Earnings summaries and quarterly performance for REGENCY CENTERS.

Executive leadership at REGENCY CENTERS.

Lisa Palmer

President and Chief Executive Officer

Alan T. Roth

East Region President and Chief Operating Officer

Martin E. Stein, Jr.

Executive Chairman of the Board

Michael J. Mas

Executive Vice President, Chief Financial Officer

Nicholas A. Wibbenmeyer

West Region President and Chief Investment Officer

Board of directors at REGENCY CENTERS.

Bryce Blair

Director

C. Ronald Blankenship

Lead Independent Director

Deirdre J. Evens

Director

Gary E. Anderson

Director

James H. Simmons, III

Director

Karin M. Klein

Director

Kristin A. Campbell

Director

Peter D. Linneman

Director

Thomas W. Furphy

Director

Research analysts who have asked questions during REGENCY CENTERS earnings calls.

Juan Sanabria

BMO Capital Markets

8 questions for REG

Todd Thomas

KeyBanc Capital Markets

8 questions for REG

Floris van Dijkum

Compass Point Research & Trading

6 questions for REG

Michael Goldsmith

UBS

6 questions for REG

Michael Gorman

BTG Pactual

6 questions for REG

Paulina Rojas Schmidt

Green Street Advisors

6 questions for REG

Wesley Golladay

Robert W. Baird & Co.

6 questions for REG

Jamie Feldman

Wells Fargo & Company

5 questions for REG

Ki Bin Kim

Truist Securities

5 questions for REG

Ronald Kamdem

Morgan Stanley

5 questions for REG

Viktor Fediv

Scotiabank

5 questions for REG

Cooper Clark

Wells Fargo

4 questions for REG

Linda Tsai

Jefferies

4 questions for REG

Samir Khanal

Bank of America

4 questions for REG

Steve Sakwa

Evercore ISI

4 questions for REG

Craig Mailman

Citigroup

3 questions for REG

Michael Griffin

Citigroup Inc.

3 questions for REG

Michael Mueller

JPMorgan Chase & Co.

3 questions for REG

Mike Mueller

JPMorgan Chase & Co.

3 questions for REG

Ravi Vaidya

Mizuho

3 questions for REG

Greg McGinniss

Scotiabank

2 questions for REG

Haendel St. Juste

Mizuho Financial Group

2 questions for REG

Nick Joseph

Citigroup Inc.

2 questions for REG

Rich Hightower

Barclays

2 questions for REG

Sydney Rome

Barclays Bank

2 questions for REG

Andrew Reale

Bank of America

1 question for REG

Dori Kesten

Wells Fargo & Company

1 question for REG

Floris Gerbrand van Dijkum

Compass Point Research & Trading, LLC

1 question for REG

Nicholas Joseph

Citigroup

1 question for REG

Paulina Rojas

Green Street

1 question for REG

Sameer Hanal

Bank of America

1 question for REG

Victor Faiti

Scotiabank

1 question for REG

Recent press releases and 8-K filings for REG.

- Regency delivered 5.3% same-property NOI growth in 2025, record 94.2% shop occupancy, 12% cash rent spreads and 13% renewal spreads in Q4 2025.

- The investments platform deployed $825 million in 2025—$500 million of acquisitions and $300 million of development—completing $160 million of projects in Q4 at 9% blended returns.

- Development activity accelerated with $300 million of new project starts in 2025 (over $800 million in the past three years), an in-process pipeline of $600 million, and visibility into $1 billion of starts over the next three years.

- For 2026, guidance includes 3.25%–3.75% same-property NOI growth, mid-5%–6% FFO/share growth (ex-refinancing impact), supported by A3/A- ratings, 5.0–5.5x leverage and $1.5 billion of available credit.

- Delivered 5.3% same-property NOI growth, supported by rent commencement and redevelopment, and achieved a record 94.2% shop occupancy at year-end.

- Recorded strong leasing spreads with 12% cash rent, 13% renewal, and 25% gap rent spreads; over 95% of 2025 leases include annual rent steps.

- Deployed $825 million into accretive investments in 2025—$500 million in acquisitions and $300 million in development—and completed 13 projects totaling $160 million at a 9% blended return.

- Initiated $300 million+ of new ground-up and redevelopment starts in 2025, maintaining an in-process pipeline of $600 million and visibility to $1 billion of starts over the next three years.

- Guided $325 million of 2026 development and redevelopment spend, with approximately two-thirds allocated to ground-up projects.

- Regency delivered full-year NAREIT FFO per share growth of ~8% and Core Operating EPS growth of ~7%, driven by same-property NOI growth of over 5% in 2025.

- 2026 guidance calls for same-property NOI growth of 3.25%–3.75%, with Q1 expected above and Q2 below the full-year range, and a 100–150 bp headwind from debt refinancing factored in.

