Earnings summaries and quarterly performance for RALPH LAUREN.

Executive leadership at RALPH LAUREN.

Patrice Louvet

President and Chief Executive Officer

Bob Ranftl

Chief Operating Officer

David Lauren

Chief Branding and Innovation Officer

Halide Alagoz

Chief Product & Merchandising Officer

Justin Picicci

Chief Financial Officer

Mercedes Abramo

Regional Chief Executive Officer, North America

Ralph Lauren

Executive Chairman and Chief Creative Officer

Roseann Lynch

Chief People Officer

Board of directors at RALPH LAUREN.

Research analysts who have asked questions during RALPH LAUREN earnings calls.

Jay Sole

UBS

8 questions for RL

Michael Binetti

Evercore ISI

8 questions for RL

Laurent Vasilescu

BNP Paribas S.A.

7 questions for RL

Dana Telsey

Telsey Advisory Group

6 questions for RL

Brooke Roach

Goldman Sachs Group, Inc.

5 questions for RL

Matthew Boss

JPMorgan Chase & Co.

5 questions for RL

Ike Boruchow

Wells Fargo

4 questions for RL

John Kernan

Cowen Inc.

4 questions for RL

Blake Anderson

Jefferies

3 questions for RL

Christopher Nardone

Bank of America

3 questions for RL

Matt Boss

JPMorgan Chase & Co.

3 questions for RL

Adrienne Yih-Tennant

Barclays

2 questions for RL

Irwin Boruchow

Wells Fargo Securities

2 questions for RL

Paul Kearney

Barclays

2 questions for RL

Rick Patel

Raymond James Financial

1 question for RL

Tom Nikic

Wedbush Securities

1 question for RL

Recent press releases and 8-K filings for RL.

