Earnings summaries and quarterly performance for HAIN CELESTIAL GROUP.

Executive leadership at HAIN CELESTIAL GROUP.

Alison E. Lewis

Interim President and Chief Executive Officer

Kristy M. Meringolo

Chief Legal and Corporate Affairs Officer, Corporate Secretary

Lee A. Boyce

Chief Financial Officer

Steven R. Golliher

Global Chief Supply Chain Officer

Wolfgang Goldenitsch

President, International

Board of directors at HAIN CELESTIAL GROUP.

Research analysts who have asked questions during HAIN CELESTIAL GROUP earnings calls.

Kaumil Gajrawala

Jefferies

9 questions for HAIN

Andrew Lazar

Barclays PLC

8 questions for HAIN

Anthony Vendetti

Maxim Group

8 questions for HAIN

John Baumgartner

Mizuho Securities

8 questions for HAIN

Jon Andersen

William Blair & Company

7 questions for HAIN

Andrew Paul Wolf

CL King & Associates

4 questions for HAIN

James Salera

Stephens Inc.

4 questions for HAIN

Jim Salera

Stephens Inc.

3 questions for HAIN

Matthew Smith

Analyst

3 questions for HAIN

Alexia Howard

AllianceBernstein

2 questions for HAIN

David Palmer

Evercore ISI

2 questions for HAIN

John Salera

Stephens

2 questions for HAIN

Kenneth Goldman

JPMorgan Chase & Co.

2 questions for HAIN

Matt Smith

Bank of America

2 questions for HAIN

Michael Lavery

Piper Sandler & Co.

2 questions for HAIN

Recent press releases and 8-K filings for HAIN.

- Hain Celestial Group has completed the sale of its North American Snacks business, including Garden Veggie Snacks™, Terra® chips, and Garden of Eatin'® snacks, to Snackruptors Inc..

- The proceeds from this transaction will be used to reduce debt, aiming to strengthen the company’s financial position and leverage profile.

- This divestiture is a strategic move to sharpen Hain's focus and advance a simplified North American portfolio centered on core categories with stronger margin and cash flow profiles.

- The company plans to support increased investment in its North American better-for-you brands across flagship categories such as yogurt, tea, and baby & kids foods.

- Hain Celestial Group has reached a definitive agreement to sell its North American snacks business to Snackrupters for $115 million in cash, with proceeds intended for debt reduction.

- The divested snacks business accounted for 22% of fiscal 2025 net sales and 38% of the North America segment's net sales, contributing negligible EBITDA over the last 12 months. The remaining North America portfolio is projected to achieve an EBITDA margin in the low double digits and a gross margin above 30%.

