Earnings summaries and quarterly performance for CME GROUP.

Executive leadership at CME GROUP.

Terrence A. Duffy

Chairman and Chief Executive Officer

Derek Sammann

Senior Managing Director, Global Head of Commodities Markets

Hilda Harris Piell

Chief Human Resources Officer

Jack Tobin

Managing Director and Chief Accounting Officer

Jonathan Marcus

Senior Managing Director and General Counsel

Julie Winkler

Chief Commercial Officer

Kendal Vroman

Chief Transformation Officer

Lynne Fitzpatrick

President and Chief Financial Officer

Michael Dennis

Senior Managing Director, Global Head of Fixed Income

Sunil Cutinho

Chief Information Officer

Suzanne Sprague

Chief Operating Officer and Global Head of Clearing

Tim McCourt

Senior Managing Director, Global Head of Equities, FX and Alternate Products

Board of directors at CME GROUP.

Bryan T. Durkin

Director

Charles P. Carey

Director

Daniel G. Kaye

Director

Deborah J. Lucas

Director

Dennis A. Suskind

Lead Independent Director

Elizabeth A. Cook

Director

Harold Ford Jr.

Director

Howard J. Siegel

Director

Kathryn Benesh

Director

Martin J. Gepsman

Director

Patrick J. Mulchrone

Director

Patrick W. Maloney

Director

Phyllis M. Lockett

Director

Rahael Seifu

Director

Robert J. Tierney Jr.

Director

Timothy S. Bitsberger

Director

William R. Shepard

Director

William W. Hobert

Director

Research analysts who have asked questions during CME GROUP earnings calls.

Brian Bedell

Deutsche Bank

9 questions for CME

Michael Cyprys

Morgan Stanley

9 questions for CME

Craig Siegenthaler

Bank of America

8 questions for CME

Patrick Moley

Piper Sandler & Co.

8 questions for CME

Dan Fannon

Jefferies & Company Inc.

6 questions for CME

Kenneth Worthington

JPMorgan Chase & Co.

6 questions for CME

Kyle Voigt

Keefe, Bruyette & Woods

6 questions for CME

Alex Kramm

UBS Group AG

5 questions for CME

Benjamin Budish

Barclays PLC

5 questions for CME

Christopher Allen

Citigroup

5 questions for CME

Simon Clinch

Redburn Atlantic

5 questions for CME

Ben Budish

Barclays PLC

4 questions for CME

William Katz

TD Cowen

4 questions for CME

Alexander Blostein

Goldman Sachs

3 questions for CME

Ashish Sabadra

RBC Capital Markets

3 questions for CME

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for CME

Kwun Sum Lau

Oppenheimer

3 questions for CME

Anthony Valentini

Goldman Sachs

2 questions for CME

Bill Katz

TD Securities

2 questions for CME

Chris Allen

Citi

2 questions for CME

Eli Abboud

Bank of America

2 questions for CME

Ken Worthington

JPMorgan

2 questions for CME

Owen Lau

Oppenheimer & Co. Inc.

2 questions for CME

Will Chi

RBC Capital Markets

2 questions for CME

William Qi

RBC Capital Markets

2 questions for CME

Kyle Voit

KBW

1 question for CME

Simon Alistair Clinch

Redburn Atlantic

1 question for CME

Recent press releases and 8-K filings for CME.

- Record trading volumes in 2025, with average daily volume up 6% to 2,128.1 million contracts, marking the fifth consecutive annual record across all asset classes.

