Earnings summaries and quarterly performance for COTY.

Executive leadership at COTY.

Board of directors at COTY.

Research analysts who have asked questions during COTY earnings calls.

Anna Lizzul

Bank of America Corporation

5 questions for COTY

Olivia Tong Cheang

Raymond James Financial, Inc.

5 questions for COTY

Susan Anderson

Canaccord Genuity Group

5 questions for COTY

Ashley Helgans

Jefferies

4 questions for COTY

Christopher Carey

Wells Fargo & Company

4 questions for COTY

Oliver Chen

TD Cowen

4 questions for COTY

Andrea Teixeira

JPMorgan Chase & Co.

3 questions for COTY

Filippo Falorni

Citigroup Inc.

3 questions for COTY

Korinne Wolfmeyer

Piper Sandler & Co.

3 questions for COTY

Robert Ottenstein

Evercore ISI

3 questions for COTY

Carla Casella

JPMorgan Chase & Co.

2 questions for COTY

Julia Shelanski

TD Securities

2 questions for COTY

Mark Astrachan

Stifel

2 questions for COTY

Patrice Kanada

Goldman Sachs Group, Inc.

2 questions for COTY

Priya Ohri-Gupta

Barclays Capital

2 questions for COTY

Shovana Chowdhury

JPMorgan Chase & Co.

2 questions for COTY

Steve Powers

Deutsche Bank

2 questions for COTY

Sydney Wagner

Jefferies

2 questions for COTY

Anna Lazul

Bank of America Corporation

1 question for COTY

Bonnie Herzog

Goldman Sachs

1 question for COTY

Chris Terry

Wells Fargo & Company

1 question for COTY

Priya Uri Gupta

Barclays PLC

1 question for COTY

Stephen Robert Powers

Deutsche Bank

1 question for COTY

Recent press releases and 8-K filings for COTY.

- Markus Strobel has assumed the role of Executive Chairman and Interim CEO, marking a leadership transition and a new strategic chapter for the company.

- Coty is implementing a strategic overhaul for its Consumer Beauty division, focusing on iconic assets, streamlined innovation, and reallocating marketing spend to drive sell-out growth, with profitability improvements anticipated in fiscal 2027.

- The company anticipates a mid-single-digit sales decline in Q3 2026, primarily driven by ongoing headwinds in Consumer Beauty and challenges in Prestige Beauty sell-out.

- Gross margin in Q2 was lower than expected due to high promotional activity in Prestige, tariffs (estimated $8 million for Q2, below $40 million for the full year), Forex headwinds, and Consumer Beauty volume/mix issues; this pattern is expected to continue in Q3 before a sequential recovery in Q4 and Fiscal 2027.

- Coty is preparing for the Gucci license exit in June 2028 by focusing on growing other major brand franchises, building new acquired brands, and adjusting cost structures, while remaining open to value-creating deals.

- Coty anticipates a mid-single digit sales decline in Q3 2026, primarily due to ongoing challenges in Consumer Beauty and a weaker-than-expected Prestige sellout at the end of Q2.

- Q2 2026 gross margin was lower than expected, impacted by high promotional activity in Prestige, $8 million in tariffs (projected under $40 million for the full year), Forex headwinds, and fixed cost under absorption from lower Consumer Beauty volumes.

- For Consumer Beauty, the strategy involves focusing on iconic brands like COVERGIRL and Rimmel, streamlining innovation bundles, and increasing working media spend, with profitability improvements expected in fiscal 2027.

- In preparation for the Gucci license exit in June 2028, Coty plans to grow other key franchises (e.g., Hugo Boss, Marc Jacobs), develop new licenses (Swarovski, Armani), and adjust its cost structure to maintain profitability.

- Interim CEO Markus Strobel acknowledged that recent financial performance has not met expectations, emphasizing a new focus on realism, discipline, and focused execution to drive improvement over time.

- Coty anticipates a mid-single-digit sales decline in Q3 2026, primarily driven by ongoing challenges and strategic adjustments within its Consumer Beauty division.

- The Consumer Beauty strategy focuses on iconic brands, streamlining innovation, and reallocating marketing spend, with profitability improvements expected in fiscal 2027.

- The Prestige division experienced lower-than-expected Q2 2026 gross margins due to high promotional activity, $8 million in tariffs, and Forex impacts, with similar pressures expected in Q3 before a recovery in Q4.

- Coty is preparing for the Gucci license exit in June 2028 by growing other major franchises, developing new brands, and optimizing its cost structure.

