Earnings summaries and quarterly performance for GROUP 1 AUTOMOTIVE.

Executive leadership at GROUP 1 AUTOMOTIVE.

Daryl A. Kenningham

President and Chief Executive Officer

Daniel J. McHenry

Senior Vice President and Chief Financial Officer

Gillian A. Hobson

Senior Vice President, Chief Legal Officer and Corporate Secretary

Jamie Albertine

Senior Vice President, Corporate Development and Procurement

Peter C. DeLongchamps

Senior Vice President, Manufacturer Relations, Financial Services and Public Affairs

Shelley Washburn

Senior Vice President and Chief Marketing Officer

Board of directors at GROUP 1 AUTOMOTIVE.

Research analysts who have asked questions during GROUP 1 AUTOMOTIVE earnings calls.

Rajat Gupta

JPMorgan Chase & Co.

8 questions for GPI

Jeff Lick

Stephens Inc.

7 questions for GPI

Bret Jordan

Jefferies

5 questions for GPI

David Whiston

Morningstar, Inc.

5 questions for GPI

Daniela Haigian

Morgan Stanley

4 questions for GPI

Glenn Chin

Seaport Research Partners

4 questions for GPI

Michael Ward

Citi Research

4 questions for GPI

John Murphy

Bank of America

3 questions for GPI

Ronald Jewsikow

Guggenheim Partners

3 questions for GPI

John Babcock

Bank of America

2 questions for GPI

John Saager

Evercore ISI

2 questions for GPI

Patrick Buckley

Jefferies Financial Group Inc.

2 questions for GPI

Daniel Hagan

Morgan Stanley

1 question for GPI

Federico Merendi

Bank of America

1 question for GPI

Thomas Wendler

Stephens Inc.

1 question for GPI

Recent press releases and 8-K filings for GPI.

