Earnings summaries and quarterly performance for Marqeta.

Executive leadership at Marqeta.

Board of directors at Marqeta.

Research analysts who have asked questions during Marqeta earnings calls.

Darrin Peller

Wolfe Research, LLC

8 questions for MQ

Timothy Chiodo

UBS Group AG

8 questions for MQ

Craig Maurer

FT Partners

6 questions for MQ

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

5 questions for MQ

James Faucette

Morgan Stanley

4 questions for MQ

Tien-tsin Huang

JPMorgan Chase & Co.

4 questions for MQ

Andrew Bauch

Wells Fargo & Company

3 questions for MQ

Andrew Schmidt

Citigroup Inc.

3 questions for MQ

Ramsey El-Assal

Barclays

3 questions for MQ

Connor Allen

JPMorgan Chase & Co.

2 questions for MQ

Cristopher Kennedy

William Blair & Company

2 questions for MQ

Jamie Friedman

Susquehanna International Group

2 questions for MQ

Michael Infante

Morgan Stanley

2 questions for MQ

Bryan Keane

Deutsche Bank

1 question for MQ

Bryan Keene

Citigroup

1 question for MQ

Cassie Chan

Bank of America

1 question for MQ

Connor

JPMorgan Chase & Co.

1 question for MQ

Connor O'Mara

JPMorgan Chase & Co.

1 question for MQ

Nate Svensson

Deutsche Bank

1 question for MQ

Vasundhara Govil

Keefe, Bruyette & Woods (KBW)

1 question for MQ

Recent press releases and 8-K filings for MQ.