- The company deployed >$825 million of accretive investments in 2025 (>$500 million in acquisitions; $300 million in development/redevelopment), with a $600 million in-process pipeline and visibility to $1 billion of project starts over the next three years.

- Operational fundamentals remain robust: same-property NOI up 5.3%, average commencement rate +150 bps, shop occupancy at 94.2%, Q4 cash rent spreads 12%, renewal spreads 13%, and gap rent spreads 25%.

- Regency Centers’ portfolio consists of 85%+ grocery-anchored centers across 480 properties; net debt & preferred stock to trailing-12 month EBITDAre at 5.1x with ~$1.4 B revolver availability.

- 2025 reported per diluted share: Net Income $2.82, Nareit FFO $4.64, Core Operating Earnings $4.41.

- 2026 guidance per diluted share: Net Income $2.35–$2.39, Nareit FFO $4.83–$4.87, Core Operating Earnings $4.59–$4.63.

- Same property NOI growth (excl. termination fees) expected at +3.25%–+3.75% in 2026.

- Q4 2025 completions include 13 projects totaling $164 M, with $90 M+ in ground-up developments.

- Net income per diluted share was $1.09 in Q4 (vs. $0.46 in Q4 2024) and $2.82 for the full year (vs. $2.11 in 2024).

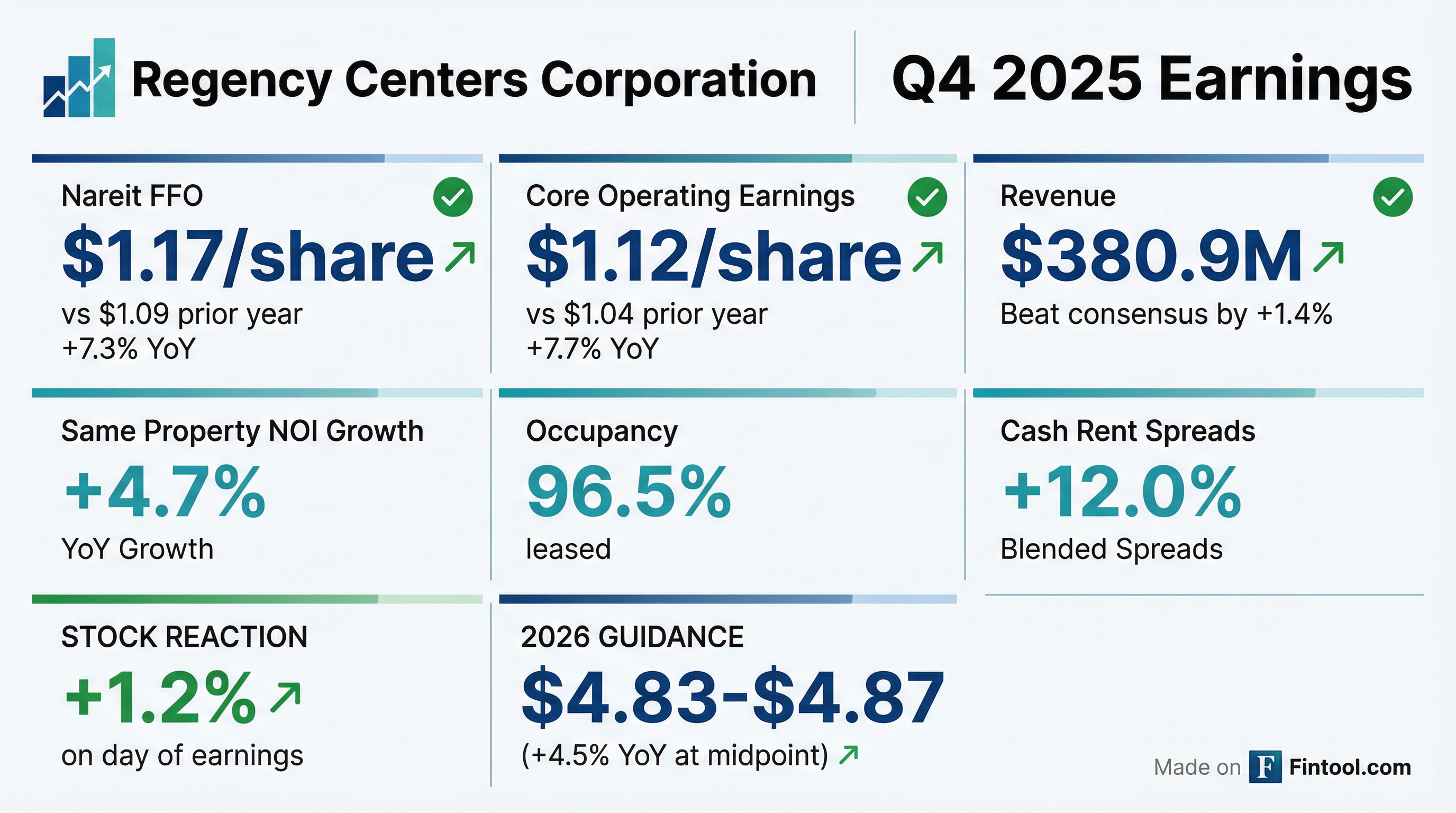

- Nareit FFO per diluted share was $1.17 in Q4 and $4.64 for the year; Core Operating Earnings were $1.12 in Q4 and $4.41 for the year.

