Earnings summaries and quarterly performance for ROYAL CARIBBEAN CRUISES.

Executive leadership at ROYAL CARIBBEAN CRUISES.

Board of directors at ROYAL CARIBBEAN CRUISES.

Amy McPherson

Director

Ann S. Moore

Director

Arne Alexander Wilhelmsen

Director

Donald Thompson

Director

Eyal M. Ofer

Director

John F. Brock

Lead Independent Director

Maritza G. Montiel

Director

Michael O. Leavitt

Director

Rebecca Yeung

Director

Richard D. Fain

Director

Stephen R. Howe, Jr.

Director

Vagn O. Sørensen

Director

Research analysts who have asked questions during ROYAL CARIBBEAN CRUISES earnings calls.

Brandt Montour

Barclays PLC

6 questions for RCL

Conor Cunningham

Melius Research

6 questions for RCL

Robin Farley

UBS

6 questions for RCL

James Hardiman

Citigroup

5 questions for RCL

Matthew Boss

JPMorgan Chase & Co.

5 questions for RCL

Steven Wieczynski

Stifel

5 questions for RCL

Benjamin Chaiken

Mizuho Financial Group, Inc.

4 questions for RCL

Vince Ciepiel

Cleveland Research Company

4 questions for RCL

David Katz

Jefferies Financial Group Inc.

2 questions for RCL

Elizabeth Dove

Goldman Sachs

2 questions for RCL

Lizzie Dove

Goldman Sachs

2 questions for RCL

Matt Boss

JPMorgan Chase & Co.

1 question for RCL

Steve Wieczynski

Stifel Financial Corp.

1 question for RCL

Xian Siew

BNP Paribas

1 question for RCL

Recent press releases and 8-K filings for RCL.

- Completed offering of $1.25 billion 4.750% Senior Notes due 2033 and $1.25 billion 5.250% Senior Notes due 2038 under an underwriting agreement dated February 12, 2026 and a Fifth Supplemental Indenture dated February 27, 2026.

- Net proceeds of $2.471 billion will be used to refinance senior notes maturing in 2026 and repay existing indebtedness.

- 2033 Notes accrue 4.75% interest, payable semi-annually on May 15 and November 15 (first payment November 15, 2026), maturing May 15, 2033; 2038 Notes accrue 5.25% interest, payable semi-annually on February 27 and August 27 (first payment August 27, 2026), maturing February 27, 2038.

- Royal Caribbean Cruises priced and closed a public offering of $1.25 billion 4.750% senior unsecured notes due May 15, 2033, and $1.25 billion 5.250% senior unsecured notes due February 27, 2038.

- The company will use net proceeds to refinance senior notes maturing in 2026 and repay existing indebtedness.

- J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC and PNC Capital Markets LLC acted as lead book-running managers.

- CFO Naftali Holtz noted the transaction “extends our maturities and reduces near-term refinancing needs,” enhancing financial flexibility.

- On February 12, 2026, Royal Caribbean Cruises Ltd. entered into underwriting agreements to issue $1.25 billion of 4.750% Senior Notes due 2033 and $1.25 billion of 5.250% Senior Notes due 2038.

- The offering, led by J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC and PNC Capital Markets LLC, is expected to close on February 27, 2026, subject to customary closing conditions.

- The 2033 Notes were priced at 99.074% (4.750% coupon) with interest payable May 15 and November 15, commencing November 15, 2026; the 2038 Notes were priced at 99.158% (5.250% coupon) with interest payable February 27 and August 27, commencing August 27, 2026.

- Net proceeds will be used to refinance senior notes maturing in 2026 and to repay existing indebtedness.

- Royal Caribbean Group commenced a registered public offering of senior unsecured notes to refinance its 2026 maturities and repay existing indebtedness.

- The net proceeds will be allocated to refinance senior notes maturing in 2026 and to repay outstanding term loans and other debt.

- J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC and PNC Capital Markets LLC are the lead book-running managers.

- The offering is being conducted under an automatic shelf registration statement that became effective on February 29, 2024.