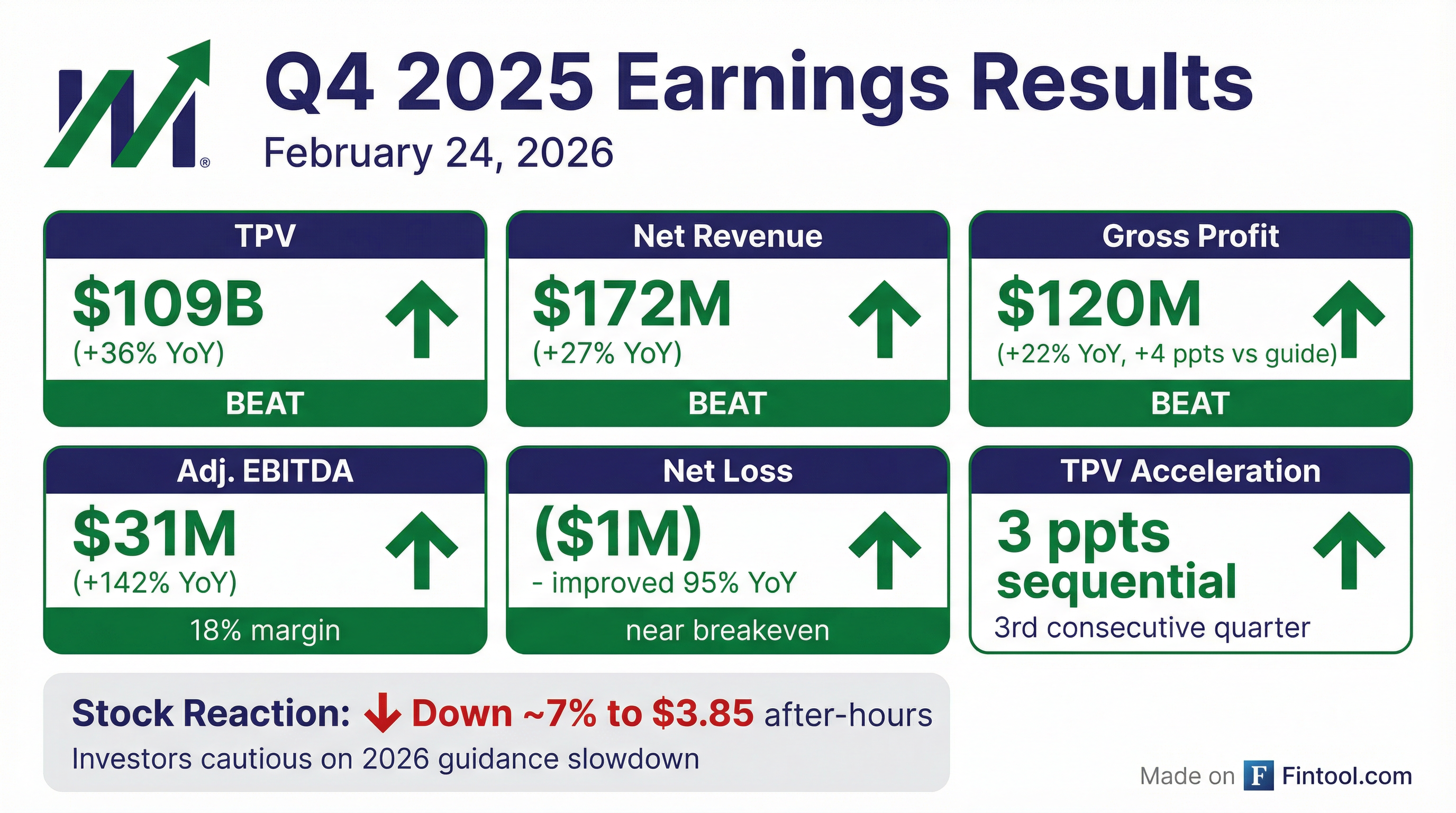

- Marqeta reported strong Q4 2025 results, with Total Processing Volume (TPV) reaching $109 billion (a 36% year-over-year increase), net revenue of $172 million (up 27% year-over-year), and Adjusted EBITDA of $31 million (an 18% margin), marking an all-time high. For the full year 2025, TPV grew 31%, net revenue 23%, and gross profit 24%, leading to Adjusted EBITDA of $110 million, more than 3.5 times that of 2024.

- The company provided 2026 full-year guidance, expecting TPV growth in the high 20s, gross profit growth between 10%-12% (implying $481 million-$490 million), net revenue growth of 12%-14%, and anticipates generating a modest GAAP net income of approximately $10 million.

- Key factors impacting 2026 gross profit growth include a 7 percentage point combined pressure from two large contract renewals and Block's pricing tiering, as well as an expected 1.5-2 percentage point reduction due to Cash App's diversification of new issuance.

- Strategic highlights include significant growth in Europe, with Q4 2025 TPV nearly 40% higher than annual TPV in 2023, enhanced offerings through the TransactPay acquisition in Q3 2025, and continued strength in Lending and Buy Now, Pay Later (BNPL) use cases, which grew just shy of 60% year-over-year in Q4 2025.

- Patty was appointed as the new CFO on February 9, 2026, bringing extensive experience in technology, financial services, and payments.

- Marqeta reported strong Q4 2025 results, with Total Processing Volume (TPV) reaching $109 billion, a 36% year-over-year increase, and net revenue of $172 million, up 27% year-over-year. Gross profit grew 22% to $120 million, and adjusted EBITDA was $31 million, representing an 18% margin.

- For the full year 2025, TPV grew 31%, net revenue 23%, and gross profit 24% year-over-year, with adjusted EBITDA reaching $110 million.

- The company provided 2026 guidance, expecting TPV growth in the high 20s, gross profit growth between 10%-12%, and net revenue growth of 12%-14%. Marqeta anticipates achieving a modest GAAP net income of approximately $10 million in 2026.

- Key factors expected to pressure 2026 gross profit growth include a 4 percentage point reduction from two major contract renewals, a 3 percentage point reduction due to Block TPV reaching a new pricing tier, and a 1.5-2 percentage point reduction from Cash App's diversification of new issuance.

- Operational highlights include significant growth in Europe TPV, which more than doubled the overall company's growth rate in Q4 2025, and value-added services contributing over 7% of gross profit. The company also repurchased 84.8 million shares for the full year 2025, reducing outstanding shares by nearly 17% from 2024 year-end.

- Marqeta reported strong Q4 2025 results, with Total Processing Volume (TPV) reaching $109 billion (up 36% year-over-year), net revenue of $172 million (up 27%), gross profit of $120 million (up 22%), and Adjusted EBITDA of $31 million. For the full year 2025, TPV grew 31%, net revenue grew 23%, gross profit grew 24%, and Adjusted EBITDA was $110 million.

- The company provided 2026 guidance, expecting gross profit growth between 10%-12% (implying $481 million-$490 million) and anticipates generating a modest GAAP net income of approximately $10 million for the year, marking a pivotal milestone.

- Key factors expected to pressure 2026 gross profit growth include a 7 percentage point impact from two large contract renewals and Block's pricing tier adjustment, and an additional 1.5-2 percentage points from Cash App's diversification of new issuance.

- Marqeta highlighted continued momentum in European TPV growth (more than twice as fast as the overall company in Q4 2025), the successful acquisition of TransactPay in Q3 2025, and significant expansion in value-added services, which contributed over 7% of gross profit in Q4 2025 and more than doubled year-over-year.

- Marqeta reported strong Q4 2025 financial results, with Total Processing Volume (TPV) increasing by 36% to $109 billion and Gross Profit growing 22% to $120 million.

- Adjusted EBITDA for Q4 2025 surged 142% to $31 million, contributing to a full-year 2025 Adjusted EBITDA of $110 million, which is more than 3.5 times higher than 2024.

- Net Revenue for Q4 2025 increased 27% year-over-year to $172 million, while the company recorded a Net Loss of $1 million for the quarter.

- The company provided 2026 guidance, projecting Gross Profit growth of 10-12% and GAAP Net Income of approximately $10 million for the year.

- Marqeta reported strong financial performance for Q4 and full year 2025, with Total Processing Volume (TPV) increasing 36% year-over-year to $109 billion in Q4 2025 and 31% to $383 billion for the full year.

- Net Revenue grew 27% to $172 million in Q4 2025 and 23% to $625 million for the full year 2025.

- The company achieved a Q4 2025 Adjusted EBITDA of $31 million, a 142% year-over-year increase, and a full year 2025 Adjusted EBITDA of $110 million, an $80 million year-over-year improvement.