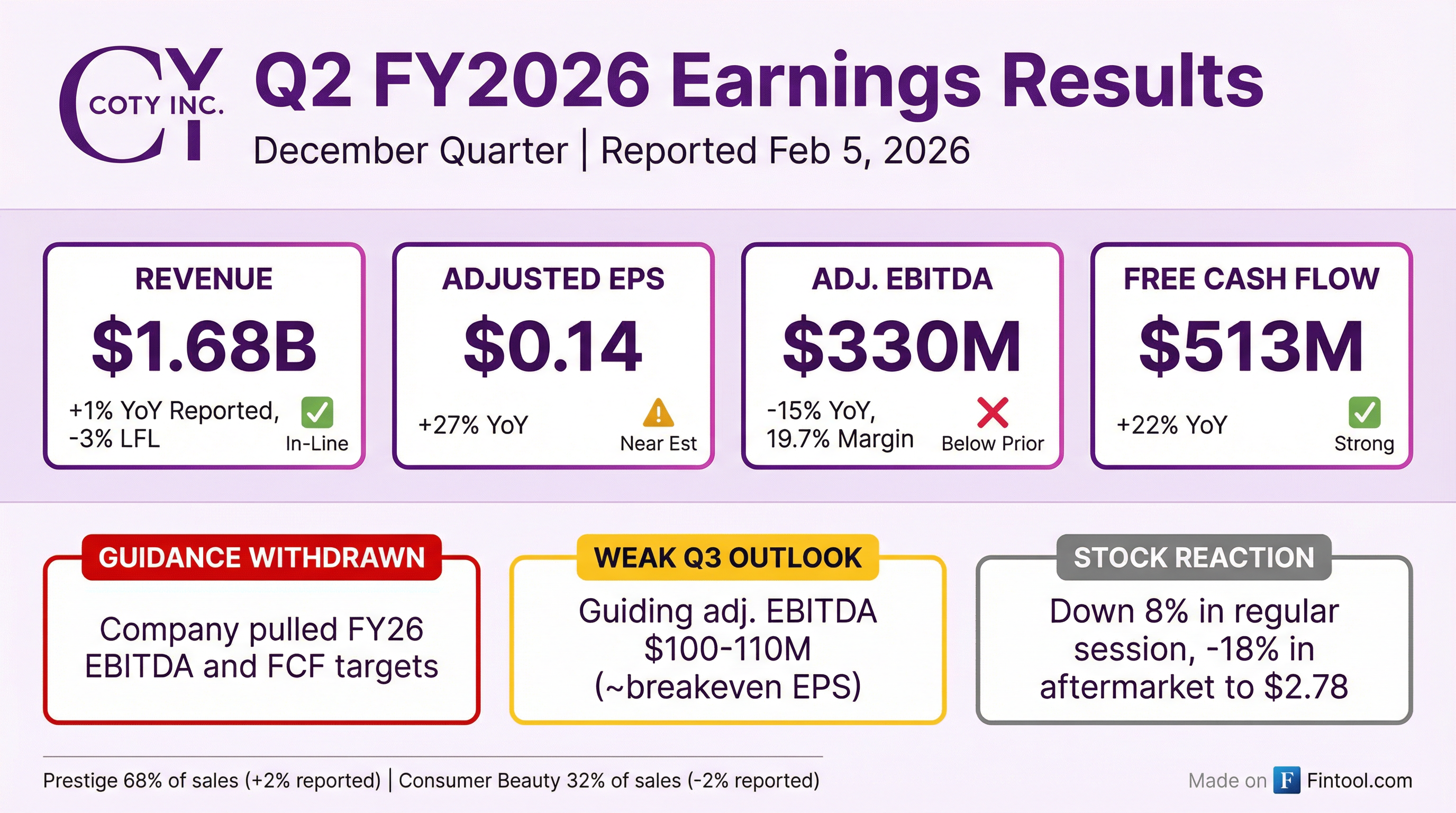

- Coty's Q2 results included net revenue of $1.68 billion (up 1% reported, down ~3% like-for-like) that beat estimates, but adjusted EPS of $0.14 missed forecasts, and the company swung to a net loss of $126.9 million.

- Margins deteriorated, with adjusted gross margin falling ~260 basis points to ~64.2%, and adjusted operating income and EBITDA declining, reflecting a promotional environment, tariffs, and volume softness.

- Management withdrew full-year guidance, forecasting a mid-single-digit like-for-like revenue decline in the coming quarter due to weak consumer beauty trends and a leadership transition.

- The company completed the sale of its remaining 25.8% Wella stake for $750 million and used most of the proceeds to reduce total debt to $3.04 billion from $4.06 billion at September 30, 2025.

- By segment, Prestige accounted for 68% of sales ($1,133.6 million) with reported growth, while Consumer Beauty contributed $545 million (32%) and declined.

