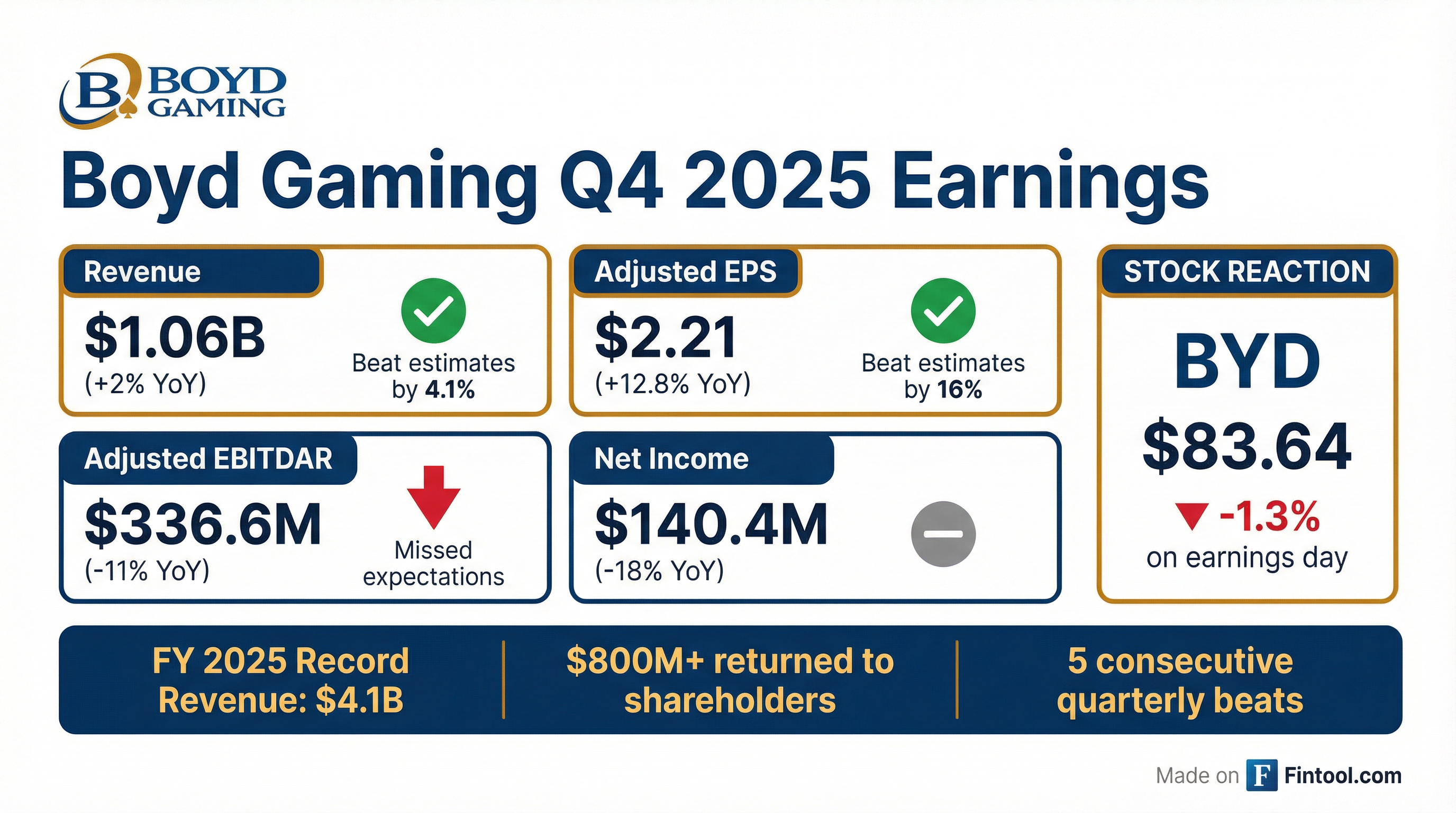

Earnings summaries and quarterly performance for BOYD GAMING.

Executive leadership at BOYD GAMING.

Keith Smith

President and Chief Executive Officer

Josh Hirsberg

Chief Financial Officer and Treasurer

Lori Nelson

Chief Accounting Officer

Marianne Boyd Johnson

Executive Chairman

Stephen Thompson

Chief Administrative Officer

Uri Clinton

General Counsel and Corporate Secretary

Board of directors at BOYD GAMING.

Research analysts who have asked questions during BOYD GAMING earnings calls.

David Katz

Jefferies Financial Group Inc.

8 questions for BYD

Steven Wieczynski

Stifel

7 questions for BYD

Brandt Montour

Barclays PLC

6 questions for BYD

Chad Beynon

Macquarie

6 questions for BYD

John DeCree

CBRE

6 questions for BYD

Jordan Bender

JMP Securities

6 questions for BYD

Barry Jonas

Truist Securities

5 questions for BYD

Benjamin Chaiken

Mizuho Financial Group, Inc.

5 questions for BYD

Shaun Kelley

Bank of America Merrill Lynch

4 questions for BYD

Stephen Grambling

Morgan Stanley

4 questions for BYD

Carlo Santarelli

Deutsche Bank

3 questions for BYD

Daniel Politzer

Wells Fargo

3 questions for BYD

Ben Chaiken

Mitsui

2 questions for BYD

Daniel Politzer

JPMorgan Chase & Co.

2 questions for BYD

Dan Politzer

Wells Fargo

2 questions for BYD

David Hargreaves

Barclays

2 questions for BYD

Joseph Stauff

Susquehanna Financial Group, LLLP

2 questions for BYD

Max Marsh

CBRE Group, Inc.

