Earnings summaries and quarterly performance for ZIFF DAVIS.

Executive leadership at ZIFF DAVIS.

Board of directors at ZIFF DAVIS.

Research analysts who have asked questions during ZIFF DAVIS earnings calls.

RS

Ross Sandler

Barclays

8 questions for ZD

Also covers: AMZN, CART, DASH +14 more

CC

Cory Carpenter

JPMorgan Chase & Co.

7 questions for ZD

Also covers: ANGI, APP, BMBL +16 more

Rishi Jaluria

RBC Capital Markets

7 questions for ZD

Also covers: AKAM, BOX, COUR +21 more

RC

Robert Coolbrith

Evercore ISI

7 questions for ZD

Also covers: APP, BMBL, CDLX +10 more

Ygal Arounian

Citigroup

6 questions for ZD

Also covers: ANGI, BARK, BMBL +13 more

SP

Shyam Patil

Susquehanna Financial Group

5 questions for ZD

Also covers: CHKP, MGNI, MNTN +3 more

AS

Aaron Samuels

Susquehanna Financial Group, LLLP

3 questions for ZD

Also covers: CTV, RAMP, RPD

CK

Chris Kuntarich

UBS Group

1 question for ZD

Also covers: APP, BIGC, COMP +6 more

Christopher Kuntarich

UBS

1 question for ZD

Also covers: APP, COMP, DSP +6 more

RC

Robert Colbert

Evercore ISI

1 question for ZD

Recent press releases and 8-K filings for ZD.