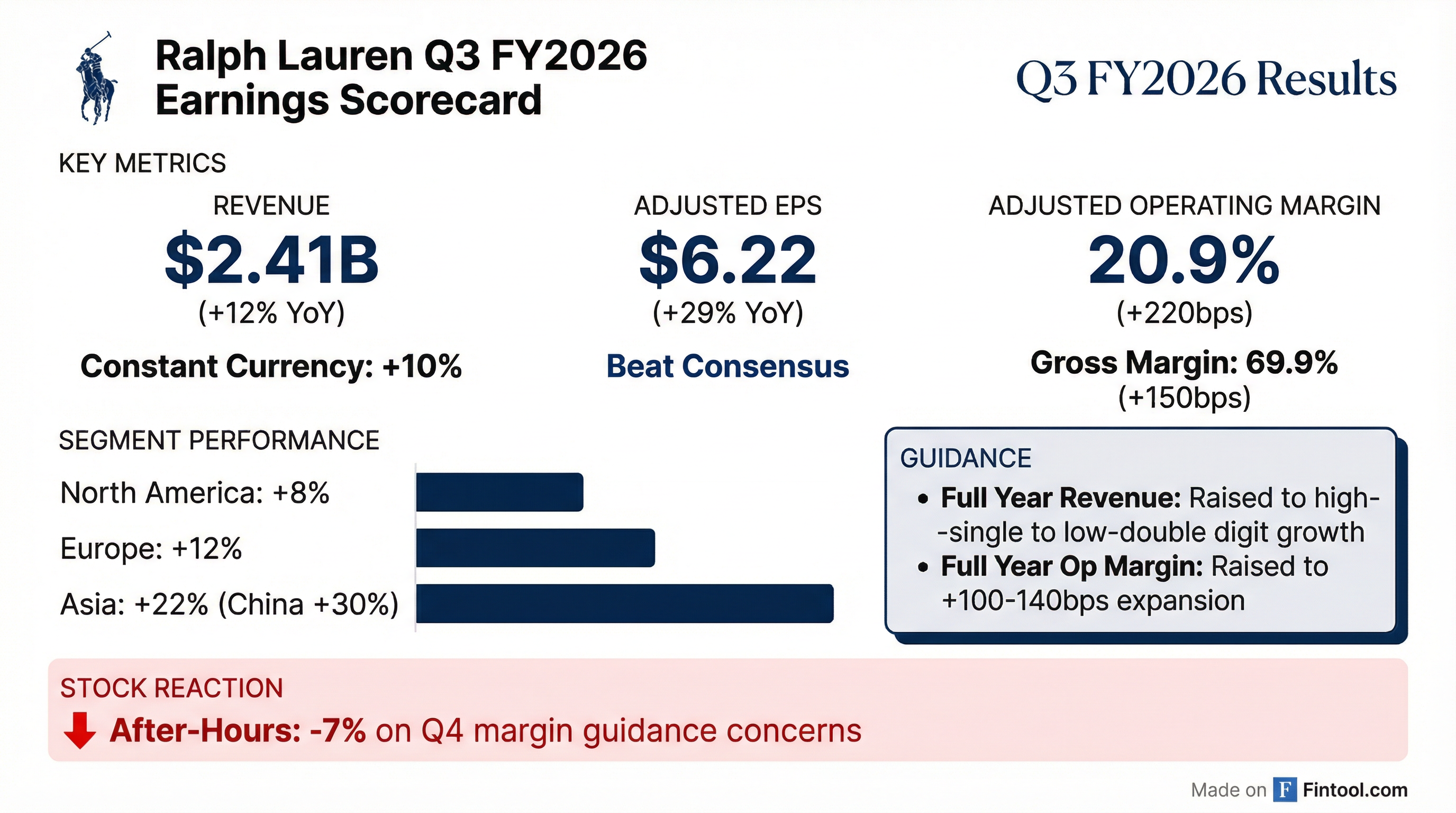

- Revenue of $2.41 billion (up ~12% y/y; 10% in constant currency) and adjusted EPS of $6.22, expanding operating margin by 220 bps to 20.9%

- Net income rose 21.6% to $361.6 million; adjusted EPS surpassed consensus by $0.42

- Broad-based top-line growth with North America +8%, Europe +12%, and Asia +22% (China +30% on Singles’ Day and Lunar New Year)

- Full-year revenue outlook raised to high-single to low-double-digit growth (constant currency) and operating-margin expansion of 100–140 bps, offset by near-term Q4 margin headwinds from tariffs and marketing costs

- Q3 revenue increased 10% on a constant‐currency basis, with comparable sales up 9%, led by Asia (+22%), North America (+8%), and Europe (+4%)¹.

- Adjusted gross margin expanded 140 bps to 69.8%, and adjusted operating margin grew 200 bps to 20.7%, driving a 21% increase in operating profit¹.

- Free cash flow for the first nine months was approximately $650 million, with $500 million returned to shareholders; the balance sheet ended Q3 with $2.3 billion in cash and $1.2 billion in debt¹².

- Fiscal 2026 guidance raised: now expect constant‐currency revenue growth of high single to low double digits (versus 5–7% prior) and operating margin expansion of 100–140 bps (versus 60–80 bps prior)².

- Total revenue grew 10% on a constant-currency basis, led by Asia (+22%), North America (+8%) and Europe (+4%).

- Adjusted gross margin expanded 140 bps to 69.8% and adjusted operating margin rose 200 bps to 20.7%, driven by AUR growth and full-price sales.

- Generated approximately $650 million in free cash flow and returned $500 million to shareholders year-to-date.

- Raised fiscal 2026 guidance to high single- to low double-digit revenue growth and 100–140 bps operating margin expansion.

- Third quarter revenues grew 10% on a constant currency basis, led by Asia +22%, North America +8%, and Europe +4%.

- Adjusted gross margin expanded 140 bps to 69.8%, driven by 18% AUR growth, favorable mix, and lower cotton costs, more than offsetting higher U.S. tariffs.

- Added 2.1 million new consumers to DTC channels in the quarter, up from 1.9 million a year ago, fueling digital and full-price store growth.

