Earnings summaries and quarterly performance for Utz Brands.

Executive leadership at Utz Brands.

Howard Friedman

Chief Executive Officer

Chad Whyte

Executive Vice President, Supply Chain

James Sponaugle

Executive Vice President, Chief People Officer

Jennifer Bentz

Executive Vice President, Chief Marketing Officer

Jeremy Stuart

Executive Vice President, Sales and Chief Customer Officer

Mitch Arends

Executive Vice President, Chief Integrated Supply Chain Officer

Shannan Redcay

Executive Vice President, Manufacturing

Theresa Shea

Executive Vice President, General Counsel and Corporate Secretary

William J. Kelley Jr.

Executive Vice President, Chief Financial Officer

Board of directors at Utz Brands.

Antonio Fernandez

Director

B. John Lindeman

Director

Christina Choi

Director

Craig Steeneck

Director

Dylan Lissette

Chairperson of the Board

Jason Giordano

Director

John Altmeyer

Director

Pamela Stewart

Director

Roger Deromedi

Lead Independent Director

Timothy Brown

Director

William Werzyn Jr.

Director

Research analysts who have asked questions during Utz Brands earnings calls.

Andrew Lazar

Barclays PLC

6 questions for UTZ

John Baumgartner

Mizuho Securities

6 questions for UTZ

Michael Lavery

Piper Sandler & Co.

6 questions for UTZ

Peter Galbo

Bank of America

6 questions for UTZ

Robert Moskow

TD Cowen

6 questions for UTZ

James Salera

Stephens Inc.

5 questions for UTZ

Scott Marks

Jefferies

4 questions for UTZ

Nik Modi

RBC Capital Markets

3 questions for UTZ

Peter Grom

UBS Group

3 questions for UTZ

Brian Holland

D.A. Davidson

2 questions for UTZ

Robert Dickerson

Jefferies

2 questions for UTZ

Erica Eiler

Oppenheimer

1 question for UTZ

Jim Salera

Stephens Inc.

1 question for UTZ

Mitchell Pinheiro

Sturdivant & Company

1 question for UTZ

Rupesh Parikh

Oppenheimer & Co. Inc.

1 question for UTZ

Recent press releases and 8-K filings for UTZ.

- Utz Brands, the largest pure-play salty snacking company, aims to outgrow the category by 200-300 basis points profitably through expansion geographies, strengthening core markets, and winning innovation.

- A significant supply chain transformation reduced manufacturing plants from 16 to 7 and involved $200 million in CapEx over two years, resulting in an adjusted gross margin expansion of 400 basis points since 2022 to 32.3% in 2025.

- The company's fastest-growing brand, Boulder Canyon, increased net sales from $45 million in 2022 to nearly $200 million in 2025, with a long-term potential to exceed $500 million.

- Expansion into California, representing 10% of the national salty snack market, is expected to add approximately $125 million in incremental sales, potentially growing the state's retail sales for Utz to over $200 million.

- Utz targets annual adjusted EBITDA growth of 6%-8% and anticipates CapEx to normalize to approximately 4% of net sales in 2026 and 3% in 2027 and beyond, driving accelerated free cash flow generation.

- Utz Brands aims to outgrow the salty snack category by 200-300 basis points profitably, driven by expansion into new geographies like California, which is projected to add $125 million in incremental sales and become a $200 million-plus retail sales business.

- The company has rationalized its manufacturing footprint from 16 plants at the end of 2022 to 7 plants today, leading to a 400 basis point expansion in adjusted gross margin to 32.3% in 2025 and productivity savings of $66 million in 2025.

- Utz anticipates a significant acceleration in Adjusted Free Cash Flow, projecting $60 million-$80 million in 2026 and $100 million+ annually thereafter, enabling deleveraging to a target of 2.5 times leverage longer term from 3.4 times at the end of 2025, and supporting a $50 million share buyback program.

- Long-term financial targets include annual Adjusted EBITDA growth of 6%-8% and the potential to achieve 17% adjusted EBITDA margins.

- Utz Brands, the largest pure-play salty snacking company with approximately $1.4 billion in revenue, aims to outgrow the category by 200-300 basis points profitably through strategies including geographic expansion and strengthening core markets.

- The company has completed a significant supply chain transformation, reducing manufacturing plants from 16 to 7 and achieving productivity savings of 6% of COGS in 2024 and 7% ($66 million) in 2025, which contributed to a 400 basis point expansion in adjusted gross margin to 32.3% in 2025.

- CapEx spending is normalizing from 7% of net sales over the past two years to an expected 4% in 2026 and 3% in 2027 and longer term, which is projected to accelerate adjusted free cash flow from $34 million in 2024 and 2025 to $60 million-$80 million in 2026 and $100 million-plus annually thereafter.