Ziff Davis Reports Q4 and Full Year 2025 Results, Announces Strategic Review

ZD

Earnings

Share Buyback

Guidance Update

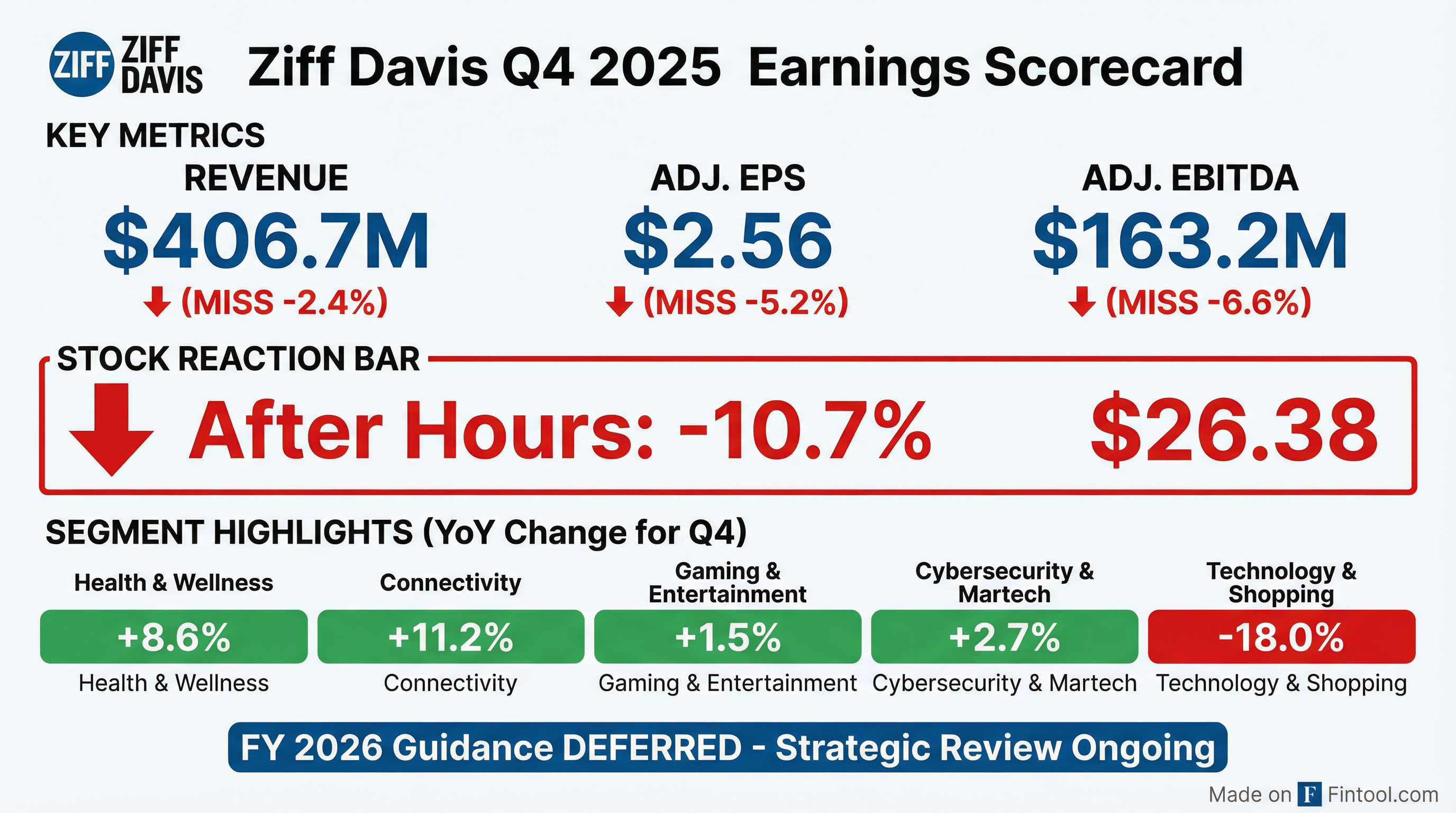

- Ziff Davis reported FY 2025 revenue of $1,451.3 million, an increase of 3.5%, and Adjusted EBITDA of $495.1 million. For Q4 2025, revenue was $406.7 million, a 1.5% decline, with Adjusted EBITDA of $163.2 million, down 5%.

- The company generated $287.9 million in free cash flow for FY 2025 and deployed $174 million to repurchase approximately 4.8 million shares, reducing shares outstanding by more than 10%. The board also increased the share repurchase authorization by 10 million shares.

- The Tech and Shopping segment experienced an 18% revenue decline in Q4 2025, primarily due to a drop in web search traffic impacting affiliate commerce revenues. Affiliate commerce commissions related to organic traffic were down approximately $25 million year-over-year in 2025.

- While Tech and Shopping faces headwinds, other segments showed growth in Q4 2025, including Health and Wellness up 8.6% and Connectivity up 11%. For full year 2026, Tech and Shopping is expected to be down mid-single digits in revenue, while Gaming and Entertainment, Health and Wellness, and Cybersecurity and MarTech are projected for low to mid-single-digit growth, and Connectivity for double-digit growth.

- Ziff Davis has engaged outside advisors to assess potential transactions to unlock shareholder value, leading to a deferral of formal 2026 guidance. However, the company expects to deliver profitable growth and strong free cash flow generation in 2026, with Q1 2026 consolidated revenue growth anticipated to be relatively flat or slightly negative.

3 days ago

Ziff Davis Reports Q4 and Full Year 2025 Results, Addresses Segment Challenges and 2026 Outlook

ZD

Earnings

Guidance Update

Demand Weakening

- Ziff Davis reported $1,451.3 million in revenue for fiscal year 2025, a 3.5% increase, and $406.7 million for Q4 2025, a 1.5% decline. The company generated almost $290 million in free cash flow for the full year, deploying $174 million in share repurchases.

- In Q4 2025, the Tech and Shopping segment's revenues declined 18% due to reduced web search traffic impacting affiliate commerce, though this was offset by over 6% growth across the other four segments. The company also sold its games publishing business in Q4 2025.

- For 2026, Ziff Davis anticipates a mid-single-digit revenue decline for Tech and Shopping, while Gaming and Entertainment, Health and Wellness, and Cybersecurity and MarTech are expected to grow low to mid-single digits, and Connectivity to see double-digit growth. Formal guidance has been deferred due to an ongoing evaluation of strategic opportunities, but the company is actively discussing AI content licensing.