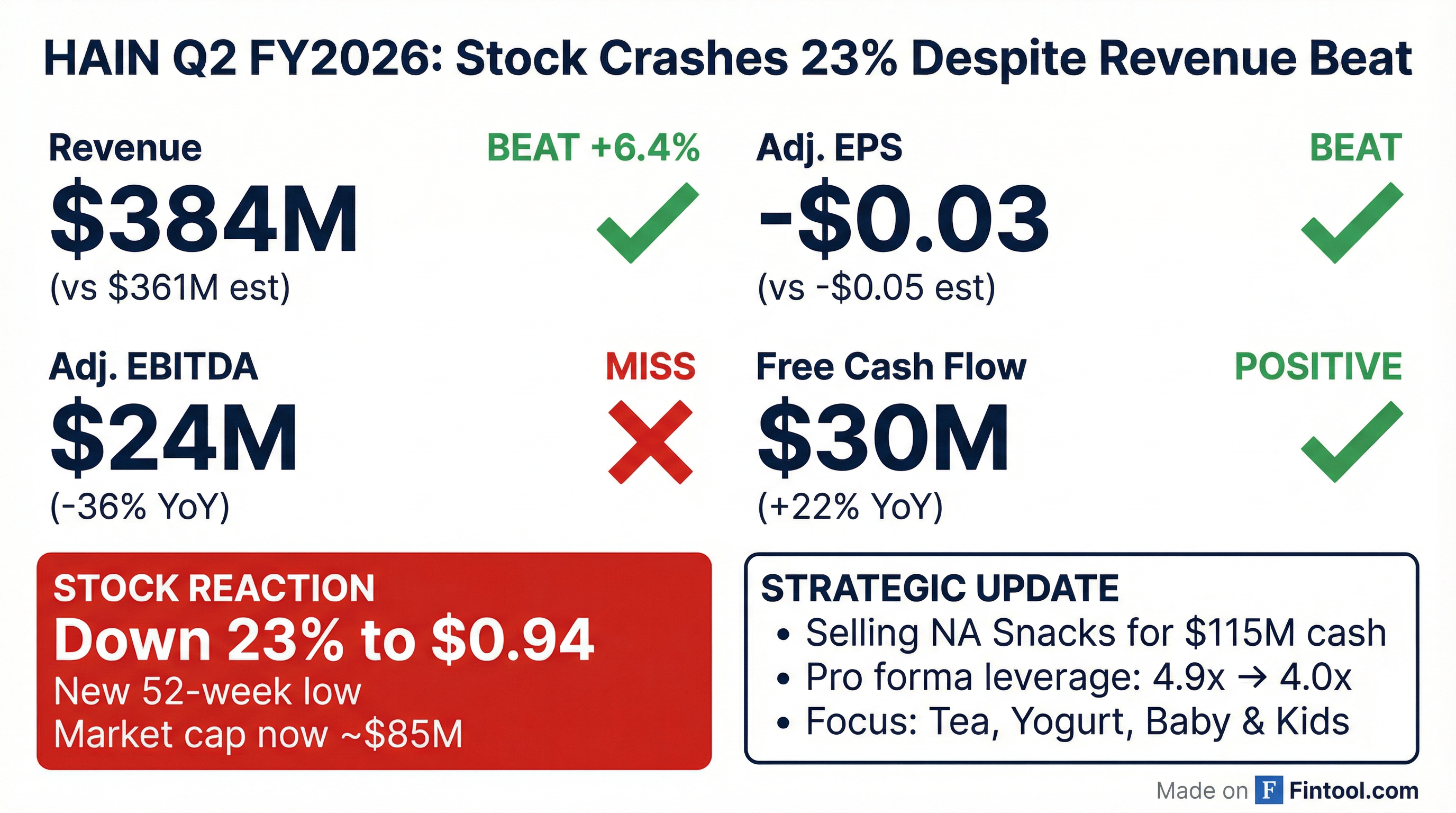

- For Q2 2026, the company reported an organic net sales decline of 7% year-over-year, Adjusted EBITDA of $24 million, and an Adjusted net loss of $3 million or $0.03 per diluted share.

- Net debt was reduced by $32 million to $637 million. Pro forma for the snacks divestiture, leverage is expected to fall from 4.9x to approximately 4x. The company's credit facility matures in December 2026 and is classified as a current liability, with active engagement with lenders to manage this upcoming maturity.

- Hain Celestial announced the definitive agreement to sell its North American snacks business for $115 million in cash on February 2nd, with proceeds intended for debt reduction.

- The divested snacks business represented 22% of fiscal 2025 net sales and 38% of North America segment net sales with negligible EBITDA contribution. Post-divestiture, the remaining North America portfolio is expected to have an EBITDA margin in the low double digits and gross margin above 30%. Pro forma leverage would decrease from 4.9x to approximately 4x.

- For Q2 2026, the company reported $24 million in Adjusted EBITDA and $30 million in free cash flow, a 22% increase year-over-year. Net debt was reduced by $32 million to $637 million.

- The company's credit facility matures in December 2026, with all associated borrowings classified as a current liability, and management is actively pursuing solutions including refinancing or extensions. They expect stronger top and bottom-line performance in the second half of fiscal 2026 and positive free cash flow for the full year.

- HAIN Celestial Group reported Q2 FY26 Net Sales of $384 million and Adjusted EBITDA of $24 million, marking declines of 7% and 36% year-over-year, respectively.

- The company announced a definitive agreement to sell its North American Snacks business for $115 million in cash, with proceeds earmarked for debt reduction.

- In Q2 FY26, Net Debt decreased by $32 million to $637 million, and Free Cash Flow increased by 22% year-over-year to $30 million.

- While not providing numeric guidance for FY26 due to strategic review uncertainty, the company expects stronger organic net sales and EBITDA trends in 2H FY26 and positive free cash flow for the full fiscal year.

- Hain Celestial Group announced on February 2nd a definitive agreement to sell its North American snacks business to Snackrupters for $115 million in cash, with proceeds intended for debt reduction. This divested business represented 22% of the company's net sales in fiscal 2025 and 38% of the North America segment's net sales, contributing negligible EBITDA over the last 12 months.

