Earnings summaries and quarterly performance for REPLIGEN.

Executive leadership at REPLIGEN.

Board of directors at REPLIGEN.

Carrie Eglinton Manner

Director

Glenn Muir

Director

Karen Dawes

Lead Independent Director

Konstantin Konstantinov

Director

Margaret Pax

Director

Martin Madaus

Director

Nicolas Barthelemy

Director

Rohin Mhatre

Director

Tony Hunt

Executive Chair of the Board

Research analysts who have asked questions during REPLIGEN earnings calls.

Justin Bowers

Deutsche Bank AG

6 questions for RGEN

Puneet Souda

Leerink Partners

6 questions for RGEN

Brendan Smith

Stifel, Nicolaus & Company, Incorporated

5 questions for RGEN

Dan Arias

Stifel Financial Corp.

5 questions for RGEN

Doug Schenkel

Wolfe Research LLC

5 questions for RGEN

Matt Larew

William Blair & Co.

5 questions for RGEN

Brandon Couillard

Wells Fargo & Company

4 questions for RGEN

Casey Woodring

JPMorgan Chase & Co.

4 questions for RGEN

Dan Leonard

UBS Group AG

4 questions for RGEN

Matthew Stanton

Jefferies

4 questions for RGEN

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

3 questions for RGEN

Matthew Hewitt

Craig-Hallum Capital Group LLC

3 questions for RGEN

Paul Knight

KeyBanc Capital Markets

3 questions for RGEN

Rachel Vatnsdal Olson

JPMorgan

3 questions for RGEN

Subbu Nambi

Guggenheim Securities

3 questions for RGEN

Subhalaxmi Nambi

Guggenheim Securities

3 questions for RGEN

Anna Snopkowski

KeyBanc Capital Markets

2 questions for RGEN

Conor Noel McNamara

RBC Capital Markets

2 questions for RGEN

Daniel Leonard

Stifel Financial Corp.

2 questions for RGEN

Daniel Markowitz

Evercore ISI

2 questions for RGEN

Douglas Schenkel

Wolfe Research, LLC

2 questions for RGEN

Jacob Johnson

Stephens Inc.

2 questions for RGEN

Luke Sergott

Barclays

2 questions for RGEN

Mac Etoch

Stephens Inc.

2 questions for RGEN

Matt Hewitt

Craig-Hallum Capital Group

2 questions for RGEN

Matthew Larew

William Blair & Company

2 questions for RGEN

Philip Boyd

Leerink Partners

2 questions for RGEN

Tom DeBourcy

Nephron Research LLC

2 questions for RGEN

Rachel Vatnsdal

JPMorgan Chase & Co.

1 question for RGEN

Salem Salem

Barclays

1 question for RGEN

Recent press releases and 8-K filings for RGEN.

- Repligen (RGEN) reported Q4 2025 revenue of $198 million, reflecting 14% organic growth, and full-year 2025 revenue of $738 million, with 14% organic growth.

- For full-year 2025, the company achieved an adjusted gross margin of 52.6% (up 220 basis points year-over-year) and an adjusted operating margin of 13.8% (up 90 basis points year-over-year), with adjusted diluted EPS of $1.71.

- The company provided full-year 2026 guidance for revenue between $810 million and $840 million, representing 9%-13% organic growth (including a 2-point headwind from a gene therapy platform), and adjusted diluted EPS between $1.93 and $2.01, an increase of 15% at the midpoint.

- 2026 guidance also projects adjusted gross margins of 53.6%-54.1% and adjusted income from operations between $122 million and $130 million, indicating 125 basis points and 150 basis points of margin expansion at the midpoint, respectively.

