Earnings summaries and quarterly performance for Tempus AI.

Executive leadership at Tempus AI.

Eric Lefkofsky

Chief Executive Officer

Andrew Polovin

Executive Vice President, General Counsel and Secretary

Erik Phelps

Executive Vice President, Chief Administrative and Legal Officer

James Rogers

Chief Financial Officer

Ryan Fukushima

Chief Operating Officer

Board of directors at Tempus AI.

Research analysts who have asked questions during Tempus AI earnings calls.

Ryan MacDonald

Needham & Company

7 questions for TEM

Daniel Brennan

TD Cowen

6 questions for TEM

Mark Massaro

BTIG, LLC

6 questions for TEM

Michael Ryskin

Bank of America Merrill Lynch

6 questions for TEM

Andrew Brackmann

William Blair & Company, L.L.C.

5 questions for TEM

Mark Schappel

Loop Capital Markets

5 questions for TEM

Casey Woodring

JPMorgan Chase & Co.

4 questions for TEM

David Westenberg

Piper Sandler

4 questions for TEM

Dan Arias

Stifel Financial Corp.

3 questions for TEM

Subbu Nambi

Guggenheim Securities

3 questions for TEM

Tejas Savant

Morgan Stanley

3 questions for TEM

Bradley Bowers

Mizuho Securities USA LLC

2 questions for TEM

Colleen Kusy

Robert W. Baird & Co.

2 questions for TEM

Dan Brennan

UBS

2 questions for TEM

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

2 questions for TEM

Jesse Case

Canaccord Genuity

2 questions for TEM

Kallum Titchmarsh

Morgan Stanley

2 questions for TEM

Rachel Vatnsdal

JPMorgan Chase & Co.

2 questions for TEM

Rachel Vatnsdal Olson

JPMorgan

2 questions for TEM

Ricky

Guggenheim

2 questions for TEM

Subhalaxmi Nambi

Guggenheim Securities

2 questions for TEM

Colleen

Wolfe Research

1 question for TEM

Colleen Babington

Wolfe Research, LLC

1 question for TEM

Douglas Schenkel

Wolfe Research, LLC

1 question for TEM

Doug Schenkel

Wolfe Research LLC

1 question for TEM

Mark [indiscernible]

Luke Capital

1 question for TEM

Ryan McDowell

Needham

1 question for TEM

Yuko Oku

Morgan Stanley

1 question for TEM

Recent press releases and 8-K filings for TEM.

- Tempus AI reported a strong Q4 2025, with core business revenue up over 33%, oncology unit growth of 29%, and Insights revenue increasing 69% (including a one-time impact). Net revenue retention was 126%.

- For 2026, the company guided to $1.59 billion in total revenue, aligning with its 25% long-term growth expectations, and approximately $65 million of positive adjusted EBITDA. The Insights business is projected to grow 40% in Q1 2026.

- Average Selling Prices (ASPs) in Q4 2025 were around $1,640, with an anticipated upside of over $500 in the coming years, largely due to the transition of xT CDx to the FDA-approved version by the end of 2026. Oncology volume growth is expected to remain strong, while hereditary volume growth is projected to moderate to high teens in 2026.

- The company continues to leverage its proprietary data, with over 450 petabytes of connected multimodal data, and successfully met benchmarks for its oncology foundation model in Q1 2026, with plans to expand AI model development.