3 days ago

Ziff Davis Reports Q4 and Full Year 2025 Results, Addresses Segment Challenges and Strategic Outlook

ZD

Earnings

Guidance Update

Share Buyback

- For the full year 2025, Ziff Davis reported revenues grew 3.5% to $1,451.3 million, with Adjusted EBITDA of $495.1 million and Adjusted diluted EPS of $6.63. In Q4 2025, revenues declined 1.5% to $406.7 million, and Adjusted EBITDA decreased 5% to $163.2 million.

- The Tech and Shopping segment experienced an 18% decline in Q4 2025 revenues due to a drop in web search traffic, impacting affiliate commerce. This segment is projected to continue a double-digit revenue decline in the first half of 2026, with a full-year decline of mid-single digits. In contrast, four of the other five segments grew revenues in Q4, with Health and Wellness growing 8.6% and Connectivity growing 11%.

- Ziff Davis deployed $174 million in share repurchases in 2025, reducing shares outstanding by more than 10%, and the board increased the repurchase authorization by 10 million shares. The company also sold its game publishing business in Q4 2025. Due to an ongoing review of potential strategic opportunities, formal guidance for 2026 has been deferred, but the company anticipates low to mid-single digit revenue growth for most segments (excluding Tech and Shopping) and expects Adjusted EBITDA margins to hover around 34% for FY 2026.

3 days ago

Ziff Davis Announces Q4 and Full Year 2025 Financial Results

ZD

Earnings

Demand Weakening

- For Q4 2025, Ziff Davis reported total revenues of $406.7 million, a 1.5% decrease from Q4 2024, with Adjusted EBITDA at $163.2 million, down 5.0%, and Adjusted diluted EPS at $2.56, a 0.8% decrease.

- For the full fiscal year 2025, total revenues increased by 3.5% to $1,451.3 million, Adjusted EBITDA grew by 0.3% to $495.1 million, and Adjusted diluted EPS rose by 0.2% to $6.63 compared to FY 2024.

- In Q4 2025, Advertising and Performance Marketing revenue declined by 4.4% to $246 million, while Subscription and Licensing revenue increased by 4.0% to $153 million.

- The Health & Wellness segment demonstrated strong growth, with Q4 2025 revenues increasing by 8.6% to $114.8 million and FY 2025 revenues up 11.0% to $402.4 million. Conversely, the Technology & Shopping segment's Q4 2025 revenues decreased by 18.0% to $108.9 million.

- As of December 31, 2025, Ziff Davis held $700 million in total cash, cash equivalents, and investments against $872 million in total gross debt.

3 days ago

Ziff Davis Reports Fourth Quarter and Full Year 2025 Financial Results

ZD

Earnings

Share Buyback

- For the fourth quarter of 2025, Ziff Davis reported revenues of $406.7 million, Adjusted EBITDA of $163.2 million, and Adjusted diluted EPS of $2.56.

- For the full year 2025, revenues increased 3.5% to $1.45 billion, Adjusted EBITDA increased 0.3% to $495.1 million, and Adjusted diluted EPS increased 0.2% to $6.63.

- The company generated $287.9 million in Free cash flow and deployed $173.8 million in share repurchases during 2025.

4 days ago

Ziff Davis Reports Q4 CY2025 Results with Revenue Miss and Significant GAAP Profit Decline

ZD

Earnings

Demand Weakening

Share Buyback

- Ziff Davis reported Q4 CY2025 revenue of $406.7 million, a 1.5% year-over-year decrease that missed consensus estimates, and GAAP net income significantly fell to $0.37 million ($0.01 per share) from $64.08 million ($1.43 per share) in the prior year.

- For full-year 2025, the company grew revenues, adjusted EBITDA, and adjusted diluted EPS, generating nearly $290 million of free cash flow and recording $47.4 million ($1.15 per share) in net income. Management used approximately $174 million for share repurchases.

- The company maintains strong profitability with an 86.1% gross margin and 26.88% EBITDA margin, alongside a 1.61 current ratio and 0.48 debt-to-equity ratio; however, an Altman Z-score near 1.72 flags elevated distress risk.