- Same Property NOI grew by 4.7% in Q4 and 5.3% for the full year (excluding termination fees), with occupancy at 96.5% as of December 31, 2025.

- Declared a quarterly cash dividend of $0.755 per share on February 4, 2026; pro-rata net debt and preferred stock to TTM operating EBITDAre was 5.1x as of year-end.

- Regency reported Net Income Attributable to Common Shareholders per diluted share of $1.09 for Q4 2025 (vs. $0.46 in Q4 2024) and $2.82 for FY 2025 (vs. $2.11 in FY 2024).

- Fourth quarter Nareit FFO was $1.17 per diluted share, and full-year Nareit FFO was $4.64 per diluted share, representing 7.9% growth year-over-year.

- Same Property NOI (excluding termination fees) rose 4.7% in Q4 and 5.3% for FY 2025, with portfolio occupancy at 96.5% as of December 31, 2025.

- Executed 6.8 million sq ft of comparable new and renewal leases in 2025 at +10.8% cash rent spread and +21.4% straight-lined rent spread.

- Provided initial 2026 guidance with Nareit FFO per diluted share of $4.83–$4.87 and Same Property NOI growth of +3.25% to +3.75%.

- Delivered strong operating performance with 5.25–5.5% same-property NOI growth guidance, driven by robust leasing activity and low bad debt.

- Raised full-year outlook to mid-7% NAREIT FFO growth and mid-6% core operating earnings growth, reflecting higher organic NOI and accretive capital deployment.

- Deployed over $750 million of capital year-to-date into acquisitions, ground-up development, and redevelopments; expects $10 million of incremental NOI from 2026 ground-up projects.

- Increased the quarterly dividend by more than 7%, underscoring commitment to returning cash to shareholders.

- Maintains an A-rated balance sheet with leverage within the 5–5.5× target range and nearly full availability on its $1.5 billion credit facility.

- Regency delivered ~5% same-property NOI growth, driven by 4.7% base rent growth, with occupancy at 96.4%.

- Invested $170 million in new development starts in Q3 (YTD $220 million), expects $300 million of starts in 2025, and completed a $350 million five-property acquisition in South Orange County.

- Raised full-year guidance to 5.25%–5.5% same-property NOI growth; NAREIT FFO now expected to grow mid-7%, core operating earnings mid-6%, and increased the dividend by >7%.

- Maintained a strong balance sheet with 5x–5.5x leverage, near-full availability on its $1.5 billion credit facility, and provided early 2026 outlook of mid-3% same-property NOI growth, mid-6% total NOI growth, and mid-4% NAREIT FFO growth.

- YTD 2025 Nareit FFO per diluted share was $3.46; full-year 2025 guidance for Nareit FFO is $4.62–$4.64 per share and Core Operating Earnings (COE) is $4.39–$4.41 per share, implying mid-7% y/y FFO growth at the midpoint.

- Full-year 2025 net income per diluted share guidance is $2.30–$2.32; YTD actual was $1.73 per share.

- Same-property NOI growth is expected to be 5.25%–5.50%, driven by lease renewals, rent step-ups and net acquisition activity.

- Portfolio comprises over 480 open-air shopping centers, with $668 million of development and redevelopment projects in process; operating platform spans 25+ offices nationwide.

- Balance sheet remains strong with net debt & preferred stock to trailing-12M EBITDAre of 5.3x, $1.5 billion revolver availability, and credit ratings of Moody’s A3 / S&P A-.

- Regency updated its 2025 Nareit FFO per diluted share guidance to $4.62–$4.64, up 2¢ at the midpoint, implying mid-7% y/y growth, driven by Same Property NOI growth of +5.25%–+5.5%.

- Maintains a strong balance sheet with Net Debt & Preferred Stock to TTM EBITDAre of 5.3x, sector-leading ratings (Moody’s A3 / S&P A-), and ~$1.5 B revolver availability as of 9/30/25.

- Portfolio comprises 85%+ grocery-anchored open-air centers across 480+ properties, underpinned by $668 M of development and redevelopment projects in process.

- Signed-not-occupied pipeline shows a 200 bp leased-to-commenced occupancy gap (~$36 M incremental ABR), with 32% of SNO leases expected to commence by YE 2025 and 99% by YE 2026.

Quarterly earnings call transcripts for REGENCY CENTERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more