- Utz Brands targets annual adjusted EBITDA growth of 6%-8% and expects to reduce its leverage ratio from 3.4x at the end of 2025 to 3x-3.2x by the end of 2026 and 2.5x longer term, supported by a recently announced $50 million share buyback program.

- A new protein line for the Utz brand, offering 8-10g of protein per serving, is planned for national launch in the second quarter of 2026.

- Utz Brands unveiled a post-transformation strategy, setting long-term targets including $1.9 billion in net sales potential, annual adjusted EBITDA growth of 6–8% with margins expanding to at least 17%, and adjusted free cash flow of $100M+ beginning in 2027.

- The company plans to grow organic net sales 2–3 percentage points faster than the salty snack category, driven by geographic expansion and innovation, with margin improvement expected from roughly 4% COGS productivity gains. Leverage is projected to decline to about 2.5x over time, from an estimated 2.7x–3.0x in 2027.

- Despite these projections, the stock has declined roughly 30% over the past year, trading near a 52-week low with a high EV/EBITDA multiple of about 25.2x, and analysts currently rate UTZ around Neutral/Hold.

- Utz Brands, Inc. presented its long-term strategy and growth targets at the 2026 Consumer Analyst Group of New York (CAGNY) Conference on February 18, 2026, aiming for sustainable growth and accelerated free cash flow.

- The company targets Organic Net Sales growth 2-3 percentage points faster than the Salty Snack Category, with a long-term Net Sales potential of $1.9 billion.

- Key financial objectives include annual Adjusted EBITDA growth of 6-8% and an Adjusted EBITDA margin of at least 17% long-term.

- Utz expects accelerated Adjusted Free Cash Flow of $100 million plus in 2027 and beyond, and aims to achieve long-term leverage of approximately 2.5x.

- Utz Brands outlined its long-term strategy at the 2026 Consumer Analyst Group of New York (CAGNY) Conference, focusing on driving growth faster than the Salty Snack Category and accelerating free cash flow as it exits a capital-intensive transformation stage.

- The company targets Organic Net Sales growth 2-3 percentage points faster than the Salty Snack Category, aiming for a long-term Net Sales potential of $1.9 billion.

- Key financial goals include annual Adjusted EBITDA growth of 6-8%, an Adjusted EBITDA margin of at least 17% long-term, and accelerated Adjusted Free Cash Flow of $100 million plus in 2027 and beyond.

- Utz also expects to achieve approximately 2.5x long-term leverage through Adjusted EBITDA growth and debt paydown, anticipating 2.7x-3.0x leverage in 2027.

- Utz Brands expects 40-50 basis points of EBITDA margin expansion at the midpoint of its 2026 guidance, which accounts for a $4 million-$6 million investment for California expansion. This guidance is considered prudent due to the dynamic market environment.

- The company anticipates positive distribution gains in 2026, driven by geographic white space expansion, including the California market starting in Q2, and continued traction of innovation and Power Three brands in core markets.

- Utz Brands finished 2025 with a leverage ratio of 3.4 times and targets a 2026 leverage ratio of 3.0-3.2 times, with a long-term goal of 2.5-3 times and a free cash flow goal of $100 million.

- The 2026 guidance contemplates a flat category environment, despite some positive category improvement seen in Q4 2025 and January 2026. The company's commercial plan focuses on geographic white space, distribution gains, marketing, and innovation to drive growth.

- Utz Brands has provided its 2026 guidance and strategic outlook, including financial targets and investment plans.

- Key quantitative information for 2026 guidance and related metrics are presented in the table below:

| Metric | 2026 Guidance | 2025 Actual | Long-term Goal |

|---|---|---|---|

| EBITDA Margin Expansion (basis points) | 40-50 (midpoint) | N/A | N/A |

| California Investment ($USD Millions) | $4-$6 | N/A | N/A |

| Leverage Ratio (times) | 3.0-3.2 | 3.4 | 2.5-3 |

| Free Cash Flow ($USD Millions) | N/A | N/A | $100 |

- The company projects a flat category for 2026, with its guidance contemplating a 2.5 (200-300 basis points) midpoint.

- Strategic growth drivers for 2026 include continued distribution gains in expansion markets like California (with shelving starting in the coming weeks) and core markets, as well as new product innovations such as protein pretzels and Boulder Canyon tallow offerings launching in Q2.