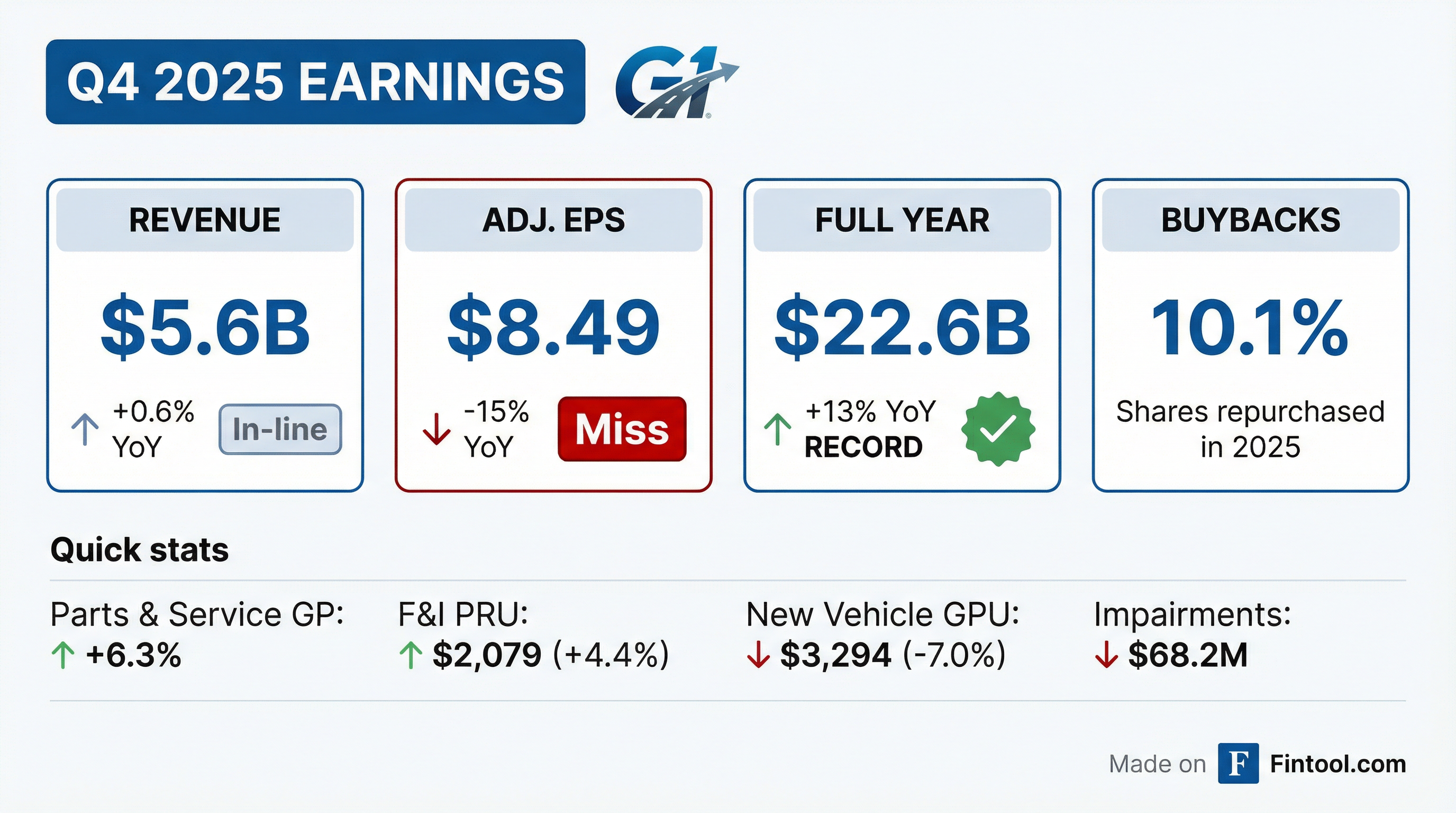

- Group 1 Automotive reported Q4 2025 revenues of $5.6 billion, gross profit of $874 million, adjusted net income of $105 million, and adjusted diluted EPS of $8.49. For the full year 2025, the company achieved an all-time high gross profit of more than $3.6 billion, including record parts and service gross profit of nearly $1.6 billion, and sold 459,000 new and used vehicles.

- In 2025, the company actively managed its portfolio by acquiring dealerships expected to generate approximately $640 million in annual revenue and disposing of 13 dealerships that had generated approximately $775 million in annualized revenue.

- Group 1 Automotive repurchased more than 10% of its outstanding shares in 2025, totaling $555 million for approximately 1.3 million shares at an average price of $413.05 through December 31, 2025. An additional 71,750 shares were repurchased subsequent to Q4 for $28.3 million.

- U.S. operations demonstrated strong performance across all business lines, with after-sales and F&I being major contributors, and same-store technicians increasing by 2.3% year-over-year. In the U.K., the company continued restructuring initiatives, including a headcount reduction of 537 positions in 2025 and working on the exit of the JLR brand, amidst a challenging macroeconomic environment.

- Group 1 Automotive reported Q4 2025 revenues of $5.6 billion, gross profit of $874 million, adjusted net income of $105 million, and adjusted diluted EPS of $8.49 from continuing operations.

- For the full year 2025, the company achieved record revenues across all major business lines, an all-time high gross profit of more than $3.6 billion, and sold a record 459,000 new and used vehicles.

- In 2025, the company strategically managed its portfolio by acquiring dealerships projected to generate $640 million in annual revenue and disposing of others with $775 million in annualized revenue. Additionally, it repurchased more than 10% of its outstanding shares.

- The UK segment continued its restructuring initiatives in 2025, including a headcount reduction of 537 positions and the completion of systems integration, aiming to improve profitability in a challenging macroeconomic environment.

- US operations demonstrated strong performance in Q4 2025, particularly in after-sales and F&I, with the company actively deploying AI and productivity tools to enhance efficiency across the business.

- Group 1 Automotive reported Q4 2025 revenues of $5.6 billion, gross profit of $874 million, and adjusted diluted EPS of $8.49 from continuing operations, contributing to record full-year 2025 gross profit of over $3.6 billion and 459,000 new and used vehicles sold.

- In 2025, the company actively managed its portfolio by acquiring dealerships expected to generate $640 million in annual revenue and disposing of 13 dealerships that generated $775 million in annualized revenue.

- Capital allocation included repurchasing more than 10% of outstanding shares in 2025 for $555 million, with an additional $28.3 million in buybacks subsequent to Q4 2025, and maintaining a rent-adjusted leverage of 3.1 times at year-end.

- UK operations continued restructuring efforts, including a headcount reduction of 537 positions and working towards exiting the JLR brand, while aftersales saw a nearly 36% year-over-year uplift in RO count.

- Management expressed optimism for the 2026 used car market due to anticipated lease returns and tax refunds, and aims to keep US SG&A as a percentage of gross profit below 70% and UK SG&A at 80% long-range.

- Group 1 Automotive reported record full-year revenues of $22.6 billion, a 13.2% increase over the prior year, and record full-year gross profits of $3.6 billion, up 11.8% for the full year 2025.

- For the fourth quarter of 2025, total revenues were $5.6 billion, a 0.6% increase compared to the prior-year quarter, with adjusted diluted earnings per common share from continuing operations at $8.49.

- Full-year 2025 adjusted diluted earnings per common share from continuing operations increased 3.8% to $40.71.

- The company repurchased approximately 10.1% of its outstanding common shares in full year 2025, totaling $554.8 million.

- Strategic capital allocation in 2025 included acquiring dealerships with approximately $640 million in expected annual revenues and divesting stores with approximately $775 million in annualized revenues.

