Earnings summaries and quarterly performance for Rubrik.

Executive leadership at Rubrik.

Board of directors at Rubrik.

Research analysts who have asked questions during Rubrik earnings calls.

Andrew Nowinski

Wells Fargo

7 questions for RBRK

Eric Heath

KeyBanc Capital Markets

7 questions for RBRK

Gregg Moskowitz

Mizuho

7 questions for RBRK

Saket Kalia

Barclays Capital

7 questions for RBRK

James Fish

Piper Sandler Companies

5 questions for RBRK

Todd Coupland

CIBC

5 questions for RBRK

Brad Zelnick

Credit Suisse

4 questions for RBRK

Fatima Boolani

Citi

4 questions for RBRK

Howard Ma

Guggenheim Securities, LLC

4 questions for RBRK

John DiFucci

Guggenheim Securities

4 questions for RBRK

Junaid Siddiqui

Truist Securities

4 questions for RBRK

Matthew Martino

Goldman Sachs

4 questions for RBRK

Zach Schneider

Baird

4 questions for RBRK

Joel Fishbein

Truist Securities

3 questions for RBRK

Keith Bachman

BMO Capital Markets

3 questions for RBRK

Shrenik Kothari

Robert W. Baird & Co.

3 questions for RBRK

Kasthuri Rangan

Goldman Sachs

2 questions for RBRK

Paramveer Singh

Oppenheimer & Co. Inc.

2 questions for RBRK

Daniel Ives

Wedbush Securities

1 question for RBRK

Jonathan Ruykhaver

Cantor Fitzgerald

1 question for RBRK

Kash Rangan

Goldman Sachs

1 question for RBRK

Saket Kaliya

Barclays

1 question for RBRK

Thomas Ingham

CIBC

1 question for RBRK

Yi Fu Lee

Cantor Fitzgerald

1 question for RBRK

Recent press releases and 8-K filings for RBRK.

- Mistral CEO Arthur Mensch predicts that more than half of current enterprise SaaS spending could shift to AI-driven solutions, enabling custom workflow applications in days.

- This outlook has rattled investors, contributing to steep declines in software stocks and ETFs, with the iShares Expanded Tech-Software Sector ETF (IGV) falling over 20% this year.

- Mistral, a European AI challenger, has achieved an annualized revenue run rate north of $400 million and a valuation of approximately $6 billion, having raised over $600 million.

- There are real-world precedents for this shift, such as Klarna replacing Salesforce and Workday with its own AI-based technology stack in late 2024.

