Earnings summaries and quarterly performance for LendingClub.

Executive leadership at LendingClub.

Board of directors at LendingClub.

Allan Landon

Director

Erin Selleck

Director

Faiz Ahmad

Director

Janey Whiteside

Director

John C. (Hans) Morris

Independent Chairman of the Board

Kathryn Reimann

Director

Michael Zeisser

Director

Stephen Cutler

Director

Timothy Mayopoulos

Director

Research analysts who have asked questions during LendingClub earnings calls.

Vincent Caintic

Stephens Inc.

7 questions for LC

Kyle Joseph

Jefferies

5 questions for LC

Timothy Switzer

KBW

5 questions for LC

Giuliano Bologna

Compass Point Research & Trading LLC

4 questions for LC

John Hecht

Jefferies

4 questions for LC

William Ryan

Seaport Research Partners

4 questions for LC

Giuliano Anderes-Bologna

Compass Point

3 questions for LC

Reginald Smith

JPMorgan Chase & Co.

3 questions for LC

Bradley Capuzzi

Piper Sandler

2 questions for LC

Crispin Love

Piper Sandler

2 questions for LC

David Scharf

Citizens Capital Markets and Advisory

2 questions for LC

Reggie Smith

JPMorgan Chase & Co.

2 questions for LC

Tim Switzer

Keefe, Bruyette & Woods (KBW)

2 questions for LC

Bill Ryan

Seaport Research Partners

1 question for LC

David Chiaverini

Wedbush Securities Inc.

1 question for LC

David Scharf

JMP Securities

1 question for LC

Timothy Jeffrey Switzer

Keefe, Bruyette & Woods

1 question for LC

Vincent Albert Caintic

BTIG

1 question for LC

Recent press releases and 8-K filings for LC.