- Delivered a record 9.4 million vacations, $17.9 billion revenue, 33% earnings growth, generated $6.5 billion operating cash flow, and returned $2 billion to shareholders in 2025

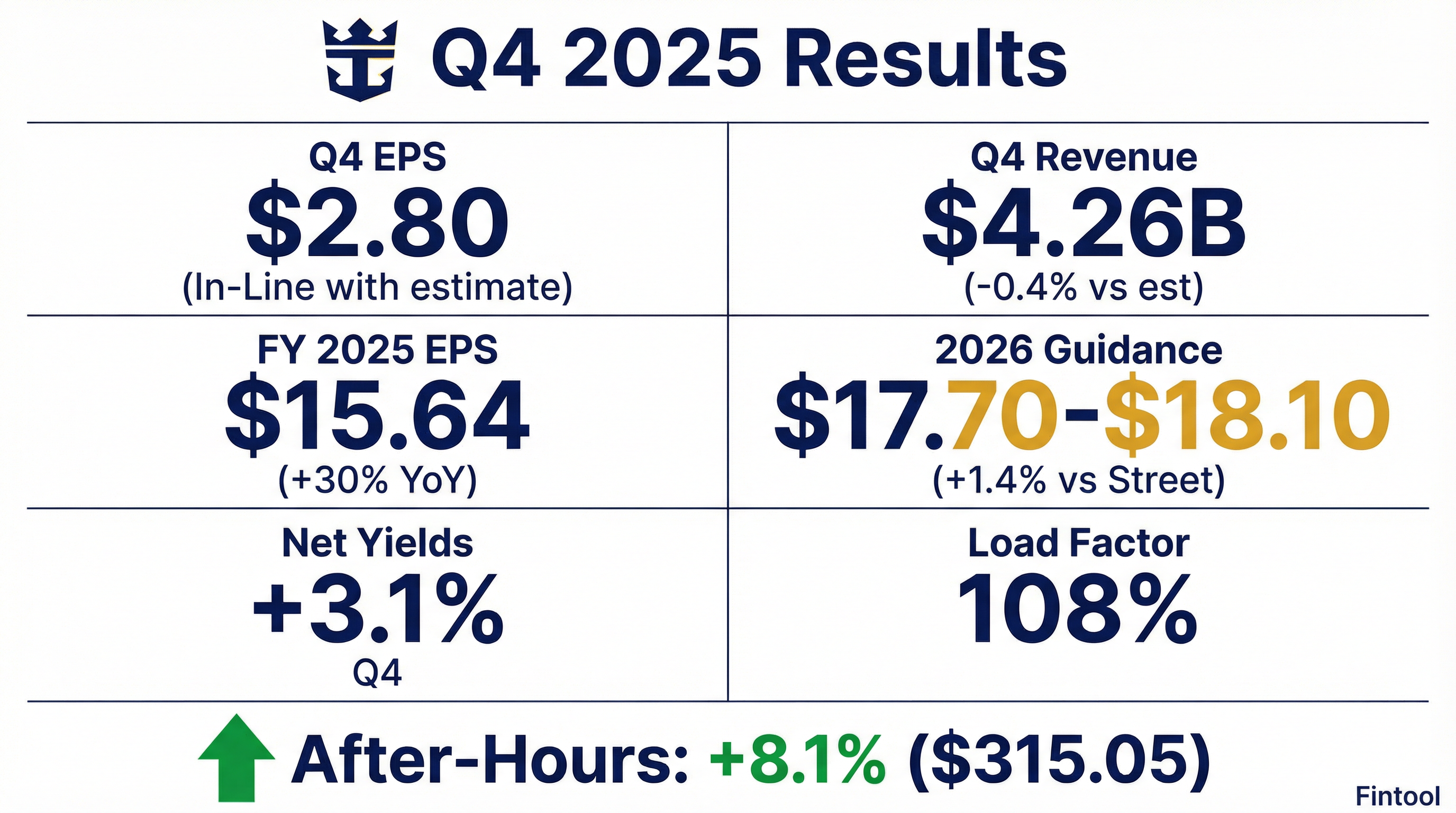

- Fourth quarter net yields grew 2.5% and adjusted EPS was $2.80, above guidance

- 2026 outlook: double-digit revenue growth, net yield up 1.5%–3.5%, adjusted EPS $17.70–18.10 (+14% y/y), and > $7 billion operating cash flow

- Announced 10 additional Celebrity River Cruises ships (fleet to reach 20 by 2031), Discovery Class order (2 firm + 4 options), loyalty program Points Choice, and opened Royal Beach Club Paradise Island

- Strong liquidity and balance sheet: ended Q4 with $7.2 billion in liquidity and leverage below 3×

- In FY 2025, the group delivered a record 9.4 million vacations, generated $18 billion in revenue, achieved 33% EPS growth, produced $6.5 billion of operating cash flow, and returned $2 billion to shareholders.