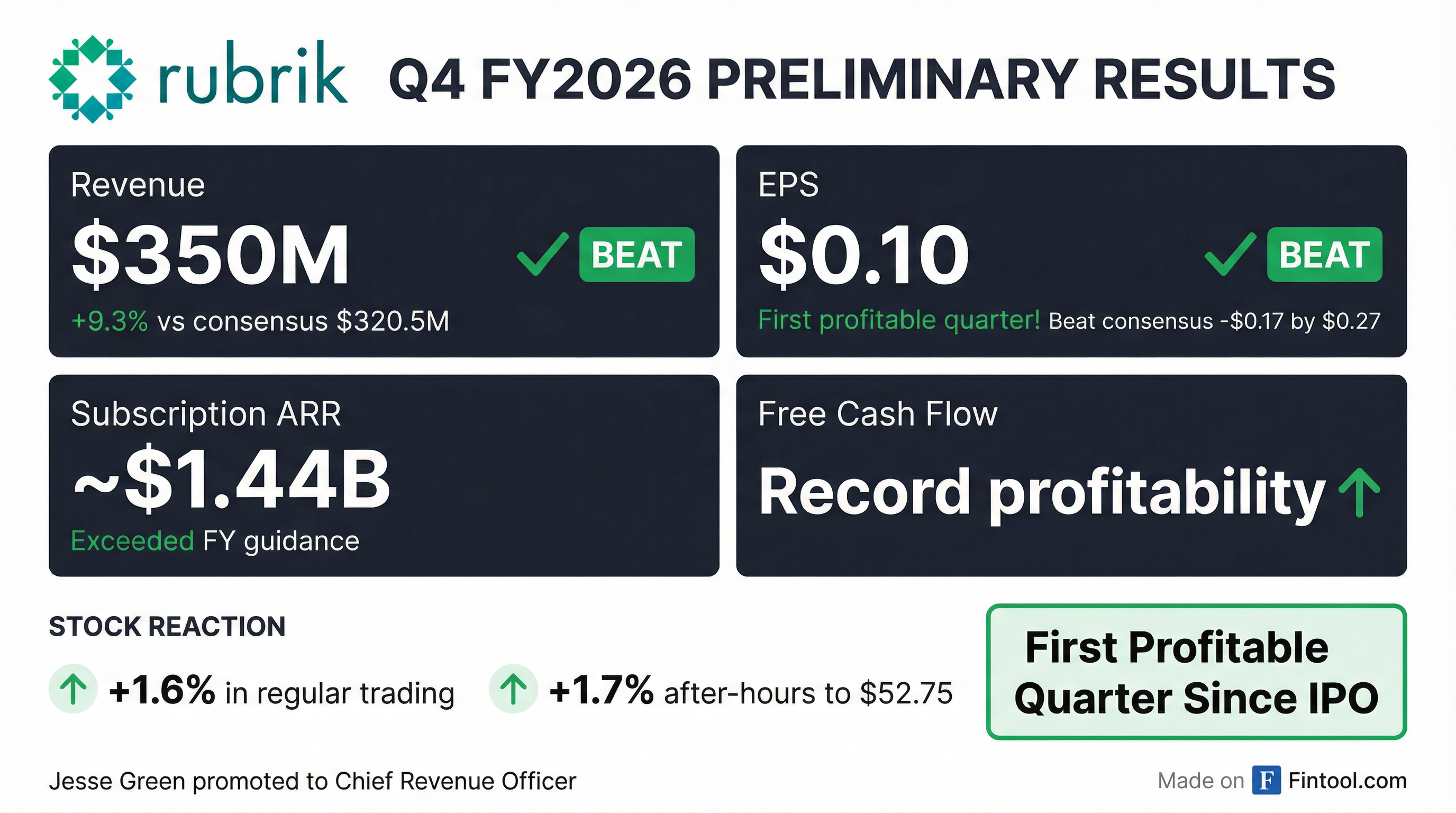

- Rubrik, Inc. announced the promotion of Jesse Green to Chief Revenue Officer, effective February 2, 2026.

- Green, previously President, Rubrik Americas, succeeds Brian McCarthy, who resigned to pursue another opportunity.

- The company reported preliminary financial results for the fourth quarter of fiscal year 2026 exceeded all guided metrics.

- Rubrik is scheduled to report its Fourth Quarter and Fiscal Year 2026 results on March 12, 2026.

- Rubrik reported a strong quarter with $94 million in net new ERR, bringing total ERR to $1.35 billion, a 34% growth, and achieved over $75 million in free cash flow.

- The company is experiencing accelerating bookings from legacy displacements in the Cyber Resilience market, which is a $50 billion opportunity, and is expanding into AI operations with its new Rubrik Agent Cloud platform, currently in beta.

- Rubrik's identity protection solution, launched three quarters ago, has grown to over 400 customers and approximately $20 million in ERR, with 40% of these customers being net new.

- While demand for Cyber Resilience products remains strong, reported revenue growth is expected to lag ARR growth by a few points next year due to accounting nuances related to material rights.

- Rubrik reported a record quarter with $94 million in net new ERR, bringing total ERR to $1.35 billion, representing 34% growth. The company also achieved over $75 million in free cash flow and improved its subscription ERR contribution margin to over 10%.

- The company operates in a $50 billion market and is experiencing accelerated bookings from legacy displacements, particularly benefiting from the Cohesity and Veritas merger.

- Rubrik's Identity Protection business has rapidly grown to $20 million ERR after just three quarters of general availability, attracting over 400 customers, with 40% being net new to Rubrik.

- Rubrik is expanding into AI operations with the beta launch of Rubrik Agent Cloud, a new platform designed to secure and accelerate agentic work adoption within enterprises.

- The company noted that reported revenue growth will lag ARR growth by a few points next year due to material rights, which were a tailwind this year but will become a headwind.