- Coty introduced a new strategic framework, "Coty Curated," focusing on concentrated investment and operational discipline to address complexity across its portfolio, led by Markus Strobel, who is one month into his role as Executive Chairman and Interim CEO.

- For Q2 2026, Coty reported Adjusted EBITDA of $330 million, a 15% year-over-year decline, and Adjusted EPS of $0.18. Prestige net sales declined by 2% like-for-like, and Consumer Beauty like-for-like sales declined 6%.

- The company generated $524 million in free cash flow in the first half of fiscal year 2026, exceeding guidance, and completed the divestiture of Wella, resulting in net debt of $2.6 billion and leverage of 2.7x, the lowest in over 9 years.

- For Q3 2026, Coty expects like-for-like sales to decline by a mid-single-digit %, gross margins to decline by 200-300 basis points, and EBITDA between $100 million and $110 million, with approximately breakeven adjusted EPS.

- Interim CEO Markus Strobel acknowledged Coty's underperformance over the past 18 months and introduced a new "Coty Curated" strategic framework focused on disciplined execution and investment in core brands.

- Coty reported a 3% like-for-like sales decline for Q2 2026, with Adjusted EBITDA down 15% year-over-year to $330 million, and Adjusted EPS of $0.18. The adjusted gross margin decreased by 260 basis points to 64.2%.

- The company withdrew its full fiscal year guidance for EBITDA and free cash flow. For Q3 2026, Coty anticipates a mid-single-digit like-for-like revenue decline, EBITDA of $100 million-$110 million, and approximately breakeven adjusted EPS.

- Coty completed the divestiture of Wella, generating $750 million in upfront proceeds, which helped reduce net debt to $2.6 billion and leverage to 2.7 turns, the lowest in over nine years.

- Markus Strobel officially joined Coty as Executive Chairman and Interim CEO on January 1, 2026, and introduced a new strategic framework called Coty Curated to improve focus and operational discipline.

- The company reported disappointing financial results over the past 18 months, with Q2 2026 adjusted gross margin declining by 260 basis points from the prior year to 64.2%.

- Coty is withdrawing its full fiscal year guidance for EBITDA and free cash flow due to a complex external environment and intensified promotional activity.

- For Q3 fiscal 2026, Coty expects like-for-like revenue to decline mid-single digits and EBITDA to decline to $100 million-$110 million, down from $204 million in Q3 fiscal 2025.

- Despite challenges, key brands like Hugo Boss grew over 30% since fiscal 2019, Burberry grew over 140% between fiscal 2019 and fiscal 2025, and Kylie Cosmetics delivered strong like-for-like sales growth in Q2 2026.

- Coty reported net revenues of $1,678.6 million for Q2 FY26, a 1% increase on a reported basis, and adjusted EPS of $0.14, marking a 27% increase year-over-year.

- The company significantly reduced its net debt and leverage to nine-year lows, with financial net debt at $2,601.4 million and a financial leverage ratio of 2.7x as of December 31, 2025, partly due to the divestiture of its remaining Wella stake.

- With new leadership under Markus Strobel, Executive Chairman and Interim CEO, initiating a "Coty. Curated." strategic framework, the company is withdrawing its prior FY26 guidance and now expects Q3 LFL revenues to decline by a mid-single-digit percentage and Q3 adjusted EBITDA of $100 million to $110 million.

- Markus Strobel has been appointed Executive Chairman of the Board and Interim Chief Executive Officer of Coty Inc., effective January 1, 2026.

- Strobel's compensation package includes an annual base salary of $1,250,000, a one-time cash sign-on bonus of $940,000, and an equity grant with a fair value of $3,000,000 in restricted stock units and 6,000,000 stock options.

- Sue Nabi will step down as Chief Executive Officer on December 31, 2025, and will receive a cash payment of approximately $1,741,575 and vesting of approximately 2,083,333 restricted stock units.

- Peter Harf will retire from the Board, effective December 31, 2025, and Patricia Capel has been appointed as a new Board member, effective January 1, 2026.

- Coty Inc. announced the appointment of Markus Strobel as Executive Chairman of the Board and Interim Chief Executive Officer, effective January 1, 2026.

- Strobel joins Coty after a 33-year career at Procter & Gamble, where he most recently served as President of P&G’s Global Skin & Personal Care business.

- He will succeed Peter Harf, who is retiring from Coty’s Board, and Sue Nabi, who is stepping down as Chief Executive Officer.

- Strobel will lead Coty during a strategic review of the Consumer Beauty business and aims to accelerate growth and strengthen its position in beauty.

Fintool News

In-depth analysis and coverage of COTY.

Quarterly earnings call transcripts for COTY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more