Earnings summaries and quarterly performance for Banco Santander (Brasil).

Research analysts who have asked questions during Banco Santander (Brasil) earnings calls.

Daniel Vaz

Banco Safra

7 questions for BSBR

Mario Pierry

Bank of America

6 questions for BSBR

Thiago Bovolenta Batista

UBS

6 questions for BSBR

Yuri Fernandes

JPMorgan Chase & Co.

5 questions for BSBR

Carlos Gomez

HSBC

4 questions for BSBR

Eduardo Nishio

Genial Investimentos

4 questions for BSBR

Eduardo Rosman

BTG Pactual

4 questions for BSBR

Marcelo Mizrahi

Bradesco BBI

4 questions for BSBR

Gustavo Schroden

Citigroup

3 questions for BSBR

Jorge Kuri

Morgan Stanley

3 questions for BSBR

Pedro Leduc

Itau BBA

3 questions for BSBR

Tito Labarta

Goldman Sachs

3 questions for BSBR

Brian Flores

Citigroup Inc.

2 questions for BSBR

Matheus Guimarães

XP Inc.

2 questions for BSBR

Carlos Gomez-Lopez

HSBC

1 question for BSBR

Daniel Vance

Bradesco BBI

1 question for BSBR

Daniel Vannucci

Bradesco BBI

1 question for BSBR

Gustavo Binsfeld

Goldman Sachs

1 question for BSBR

Gustavo Schroeder

Citigroup

1 question for BSBR

Pedro Lezuki

Itau BBA

1 question for BSBR

Thiago Bovolenta

Goldman Sachs

1 question for BSBR

Thiago Paura

Goldman Sachs Group, Inc.

1 question for BSBR

Thiago Renzo

Goldman Sachs

1 question for BSBR

Unknown Analyst

Morgan Stanley

1 question for BSBR

Yudi Fernandez

JPMorgan Chase & Co.

1 question for BSBR

Recent press releases and 8-K filings for BSBR.