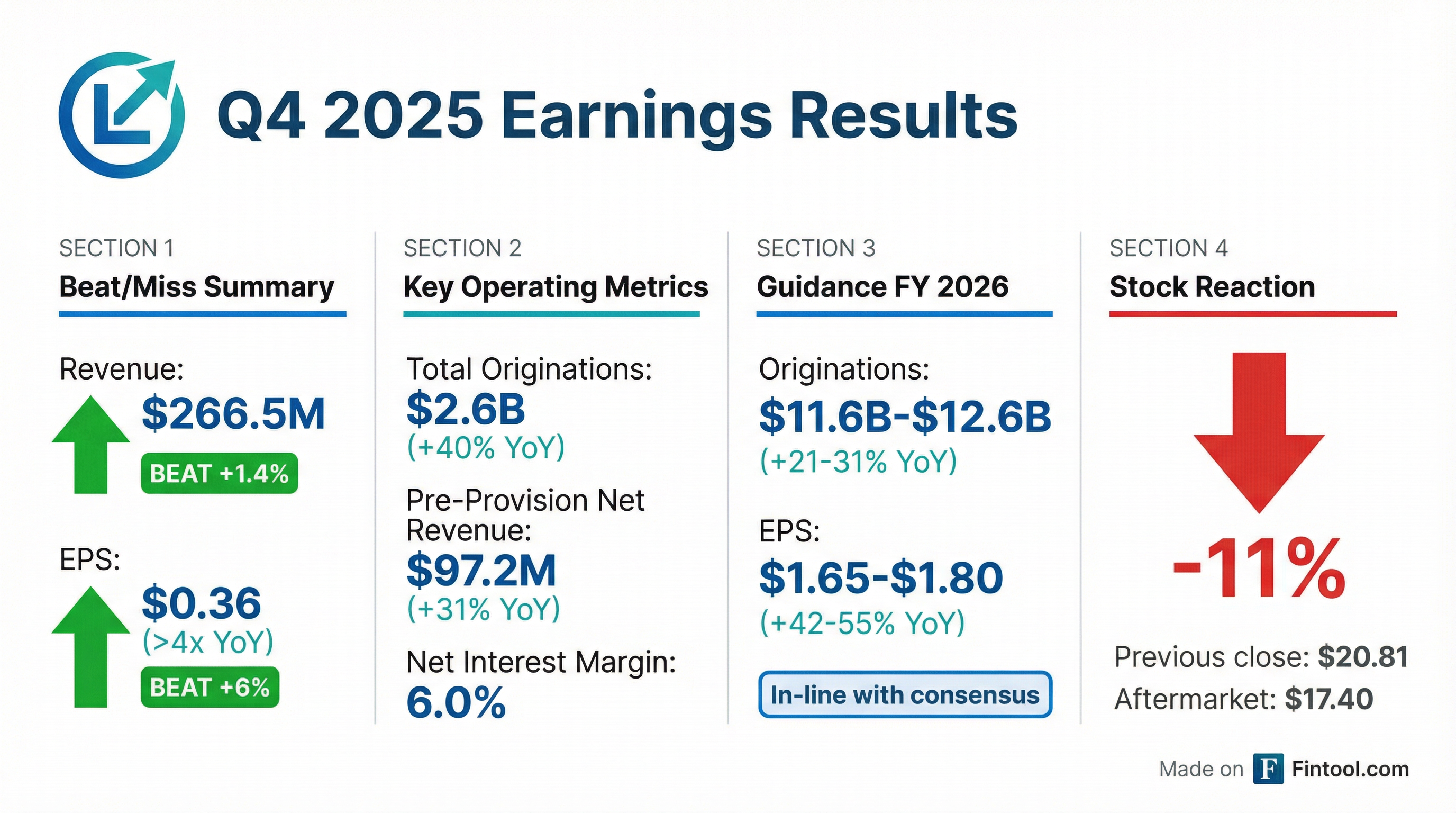

- LendingClub achieved its Q4 2025 financial targets, reporting Total Originations of $2.6 billion and Pre-Provision Net Revenue (PPNR) of $97.2 million.

- The company issued FY 2026 guidance for Total Originations between $11.6 billion and $12.6 billion and Diluted Earnings Per Share (EPS) between $1.65 and $1.80.

- Effective January 1, 2026, LendingClub will transition to the Fair Value Option for all loans, a change expected to better align revenue recognition with losses and enhance consistency between marketplace and bank financials.

- LendingClub reported a growing balance sheet with Total Interest-Earning Assets of $10.9 billion and a year-over-year Net Interest Margin expansion to 6.0% in Q4 2025.

- LendingClub reported strong Q4 2025 results, with loan originations growing 40% to $2.6 billion, non-interest income up 38% to $103 million, and diluted EPS at $0.35. For the full year 2025, diluted EPS grew 158% to $1.16.

- The company provided Q1 2026 guidance for loan originations of $2.55 billion-$2.65 billion and diluted EPS of $0.34-$0.39. For full year 2026, originations are projected to be $11.6 billion-$12.6 billion and EPS $1.65-$1.80.

- LendingClub is entering the $500 billion home improvement financing market with a planned mid-year partnership launch and will launch a new brand later in 2026.

- The company is transitioning to the Fair Value Option for all new loan originations, aiming to simplify financials and improve return on invested capital.

- A $100 million share repurchase and acquisition program was announced, with $12 million deployed in Q4 2025 at an average share price of $17.65.

- LendingClub reported Q4 2025 originations of $2.6 billion, a 40% year-on-year increase, contributing to full-year 2025 originations of nearly $10 billion, up 33%.

- Diluted EPS for Q4 2025 was $0.35 with a return on tangible common equity (ROTCE) of almost 12%, while full-year 2025 diluted EPS reached $1.16, more than doubling year-over-year.

- The company provided Q1 2026 guidance for loan originations between $2.55 billion and $2.65 billion and diluted EPS of $0.34-$0.39, alongside full-year 2026 guidance of $11.6 billion-$12.6 billion in originations and $1.65-$1.80 in EPS.

- LendingClub is transitioning to a fair value option for accounting and is on track to launch into the $500 billion home improvement financing market by mid-2026.

- A $100 million share repurchase and acquisition program was announced, and Timothy Mayopoulos will assume the role of Board Chairman in March.

- LendingClub reported Q4 2025 loan originations of $2.6 billion, marking a 40% year-on-year increase, contributing to full-year 2025 originations of nearly $10 billion, up 33%.

- For full-year 2025, diluted earnings per share more than doubled to $1.16, with a Return on Tangible Common Equity (ROTCE) of 10.2%.

- The company provided Q1 2026 guidance for loan originations between $2.55 billion and $2.65 billion and diluted EPS between $0.34 and $0.39.

- Full-year 2026 guidance projects originations of $11.6 billion to $12.6 billion and diluted EPS of $1.65 to $1.80, consistent with a 13%-15% near-term ROTCE target.

- LendingClub is transitioning to a Fair Value Option accounting for held-for-investment loans, is on track to launch into the home improvement financing market mid-year 2026, and announced a $100 million share repurchase and acquisition program.

- LendingClub reported strong fourth quarter 2025 results, with originations increasing 40% to $2.6 billion, total net revenue growing 23% to $266.5 million, and diluted EPS more than quadrupling to $0.35 compared to the prior year.