- Rubrik reported a strong quarter with $94 million in net new ERR, bringing total ERR to $1.35 billion, representing 34% growth, along with a subscription ERR contribution margin of over 10% and over $75 million in free cash flow.

- The company is experiencing accelerated legacy displacement in the cyber resilience market, which it identifies as a $50 billion opportunity.

- Rubrik's identity protection solution has rapidly grown to an about $20 million ERR business in three quarters, attracting over 400 customers, with 40% being net new to Rubrik.

- Rubrik is expanding into AI with its new Rubrik Agent Cloud platform, currently in beta, aimed at securing and accelerating agentic work adoption, leveraging its acquisition of Predibase.

- Rubrik reported strong Q3 2026 financial results, with subscription ARR reaching $1.35 billion, a 34% year-over-year increase, and cloud ARR growing 53% to $1.17 billion.

- For Q4 2026, the company expects revenue between $341 million and $343 million and non-GAAP EPS between negative $0.12 and negative $0.10.

- Full year fiscal 2026 guidance includes subscription ARR in the range of $1,439 million to $1,443 million and total revenue between $1,280 million and $1,282 million.

- Rubrik launched Rubrik Agent Cloud (RAC), a new product suite for AI resilience currently in beta, and reported its identity line of business reached approximately $20 million in subscription ARR.

- The company noted accelerated bookings from legacy replacements year-on-year in Q3 2026 and highlighted its successful cloud transformation, with cloud ARR representing 87% of total subscription ARR.

- Rubrik reported strong Q3 2026 financial results, with subscription ARR reaching $1.35 billion, a 34% year-over-year increase, and net new subscription ARR hitting a record $94 million. Subscription revenue grew 52% year over year to $336 million, and the company generated a record $77 million in free cash flow.

- The company launched Rubrik Agent Cloud (RAC), a new product suite designed for safe AI agent deployment, and expanded its identity business, which achieved $20 million in subscription ARR and saw 40% of new identity customers in Q3 being net new to Rubrik.

- Rubrik provided Q4 2026 guidance, expecting revenue of $341-$343 million and non-GAAP EPS between negative $0.12 and negative $0.10. For the full fiscal year 2026, the company anticipates subscription ARR in the range of $1,439 million-$1,443 million and total revenue of $1,280 million-$1,282 million.

- Rubrik's subscription Annual Recurring Revenue (ARR) grew 34% year-over-year to $1.35 billion as of October 31, 2025.

- Total revenue for the third quarter of fiscal year 2026 increased 48% year-over-year to $350.2 million.

- The company reported non-GAAP net income per share, diluted, of $0.10 for Q3 FY2026, a significant improvement from a non-GAAP net loss per share, diluted, of $(0.21) in the third quarter of fiscal year 2025.

- Free cash flow for Q3 FY2026 was $76.9 million, compared to $15.6 million in the third quarter of fiscal year 2025.

- Rubrik raised its outlook for fiscal year 2026, projecting full-year subscription ARR between $1,439 million and $1,443 million and revenue of $1,280 million to $1,282 million.

- Rubrik has signed a Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to deliver cyber resilience and enhance data protection for organizations using AWS environments.

- The collaboration integrates Rubrik's Preemptive Recovery Engine with AWS's secure foundation, aiming to provide capabilities such as clean recovery points, sensitive data discovery, and AI-powered threat detection for rapid operational restoration.

- The SCA also seeks to accelerate secure AI adoption by combining Rubrik's expanding AI portfolio with Amazon Bedrock, enabling customers to scale their AI initiatives safely.

- Rubrik, Inc. intends to offer $1.0 billion aggregate principal amount of 0.00% Convertible Senior Notes due 2030, with an option for initial purchasers to purchase an additional $150.0 million within 13 days.

- The unsecured notes will accrue interest payable semiannually and be convertible into cash, shares of Class A common stock or a combination thereof at Rubrik’s election; final terms (interest rate, conversion rate) will be set at pricing.

- Rubrik expects to use net proceeds to pay for capped call transactions, repay in full $327.9 million of outstanding credit agreement loans, and for general corporate purposes, including acquisitions, working capital and capital expenditures.

- The company will enter capped call transactions to offset potential dilution upon any conversion of the notes.

Quarterly earnings call transcripts for Rubrik.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more