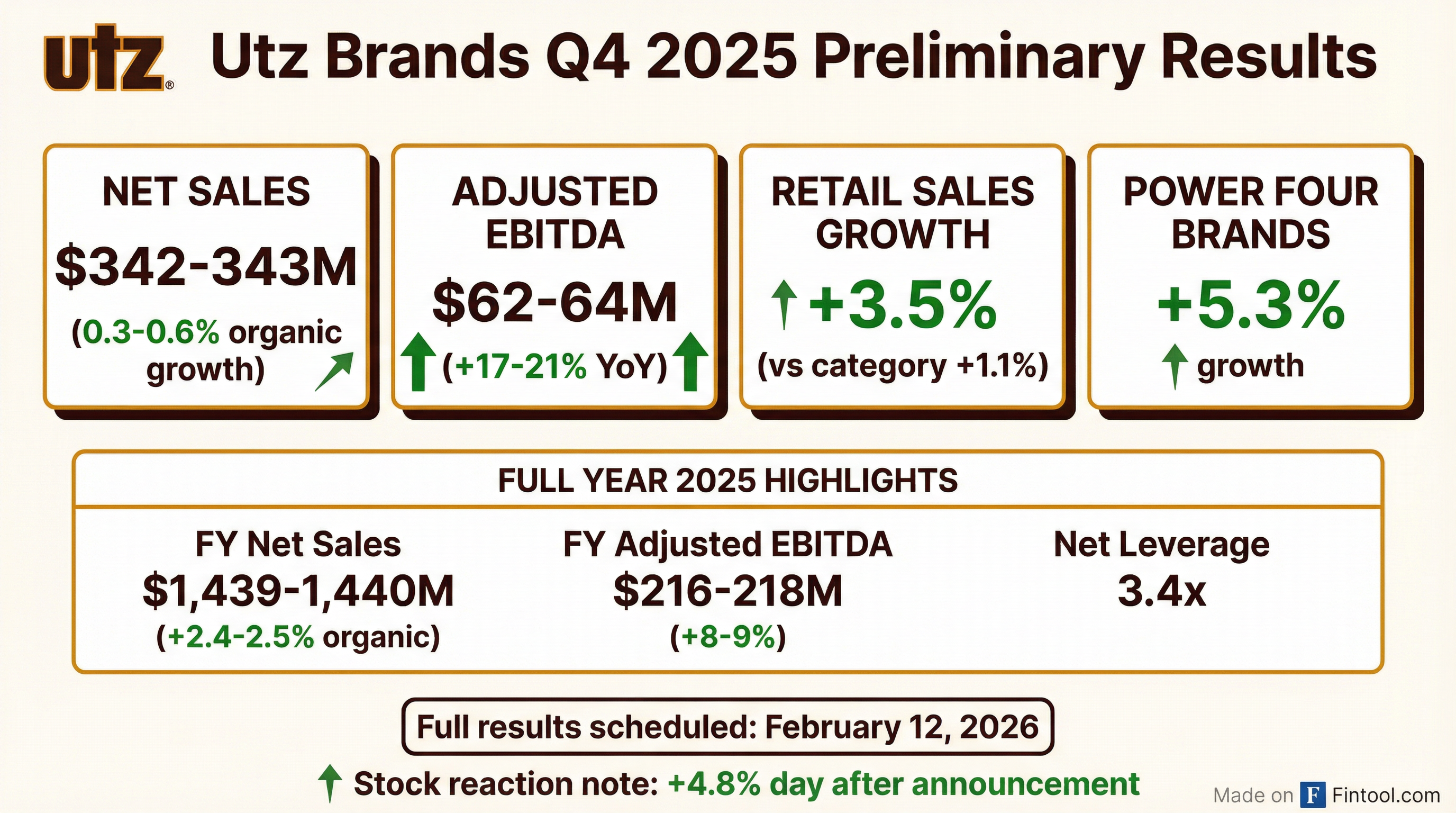

- Utz Brands reported 0.4% Net Sales growth for Q4 2025, with Branded Salty Snacks Organic Net Sales growing 2.5%. Adjusted EBITDA increased 17.5% to $62.4 million, and Adjusted EPS rose 18.2% to $0.26.

- The company achieved significant margin expansion in Q4 2025, with Adj. Gross Profit Margin up 560 basis points and Adj. EBITDA Margin up 260 basis points year-over-year, primarily driven by productivity cost savings.

- Retail Sales grew +3.5%, led by +5.3% growth in Power Four Brands, marking the 10th consecutive quarter of volume share growth.

- For fiscal year 2026, Utz Brands anticipates Organic Net Sales Growth of +2% to 3% and Adj. EBITDA Growth of +5% to 8%. Adjusted Free Cash Flow is projected between $60 million and $80 million, while Adjusted EPS Growth is expected to be (3%) to (6%) due to higher depreciation and amortization, interest, and tax rates.

- Utz Brands expects 40-50 basis points of EBITDA margin expansion in 2026 at the midpoint of its guidance, which accounts for a $4 million-$6 million investment for California expansion.

- The company anticipates a flat category for 2026, with its commercial plan focused on geographic white space, distribution gains, marketing, and innovation.

- Utz Brands finished 2025 with a 3.4 times leverage ratio and targets 3.0-3.2 times for 2026, with a long-term goal of 2.5-3 times.

- Positive distribution gains are expected in 2026, driven by expansion into new markets like California (with shelving starting in Q1 2026) and innovation in core markets.

Quarterly earnings call transcripts for Utz Brands.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more