Earnings summaries and quarterly performance for CROWN CASTLE.

Executive leadership at CROWN CASTLE.

Christian Hillabrant

President and Chief Executive Officer

Catherine Piche

Executive Vice President and Chief Operating Officer—Towers

Christopher Levendos

Executive Vice President and Chief Operating Officer—Fiber

Daniel Schlanger

Executive Vice President and Chief Transformation Officer

Edward Adams Jr.

Executive Vice President and General Counsel

Sunit Patel

Executive Vice President and Chief Financial Officer

Board of directors at CROWN CASTLE.

Andrea Goldsmith

Director

Anthony Melone

Director

Jason Genrich

Director

Katherine Motlagh

Director

Kevin Kabat

Director

Kevin Stephens

Director

Matthew Thornton III

Director

P. Robert Bartolo

Chair of the Board

Tammy Jones

Director

Research analysts who have asked questions during CROWN CASTLE earnings calls.

Batya Levi

UBS

6 questions for CCI

Michael Rollins

Citigroup

6 questions for CCI

Ric Prentiss

Raymond James

6 questions for CCI

Brendan Lynch

Barclays

5 questions for CCI

Brandon Nispel

KeyBanc Capital Markets

4 questions for CCI

Richard Choe

JPMorgan Chase & Co.

4 questions for CCI

Ari Klein

BMO Capital Markets

3 questions for CCI

David Barden

Bank of America

3 questions for CCI

James Schneider

Goldman Sachs

3 questions for CCI

Michael Funk

Bank of America

3 questions for CCI

Nicholas Del Deo

MoffettNathanson

3 questions for CCI

Nick Del Deo

MoffettNathanson LLC

3 questions for CCI

Benjamin Swinburne

Morgan Stanley

2 questions for CCI

Eric Luebchow

Wells Fargo

2 questions for CCI

Jonathan Atkin

RBC Capital Markets

2 questions for CCI

Joshua Lu

Goldman Sachs

2 questions for CCI

Simon Flannery

Morgan Stanley

2 questions for CCI

Alexander Waters

Bank of America

1 question for CCI

Jonathan Chaplin

New Street Research

1 question for CCI

Joshua Frantz

Goldman Sachs

1 question for CCI

Matthew Niknam

Deutsche Bank

1 question for CCI

Richard Gill

JPMorgan Chase & Co.

1 question for CCI

Recent press releases and 8-K filings for CCI.