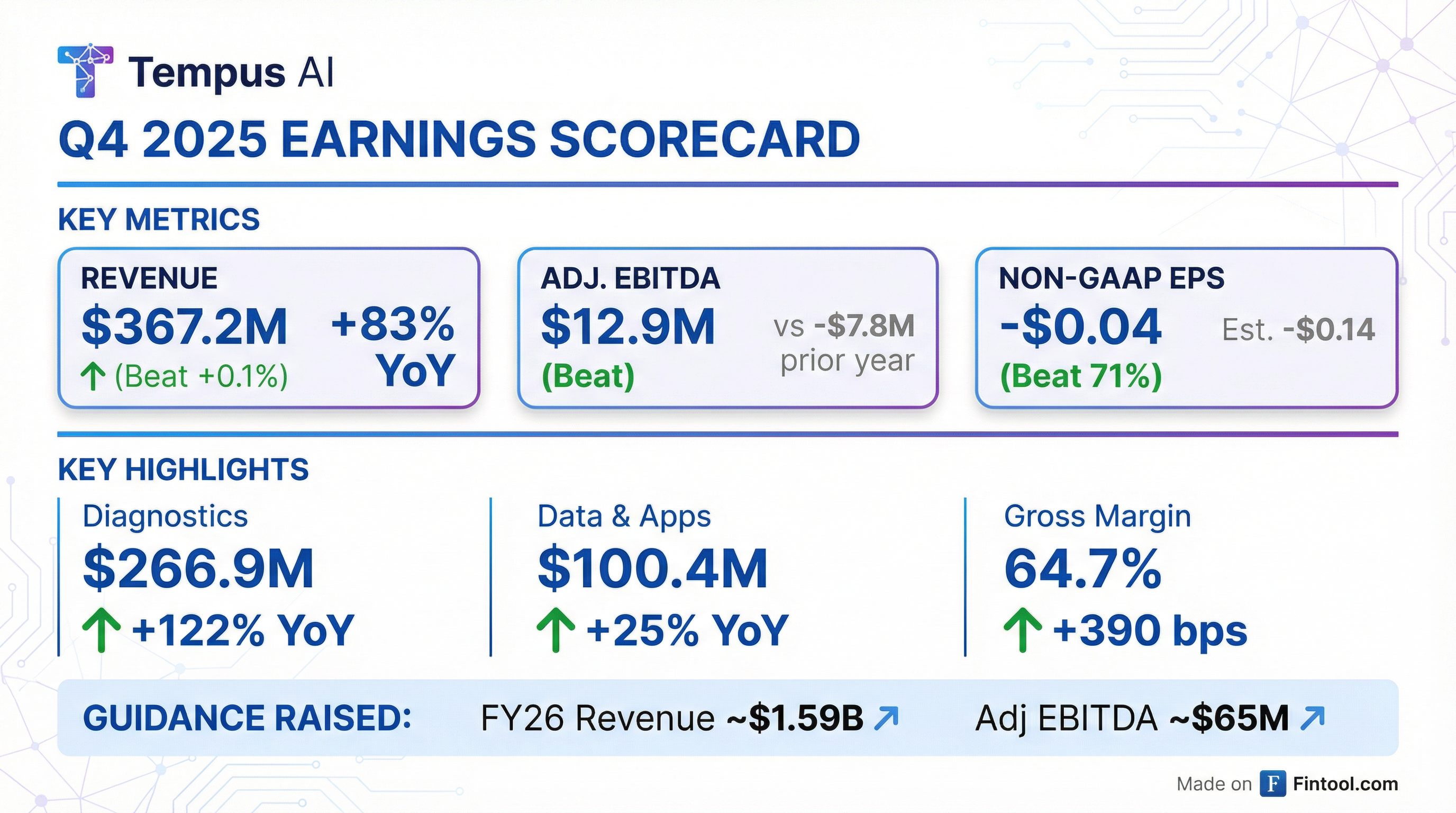

- Tempus AI reported Q4 2025 revenue of $367.2 million, an 83.0% increase year-over-year, with 33.5% organic growth (excluding Ambry).

- Adjusted EBITDA significantly improved to $12.9 million in Q4 2025, compared to a loss of ($7.8 million) in Q4 2024, and the company ended 2025 with $759.7 million in cash and marketable securities.

- Diagnostics revenue grew 121.6% year-over-year to $266.9 million, driven by 29% oncology volume growth and 23% hereditary volume growth, while Data and Applications revenue increased 25.1% year-over-year to $100.4 million. Approximately 125,000 tests were delivered in Q4 2025.

- Key operational developments include the Ambry acquisition in February 2025, expanding into rare disease, and the launch of Paige Predict, an AI-powered digital pathology suite. The company anticipates 25% top-line growth over the next 3 years.

- Tempus AI reported total core business revenue growth of over 33% for 2025, with oncology unit growth of 29% and hereditary unit growth of 23% in Q4 2025.

- The company guided to $1.59 billion in revenue and approximately $65 million of positive adjusted EBITDA for 2026.

- The data licensing business (Insights) grew 69% in Q4 2025 (including a one-time AstraZeneca warrant impact) and is projecting roughly 40% growth in Q1 2026. It boasts a net revenue retention of 126% and a total contract value greater than $1.1 billion.

- Average Selling Prices (ASPs) in Q4 2025 were around $1,640, with an anticipated upside of over $500 in the coming years, primarily driven by the migration to the FDA-approved xT CDx version by the end of 2026. The MRD offering showed 56% quarter-over-quarter growth in Q4 2025.

- Tempus AI reported strong Q4 2025 results, with total core business revenue increasing over 33% for the full year 2025.

- The company guided to $1.59 billion in revenue and approximately $65 million of positive adjusted EBITDA for 2026.

- Key growth drivers include the diagnostics business, with 29% oncology unit growth and 56% quarter-over-quarter MRD growth in Q4 2025, and the data licensing business, which grew 69% in the quarter (including a one-time impact) and is projected to grow 40% in Q1 2026, with net revenue retention at 126%.

- Average Selling Price (ASP) was $1,640 in Q4 2025, with an anticipated upside of over $500 in the coming years, primarily driven by the migration of xT CDx to the FDA-approved version.

