Earnings summaries and quarterly performance for RENAISSANCERE HOLDINGS.

Executive leadership at RENAISSANCERE HOLDINGS.

Kevin O'Donnell

President and Chief Executive Officer

David Marra

Executive Vice President and Group Chief Underwriting Officer

James Fraser

Senior Vice President and Chief Accounting Officer

Robert Qutub

Executive Vice President and Chief Financial Officer

Ross Curtis

Executive Vice President and Chief Portfolio Officer

Sean Brosnan

Senior Vice President and Chief Investment Officer

Shannon Bender

Executive Vice President, Group General Counsel and Corporate Secretary

Board of directors at RENAISSANCERE HOLDINGS.

Carol Sanders

Director

Cynthia Trudell

Director

David Bushnell

Director

Duncan Hennes

Director

Henry Klehm III

Director

James Gibbons

Non-Executive Chair of the Board

Loretta Mester

Director

Shyam Gidumal

Director

Torsten Jeworrek

Director

Valerie Rahmani

Director

Research analysts who have asked questions during RENAISSANCERE HOLDINGS earnings calls.

Elyse Greenspan

Wells Fargo

8 questions for RNR

Meyer Shields

Keefe, Bruyette & Woods

8 questions for RNR

Joshua Shanker

Bank of America Merrill Lynch

7 questions for RNR

David Motemaden

Evercore ISI

6 questions for RNR

Michael Zaremski

BMO Capital Markets

6 questions for RNR

Ryan Tunis

Cantor Fitzgerald

5 questions for RNR

Alex Scott

Barclays PLC

4 questions for RNR

Andrew Andersen

Jefferies

4 questions for RNR

Brian Meredith

UBS

3 questions for RNR

Yaron Kinar

Oppenheimer & Co. Inc.

3 questions for RNR

Andrew Kligerman

TD Cowen

2 questions for RNR

Matthew Heimermann

Citi

2 questions for RNR

Mike Zurimski

BMO

2 questions for RNR

Peter Qutubsen

Evercore

2 questions for RNR

Robert Cox

The Goldman Sachs Group, Inc.

2 questions for RNR

Tracy Benguigui

Wolfe Research

2 questions for RNR

Wesley Carmichael

Autonomous Research

2 questions for RNR

Dean Criscitiello

Keefe, Bruyette & Woods

1 question for RNR

Dean Crisitello

Wolfe Research

1 question for RNR

Jamminder Bhullar

JPMorgan Chase & Co.

1 question for RNR

Jian Huang

Morgan Stanley

1 question for RNR

Jimmy Bhullar

JPMorgan Chase & Co.

1 question for RNR

Josh Shanker

Bank of America

1 question for RNR

Taylor Scott

BofA Securities

1 question for RNR

Recent press releases and 8-K filings for RNR.

