 questions for WMB

Indraneel Mitra

Bank of America

2 questions for WMB

Jason Gabelman

TD Cowen

2 questions for WMB

Julien Dumoulin-Smith

Jefferies

2 questions for WMB

Neal Dingmann

Truist Securities

2 questions for WMB

Sunil Sibal

Seaport Global Holdings LLC

2 questions for WMB

Zackery Van Everen

Tudor, Pickering, Holt & Co.

2 questions for WMB

Zack Van Everen

TPH&Co.

2 questions for WMB

Brandon Bingham

Scotiabank

1 question for WMB

Gabriel Moreen

Mizuho Financial Group, Inc.

1 question for WMB

Recent press releases and 8-K filings for WMB.

- Full‐year 2025 revenue of $1.829 billion (+142% YoY), net income of $342 million, and adjusted EBITDA of $956 million all exceeded guidance.

- Average production rose 37% YoY to 1,086 MMcfepd (181 Mboepd); Q4 output increased 42% YoY to 1,198 MMcfepd (200 Mboepd).

- Returned over $185 million to shareholders via dividends (4Q25 dividend of $0.29 per share) and repurchasing ~7.3 million shares (~10% of outstanding).

- Completed ~$2 billion of acquisitions (Maverick Natural Resources and Canvas Energy), capturing over $80 million in synergies and achieving pro forma adjusted EBITDA of ~$1.2 billion.

- Reported $7.75 billion Adjusted EBITDA in 2025, hitting the midpoint of guidance and marking the 13th consecutive year of EBITDA growth.

- Announced a 10%+ compound annual growth target for Adjusted EBITDA from 2025 through 2030, underpinned by a portfolio of contracted pipeline, transmission, gathering, processing, and power projects.

- Expanded its Power Innovation platform to $7.3 billion of invested capital, including the new 340 MW Socrates the Younger project ($1.3 billion) and upsized Aquila and Apollo projects; platform is expected to generate $1.4 billion EBITDA by 2029.

- Has 13 pipeline/transmission projects in execution, adding 7.1 Bcf/d of capacity, plus a backlog of over 14 Bcf/d (> $15 billion CapEx) to support long-term volume growth.

- Issued 2026 guidance with $8.2 billion Adjusted EBITDA, 9% EPS growth, $5.05 AFFO per share, minimal cash taxes, and leverage peaking near 4× before declining below 3× by 2028.

- Williams delivered $7.75 billion of Adjusted EBITDA in 2025, marking the midpoint of guidance and the 13th straight year of EBITDA growth, with a 9% EBITDA and 14% EPS CAGR over the past five years.

- The company set 2026 guidance at $8.2 billion of Adjusted EBITDA (+6% year-over-year, +7% normalized), 9% EPS growth, and $5.05 AFFO per share, with leverage expected near 4.0×.

- Williams announced a 10%+ EBITDA CAGR target from 2025–2030, underpinned by fully contracted, take-or-pay pipeline and power projects with clear FID and execution timelines.

- The Power Innovation platform now totals $7.3 billion of invested capital and is projected to deliver $1.4 billion of annual EBITDA by 2029, including the new Socrates the Younger project and upsized Aquila and Apollo contracts.

- Company delivered 9% EBITDA CAGR and 14% EPS CAGR over the past five years—outperforming its 5%–7% target—and set a new 10%+ EBITDA CAGR goal for 2025–2030.

- Power Innovation platform has secured $7.3 billion in PPAs (Socrates, Aquila, Apollo, Socrates the Younger), poised to deliver $1.4 billion of annual EBITDA by 2029 under long-term take-or-pay contracts at ~5× build multiples.

- The 2026 CapEx budget of $6.4 billion is allocated to four Power Innovation projects and three major Transco expansions (including Southeast and Northeast Supply Enhancement), underpinning high-return organic growth.

- Balance sheet leverage stood at 3.7× in 2025, expected to decline below 3.5× by 2028, while maintaining a 5% dividend growth rate supported by robust cash flow.