- For the full year 2025, the company achieved significant growth, with originations up 33%, revenue up 27%, and diluted EPS up 158% compared to the prior year.

- As of December 31, 2025, LendingClub maintained a strong balance sheet with $11.6 billion in total assets, $9.8 billion in deposits, and robust capital ratios including a Tier 1 leverage ratio of 12.0% and a CET1 capital ratio of 17.4%.

- The company provided a First Quarter 2026 outlook for loan originations between $2.55 billion and $2.65 billion and diluted EPS between $0.34 and $0.39, and a Full Year 2026 outlook for loan originations between $11.6 billion and $12.6 billion and diluted EPS between $1.65 and $1.80.

- Strategic developments include the execution of $11.9 million of the $100 million Stock Repurchase and Acquisition Program and entry into home improvement financing.

- LendingClub reported a net income of $41.6 million and diluted EPS of $0.35 for the fourth quarter ended December 31, 2025, representing a 328% and 338% increase year-over-year, respectively.

- For the full year 2025, the company achieved $135.7 million in net income and $1.16 in diluted EPS, marking a 164% and 158% increase, respectively, over the prior year.

- Originations for Q4 2025 grew 40% to $2.6 billion, contributing to a 23% increase in total net revenue to $266.5 million.

- The company executed $11.9 million of its $100 million Stock Repurchase and Acquisition Program in Q4 2025 and announced its entry into home improvement financing.

- LendingClub provided Q1 2026 guidance, forecasting loan originations between $2.55 billion and $2.65 billion and diluted EPS between $0.34 and $0.39.

- LendingClub has undergone a significant strategic shift, leveraging its bank charter to pursue a "lifetime of lending and banking" by acquiring customers through lending and engaging them with additional products and services.

- The company highlights its competitive advantages, including unmatched underwriting that delivers 40% lower delinquencies than competitors, a proprietary technology platform, and a business model combining fintech speed with bank stability.

- LendingClub is expanding its product offerings, notably entering the $5 trillion annual market of home improvement financing through the acquisition of Mosaic's technology and a partnership with Wisetac.

- The company projects strong financial growth, expecting originations to grow 20% to 30% year over year and Return on Tangible Common Equity (ROTCE) to reach 13% to 15% in the near term and 18% to 20% over the medium term.

- LendingClub announced a $100 million stock repurchase and acquisition program to deploy excess capital.

- LendingClub is targeting a doubling of annual originations to $18-$22 billion over the medium term, up from $10 billion today, driven by core personal loans, major purchase finance, and secured products. This growth is supported by new entries into home improvement financing through the acquisition of Mosaic's technology and a partnership with Wisetack.

- The company projects its bank assets to grow from $11 billion to $20 billion over the medium term, while expanding its net interest margin to 6.5%+. LendingClub also aims to achieve a Return on Tangible Common Equity (ROTCE) of 18%-20% in the medium term, up from 12-13% in Q2/Q3.

- LendingClub announced a shift to fair value accounting for new originations starting Q1 2026 to better align revenue recognition with loss timing and create consistency across its bank and marketplace operations. Additionally, the company announced a $100 million stock repurchase and acquisition program.

- LendingClub's Board of Directors approved a $100 million common stock repurchase and acquisition program through December 31, 2026, reflecting the company's strong balance sheet and confidence in long-term earnings power.

- The company reported record pre-tax net income in the third quarter of 2025 and saw its Tangible Book Value per Share grow at a 14% CAGR since 2021, reaching $11.95 in Q3 2025.

- LendingClub targets medium-term total annual originations of $18-$22 billion (up from a current $10 billion run rate), approximately $20.0 billion in Total Bank Assets, and a Return on Tangible Common Equity (ROTCE) of 18-20%.

- The company intends to elect the Fair Value Option for all newly-originated loans beginning January 2026 to better align revenue recognition with losses and create consistency in financials.

- LendingClub's Board of Directors has approved a program to repurchase and acquire up to $100 million of the company's common stock.

- This program is authorized through December 31, 2026.

- CEO Scott Sanborn stated that the program reflects the company's strong balance sheet, confidence in its long-term earnings power, and a disciplined approach to capital allocation, noting record pre-tax net income in the third quarter of 2025.

- The timing and volume of shares acquired are discretionary and will depend on LendingClub's stock price, business and market conditions, and other factors.

Fintool News

In-depth analysis and coverage of LendingClub.

Quarterly earnings call transcripts for LendingClub.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more