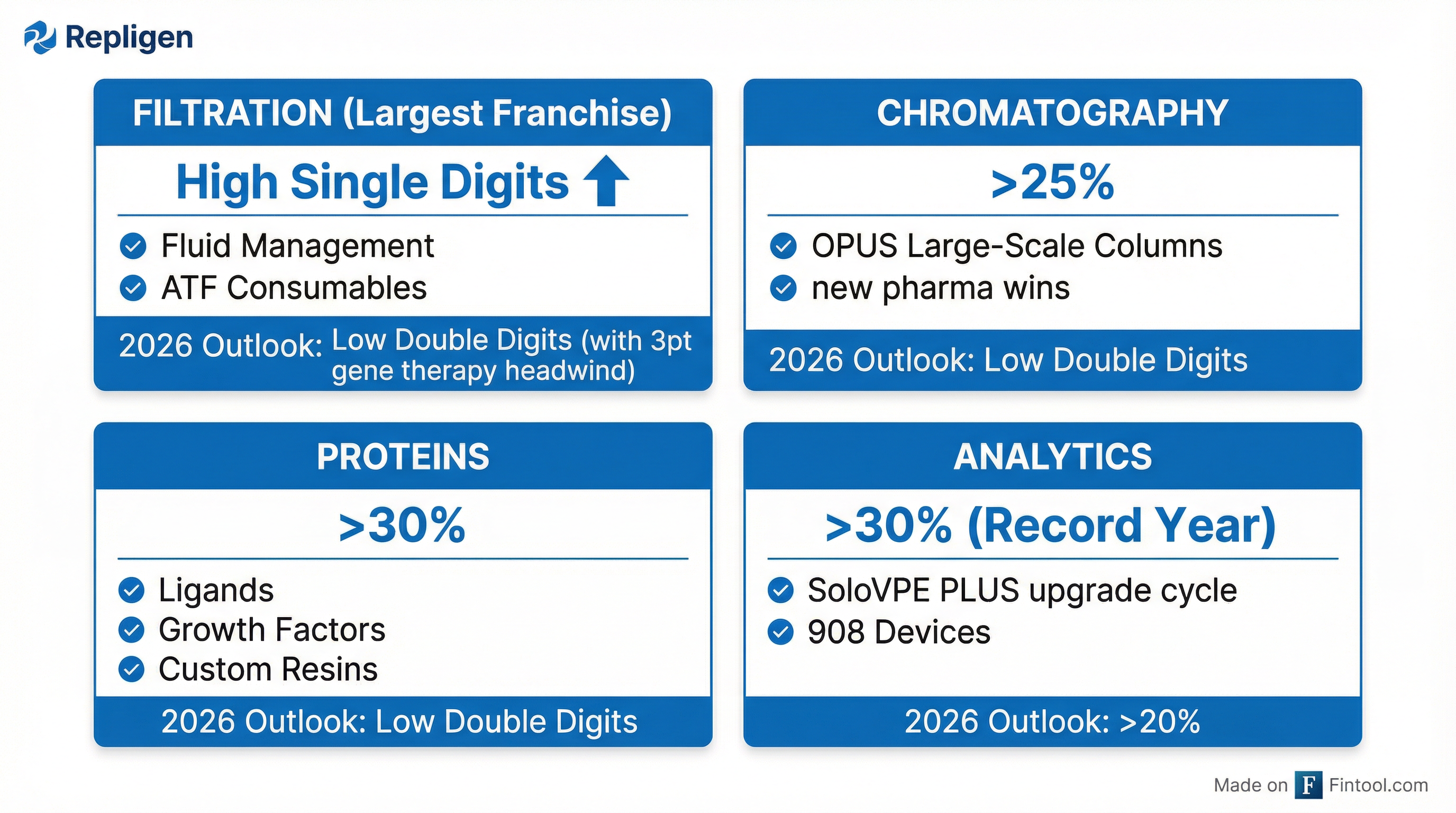

- Key growth drivers in 2025 included proteins and process analytics, both growing over 30% in Q4, and chromatography with over 25% growth. Repligen ended Q4 2025 with $768 million in cash and marketable securities.

- Repligen reported Q4 2025 revenue of $198 million with 14% organic growth, contributing to a full-year 2025 revenue of $738 million and 14% organic growth.

- For the full year 2025, the company achieved an adjusted operating margin of 13.8%, an increase of 90 basis points, and adjusted fully diluted EPS of $1.71.

- The company provided initial 2026 revenue guidance of $810 million to $840 million, representing 9%-13% organic revenue growth, and anticipates adjusted gross margins to expand to 53.6%-54.1%.

- Key growth drivers in 2025 included Proteins and Process Analytics, both growing over 30% in Q4, and Chromatography growing over 25%. The company plans to continue driving growth through the SoloVPE PLUS System upgrade cycle, leveraging the 908 Devices bioprocessing portfolio acquisition, and ongoing new product launches, with M&A remaining a top priority for capital allocation in 2026.

- Repligen concluded 2025 with Q4 revenue of $198 million and full-year revenue of $738 million, both reflecting 14% organic growth.

- For the full year 2025, adjusted diluted earnings per share was $1.71 and adjusted operating margin reached 13.8%.

- The company issued initial 2026 revenue guidance of $810 million to $840 million, projecting 9%-13% organic revenue growth.

- Repligen expects adjusted operating margin to expand by 150 basis points at the midpoint in 2026, driven by volume leverage, pricing, and productivity.

- In 2025, key growth drivers included proteins and process analytics, both growing over 30%, and the company acquired 908 Devices bioprocessing portfolio.

- Repligen reported fourth quarter 2025 revenue of $198 million, an 18% year-over-year increase as reported and 14% organic, contributing to full year 2025 revenue of $738 million, a 16% increase for both reported and organic non-COVID.

- For the full year 2025, the company achieved an adjusted operating margin of 13.8% and adjusted earnings per share of $1.71.

- Repligen provided full year 2026 revenue guidance of $810 million - $840 million, representing 10% to 14% reported revenue growth and 9% to 13% organic growth.