- The divestiture is expected to be gross margin and EBITDA accretive, with the remaining North American portfolio projected to achieve a gross margin above 30% and an EBITDA margin in the low double digits. Pro forma for this transaction, the company's leverage is anticipated to decrease from 4.9x to approximately 4x.

- For Q2 2026, the company reported Adjusted EBITDA of $24 million and generated $30 million in free cash flow, marking a 22% increase compared to the prior year period. Net debt was reduced by $32 million to $637 million.

- The company's credit facility matures in December 2026, and management is actively engaged with lenders to refinance or extend maturities. They anticipate stronger top and bottom-line performance in the second half of fiscal 2026 compared to the first half, and expect positive free cash flow for the full year.

- Hain Celestial Group reported net sales of $384 million for the fiscal second quarter ended December 31, 2025, representing a 7% decrease year-over-year, with organic net sales also declining by 7%.

- The company recorded a net loss of $116 million and an adjusted net loss of $3 million for the quarter, leading to a loss per diluted share of $1.28 and an adjusted loss per diluted share of $0.03.

- Adjusted EBITDA decreased to $24 million in Q2 FY26, down from $38 million in the prior year period.

- Despite the net loss, the company generated net cash provided by operating activities of $37 million and free cash flow of $30 million in the fiscal second quarter.

- Total debt remained stable at $705 million, while net debt decreased to $637 million at the end of the fiscal second quarter.

- For the fiscal second quarter ended December 31, 2025, The Hain Celestial Group, Inc. reported net sales of $384 million, representing a 7% decrease year-over-year, with organic net sales also decreasing by 7%.

- The company posted a net loss of $116 million and an adjusted net loss of $3 million, compared to a net loss of $104 million and adjusted net income of $8 million in the prior year period, respectively.

- Adjusted EBITDA for the quarter was $24 million, a decrease from $38 million in the prior year period, and the loss per diluted share was $1.28, with an adjusted loss per diluted share of $0.03.

- Hain Celestial generated $37 million in net cash provided by operating activities and $30 million in free cash flow during the fiscal second quarter, ending the period with total debt of $705 million and net debt of $637 million.

- Hain Celestial Group (HAIN) has entered into a definitive agreement to sell its North American Snacks business to Snackruptors Inc. for $115 million in cash.

- The divested business, which includes brands such as Garden Veggie Snacks™, Terra® chips, and Garden of Eatin'® snacks, represented 22% of Hain Celestial's net sales in fiscal 2025 and 38% of North America segment net sales, contributing negligible EBITDA over the last 12 months.

- The transaction is expected to close by February 28, 2026, with the net cash proceeds to be used for debt reduction.

- This sale is a strategic move to sharpen Hain's focus on core North American categories like tea, yogurt, and baby/kids, which exhibit a stronger financial profile with low double-digit EBITDA margins and gross margins above 30%.

- Hain Celestial Group has entered into a definitive agreement to sell its North American Snacks business, including Garden Veggie Snacks™, Terra® chips, and Garden of Eatin'® snacks, to Snackruptors Inc. for $115 million in cash.

- The divested snacks portfolio represented 22% of Hain Celestial's net sales in fiscal 2025 and 38% of its North America segment net sales, contributing negligible EBITDA over the last 12 months.

- This transaction will allow Hain Celestial to focus on a simplified North American portfolio in core categories such as tea, yogurt, and baby/kids, which are expected to deliver stronger margin and cash flow profiles, including low double-digit EBITDA margins and gross margins above 30%.

- Proceeds from the sale will be used to reduce debt, strengthening the company's financial position and leverage profile.

- The transaction is expected to close by February 28, 2026, subject to customary closing conditions.

- Hain Celestial has appointed Alison E. Lewis as its permanent President and Chief Executive Officer, effective December 15, 2025. She had been serving as Interim President and Chief Executive Officer since May 2025 and will continue in her role as a member of the Board of Directors.

- Her annual base salary is $850,000.

- Ms. Lewis is eligible for an annual incentive award with a target of 100% of her base salary and a maximum of 150% of her target annual incentive opportunity.

- She will receive long-term incentive awards consisting of 1,500,000 Performance Share Units (PSUs) and 650,000 Restricted Share Units (RSUs). The PSUs will vest based on achievement of pre-established stock price targets ($3.00, $5.00, $7.00, and $9.00) prior to the third anniversary of the effective date, and the RSUs will vest in one-third annual installments over a period of three years.

Quarterly earnings call transcripts for HAIN CELESTIAL GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more