- Raised full-year FY 2026 guidance: revenues now expected to grow high single to low double digits (vs. 5–7% prior), with operating margin expansion of 100–140 bps, and Q4 revenue growth of mid-single digits.

- Q3 net revenue increased 12% to $2.406 billion, up 10% in constant currency, driven by high-single-digit comp store sales and balanced digital growth across regions.

- Adjusted diluted EPS rose to $6.22 (up 29% YoY) versus reported EPS of $5.82 (up 25%).

- Maintained $2.3 billion in cash and short-term investments and returned approximately $500 million to shareholders YTD through dividends and share repurchases.

- Increased full-year fiscal 2026 guidance: raising constant-currency revenue growth to high-single to low-double digits (from 5%–7%) and operating margin expansion to 100–140 bps (from 60–80 bps).

- Q3 revenue rose 12% to $2.4 billion on a reported basis (10% constant currency).

- Diluted EPS was $5.82 (reported) and $6.22 (adjusted), up 25% and 29% year-over-year, respectively.

- By region, Asia sales grew 22% to $620 million, Europe increased 12% to $676 million, and North America rose 8% to $1.1 billion (all reported).

- Raised full-year Fiscal 2026 revenue outlook to high-single to low-double digit growth and operating margin expansion of 100–140 bps (constant currency); Q4 revenues are expected to grow mid-single digits.

- Returned approximately $500 million to shareholders YTD via dividends and share repurchases.

- Q2 revenue rose 17% to $2.0 billion and adjusted EPS reached $3.79, both above expectations.

- Net income climbed nearly 40% to $207.5 million and operating margin expanded 270 bps to 14.1%.

- Growth was broad-based: China sales soared over 30%, and global comparable store sales increased 13%.

- Full-year guidance was lifted to 5–7% revenue growth on a constant-currency basis, with expected margin expansion.

- Revenue grew 14%, delivering the highest Q2 revenues since beginning its elevation journey over eight years ago.

- Adjusted gross margin expanded by 70 bps to 67.7% and adjusted operating margin rose 210 bps to 13.5%.

- Raised full-year guidance based on strong year-to-date performance and execution of the Next Great Chapter Drive Plan.

- Broad-based growth: Asia +16%, Europe +15%, North America +13%; retail comps +13% and digital ecosystem sales grew double digits.

- Ralph Lauren reported 14% constant-currency revenue growth, 13% retail comps, 67.7% adjusted gross margin (+70 bps) and 13.5% adjusted operating margin (+210 bps) in Q2 FY2026.

- Regional sales grew 16% in Asia, 15% in Europe and 13% in North America; China sales surged 30% year-over-year.

- Full-year revenue guidance was raised to +5–7% on a constant-currency basis, with 60–80 bps of operating margin expansion and 10–30 bps of gross margin expansion expected.

- Through Q2, the company returned $420 million to shareholders (including $313 million of share repurchases) and closed the quarter with $1.6 billion in cash vs. $1.2 billion of debt.

- Launched the Next Great Chapter Drive strategic plan to elevate the brand and expand core and high-potential categories, adding 1.5 million new DTC consumers in the quarter.

- Strong Q2 results: 14% constant-currency revenue growth, retail comps +13%, AUR +12%, gross margin up 70 bps to 67.7%, operating margin up 210 bps to 13.5%.

- Raised FY26 guidance to 5–7% constant-currency revenue growth; expects gross margin expansion of 10–30 bps and operating margin expansion of 60–80 bps.

- Broad-based regional performance: Asia +16% (China +30%), Europe +15%, North America +13% (all CC).

- Robust balance sheet and returns: ended Q2 with $1.6 B cash & short-term investments and $1.2 B debt; repurchased $313 M in shares YTD, returning $420 M to shareholders.

- Off to a strong start on the Next Great Chapter Drive plan, with diversified brand activations (sports sponsorships) and launch of the Ask Ralph AI styling tool.

Quarterly earnings call transcripts for RALPH LAUREN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more