Earnings summaries and quarterly performance for AUTOLIV.

Executive leadership at AUTOLIV.

Mikael Bratt

President and Chief Executive Officer

Anthony Nellis

Executive Vice President, Legal Affairs; General Counsel; and Secretary

Christian Swahn

Executive Vice President, Global Supply Chain Management

Colin Naughton

President, Autoliv Asia

Fabien Dumont

Executive Vice President, Chief Technology Officer

Fredrik Westin

Chief Financial Officer and Executive Vice President, Finance

Jonas Jademyr

Executive Vice President, Quality and Program Management

Kevin Fox

President, Autoliv Americas

Magnus Jarlegren

President, Autoliv Europe

Mikael Hagström

Vice President, Corporate Control

Petra Albuschus

Executive Vice President, Human Resources and Sustainability

Sng Yih

President, Autoliv China

Staffan Olsson

Executive Vice President, Operations

Board of directors at AUTOLIV.

Adriana Karaboutis

Director

Franz-Josef Kortüm

Director

Frédéric Lissalde

Director

Gustav Lundgren

Director

Jan Carlson

Chairman of the Board

Laurie Brlas

Director

Leif Johansson

Director

Martin Lundstedt

Director

Ted Senko

Director

Xiaozhi Liu

Director

Research analysts who have asked questions during AUTOLIV earnings calls.

Hampus Engellau

Handelsbanken Capital Markets

8 questions for ALV

Agnieszka Vilela

Nordea

7 questions for ALV

Colin Langan

Wells Fargo & Company

6 questions for ALV

Emmanuel Rosner

Wolfe Research

6 questions for ALV

Jairam Nathan

Daiwa Capital Markets

6 questions for ALV

Dan Levy

Barclays PLC

4 questions for ALV

Tom Narayan

RBC Capital Markets

4 questions for ALV

Chris McNally

Evercore ISI

3 questions for ALV

Erik Pettersson-Golrang

SEB

3 questions for ALV

Vijay Rakesh

Mizuho

3 questions for ALV

Colin M. Langan

Wells Fargo Securities

2 questions for ALV

Edison Yu

Deutsche Bank

2 questions for ALV

George Galliers-Pratt

Goldman Sachs

2 questions for ALV

Mattias Holmberg

DNB Markets

2 questions for ALV

Michael Aspinall

Jefferies

2 questions for ALV

Winnie Dong

Deutsche Bank

2 questions for ALV

Xin Yu

Deutsche Bank

2 questions for ALV

Björn Enarson

Danske Bank

1 question for ALV

Elias Cohen

Neuberger Berman

1 question for ALV

Karl Bokvist

ABG Sundal Collier

1 question for ALV

Michael Jacks

Bank of America

1 question for ALV

Trevor Young

Barclays

1 question for ALV

Winnie

Deutsche Bank

1 question for ALV

Recent press releases and 8-K filings for ALV.