- Williams delivered full-year 2025 GAAP net income of $2.615 billion, or $2.14 per diluted share, up 18% year-over-year.

- Full-year 2025 Adjusted EBITDA was $7.75 billion, up 9%, and Available Funds From Operations (AFFO) reached $5.858 billion, up 9% versus 2024.

- The board raised the annual dividend by 5% to $2.10 for 2026, extending its payout streak to 52 years, with AFFO coverage of 2.40x.

- For 2026, the company guides Adjusted EBITDA of $8.05–8.35 billion, growth capex of $6.1–6.7 billion, maintenance capex of $850–950 million, and expects a leverage ratio around 4.0x.

- GAAP net income of $2.615 B (EPS $2.14), up 18%, and Adjusted EBITDA of $7.75 B, up 9%, with CFFO of $5.898 B (↑19%) and AFFO of $5.858 B (↑9%) vs. 2024

- 2026 guidance for Adjusted EBITDA of $8.05 B–$8.35 B, implying ~6% growth at midpoint vs. 2025

- Dividend raised 5% to $2.10 annualized for 2026, extending a 52-year streak, with a 2.40× coverage ratio (AFFO basis)

- Completed 12 projects in 2025 (6 pipeline transmission, 2 gathering, 4 deepwater) and closed acquisitions of Rimrock and Saber Midstream, plus strategic partnership with Woodside Energy

- On January 8, 2026, The Williams Companies completed a registered offering of $500 million 5.650% Senior Notes due 2033, $1.25 billion 5.150% Senior Notes due 2036 and $1 billion 5.950% Senior Notes due 2056.

- The notes are senior unsecured obligations ranking equally with all existing senior debt and were issued under the Base Indenture dated December 18, 2012, as supplemented by the Thirteenth Supplemental Indenture, which includes covenants limiting liens and restricting mergers, consolidations and asset sales.

- Interest on the 2033 Notes is payable semi-annually on March 15 and September 15 beginning March 15, 2026, and interest on the 2036 and 2056 Notes is payable semi-annually on the same dates beginning September 15, 2026.

- The Indenture provides for optional redemption at a make-whole premium prior to each series’ par call date and at par thereafter, with 10–60 days’ notice to holders.

- On January 5, 2026, Williams priced a $2.75 billion public offering of senior notes: $500 million of 5.650% due 2033 at 104.465% of par, $1.25 billion of 5.150% due 2036 at 99.882% of par, and $1 billion of 5.950% due 2056 at 99.645% of par.

- The offering is expected to settle on January 8, 2026, subject to customary closing conditions.

- Williams will use the net proceeds to repay near-term debt maturities—including $1.1 billion of 5.400% notes due 2026—and for other general corporate purposes.

- Williams priced $2.75 billion of senior notes: $500 million 5.650% due 2033 at 104.465% of par, $1.25 billion 5.150% due 2036 at 99.882%, and $1 billion 5.950% due 2056 at 99.645%

- Expected settlement date of January 8, 2026

- Net proceeds will repay near-term debt, including $1.1 billion 5.400% notes due 2026, and fund general corporate purposes

- Joint book-running managers are Barclays Capital, BofA Securities, CIBC World Markets, and Truist Securities

- On December 1, 2025, Northwest Pipeline LLC, a Williams subsidiary, entered into a $250 million Credit Agreement with PNC Bank, National Association as administrative agent and PNC Capital Markets LLC as lead arranger to refinance its 7.125% senior notes due December 1, 2025 and fund working capital, acquisitions, capital expenditures and other general corporate purposes.

- The term loan matures on December 1, 2028 (three years) and bears interest at either Alternate Base Rate + Applicable Rate or SOFR + Applicable Rate, with spreads set by the Company’s senior unsecured debt ratings.

- The Agreement imposes a financial covenant requiring maintenance of a debt-to-capitalization ratio no greater than 65%, tested at each fiscal quarter-end, and contains customary representations, warranties, covenants and events of default.

Fintool News

In-depth analysis and coverage of WILLIAMS COMPANIES.

Quarterly earnings call transcripts for WILLIAMS COMPANIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more