Earnings summaries and quarterly performance for Under Armour.

Executive leadership at Under Armour.

Kevin Plank

President and Chief Executive Officer

David Bergman

Chief Financial Officer

Kara Trent

President, Americas

Mehri Shadman

Executive Vice President, Chief Legal Officer & Corporate Secretary

Reza Taleghani

Executive Vice President and Chief Financial Officer (effective Feb 2026)

Shawn Curran

Chief Supply Chain Officer

Yassine Saidi

Chief Product Officer

Board of directors at Under Armour.

Carolyn Everson

Director

David Gibbs

Director

Dawn Fitzpatrick

Director

Douglas Coltharp

Director

Eric Olson

Director

Eugene Smith

Director

Jerri DeVard

Director

Mohamed El-Erian

Chair of the Board of Directors

Patrick Whitesell

Director

Robert Sweeney

Director

Research analysts who have asked questions during Under Armour earnings calls.

Jay Sole

UBS

6 questions for UAA

Simeon Siegel

BMO Capital Markets

6 questions for UAA

Laurent Vasilescu

BNP Paribas S.A.

3 questions for UAA

Peter McGoldrick

Stifel

3 questions for UAA

Robert Drbul

Guggenheim Securities

3 questions for UAA

Samuel Poser

Williams Trading, LLC

3 questions for UAA

Brooke Roach

Goldman Sachs Group, Inc.

2 questions for UAA

Jim Duffy

Stifel Financial Corp.

2 questions for UAA

Kelly Crago

Citigroup Inc.

2 questions for UAA

Paul Lejuez

Citigroup

2 questions for UAA

Sam Poser

Williams Trading LLC

2 questions for UAA

Bob Drbul

Guggenheim Securities

1 question for UAA

Bob Drubel

BTIG

1 question for UAA

Brian Nagel

Oppenheimer & Co. Inc.

1 question for UAA

Chris

TD Cowen

1 question for UAA

Geoff Lowery

Redburn

1 question for UAA

Recent press releases and 8-K filings for UAA.

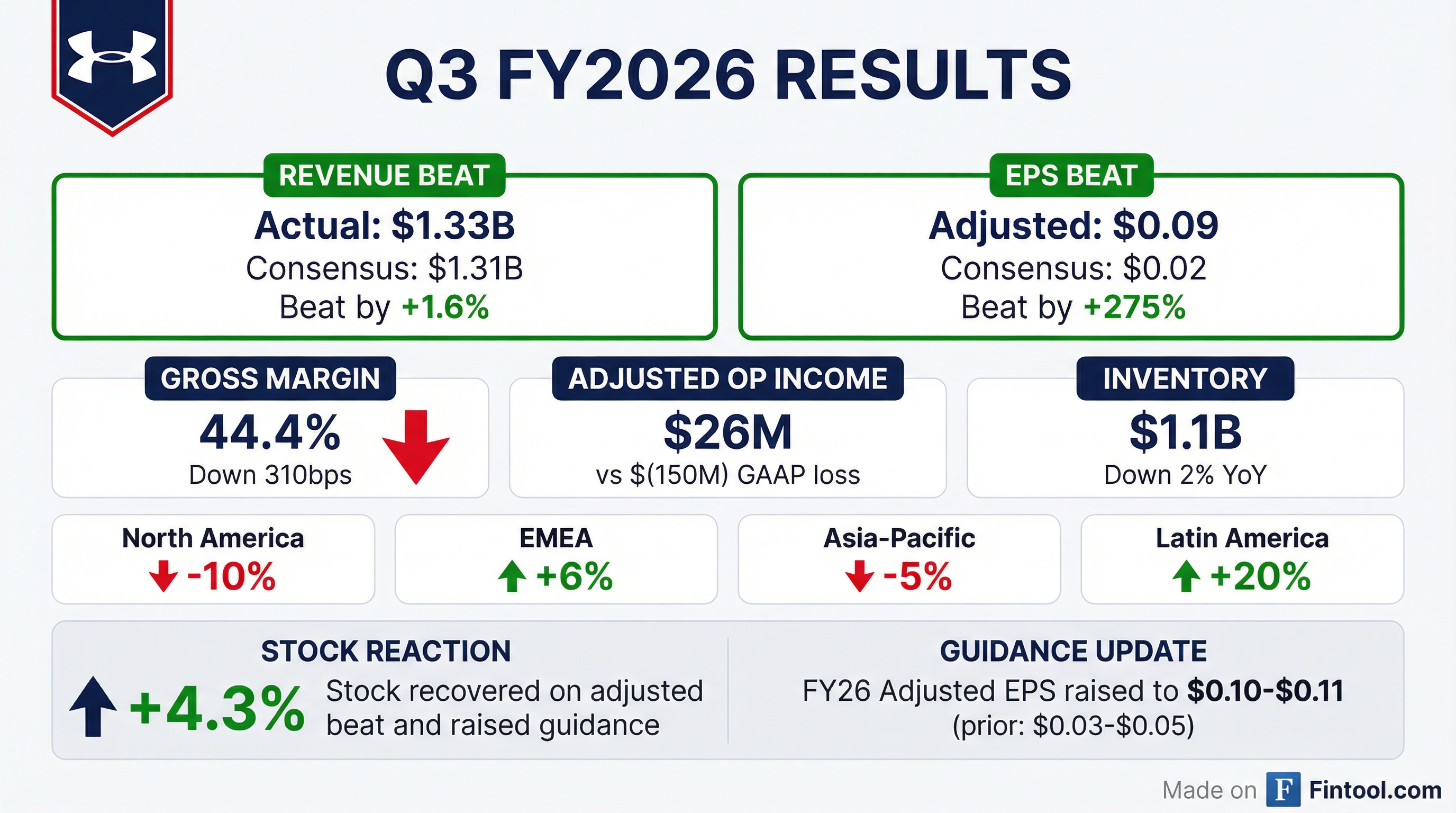

- Under Armour reported a 5% decline in Q3 2026 revenue to $1.3 billion, with gross margin down 310 basis points year over year to 44.4%, and adjusted diluted EPS at $0.09. The reported diluted loss per share was $1.01, which included a $247 million non-cash valuation allowance against certain U.S. federal deferred tax assets.