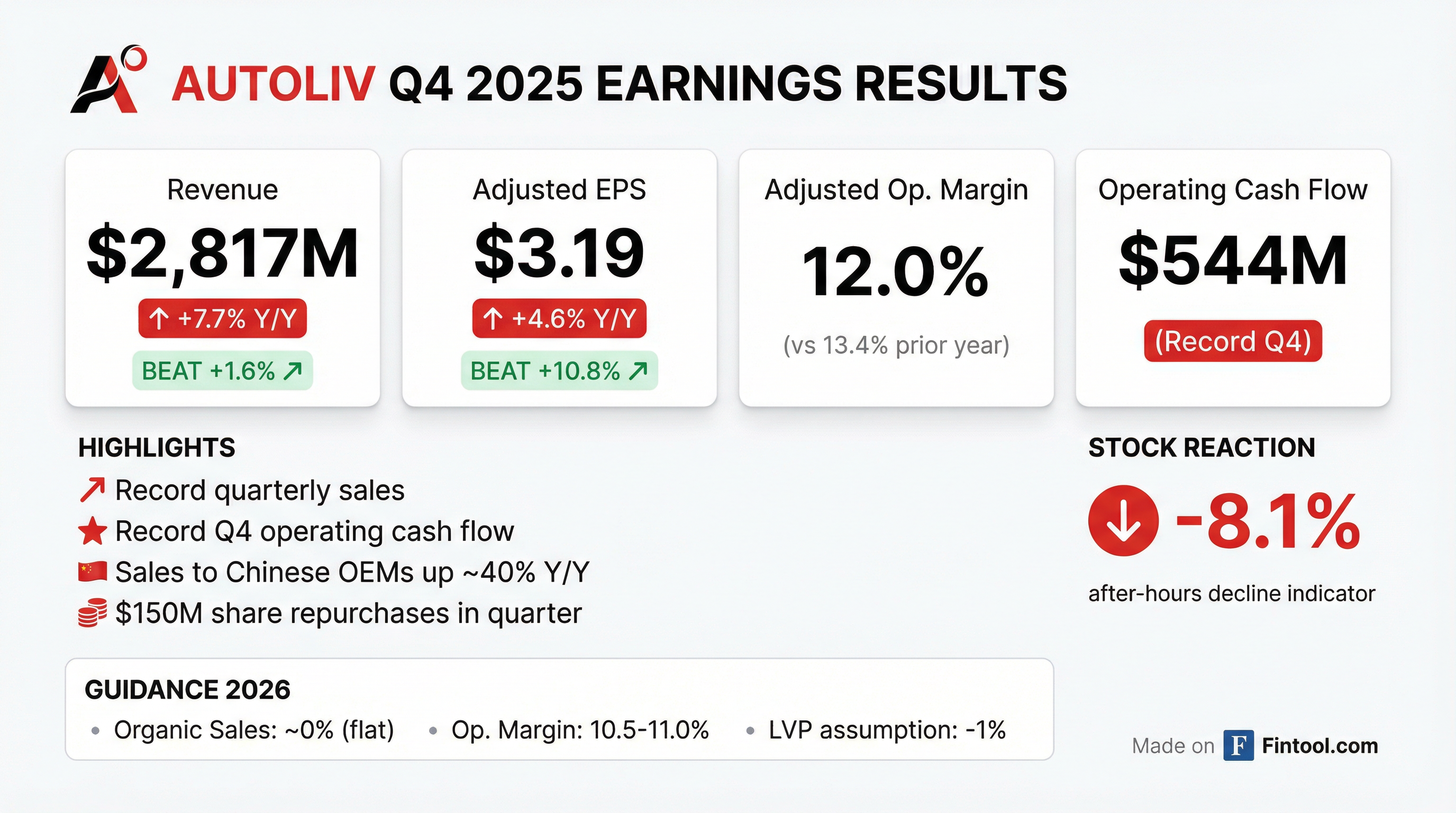

- Autoliv reported record high sales for both Q4 and the full year 2025, with net sales of $2.8 billion in Q4 2025 (an 8% increase year-over-year) and $10.8 billion for the full year (a 4% increase compared to 2024).

- The company achieved record operating and free operating cash flow for Q4 and the full year 2025, with $544 million in operating cash flow for Q4 and $1.2 billion for the full year. Adjusted earnings per share (EPS) rose 18% to $9.85 for the full year, also a record.

- For 2026, Autoliv expects organic sales to be flat and to outperform light vehicle production by approximately 1 percentage point. The adjusted operating margin is guided to be around 10.5%-11%, anticipating a $30 million raw material headwind and $20 million in structural cost savings.

- Strategic highlights include the development of the first foldable steering wheel for autonomous vehicles, targeted for volume production in late 2026, and continued strong sales growth in India and with Chinese OEMs. The company also returned $216 million to shareholders in Q4 2025.

- Autoliv reported record quarterly sales of $2,817 million in Q4 2025 and record annual sales of $10,815 million for FY 2025, driven by strong growth in India and China.

- The company achieved record adjusted EPS of $3.19 in Q4 2025 and $9.85 for FY 2025, with the full-year EPS rising 18%.

- ALV generated record operating cash flow of $544 million in Q4 2025 and $1,157 million for FY 2025, including $734 million in free operating cash flow for the full year.

- Shareholder returns in Q4 2025 included $150 million in share repurchases and a $0.87 per share dividend, contributing to total FY 2025 repurchases of $351 million and dividends of $3.12 per share.

- For 2026, Autoliv anticipates an organic sales increase of around 0% and an adjusted operating margin of approximately 10.5% to 11.0%, based on an expected -1% decrease in global Light Vehicle Production (LVP).

- ALV reported record quarterly sales of $2,817 million and record EPS of $3.19 for Q4 2025, with full-year 2025 sales reaching $10,815 million and adjusted EPS rising 18% to $9.85.

- The company generated record free operating cash flow of $434 million in Q4 2025 and $734 million for the full year, driven by working capital improvement and reduced Capex.

- Shareholder returns included $150 million in share repurchases and a $0.87 per share dividend in Q4 2025, with full-year repurchases totaling $351 million and dividends of $3.12 per share.

- For 2026, ALV forecasts an adjusted operating margin of 10.5% to 11.0% and operating cash flow of approximately $1.2 billion, despite an expected 1% decrease in global Light Vehicle Production.

- Autoliv (ALV) reported record financial results for the full year 2025, with net sales reaching $10.8 billion, adjusted operating income of $1.1 billion, and adjusted earnings per share of $9.85, marking an 18% increase.