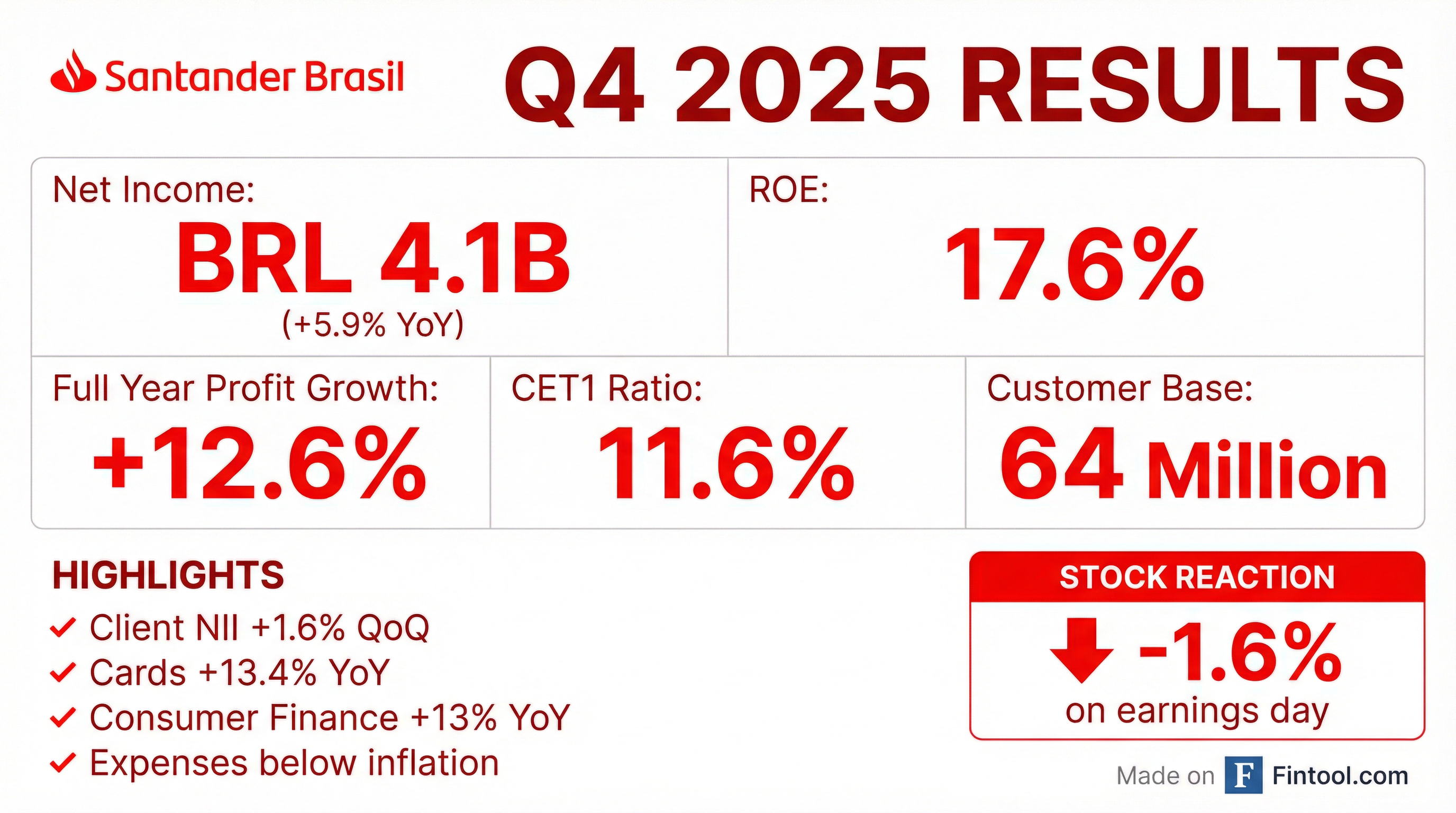

- Banco Santander (Brasil) S.A. reported a managerial net profit of R$4.1 billion in Q4 2025, marking a 1.9% increase quarter-over-quarter and a 6.0% increase year-over-year, with a Return on Average Equity (ROAE) of 17.6%.

- The expanded loan portfolio grew to R$708.2 billion, up 2.8% quarter-over-quarter and 3.7% year-over-year.

- Net Interest Income (NII) was R$15.3 billion in Q4 2025, increasing 0.8% quarter-over-quarter but decreasing 4.0% year-over-year, while fees totaled R$5.8 billion, growing 3.6% quarter-over-quarter and 4.3% year-over-year.

- The cost of risk reached 3.76%, reflecting a 0.1 percentage point decrease quarter-over-quarter.

- Funding from clients increased to R$670.4 billion, a 1.7% quarter-over-quarter and 3.9% year-over-year rise.

- BSBR reported Q4 2025 net income of BRL 4.1 billion, an increase of 1.9% quarter-on-quarter and nearly 6% year-on-year, achieving a Return on Equity (ROE) of 17.6%.

- The company demonstrated effective cost management, ending 2025 with expense growth below inflation and an improvement of 100 basis points in the efficiency ratio compared to 2024.

- Loan portfolios experienced significant year-over-year growth, including cards up 13.4%, consumer finance up 13%, and small and medium-sized enterprises (SMEs) up 13%.

- The over 90-day Non-Performing Loan (NPL) ratio increased by 25 basis points in Q4 2025, primarily due to anticipated write-offs, with particular pressure noted in smaller SME companies.

- Management stated that while M&A is an option, they are unlikely to pursue large M&A within Brazil, focusing instead on organic growth in targeted, more profitable segments like high-income individuals and SMEs, supported by investments in technology and expansion.

- Santander Brasil reported a net income of BRL 4.1 billion in Q4 2025, an increase of 6% year-on-year and 1.9% quarter-on-quarter, with profitability reaching 17.6% as the company aims for 20%+.

- The company experienced strong year-on-year growth in key portfolios, including cards (13.4%), consumer finance (13%), and small and medium-sized enterprises (SMEs) (13%).

- Strategic initiatives include expanding the customer base to over 74 million clients, leveraging hyper-personalization and AI, and investing 16% over the past two years in expansion and technology.

- Management maintains a cautious credit approach, reducing exposure to higher-risk profiles and opting not to grow payroll-deductible loans due to low profitability. Delinquency pressure was observed in smaller SME companies and the low-income segment, with the latter expected to take 2-3 years to recover profitability.

- Santander Brasil reported a net income of BRL 4.1 billion in Q4 2025, achieving a Return on Equity (ROE) of 17.6%, with a stated goal to reach 20%+ profitability.

- The bank demonstrated strong loan book growth year-on-year, with cards increasing 13.4%, consumer finance up 13%, and small and medium-sized enterprises (SMEs) growing 13%.

- Despite growth, the company noted an increase in over 90-day Non-Performing Loans (NPL) in Q4 2025, particularly in smaller SMEs, and anticipates some additional pressure on quality indicators in the first half of 2026.

- Strategic focus includes enhancing customer centricity through hyper-personalization and AI, alongside disciplined expense management that resulted in annual growth below inflation, with a target to keep nominal expenses close to zero.