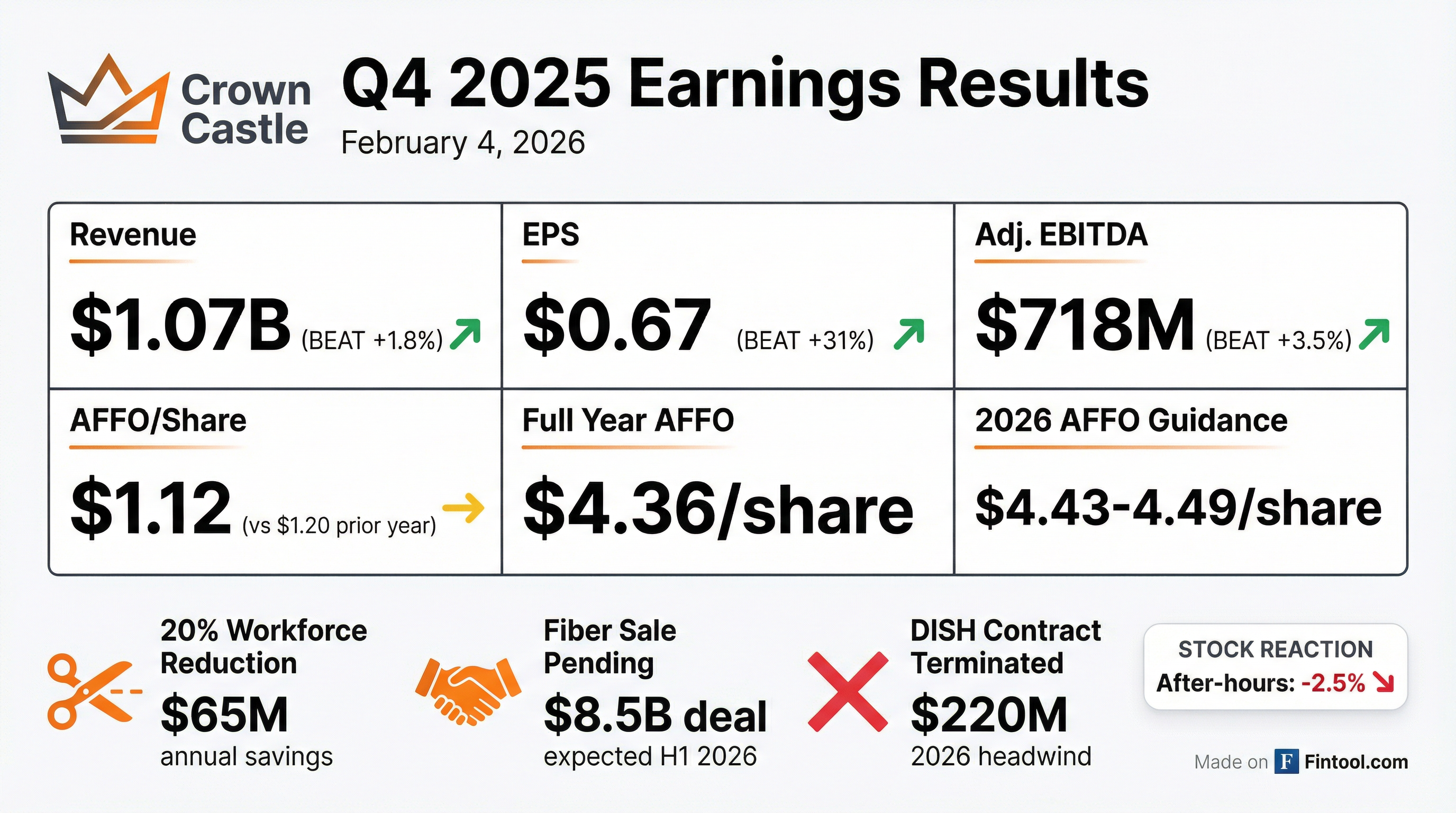

- Sale of small cell and fiber businesses expected in H1 2026, enabling a focus on a simpler U.S. tower portfolio.

- DISH agreement terminated after default, and Crown Castle is seeking to recover >$3.5 billion in remaining contract payments.

- Workforce realignment: ~20% reduction (~1,250 employees) in continuing operations to deliver $65 million in annualized cost savings.

- 2026 outlook at midpoints: Site rental revenues $3.9 billion, Adjusted EBITDA $2.7 billion, AFFO $1.9 billion, with 3.5% organic growth ex-DISH (3.3% including DISH impact).

- Capital allocation post-sale: maintain $4.25 annualized dividend, allocate $1 billion to buybacks and $7 billion to debt repayment to target 6–6.5× leverage.

- Crown Castle is on track to close the sale of its small cell and fiber businesses in H1 2026; the DOJ has cleared the Hart-Scott-Rodino review with only a few state and federal approvals remaining, and ~60% of the consolidated workforce will transfer with the sale as the company focuses solely on its U.S. tower operations.

- After Dish Wireless defaulted, Crown Castle terminated the contract and is seeking recovery of >$3.5 billion in owed payments; it has accelerated a restructuring plan to reduce tower and corporate staffing by 20% (to ~1,250 FTE) and expects to cut annualized operating costs by $65 million.

- Full-year 2026 guidance (midpoints) assumes site rental revenues of $3.9 billion, adjusted EBITDA of $2.7 billion, and AFFO of $1.9 billion, reflecting 3.3% organic growth (or 3.5% growth excluding Dish).

- The capital allocation framework maintains a $4.25 annualized dividend, $150–$250 million of net capex, $1 billion in share repurchases, $7 billion of debt repayment, and a target leverage ratio of 6–6.5×.

- Crown Castle delivered FY 2025 site rental revenues of $4,049 M, adjusted EBITDA of $2,863 M, and AFFO of $1,904 M, each exceeding initial and previous outlooks.

- For FY 2026, the company forecasts site rental revenues of $3,828–3,873 M (midpoint $3,850 M), adjusted EBITDA of $2,665–2,715 M (midpoint $2,690 M), and AFFO of $1,895–1,945 M (midpoint $1,920 M).

- Updated AFFO guidance for the 12 months following the Fiber Business sale close ranges from $2,025–2,175 M (midpoint $2,100 M), reflecting a $280 M reduction from the prior range, partially offset by $40 M of interest expense benefits.

- Crown Castle plans to close the sale of its small cell and fiber businesses in H1 2026, transition to a U.S.-only tower business, and allocate proceeds to repurchase ~$1 billion of shares and repay ~$7 billion of debt, while maintaining a $4.25 annual dividend and targeting 6.0–6.5× leverage.

- The company terminated its DISH Wireless contract after DISH’s January payment default, is seeking to recover > $3.5 billion, and expects $220 million of DISH churn in its 2026 outlook.