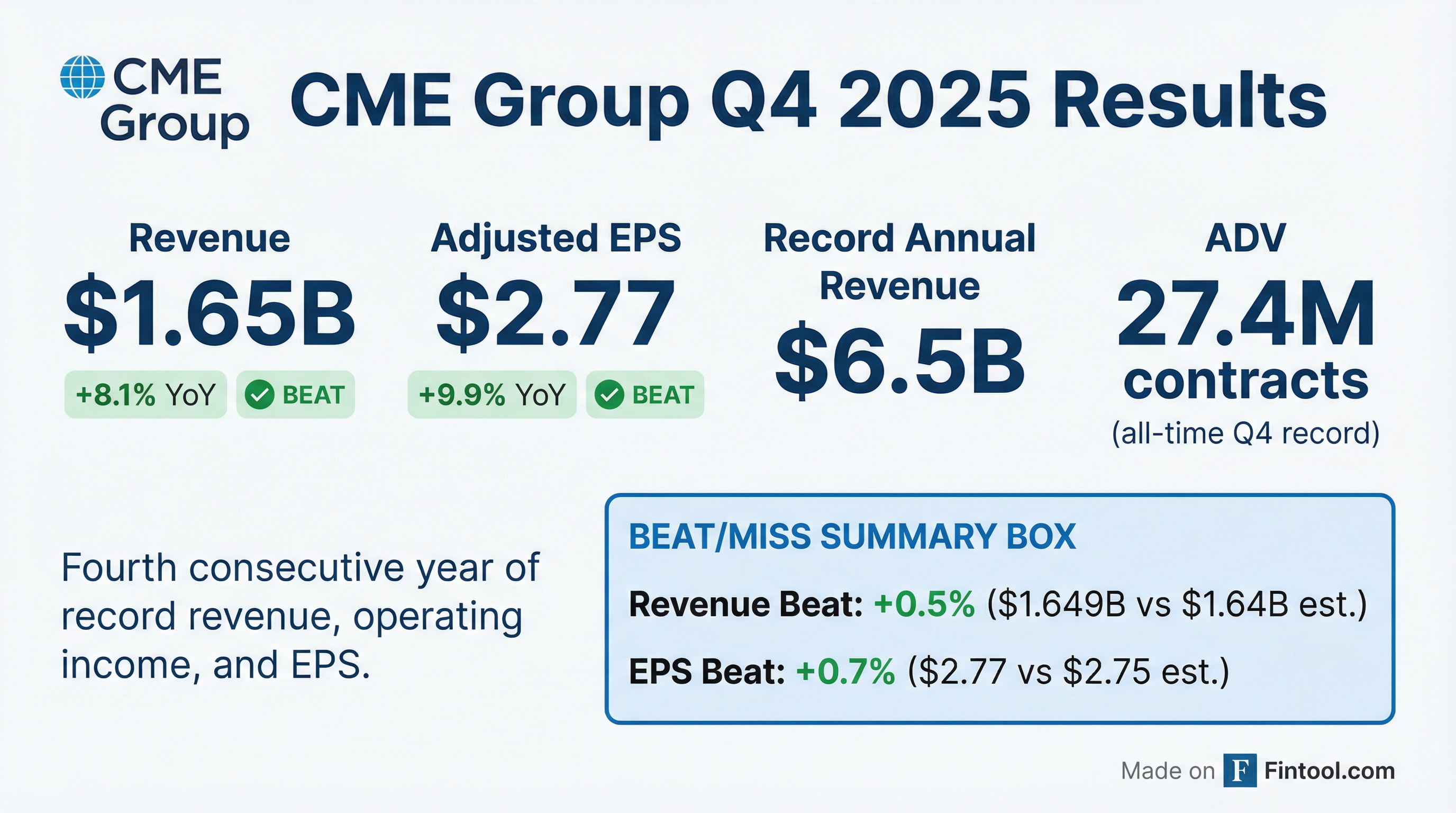

- 2025 financial highlights: revenue of $6.5 billion (+6% YoY); adjusted net income of $4.1 billion; Q4 revenue of $1.65 billion (+8% YoY); Q4 adjusted EPS of $1.0277 (+10% YoY).

- Strategic product launches drove growth: over 68 million Event Contracts traded in first 6 weeks; Micro products reached a Q4 record 4.4 million contracts/day (+59%); crypto ADV of 379,000 contracts (+92%, $13 billion notional), with new silver and crypto futures and 24/7 crypto trading planned.

- 2026 guidance: adjusted operating expenses (ex-license fees) of $1.695 billion; capital expenditures of $85 million; adjusted effective tax rate of 23.5%–24.5%; fee adjustments to lift revenues by 1%–1.5% on similar activity.

- Capital returns: cash balance of $4.6 billion (incl. $1.3 billion OSTTRA proceeds); share repurchases of $256 million in Q4 and $276 million YTD; Q4 dividends of $455 million (–2025 total $3.9 billion).

- Achieved 5th consecutive year of record volume, with average daily volume up 6% to 2,128.1M contracts and record international volume of 8.4M contracts/day.

- Posted 2025 revenue of $6.5B (+6%), adjusted net income of $4.1B (adj EPS +9%), Q4 revenue of $1.65B (+8%) and adj diluted EPS $1.0277 (+10%); guided 2026 adj opex (ex-license) to $1.695B, capex $85M, and tax rate 23.5%-24.5%.

- Expanded retail offerings: launched event contracts (68M traded in 6 weeks), grew microproducts 59% to 4.4M contracts/day, and to launch a 100-oz silver contract following 1-oz gold’s 66K/day volume.

- Cryptocurrencies saw Q4 avg daily volume of 379K (+92%), $13B notional/day; launching Cardano, Chainlink, and Stellar futures on Feb 9 and 24/7 crypto trading next quarter.

- Ended Q4 with $4.6B cash, repurchased $256M in Q4 (plus $276M in early 2026) and paid $455M in Q4 dividends ($3.9B in 2025).