- Banco Santander (Brasil) S.A.'s Board of Directors approved the declaration and payment of Interest on Company's Equity in a gross amount of R$ 2,000,000,000.00 (two billion Brazilian reais).

- This gross amount corresponds to R$ 0.25517315448 per common share, R$ 0.28069046993 per preferred share, and R$ 0.53586362441 per Unit.

- After the deduction of Income Tax Withheld at Source, the net amount is R$ 1,650,000,000.00, corresponding to R$ 0.21051785245 per common share, R$ 0.23156963769 per preferred share, and R$ 0.44208749014 per Unit.

- Shareholders registered by the end of January 20, 2026, will be entitled to this payment, which is scheduled for February 5, 2026.

- This Interest on Company's Equity will be fully considered within the mandatory dividends to be distributed by the Company for the year 2026.

- Banco Santander (Brasil) S.A. (Santander Brasil) has issued financial bills with a subordination clause.

- The total amount of the issuance is BRL 2,362,800,000.00.

- The proceeds from these financial bills will be used to compose the Company's Tier II Reference Equity, which will impact its Tier II capitalization ratio.

- The financial bills have a 10-year maturity term and include a repurchase option starting in 2030.

- For the first nine months of 2025, Banco Santander (Brasil) S.A. reported a Managerial Net Profit of R$11.5 billion, representing a 15.1% increase year-over-year, and an Accounting Net Profit of R$11.316 billion, up 16.3%.

- The company achieved a Return on Average Equity (ROAE) of 17.1% for the first nine months of 2025, an increase of 1.5 percentage points compared to the same period in 2024.

- The expanded loan portfolio grew by 3.8% compared to September 2024, with consumer finance and small and medium enterprises portfolios growing by 12.6% and 12.4%, respectively.

- The Board of Directors approved the distribution of R$2,000,000,000.00 in Interest on Equity on October 10, 2025, to be paid from November 7, 2025.

- The company is assessing the impacts of upcoming IFRS amendments (IFRS 9, IFRS 7, IFRS 18, IFRS 19) which are effective for reporting periods beginning on or after January 1, 2026, and January 1, 2027.

- Banco Santander (Brasil) S.A. (BSBR) announced its Board of Directors resolved to submit two merger transactions for shareholder consideration at Extraordinary General Meetings on November 28, 2025.

- The first transaction involves the merger of a spun-off portion of Return Capital Gestão de Ativos e Participações S.A., a wholly-owned subsidiary, into BSBR. This transaction will transfer 97% of Return's net equity, with a net book value of R$8,460,000,000.00 as of September 30, 2025.

- The second transaction is the merger of Santander Leasing S.A. Arrendamento Mercantil, another wholly-owned subsidiary, into BSBR. This merger is contingent on BACEN approval.

- Both mergers aim to centralize activities, optimize capital structure, simplify the corporate structure, and reduce administrative costs. The estimated total costs for each merger are not expected to exceed R$450,000.00.

- Banco Santander (Brasil) S.A. (BSBR) will hold an Extraordinary General Meeting on November 28, 2025, to approve the partial spin-off of its wholly-owned subsidiary, Return Capital Gestão de Ativos e Participações S.A., and the subsequent merger of the spun-off portion into Santander Brasil.

- The spun-off portion, representing 97% of Return's net equity, is valued at R$8,460,000,000.00 (eight billion, four hundred and sixty million Brazilian reais) based on an appraisal as of September 30, 2025.

- This transaction aims to unify activities, simplify the corporate structure, optimize capital, and reduce administrative costs, without resulting in a capital increase or share dilution for Santander Brasil.

- Banco Santander (Brasil) S.A. reported a net profit of R$ 4.0 billion in the third quarter of 2025, representing a 9.6% increase quarter-over-quarter and a 9.4% increase year-over-year.

- The company's Return on Average Equity (ROAE) was 17.5% for Q3 2025, expanding by 1.2 percentage points quarter-over-quarter and 0.5 percentage points year-over-year.

- The expanded loan portfolio grew to R$ 688.8 billion, an increase of 2.0% quarter-over-quarter and 3.8% year-over-year.

- Net Interest Income (NII) reached R$ 15.2 billion in Q3 2025, a 1.2% decline quarter-over-quarter and a 0.1% decline year-over-year, while fees increased to R$ 5.5 billion, up 6.7% quarter-over-quarter and 4.1% year-over-year.

- The cost of risk was 3.86%, remaining stable quarter-over-quarter and increasing by 0.2 percentage points year-over-year.

Quarterly earnings call transcripts for Banco Santander (Brasil).

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more