- The company emphasized its strategic advantage in proprietary data and AI, with its oncology foundation model meeting Q1 2026 benchmarks for AstraZeneca.

- Tempus AI, Inc. reported Q4 2025 revenue of $367.2 million, an 83.0% year-over-year increase, and full year 2025 revenue of $1.3 billion, up 83.4% year-over-year.

- The company achieved Q4 2025 Adjusted EBITDA of $12.9 million, an improvement from ($7.8 million) in Q4 2024, and a full year 2025 Adjusted EBITDA of ($7.4 million), an improvement of $97.3 million year-over-year.

- As of December 31, 2025, Tempus AI held $759.7 million in cash and marketable securities.

- Tempus AI provided 2026 revenue guidance of approximately $1.59 billion and expects full year 2026 Adjusted EBITDA of approximately $65 million.

- Growth was primarily driven by Diagnostics revenue, which grew 121.6% year-over-year in Q4 2025, and Data and Applications revenue, which increased 25.1% year-over-year.

- Tempus AI reported Q4 2025 revenue of $367.2 million, an 83.0% year-over-year increase, and full-year 2025 revenue of $1.3 billion, up 83.4% year-over-year.

- The company achieved positive Adjusted EBITDA of $12.9 million in Q4 2025 and an improved Adjusted EBITDA of ($7.4 million) for the full year 2025.

- Diagnostics revenue grew 121.6% year-over-year to $266.9 million in Q4 2025, driven by 29% Oncology volume growth and 23% Hereditary volume growth.

- Tempus AI provided 2026 revenue guidance of approximately $1.59 billion and expects full-year 2026 Adjusted EBITDA of approximately $65 million.

- As of December 31, 2025, the company held $759.7 million in cash and marketable securities and ended the year with over $1.1 billion in Total Remaining Contract Value and 126% Net Revenue Retention.

- Median Technologies announced that its eyonis® LCS, an AI-based medical device software for early cancer diagnosis, received FDA 510(k) authorization for the US market on February 9, 2026.

- Oran Muduroglu has been appointed President of Median eyonis Inc. to lead the US launch of eyonis® LCS.

- Tempus AI signed a non-exclusive distribution agreement with Median Technologies on February 12, 2026, to accelerate the commercial availability of eyonis® LCS across the US.

- This agreement includes the integration of eyonis® LCS into Tempus's Pixel platform, leveraging Tempus's established network in oncology and AI-driven precision medicine.

- eyonis® LCS is eligible for Medicare reimbursement under the New Tech APC program, with an estimated reimbursement of $601 to $700 per examination for 2026, and initial US sites are projected to be operational in Q3 2026.

- Tempus AI, Inc. (NASDAQ: TEM) has announced the launch of its novel HRD-RNA algorithm, an AI-driven, 1,660-gene logistic regression model.

- This new RNA-based approach provides a dynamic, real-time assessment of a tumor's functional status for identifying Homologous Recombination Deficiency (HRD), offering a significant improvement over traditional static DNA-based assays.

- The algorithm is designed to identify patients likely to respond to platinum-based chemotherapy or PARP inhibitors, potentially expanding the population for life-saving therapies.

- A real-world validation study demonstrated that HRD-RNA positive metastatic pancreatic patients treated with first-line platinum-based regimens showed a significant reduction in mortality risk.

- The HRD-RNA algorithm is currently available for research use only, with clinical availability anticipated later this year.

- Tempus AI has signed a non-exclusive distribution agreement with Median Technologies to expand access to eyonis® LCS Software as a Medical Device in the United States.

- Tempus AI will distribute the FDA-cleared AI-based lung cancer screening software through its Tempus Pixel platform, integrating it into clinical workflows.

- The collaboration targets the 14.5 million Americans eligible for lung cancer screening, with revenues generated from eyonis® LCS to be shared between the parties.

- Tempus AI is also expected to support the commercial rollout of eyonis® LCS across Europe once Median Technologies obtains CE marking in Q2 2026.

- Tempus AI announced results demonstrating its AI-driven Immune Profile Score (IPS) test more accurately predicts outcomes for patients receiving immune checkpoint inhibitors (ICIs) compared to conventional biomarkers such as tumor mutational burden (TMB), microsatellite instability (MSI), and PD-L1.

- The study found that IPS consistently outperforms conventional biomarkers in predicting ICI outcomes (HR=0.45) across four independent validation cohorts of pan-cancer metastatic solid organ cancer patients.

- IPS identified 13% of patients with microsatellite stable colorectal cancer and 17% of patients with rare metastatic solid tumors who showed strong real-world overall survival with ICI treatment, indicating potential expanded treatment options for these populations.

- The IPS test is available as an add-on for clinicians ordering Tempus’ xT (DNA) and xR (RNA) assays.

Quarterly earnings call transcripts for Tempus AI.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more