- For full-year 2026, Crown Castle guided site rental revenues of $3.9 billion, adjusted EBITDA of $2.7 billion, and AFFO of $1.9 billion, implying 3.3% organic growth (or 3.5% ex-DISH).

- The company will reduce its tower and corporate workforce by ~20% (to ~1,250 FTEs) and deliver $65 million of annualized cost savings, with $55 million in 2026 and $10 million in 2027.

- Full-year 2025 results featured 4.9% organic growth (excluding Sprint churn), enabling Crown Castle to exceed guidance for site rental revenues, adjusted EBITDA, and FFO.

- Full-year 2025 site rental revenues were $4,049 M (–5%), net income was $444 M, adjusted EBITDA was $2,863 M, and AFFO was $1,904 M.

- FY 2026 Outlook includes site rental revenues of $3,850 M (–5%), net income of $780 M, adjusted EBITDA of $2,690 M, and AFFO of $1,920 M.

- Plans to maintain the annual dividend at $4.25 per share, implement ~20% tower and corporate workforce reduction for $65 M in annual operating cost savings, and close the Fiber Business sale in H1 2026.

- Post-sale, expects to repurchase ~$1 B of shares and repay ~$7 B of debt using proceeds from the Fiber Business sale.

- Site rental revenues for FY 2025 were $4,049 M (–5%), delivering net income of $444 M (diluted EPS $1.01), Adjusted EBITDA of $2,863 M and AFFO of $1,904 M ($4.36/share).

- Full-year 2026 guidance includes site rental revenues of $3,850 M (–5%), net income of $780 M (+76%), Adjusted EBITDA of $2,690 M (–6%) and AFFO of $1,920 M (+1%).

- Company will cut tower and corporate headcount by approximately 20%, targeting $65 M of annualized operating cost savings, and plans to maintain its dividend at $4.25/share.

- Under its capital allocation framework, Crown Castle intends to repurchase $1 B of shares and repay $7 B of debt post Fiber Business sale; it ended Q4 with $4.1 B revolver availability and 84% fixed-rate debt.

- On January 12, 2026, Crown Castle announced that DISH Wireless defaulted on its payment obligations, leading Crown Castle to terminate their wireless infrastructure agreement and seek recovery of over $3.5 billion in remaining payments.

- Crown Castle does not expect the termination and default recovery actions to impact its full-year 2025 financial results.

- The company furnished a notice of default under its Master Lease Agreement with DISH and will enforce its contractual rights to recover the owed amounts.

- Crown Castle announced that DISH Wireless has defaulted on its payment obligations, leading to termination of their wireless infrastructure agreement and the pursuit of over $3.5 billion in remaining payments owed.

- DISH previously discontinued its network business after EchoStar sold key spectrum licenses to AT&T and SpaceX, citing FCC actions as grounds to stop honoring contracts.

- Crown Castle does not expect the DISH default to impact its full-year 2025 financial results.

- Divestiture plan: Crown Castle expects to complete the $8.5 billion sale of its fiber and small-cell business by H1 2026, relaunching as a pure-play U.S. tower company (“Crown 2.0”) and targeting significant operational efficiencies.

- Capital allocation: Of the divestiture proceeds, $6 billion will be used to repay debt and the remainder for share buybacks; the company aims to deploy 75–80% of AFFO to dividends and maintain an investment-grade rating.

- Legal proceedings: Filed suit against Dish—which represents ~5% of revenues—to uphold site-lease contracts through 2036 and dismiss Dish’s force majeure defense related to its spectrum sale.

- Growth outlook: Sees mid-single-digit organic revenue growth driven by rent escalators and increased tower usage; plans no major M&A outside the U.S. and will pursue disciplined, accretive CapEx

- Crown Castle plans to complete the sale of its fiber and small cell business by end of H1 2026 and reposition as a standalone, U.S.-focused tower company (“Crown 2.0”).

- The company has filed a lawsuit to enforce its lease contract with Dish—representing approximately 5% of total revenues—through 2036, rejecting Dish’s force majeure defense.

- Management expects continued tower demand driven by ongoing 5G deployment and over 30% annual mobile data growth, despite carriers nearing peak wireless CapEx.

- After the divestiture, Crown Castle will allocate $6 billion of proceeds to debt reduction and the remainder to share buybacks, while maintaining a 75–80% AFFO dividend payout and an investment-grade credit profile.

- The company aims to be best-in-class in SG&A, targeting several percentage points of cost reduction through process improvements and digital initiatives over the next few years.

Quarterly earnings call transcripts for CROWN CASTLE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more