- Group 1 Automotive reported record full-year revenues of $22.6 billion in 2025, marking a 13.2% increase over the comparable prior year, and record full-year gross profits of $3.6 billion, an 11.8% increase.

- For the full year 2025, adjusted diluted earnings per common share from continuing operations was $40.71, representing a 3.8% increase compared to the prior year.

- In the fourth quarter of 2025, total revenues were $5.6 billion, a 0.6% increase compared to the prior-year quarter, with diluted earnings per common share from continuing operations at $3.47 and adjusted diluted earnings per common share from continuing operations at $8.49.

- The company repurchased approximately 10.1% of its outstanding common shares in full year 2025, for a total of $554.8 million.

- Group 1 Automotive acquired dealership operations with total expected annual revenues of approximately $640 million and divested 13 underperforming stores, with annualized revenues associated with dispositions totaling approximately $775 million in 2025.

- Group 1 Automotive's board of directors approved a new share repurchase authorization of $500 million, representing an increase of $457 million.

- Year-to-date 2025, the company has repurchased 1,038,797 shares for a total of $434 million at an average price of $417.38 per common share.

- The board declared a quarterly dividend of $0.50 per share, payable on December 15, 2025, to stockholders of record as of December 1, 2025.

- This dividend is consistent with the previously announced 6% increase in the annualized dividend rate, from $1.88 per share in 2024 to $2.00 per share in 2025.

- Group 1 Automotive reported record quarterly revenues of $5.8 billion, gross profit of $920 million, adjusted net income of $135 million, and adjusted diluted EPS of $10.45 from continuing operations for Q3 2025.

- U.S. operations demonstrated strong performance, achieving record quarterly revenues in used vehicles, parts and service, and F&I, with F&I PRU reaching an all-time high of nearly $2,500.

- In the UK, the company took a $123.9 million asset impairment in Q3 2025, including an $18.1 million franchise rights impairment, following its decision to exit the Jaguar Land Rover brand within 24 months.

- The company continued its capital allocation strategy by repurchasing approximately 186,000 shares for $82 million in Q3 2025, and an additional 140,000 shares for $60.9 million subsequent to the quarter.

- Group 1 Automotive reported record quarterly revenues of $5.8 billion, gross profit of $920 million, adjusted net income of $135 million, and adjusted diluted EPS of $10.45 for Q3 2025.

- The company announced its decision to exit the Jaguar Land Rover (JLR) brand in the U.K. within 24 months, leading to a $123.9 million asset impairment in the quarter, which included an $18.1 million franchise rights impairment charge related to JLR.

- U.S. operations delivered strong performance, achieving record quarterly revenues in used vehicles, parts and service, and F&I, with F&I PRU reaching an all-time high of nearly $2,500.

- Group 1 Automotive repurchased approximately 186,000 shares for $82 million in Q3 2025 and an additional 140,000 shares for $60.9 million subsequent to the quarter, with $165.4 million remaining on the board-authorized common share repurchase program.

- Group 1 Automotive reported record quarterly revenues of $5.8 billion and adjusted diluted EPS of $10.45 from continuing operations for Q3 2025.

- The company announced its decision to exit the Jaguar Land Rover brand in the U.K. within 24 months, which resulted in a $123.9 million asset impairment in the quarter.

- U.S. operations delivered strong performance, achieving record quarterly records in used vehicles, parts and service, and F&I, with F&I PRU reaching an all-time high of nearly $2,500.

- To address a challenging U.K. operating environment, the company implemented approximately 700 headcount reductions, closed four dealerships, and terminated eight franchises.

- Group 1 Automotive continued its capital allocation strategy by repurchasing approximately 186,000 shares for $82 million in Q3 2025 and an additional 140,000 shares for $60.9 million subsequent to the quarter.

- GPI's U.S. Same Store Retail Used Vehicle Unit Sales increased +3% YoY in Q3 2025, outperforming the U.S. Used Market Unit Sales increase of +1% YoY.

- U.S. Same Store Finance & Insurance (F&I) Gross Profit Per Retail Unit (PRU) reached a record all-time high of $2,506 in Q3 2025, marking a +5% YoY increase.

- U.S. Same Store Parts & Service Revenue grew +8% YoY in Q3 2025, driven by +16% growth in Warranty and +9% in Customer Pay.

- For the nine months ended Q3 2025, Adjusted Operating Income was $753 million with an Adjusted Operating Margin of 4.4%, and Adjusted Free Cash Flow was $500 million.

- As of September 30, 2025, the company maintained $989 million in total liquidity and a Rent Adjusted Leverage Ratio of 2.9x, with total debt including floorplan at $5.4 billion.

Quarterly earnings call transcripts for GROUP 1 AUTOMOTIVE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more