- Trailing 12-month revenue of approximately $1.45 billion indicates demand stagnation, being close to five years ago, though analysts expect ~3.6% revenue growth over the next 12 months.

4 days ago

Ziff Davis Reports Q4 and Full Year 2025 Financial Results

ZD

Earnings

Guidance Update

Share Buyback

- Ziff Davis reported full year 2025 revenues increased 3.5% to $1.45 billion, Adjusted EBITDA increased 0.3% to $495.1 million, and Adjusted diluted EPS increased 0.2% to $6.63.

- For the fourth quarter of 2025, revenues decreased to $406.7 million compared to $412.8 million in Q4 2024, and net income significantly decreased to $0.4 million from $64.1 million in Q4 2024.

- The company generated $287.9 million in Free cash flow for the full year 2025 and deployed $173.8 million in share repurchases during the year.

- Ziff Davis is deferring its fiscal 2026 guidance as it evaluates value-creating opportunities, including the potential sale of entire divisions.

4 days ago

Ziff Davis Discusses Value Creation Initiatives and Segment Performance

ZD

M&A

Share Buyback

Revenue Acceleration/Inflection

- Ziff Davis is actively exploring strategies, including potential spinoffs, to unlock shareholder value due to a perceived gap between its intrinsic business value and public share price.

- The company has significantly prioritized share buybacks, repurchasing 3.6 million shares year-to-date and allocating over $100 million in 2025, representing 80-85% of its free cash flow year-to-date.

- In 2025, Ziff Davis completed seven acquisitions, deploying less than $70 million in capital for M&A.

- To enhance transparency and address a "conglomerate discount," Ziff Davis transitioned to five reportable segments in February 2025.

- The Health and Wellness segment is demonstrating strong performance with double-digit revenue growth and high 30s EBITDA margins, while the Cybersecurity and MarTech segment returned to revenue growth in Q3 2025.

Dec 3, 2025, 2:35 PM

Ziff Davis discusses strategy to unlock shareholder value and 2025 capital allocation

ZD

Share Buyback

M&A

Revenue Acceleration/Inflection

- Ziff Davis has structured its business into five reportable segments as of February 2025: Tech and Shopping, Gaming and Entertainment, Everyday Health, Connectivity, and Cybersecurity and MarTech.

- The company is focused on unlocking shareholder value, believing there is a gap between the intrinsic value of its businesses and its public share price.

- In 2025, Ziff Davis significantly increased capital allocation to its stock buyback program, repurchasing approximately 3.6 million shares and deploying 80-85% of its free cash flow to buybacks.

- The company closed seven acquisitions in 2025, deploying less than $70 million into M&A, compared to over $100 million for stock buybacks.

- The Cybersecurity and MarTech segment returned to revenue growth in Q3 2025, while the Health and Wellness segment (Everyday Health) has shown double-digit revenue growth with high 30s EBITDA margins.

Dec 3, 2025, 2:35 PM

Ziff Davis CFO Discusses Value Creation, Capital Allocation, and Segment Performance at UBS Conference

ZD

Share Buyback

M&A

Revenue Acceleration/Inflection

- Ziff Davis's CFO, Bret Richter, highlighted the company's focus on unlocking shareholder value, citing a perceived gap between its intrinsic value and public share price.

- To enhance transparency and address a potential conglomerate discount, Ziff Davis transitioned from two to five reportable segments in February 2025.

- The company's revenue model is diversified, with over 40% from subscription and licensing. Approximately 35% of total revenue is web traffic dependent, with about half of that originating from search.

- In 2025, Ziff Davis has prioritized capital return, repurchasing approximately 3.6 million shares year-to-date and allocating 80-85% of free cash flow to buybacks. M&A activity included seven acquisitions with less than $70 million deployed, significantly less than the over $100 million spent on stock buybacks.

- Key growth areas include the Health and Wellness segment, which shows double-digit revenue growth and high 30s EBITDA margins, and the Cybersecurity and MarTech segment, which returned to revenue growth in Q3 2025.

Dec 3, 2025, 2:35 PM

Quarterly earnings call transcripts for ZIFF DAVIS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more