- For fiscal year 2026, the company updated its outlook, now expecting full-year revenue to decline approximately 4% (compared to a prior expectation of 4%-5%) and adjusted operating income to be approximately $110 million (at the high end of the $95-$110 million range). Adjusted diluted EPS is projected to be $0.10-$0.11.

- Management stated that the most disruptive phase of its turnaround is now behind the company, with a focus on execution and stabilization. Inventory is down year-over-year, and the elimination of 25% of SKUs is complete.

- North America is beginning to turn the corner, with the December quarter marking the bottom of the reset, while EMEA remains solid, and APAC is positioning for stabilization over the next 12 months.

- Under Armour reported a 5% decline in Q3 2026 revenue to $1.3 billion, with gross margin decreasing 310 basis points year-over-year to 44.4%. The company also recorded a $99 million litigation reserve expense and $75 million in restructuring charges in Q3.

- The company modestly raised its full-year adjusted operating income outlook to approximately $110 million and expects adjusted diluted earnings per share of $0.10-$0.11, with full-year revenue now projected to decline approximately 4%.

- CEO Kevin Plank stated that the most disruptive phase of the company's reset is now behind them, with North America "beginning to turn the corner" and EMEA showing 6% reported revenue growth. However, footwear sales declined 14% year-to-date.

- CFO Dave Bergman is transitioning out of his role after nine years, and new leadership appointments were made, including Kara Trent as Chief Merchandising Officer and Eric Liedtke as Chief Marketing Officer.

- Under Armour reported Q3 2026 revenue of $1.3 billion, a 5% decline year-over-year, which was slightly better than its previous outlook.

- The company recorded a reported operating loss of $150 million and a reported diluted loss per share of $1.01 for Q3 2026, primarily due to non-recurring impacts such as a $99 million litigation reserve expense, $78 million in restructuring and transformation charges, and a $247 million non-cash deferred tax asset valuation allowance.

- Excluding these items, adjusted operating income was $26 million and adjusted diluted earnings per share was $0.09.

- Under Armour updated its fiscal year 2026 outlook, now projecting full-year revenue to decline approximately 4% (an improvement from the prior 4%-5% decline) and adjusted operating income of approximately $110 million (at the high end of the previous $95-$110 million range).

- The company announced leadership changes, including Kara Trent as Chief Merchandising Officer, Adam Peake as President of the Americas, and Eric Liedtke as Chief Marketing Officer and EVP of Strategy, while CFO Dave Bergman is transitioning out of his role.

- Under Armour reported Q3 Fiscal 2026 revenue of $1.33 billion, a 5 percent decrease from the prior year, with North America revenue declining 10 percent.

- The company recorded a net loss of $431 million and a diluted loss per share of $1.01, primarily due to a $247 million valuation allowance on U.S. federal deferred tax assets. Adjusted diluted earnings per share for the quarter were $0.09.

- Gross margin for Q3 Fiscal 2026 declined 310 basis points to 44.4 percent, mainly due to higher tariffs, pricing headwinds, and an unfavorable channel and regional mix.

- For Fiscal 2026, Under Armour updated its outlook, now expecting revenue to decline approximately 4 percent and adjusted diluted earnings per share to range from $0.10 to $0.11.

- Under Armour, Inc. announced on November 13, 2025, plans to separate Curry Brand from Under Armour, making Curry Brand independent. The company does not anticipate a significant effect on its consolidated financial results or profitability from this separation.

- The separation is part of an expanded fiscal 2025 restructuring plan, which increases total estimated pre-tax charges by $95 million to $255 million. As of September 30, 2025, approximately $147 million of these charges had been incurred.

- Under Armour raised its fiscal 2026 adjusted operating income outlook to $95 million to $110 million, up from the previous range of $90 million to $105 million.

- Under Armour, Inc. (UAA) reported a 5% decrease in revenue to $1.3 billion for the second quarter of fiscal 2026, resulting in a GAAP net loss of $19 million and a diluted loss per share of $0.04.

- The company's gross margin declined by 250 basis points to 47.3% in Q2 fiscal 2026, primarily due to supply chain headwinds, increased tariffs, and an unfavorable channel and regional mix.

- For fiscal year 2026, Under Armour expects revenue to decrease 4% to 5%, GAAP operating income to range from $19 million to $34 million, and GAAP diluted loss per share to be between $0.15 and $0.17.

- Reza Taleghani will join Under Armour as Executive Vice President and Chief Financial Officer in February 2026, succeeding David Bergman.

- Under Armour repurchased $25 million of its Class C common stock in the second quarter of fiscal 2026, bringing the total repurchased to $115 million under its $500 million program.

Fintool News

In-depth analysis and coverage of Under Armour.

Quarterly earnings call transcripts for Under Armour.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more