- CME Group delivered record 2025 results with revenues of $6.5 billion (+6%), adjusted net income of $4.1 billion (9% EPS growth), and Q4 revenues of $1.65 billion (+8%) with Q4 adjusted EPS of $1.0277 (+10%).

- Achieved record volumes in 2025 with average daily volume of 2,128.1 million contracts (+6%), and provided customers with average daily margin offsets of $80 billion, up $20 billion year-over-year.

- Received SEC approval for CME Securities Clearing, set to launch in 2026, and expanded product suite with event contracts, 24/7 crypto trading, and a new 100-ounce silver contract, boosting retail engagement.

- Executed $256 million in share repurchases in Q4 and $276 million in early 2026; paid $455 million in Q4 dividends and $3.9 billion in dividends for full year 2025.

- Provided 2026 guidance targeting $1.695 billion in adjusted operating expenses, $85 million in capital expenditures, and an effective tax rate of 23.5%–24.5% to support growth initiatives.

- Q4 2025 revenue of $1.65 billion, operating income of $1.02 billion, net income of $1.18 billion and diluted EPS of $3.24.

- Full‐year 2025 revenue of $6.52 billion, operating income of $4.23 billion, net income of $4.07 billion and diluted EPS of $11.16.

- Record annual market data revenue of $803 million, up 13% year-over-year.

- Record average daily volume of 28.1 million contracts in 2025, including 12% growth in commodities and 5% in financials.

- Paid $3.9 billion in dividends in 2025; $30 billion returned to shareholders since 2012.

- Record annual revenue of $6.5 billion, up 6%, with market data revenue of $803 million, up 13%

- Full-year operating income of $4.2 billion, net income of $4.1 billion, and diluted EPS of $11.16 (adjusted $11.20)

- Fourth-quarter revenue of $1.6 billion, operating income of $1.0 billion, net income of $1.2 billion, and diluted EPS of $3.24 (adjusted $2.77)

- Record Q4 average daily volume of 27.4 million contracts, up 7%, alongside plans to expand U.S. Treasury clearing, 24/7 cryptocurrency trading and prediction markets

- CME Group reported a record January ADV of 29.6 million contracts, up 15% year-over-year.

- Interest Rate ADV led at 13.9 million contracts (+18%), with Equity Index at 7.3 million (+4%) and Energy at 3.6 million (+11%).

- Metals ADV jumped 218% to 2.2 million contracts, driven by record Micro Silver (438 k), Micro Copper (48 k) and 1-Ounce Gold (115 k) ADV.

- International ADV increased 19% to 9.2 million contracts—EMEA up 18% to 6.7 million and APAC up 25% to 2.2 million.

- Cryptocurrency ADV more than doubled (+106%) to 408 000 contracts (USD 10.8 billion notional).

- CME Group’s metals complex set a new single-day trading record of 3,338,528 contracts on January 26, 2026, up 18% from the prior high of 2,829,666 contracts on October 17, 2025.

- Micro Silver futures led the session with a record 715,111 contracts traded and 35,702 contracts in open interest, while Silver, Micro Gold and 1-Ounce Gold futures each ranked among the top five trading days for the metals complex.

- CME Group will launch 100-Ounce Silver futures on February 9, 2026, pending regulatory approval to meet increasing retail demand.

- CME Group will introduce futures contracts for Cardano (ADA), Chainlink (LINK) and Stellar (Lumens) on February 9, pending regulatory approval, with both standard and micro-sized contracts (e.g., 100,000 ADA and 10,000 ADA for ADA futures).

- The new listings expand CME’s crypto derivatives suite—already including Bitcoin, Ether, XRP and Solana—after the company achieved record 2025 ADV of 278,300 contracts ($12 billion notional) and average open interest of 313,900 contracts ($26.4 billion notional).

- CME Group will launch a 100-Ounce Silver futures contract on February 9, 2026, pending regulatory approval

- The move responds to record retail demand in 2025—Micro Gold futures averaged 301K contracts/day and Micro Silver futures averaged 48K contracts/day

- The new contract, listed on COMEX, will be financially settled to the daily settlement price of the global benchmark silver futures, offering lower-capital access for traders

- CME Group will shift margin calculations for gold, silver, platinum, and palladium futures from fixed dollar amounts to a percentage of notional value, effective after the close on Jan. 13, 2026, to better align collateral with market moves.

- The change comes after extreme volatility in precious metals, with gold up ~65% in 2025 and briefly topping $4,600, silver +170%, platinum +150% and palladium +95% as of Jan. 6, 2026.

- This adjustment aims to reduce frequent manual margin resets and enhance risk management amid record highs and dramatic price swings.

- CME Group’s robust financial profile (operating margin ~64.98%, net margin ~58.84%, debt-to-equity ~0.12 and market cap ~$95.55 billion) supports its capacity to implement these risk-setting enhancements.

Quarterly earnings call transcripts for CME GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more