2 questions for BYD

Patrick Scholes

Truist Financial Corporation

2 questions for BYD

Steven Pizzella

Jefferies

2 questions for BYD

Joseph Greff

JPMorgan Chase & Co.

1 question for BYD

Patrick Kee

Truist Securities

1 question for BYD

Steve Pizzella

Deutsche Bank

1 question for BYD

Steve Wieczynski

Stifel Financial Corp.

1 question for BYD

Recent press releases and 8-K filings for BYD.

- Boyd Gaming achieved record company-wide revenues and EBITDA of approximately $1.4 billion for the full year 2025, with property level margins remaining at 40%.

- In 2025, the company generated nearly $1.8 billion from its FanDuel ownership interest, which helped reduce total leverage to 1.7 times and allowed for $836 million to be returned to shareholders through dividends and share repurchases, decreasing the total share count by 11%.

- For 2026, Boyd Gaming projects capital expenditures of $650 million-$700 million and expects to maintain share repurchases of approximately $150 million per quarter, totaling more than $650 million per year in capital returns. The online segment is projected to generate EBITDAR of $30 million-$35 million, and the managed and other business $110 million-$114 million.

- Boyd Gaming achieved record company-wide revenues for the full year 2025, with full-year EBITDA of approximately $1.4 billion and property level margins of 40%. For Q4 2025, revenues were $1.1 billion and EBITDA was $337 million.

- The company returned over $800 million to shareholders in 2025 through dividends and share repurchases, reducing the total share count by 11%. They anticipate maintaining repurchases of approximately $150 million per quarter and regular quarterly dividends, totaling over $650 million per year.

- Leverage stood at 1.7x at year-end 2025, with an expectation to approach 2.5x in 2026 due to tax credit payments and capital investments. Key growth initiatives for 2026 include the opening of Cadence Crossing Casino in late Q1, completion of the Suncoast modernization project in Q3, and continued growth from Boyd Interactive and Sky River Casino management fees, with projected 2026 capital expenditures of $650 million-$700 million.

- While the Las Vegas Locals segment showed strong play from Southern Nevada residents, Q4 2025 results were impacted by a decline in destination business, particularly in cash hotel revenues.

- Boyd Gaming achieved record company-wide revenues and approximately $1.4 billion in EBITDA for the full year 2025, maintaining property level margins at 40%.

- The company returned $836 million to shareholders in 2025 through dividends and share repurchases, reducing the total share count by 11%, and plans to continue repurchasing approximately $150 million per quarter in 2026.

- In 2025, Boyd Gaming generated nearly $1.8 billion from its FanDuel ownership interest, which was utilized to reduce total leverage to 1.7 times; however, leverage is anticipated to approach 2.5 times in 2026 due to tax payments and capital investments.

- Capital expenditures for 2026 are projected to be $650 million-$700 million, allocated towards growth projects such as Cadence Crossing, the Virginia resort, and Par-A-Dice development, alongside property enhancements.

- While play from core and retail customers remained strong, the company noted continued weakness in destination business, particularly impacting cash hotel revenues in the Las Vegas Locals segment.

- Boyd Gaming Corporation reported Q3 2025 revenues exceeding $1 billion and EBITDA of $322 million, with company-wide margins consistent with the prior year at 37%.

- The company increased its online segment EBITDA guidance for 2025 to $60 million and expects $30 million in EBITDA for 2026.

- Capital expenditures for Q3 2025 were $146 million, bringing year-to-date expenditures to $440 million, with a full-year 2025 expectation of approximately $600 million. Significant growth projects include a $750 million resort development in Norfolk, Virginia, with the permanent resort scheduled to open in November 2027.

- During Q3 2025, Boyd Gaming repurchased $160 million in stock and paid $15 million in dividends, and intends to maintain $150 million per quarter in share repurchases going forward.

- The company's total leverage ratio significantly declined from 2.8x in Q2 2025 to 1.5x in Q3 2025, following the FanDuel transaction and debt repayment.

- Boyd Gaming Corporation reported Q3 2025 revenues exceeding $1 billion and EBITDA of $322 million, with company-wide margins consistent with the prior year at 37%.

- The company is increasing its online segment EBITDA guidance for 2025 to $60 million and expects $30 million for 2026.

- Total capital expenditures for 2025 are projected to be approximately $600 million, including $100 million for growth capital and $150 million for the Virginia casino development. Key growth projects include Cadence Crossing opening in Q2 2026 and the $750 million Norfolk, Virginia resort scheduled to open in November 2027.

- In Q3 2025, Boyd Gaming repurchased $160 million in stock and paid $15 million in dividends, bringing year-to-date shareholder returns to $637 million. The company intends to maintain $150 million per quarter in share repurchases.

- The company's leverage ratio significantly decreased from 2.8 times at the end of Q2 to 1.5 times at the end of Q3 2025, following the FanDuel transaction.

- Boyd Gaming Corporation has partnered with Fanatics Betting and Gaming for mobile sports betting and retail sportsbooks in Missouri.

- Under the multi-year agreement, Fanatics Sportsbook will operate online betting under Boyd’s license and open Fanatics-branded retail sportsbooks at Boyd’s Ameristar Casino Hotel Kansas City and Ameristar Casino Resort and Spa St. Charles.

- The launch of online and retail betting products in Missouri is planned for this December, contingent upon receipt of all required regulatory approvals.

Quarterly earnings call transcripts for BOYD GAMING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more