- Marqeta's GAAP Net Loss decreased by 95% to $1 million in Q4 2025, with the full year 2025 GAAP Net Loss at $14 million.

- The company highlighted business momentum through new use cases with Uber, a new client Four Technologies, and the onboarding of the first customer for its enhanced Real-Time Decisioning product utilizing AI and machine learning capabilities.

- Marqeta reported strong financial results for the full year ended December 31, 2025, with Total Processing Volume (TPV) of $383 billion, an increase of 31% year-over-year, and Net Revenue of $625 million, up 23%.

- For the fourth quarter ended December 31, 2025, TPV grew 36% year-over-year to $109 billion, and Net Revenue increased 27% to $172 million.

- The company achieved Gross Profit of $437 million for the full year 2025, a 24% increase, and $120 million for Q4 2025, up 22%.

- Adjusted EBITDA for the full year 2025 was $110 million, an $80 million improvement year-over-year, and $31 million for Q4 2025, an $18 million improvement year-over-year.

- Marqeta provided guidance for Q1 2026 Net Revenue growth of 17-19% and Gross Profit growth of 17-19%, and for full year 2026 Net Revenue growth of 12-14% and Gross Profit growth of 10-12%.

- Mike Milotich was recently named CEO of Marqeta, having served as interim CEO since February. His strategic focus includes continuing to develop Marqeta's full, modern platform and ensuring its scalability, with an expected addition of approximately $100 billion in volume this year.

- The company reported strong performance in its buy now, pay later (BNPL) business, with lending and BNPL use cases growing over 60%, which is twice the company's overall rate, and accelerating 10 points from Q2. The on-demand delivery business also saw its growth rate double into double digits.

- Marqeta expects to grow gross profit over 20% this year, an acceleration from the 18% exit rate in Q4 last year. Adjusted EBITDA is projected to exceed $100 million this year, more than tripling last year's $29 million, with an EBITDA margin of approximately 17%.

- Marqeta's largest customer, Block, is diversifying processors for new Cash App card issuance starting January 1st, which is expected to result in a 200 basis points gross profit impact in 2026.

- The company anticipates adjusted expenses to grow in the low single digits this year and high single digits going forward, which is significantly slower than gross profit growth, indicating continued margin expansion. Stock-based compensation is expected to stabilize around $110 million annually, contributing to a goal of GAAP break-even in 2026.

- Mike Milotich, recently appointed CEO, outlined Marqeta's strategic focus on its modern platform operating at scale across 40+ markets, emphasizing enhanced capabilities and operational efficiency.

- The company reported robust growth in key segments, with the lending and buy now, pay later (BNPL) use case accelerating 10 points from Q2 to grow over 60% in the last quarter, and Europe's Total Processing Volume (TPV) growing over 100% in Q3.

- Marqeta expects gross profit growth of over 20% this year, an increase from 18% in Q4 last year, and projects adjusted EBITDA to exceed $100 million (more than three times last year's $29 million), reaching an approximate 17% EBITDA margin.

- Looking ahead, Block's diversification of Cash App processing is anticipated to result in a 200 basis points gross profit impact in 2026, and two major contract renewals are expected to each impact growth by about 2 points in Q4 2025 and early 2026. Despite these factors, the company aims for at least GAAP break-even in 2026.

- Marqeta reported impressive third-quarter metrics, with TPV up 33%, net revenue up 28%, gross profit up 27%, and an EBITDA margin of 19%. The company anticipates adjusted EBITDA to exceed $100 million in 2025, more than tripling the $29 million from the previous year, and expects to achieve GAAP break-even in 2026.

- The Buy Now Pay Later (BNPL) use case is experiencing significant acceleration, with TPV growth over 60%, driven by the Visa Flexible Credential, increased wallet distribution, and European expansion. Expense management also shows consistent growth in the 30% range, fueled by platform flexibility and embedded finance opportunities.

- International expansion, particularly in Europe, is growing over 100% and is expected to sustain elevated growth due to the platform's capabilities and the strategic acquisition of TransactPay. TransactPay is anticipated to significantly improve gross profit take rates in Europe by enabling program management and EMI licenses.

- Marqeta is managing the impact of Block's diversification, which could affect gross profit by high single-digit millions (approximately two points of growth) in 2026 if all new issuance moves to another platform. The company aims to remain Block's primary provider and is implementing new pricing strategies for renewals to minimize future drag.

- Marqeta reported strong third-quarter metrics, with TPV up 33%, net revenue up 28%, gross profit up 27%, and an EBITDA margin of 19%.

- The company is experiencing significant growth in its Buy Now Pay Later (BNPL) segment, which is growing over 60%, and international volumes, with Europe growing over 100% for many quarters, boosted by the TransactPay acquisition.

- Marqeta expects its adjusted EBITDA to exceed $100 million in 2025, more than triple the $29 million from the previous year, and anticipates reaching GAAP break-even in 2026.

- The company is actively searching for a new CFO and is managing the diversification of its Block relationship, which could impact gross profit by high single-digit millions in 2026.

Quarterly earnings call transcripts for Marqeta.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more