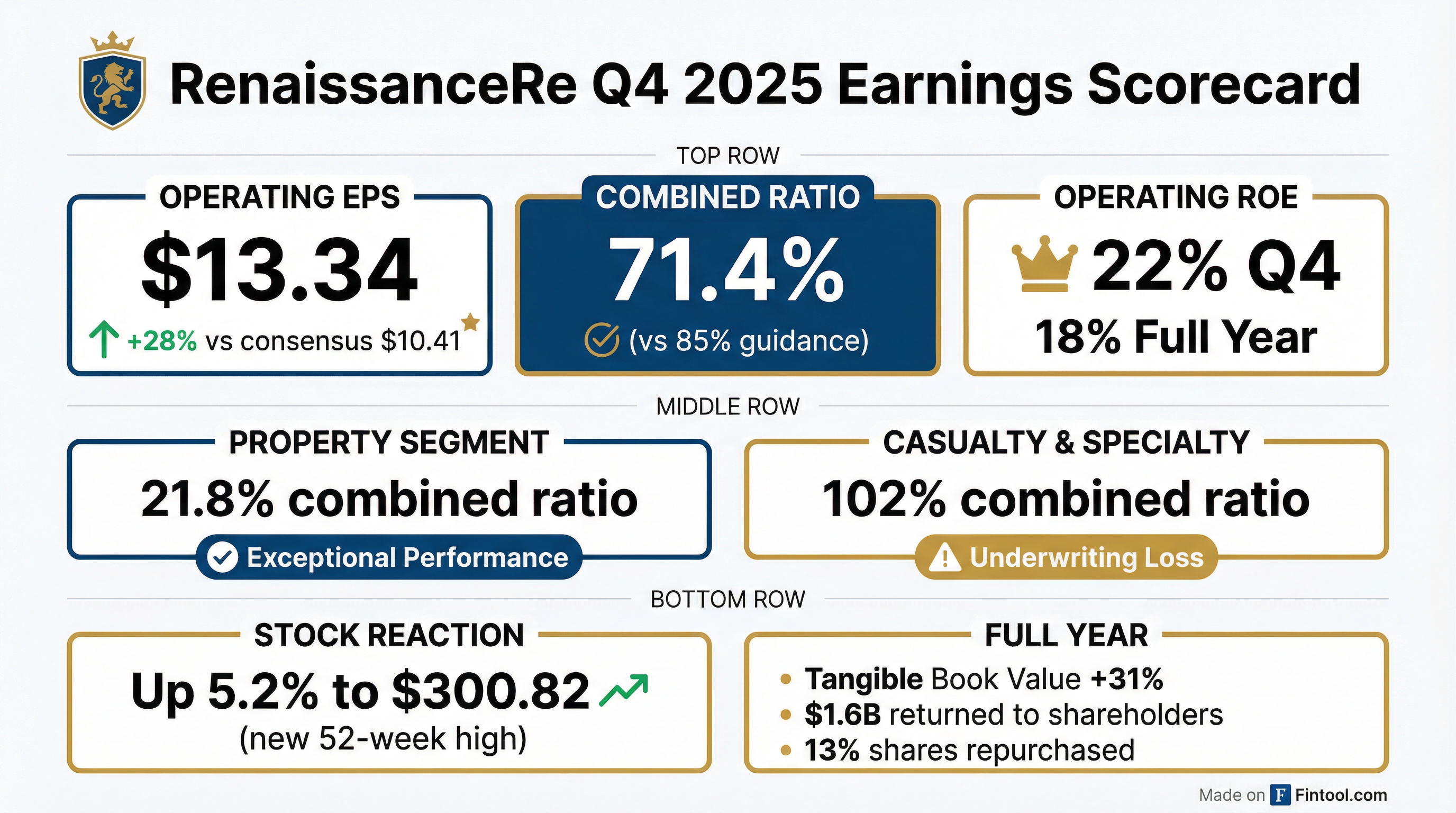

- Net income available to common shareholders for Q4 2025 was $751,638, a significant increase from a loss of $(198,503) in Q4 2024. For the full year 2025, net income was $2,646,959, up from $1,834,985 in 2024.

- Diluted earnings per common share for Q4 2025 was $16.75, compared to $(3.95) in Q4 2024. For the full year 2025, diluted EPS was $56.03, up from $35.21 in 2024.

- The adjusted combined ratio improved to 70.0% in Q4 2025 from 89.4% in Q4 2024, reflecting enhanced underwriting performance.

- The total investment result (managed) for Q4 2025 was $653,998, a substantial increase from a loss of $(186,885) in Q4 2024, with an annualized return of 7.5%.

- Book value per common share increased to $247.00 as of December 31, 2025, from $195.77 at December 31, 2024, representing a 26.2% year-to-date change.

- RNR delivered strong financial performance in 2025, with operating income of $1.9 billion , an operating ROE of 18% , and tangible book value per share plus accumulated dividends growing by 30% or 31%. The company also returned $1.6 billion to shareholders through repurchases of over 6.4 million shares in 2025.

- The company's three drivers of profit contributed significantly in 2025: underwriting income was $1.3 billion with an adjusted combined ratio of 85% , fee income reached $329 million , and retained net investment income was $1.2 billion, up 4%.

- Looking into 2026, property CAT rates were down low-teens% at the January 1 renewal , with gross premiums written in property catastrophe expected to be down mid-single digits for the year. In casualty and specialty, gross premiums are likely to be down, with net premiums decreasing more, and an adjusted combined ratio expected in the high 90s%.

- RenaissanceRe delivered strong financial results in 2025, with operating income of $1.9 billion and an operating ROE of 18%. Tangible book value per share plus accumulated dividends grew by 30% , marking the third consecutive year of over 25% growth.

- The company returned $1.6 billion to shareholders in 2025 through share repurchases, buying over 6.4 million shares. In Q4 2025, $650 million of shares were repurchased.

- All three profit drivers performed strongly in 2025, with underwriting income of $1.3 billion , fee income of $329 million , and retained net investment income of $1.2 billion.

- For Q4 2025, operating earnings per share were $13.34 and operating return on equity was 22%.

- For 2026, the company expects continued robust income from all three profit drivers , with the operating expense ratio projected to average 5%-5.5% after tax credits , and Property Cat premiums anticipated to be down mid-single digits.

- RenaissanceRe delivered strong financial performance in 2025, reporting operating income of $1.9 billion and an operating return on equity of 18%.

- The company achieved significant shareholder value growth, with tangible book value per share plus accumulated dividends growing by 30% in 2025, marking the third consecutive year of over 25% growth.