- In Q4 2025, net cruise yields grew 2.5% and adjusted EPS was $2.80.

- For 2026, capacity is projected to rise mid-single digits, net yields to grow 1.5%–3.5%, adjusted EPS to reach $17.70–$18.10, and operating cash flow to exceed $7 billion.

- Strategic investments include committing to 10 additional Celebrity River Cruise ships (bringing the fleet to 20 vessels by 2031) and ordering two Discovery Class ocean ships with options for four more.

- Fourth quarter net yields grew 2.5% and adjusted EPS was $2.80, exceeding guidance.

- For the full year, total revenue rose 8.8%, adjusted EPS increased 33% to $15.64, adjusted EBITDA grew 17.6% to just over $7 billion, with operating cash flow of $6.4 billion and $2 billion returned to shareholders.

- 2026 outlook: revenue expected to grow double-digit, net yield growth of 1.5%–3.5%, and adjusted EPS of $17.70–18.10.

- Capacity is projected to rise 6.7% in 2026, with net cruise costs (ex-fuel) flat to up 1% and fuel expense of ~$1.17 billion.

- Announced commitments for 10 additional Celebrity River Cruises ships (to reach 20 by 2031) and new Discovery Class ocean ships, alongside launch of Royal Beach Club Paradise Island.

- Q4 by the numbers: load factor 108%, net yield growth +2.5% YoY (constant currency), NCCx -6.3%, adjusted EBITDA $1.48 B (+35%), adjusted EPS $2.80 (+72%), operating cash flow $1.6 B.

- FY2025 highlights: load factor 110%, net yield growth +3.7% YoY, NCCx -0.1%, adjusted EBITDA $7.03 B (+18%), adjusted EPS $15.64 (+33%), operating cash flow $6.5 B.

- FY2026 guidance: APCDs 56.9 M, capacity growth +6.7%, net yield growth +1.5%–3.5%, NCCx growth 0.0%–1.0%, fuel ~$1,173 M, D&A $1,890–1,900 M, net interest $990–1,000 M, adjusted EPS $17.70–18.10.

- Royal Caribbean delivered 2025 EPS of $15.61 and Adjusted EPS of $15.64, surpassing guidance on stronger revenues and joint-venture performance.

- Full-year 2025 revenues reached $17.9 billion, with net income of $4.3 billion and Adjusted EBITDA of $7.0 billion.

- For 2026, the company forecasts Adjusted EPS of $17.70–$18.10, aiming for double-digit revenue and earnings growth under its Perfecta program.

- Capacity is expected to grow 6.7% in 2026, alongside the launch of the new Discovery Class and 10 additional ships for Celebrity River Cruises.

- Full-year 2025 revenues of $17.9 billion, Net Income of $4.3 billion (EPS $15.61; Adjusted EPS $15.64), and Adjusted EBITDA of $7.0 billion.

- Q4 2025 Net Income of $0.8 billion (EPS $2.76 vs $2.02 LY), Adjusted Net Income of $0.8 billion (EPS $2.80 vs $1.63 LY), revenues $4.3 billion, and Adjusted EBITDA $1.5 billion.

- 2026 guidance: Adjusted EPS of $17.70–$18.10 (+23% CAGR 2024–26), Net Yields +2.1% to 4.1% as-reported, and NCC ex-fuel per APCD +0.4% to 1.4%.

- Growth investments include two firm Discovery Class ocean ships (with four options) debuting in 2029/2032 and ten new Celebrity River Cruises vessels by 2031.

Fintool News

In-depth analysis and coverage of ROYAL CARIBBEAN CRUISES.

Quarterly earnings call transcripts for ROYAL CARIBBEAN CRUISES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more