- The company expects adjusted operating margin expansion of 150 basis points at the midpoint for full year 2026, with guidance for adjusted operating margin between 15.1% and 15.5%.

- Key business highlights for 2025 included 14% organic growth, expansion of the Analytics portfolio through M&A, and the launch of three new high-performance chromatography resins.

- Repligen reported fourth quarter 2025 revenue of $198 million, an 18% year-over-year increase (14% organic), and full year 2025 revenue of $738 million, a 16% year-over-year increase (14% organic non-COVID).

- For the full year 2025, adjusted earnings per share was $1.71.

- The company provided full year 2026 revenue guidance of $810 million to $840 million, representing 10% to 14% reported revenue growth (9% to 13% organic), and anticipates adjusted operating margin expansion of 150 basis points at the midpoint.

- Q4 2025 saw 14% organic growth driven by Analytics and Proteins, exceeding prior guidance, and the launch of new high-performance chromatography resins.

- Repligen provided its FY25 adjusted financial guidance, projecting revenue between $729M and $737M and diluted EPS between $1.65 and $1.68.

- The company's strategic priorities for 2026 include above-market growth, expanding margins, and adding capabilities via M&A.

- Repligen is committed to a path to ~30% adjusted EBITDA margin over the medium term, targeting over 100 basis points of annual gross margin expansion.

- M&A remains the top priority for capital allocation in 2026, supported by a strong balance sheet with $749M in cash as of September 30, 2025.

- Repligen reported $733 million in sales at the midpoint of its 2025 guidance and aims to double its size by 2030.

- The company targets an EBITDA margin of 30% by 2030, up from approximately 19% in 2025, driven by volume leverage, product mix, and operational efficiency.

- Repligen achieved an 18% CAGR from 2019 to 2025 (excluding COVID impact) and operates in a total addressable market that expanded from $3 billion to $13 billion over the last six years, representing only 2% of the current market.

- For 2026, the company anticipates 11%-12% top-line growth, factoring in 500 basis points of market growth and 200 basis points of headwinds from a specific gene therapy drug.

- Innovation is a core strategy, with 80% of its portfolio considered highly differentiated and 50 new products launched in the last five years.

- Repligen achieved an 18% CAGR from 2019 to 2025 (excluding COVID noise) and saw its total addressable market grow from $3 billion to $13 billion over the last six years, currently holding about 2% market share.

- In 2025, the company reported more than 5% above market growth at the midpoint of guidance, with 15% organic non-COVID growth. For 2026, Repligen aims to outpace market growth by 5 points, factoring in a 200 basis point headwind from a gene therapy drug.

- Repligen targets to double its size by 2030 and achieve an EBITDA margin of approximately 30% by the same year, up from around 19% at the 2025 guidance midpoint.

- Key strategic drivers include annual R&D investment of 6%-7% of sales, continued M&A activity, expansion in APAC, and investments in infrastructure and AI tools to support growth and margin expansion.

- The company is diversifying its portfolio, with 16% of sales in new modalities in 2025, strong momentum in chromatography, and an expected multi-year tailwind from the SoloVPE plus upgrade cycle.

- Repligen achieved $733 million in sales at the midpoint of its 2025 guidance and aims to be a double-sized company by 2030, targeting 5 points above market growth for the next five years.

- The company is committed to margin expansion, projecting an increase from 19% EBITDA in 2025 to 30% EBITDA by 2030, driven by OPEX leverage, price, productivity, and an improved product mix.

- For 2026, Repligen anticipates 11%-12% top-line growth, factoring in a 200 basis point headwind from a specific gene therapy drug.

- Repligen is actively pursuing growth through innovation (spending 6%-7% of sales on R&D), M&A, and capitalizing on significant opportunities in the $13 billion total addressable market and reshoring initiatives.

- Key product developments include the early-stage SoloVPE+ upgrade cycle (with over 2,500 installed units) and the increasing adoption of ATF systems, which are specced into more than 50 late-stage and commercial drugs.

- Repligen reported 18% organic growth in Q3, with strong performance across all franchises, particularly proteins and analytics, and orders growing over 20% year-over-year on a reported basis.

- The company anticipates a 2-point growth headwind in 2026 from a gene therapy customer, following $10 million in sales in the first half of the current year and de minimis sales in the second half.

- Repligen maintains its long-term framework to outgrow the market by 500 basis points, driven by market creation (e.g., ATF, analytics), clinical-to-commercial progression, new modalities, and commercial execution.

- The ATF business, a significant growth driver, saw consumables outpace capital equipment in Q2 of last year, with a blockbuster drug potentially generating over $15 million annually in consumables pull-through at peak volumes.

- The company targets 30% EBITDA margins by 2030, aiming for over 1 point of gross margin expansion annually and OpEx leverage, while prioritizing internal investments and M&A for capital allocation.

Quarterly earnings call transcripts for REPLIGEN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more