- In Q4 2025, consolidated sales were over $2.8 billion, an 8% increase compared to Q4 2024, and the company outperformed the global light vehicle production (LVP) market by 3 percentage points.

- For the full year 2026, Autoliv expects flat organic sales, anticipating a 1% decline in global LVP, but projects the adjusted operating margin to be around 10.5%-11% and operating cash flow to be around $1.2 billion.

- The company returned significant capital to shareholders in 2025, paying $3.12 per share in dividends and repurchasing $351 million in shares, and initiated a new $2.5 billion share repurchase program.

- Autoliv reported record high sales for both Q4 and the full year 2025, with Q4 sales increasing 8% year-over-year to over $2.8 billion and full year net sales reaching $10.8 billion, up 4% from 2024.

- The company achieved record earnings per share for both the quarter and full year, with adjusted EPS rising 18% to $9.85 for the full year 2025.

- Autoliv delivered record operating and free operating cash flow for both Q4 and the full year, generating $734 million in free operating cash flow for 2025.

- For 2026, Autoliv expects flat organic sales and an adjusted operating margin of around 10.5%-11%, anticipating to outperform light vehicle production by approximately 1 percentage point.

- The company returned approximately $590 million to shareholders in 2025 through dividends and share buybacks, and reduced its debt leverage ratio to 1.1x.

- Autoliv reported Q4 2025 net sales of $2,817 million, an increase of 7.7%, with 4.2% organic sales growth that outperformed global Light Vehicle Production.

- For the full year 2025, Autoliv achieved record net sales of $10,815 million, operating income of $1,088 million, and diluted earnings per share of $9.55.

- The company generated record operating cash flow of $544 million in Q4 2025 and $1,157 million for the full year, while also returning capital to shareholders through a $0.87 per share dividend and repurchasing 1.26 million shares.

- Autoliv issued full year 2026 guidance, expecting around 0% organic sales growth, an adjusted operating margin of 10.5-11.0%, and approximately $1.2 billion in operating cash flow.

- Autoliv reported record quarterly operating cash flow of $544 million and full-year operating cash flow of $1.157 billion in Q4 2025, but adjusted operating profit fell year-over-year to $337 million, leading to an approximate 9% decline in shares.

- For FY26, the company is targeting an adjusted operating margin of 10.5–11.0% and around $1.2 billion of operating cash flow.

- Management cautioned that Q1 2026 margins will be "considerably weaker" before improving later in the year.

- The company achieved organic net sales growth of 4.2% in Q4 2025, outperforming global light vehicle production by 2.9 percentage points.

- Autoliv paid a dividend of $0.87 per share (a 2.4% increase from Q3 2025) and repurchased/retired 1.26 million shares during the quarter.

- Autoliv, Inc. (ALV) announced a quarterly dividend of $0.87 per share for the fourth quarter of 2025, representing a 2.4% increase from the previous dividend of 85 cents per share.

- The dividend is payable on December 10, 2025, to holders of common stock and December 11, 2025, to holders of Swedish Depository Receipts, for shareholders of record as of November 21, 2025.

- This increased dividend results in an annualized total dividend of approximately $260 million.

- Autoliv, Inc. issued EUR 300,000,000 in notes on October 29, 2025, with a 3.000% coupon rate per annum and a maturity date of October 29, 2030.

- The notes were issued at 99.771% of their aggregate nominal amount and are expected to be rated Baa1 by Moody's and BBB+ by Fitch Ratings.

- The net proceeds from the offering will be allocated to new or existing Eligible Projects in categories such as Clean Transportation, Renewable Energy, Energy Efficiency, or De-carbonization of Operations and Products.

- Autoliv reported record-breaking Q3 2025 sales and earnings, with net sales increasing 6% year-over-year to approximately €2.7 billion and adjusted operating margin rising 70 basis points to 10%. Adjusted diluted EPS grew 26% or by $0.48, marking the ninth consecutive quarter of growth.

- The company maintained a strong financial position with €258 million in operating cash flow and a low leverage ratio of 1.3 times. This supported increased shareholder returns, including a quarterly dividend of $0.85 per share and $100 million in share repurchases during the quarter.

- Autoliv is strategically expanding in China with investments in a second R&D center and a joint venture with HSAE for advanced safety electronics, alongside significant organic growth in India. The company also successfully recovered approximately 75% of Q3 tariff costs.

- For the full year 2025, Autoliv expects organic sales to increase by around 3% and projects an adjusted operating margin in the middle of its 10% to 10.5% guided range, with operating cash flow anticipated to be around USD $1.2 billion.

Quarterly earnings call transcripts for AUTOLIV.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more