- Capital management included repurchasing $650 million of shares during Q4 2025, contributing to a total of $1.6 billion and over 6.4 million shares repurchased throughout 2025.

- All three drivers of profit contributed strongly in 2025, with underwriting income of $1.3 billion (achieving an adjusted combined ratio of 85%), fee income of $329 million, and retained net investment income of $1.2 billion.

- Looking ahead to Q1 2026, the company anticipates other property net premiums earned of approximately $360 million, casualty and specialty net premiums earned of around $1.4 billion with an adjusted combined ratio in the high 90s%, and management fees of around $50 million with performance fees of around $30 million.

- For the full year 2025, RenaissanceRe reported $2.6 billion of net income available to common shareholders and $1.9 billion of operating income available to common shareholders. In Q4 2025, net income was $751.6 million and operating income was $601.1 million.

- The company achieved a return on average common equity of 25.9% and an operating return on average common equity of 18.2% for the full year 2025. The combined ratio for the full year 2025 was 87.2%, and 71.4% for Q4 2025.

- Book value per common share grew by 26.2% in 2025, with tangible book value per common share plus change in accumulated dividends growing by 30.8%.

- RenaissanceRe repurchased approximately $1.6 billion of common shares in 2025, reducing the share count by 12.8%. An additional $113.4 million in shares were repurchased from January 1, 2026, through January 30, 2026.

- RenaissanceRe reported annual net income available to common shareholders of $2.6 billion and operating income available to common shareholders of $1.9 billion for 2025.

- For Q4 2025, the company reported net income available to common shareholders of $751.6 million and operating income available to common shareholders of $601.1 million.

- In 2025, RenaissanceRe achieved a return on average common equity of 25.9% and an operating return on average common equity of 18.2%.

- The company repurchased approximately $1.6 billion of common shares in 2025, reducing its share count by 12.8%.

- The combined ratio for 2025 was 87.2% and the adjusted combined ratio was 85.4%.

- Third Point LLC sent a letter to CoStar Group's Board of Directors on January 27, 2026, expressing concerns about weak board oversight, misaligned management incentives, and disastrous capital allocation policies, particularly regarding the residential real estate (RRE) strategy.

- The firm estimates CoStar has invested approximately $5 billion in its RRE segment over the past five years, including $3 billion in its U.S. RRE segment, which generated only $60 million in revenue in 2024 and an expected $80 million in 2025.

- CoStar's stock has underperformed significantly, down 27% over the past five years compared to a 94% total return for the S&P 500, while CEO Andy Florance received approximately $37 million in compensation in 2024 despite these results.

- Third Point's standstill agreement has expired, and they intend to introduce a slate of new directors to the board, recommending the company eliminate RRE losses and refocus on its core commercial real estate (CRE) business.

- RenaissanceRe Holdings Ltd. (RNR) entered into a deed of amendment on December 22, 2025, to its existing secured letter of credit facility with Citibank Europe Plc and its subsidiaries.

- The amendment extends the facility's Availability End Date to December 31, 2026, and its Expiry Date to December 31, 2027.

- The facility provides for a commitment to issue letters of credit up to $320 million, with a right to increase to $350 million.

- RenaissanceRe Holdings Ltd. reported strong Q3 2025 results, with $734 million in operating income and an operating return on average common equity of 28%. Operating income per share was $15.62, and underwriting income nearly doubled from Q3 2024 to $770 million.

- Year-to-date, the company achieved almost $1.3 billion in operating income and grew tangible book value per share plus change in accumulated dividends by almost 22%.

- The company returned over $1 billion in capital to shareholders through repurchases year-to-date and anticipates continuing share buybacks, having bought back over 850,000 shares for $205 million since Q2 2024 and an additional $100 million post quarter-end as of October 24, 2025.

- Looking ahead to 2026, while property catastrophe rates are expected to decrease by about 10%, the company anticipates return levels to remain very attractive, maintaining a focus on margin over growth and disciplined underwriting.

- RenaissanceRe Holdings Ltd. reported strong Q3 2025 financial results, including an annualized return on equity of 35% and operating income per share of $15.62.

- The company generated $1.9 billion in GAAP earnings and $3.2 billion in operating cash flow year-to-date, growing tangible book value by $1 billion.

- RenaissanceRe returned $1 billion of capital to shareholders through repurchases as of October 24, 2025, and plans to continue share buybacks, considering them an "exceptional value".

- Underwriting income nearly doubled to $770 million in Q3 2025 , driven by disciplined underwriting, while the market anticipates property catastrophe rates could be down about 10% at the January 1, 2026 renewal, though returns are expected to remain attractive.

Quarterly earnings call transcripts for RENAISSANCERE HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more