Earnings summaries and quarterly performance for VALVOLINE.

Research analysts who have asked questions during VALVOLINE earnings calls.

Steven Zaccone

Citigroup

8 questions for VVV

David Bellinger

Mizuho Securities USA LLC

6 questions for VVV

Justin Kleber

Robert W. Baird & Co.

6 questions for VVV

Simeon Gutman

Morgan Stanley

6 questions for VVV

Steven Shemesh

RBC Capital Markets

6 questions for VVV

David Lantz

Wells Fargo & Company

5 questions for VVV

Mark Jordan

Goldman Sachs Group, Inc.

5 questions for VVV

Peter Keith

Piper Sandler & Co.

5 questions for VVV

Tom Wendler

Stephens Inc.

5 questions for VVV

Bret Jordan

Jefferies

2 questions for VVV

Chris O'Cull

Stifel

2 questions for VVV

Christopher O'Cull

Stifel, Nicolaus & Company

2 questions for VVV

Max Rakhlenko

TD Cowen

2 questions for VVV

Michael Harrison

Seaport Research Partners

2 questions for VVV

Patrick

Wolfe Research

2 questions for VVV

Sarah

TD Cowen

2 questions for VVV

Scott Stember

ROTH MKM

2 questions for VVV

Skylar Tennant

Morgan Stanley & Co. LLC

2 questions for VVV

Alexia Morgan

Piper Sandler

1 question for VVV

Chris O'cull

Stifel Financial Corp

1 question for VVV

David Lance Hays

Wells Fargo

1 question for VVV

Kate McShane

Goldman Sachs

1 question for VVV

Maksim Rakhlenko

Cowen and Company

1 question for VVV

Mike Harrison

Seaport Research Partners

1 question for VVV

Thomas Wendler

Stephens Inc.

1 question for VVV

Recent press releases and 8-K filings for VVV.

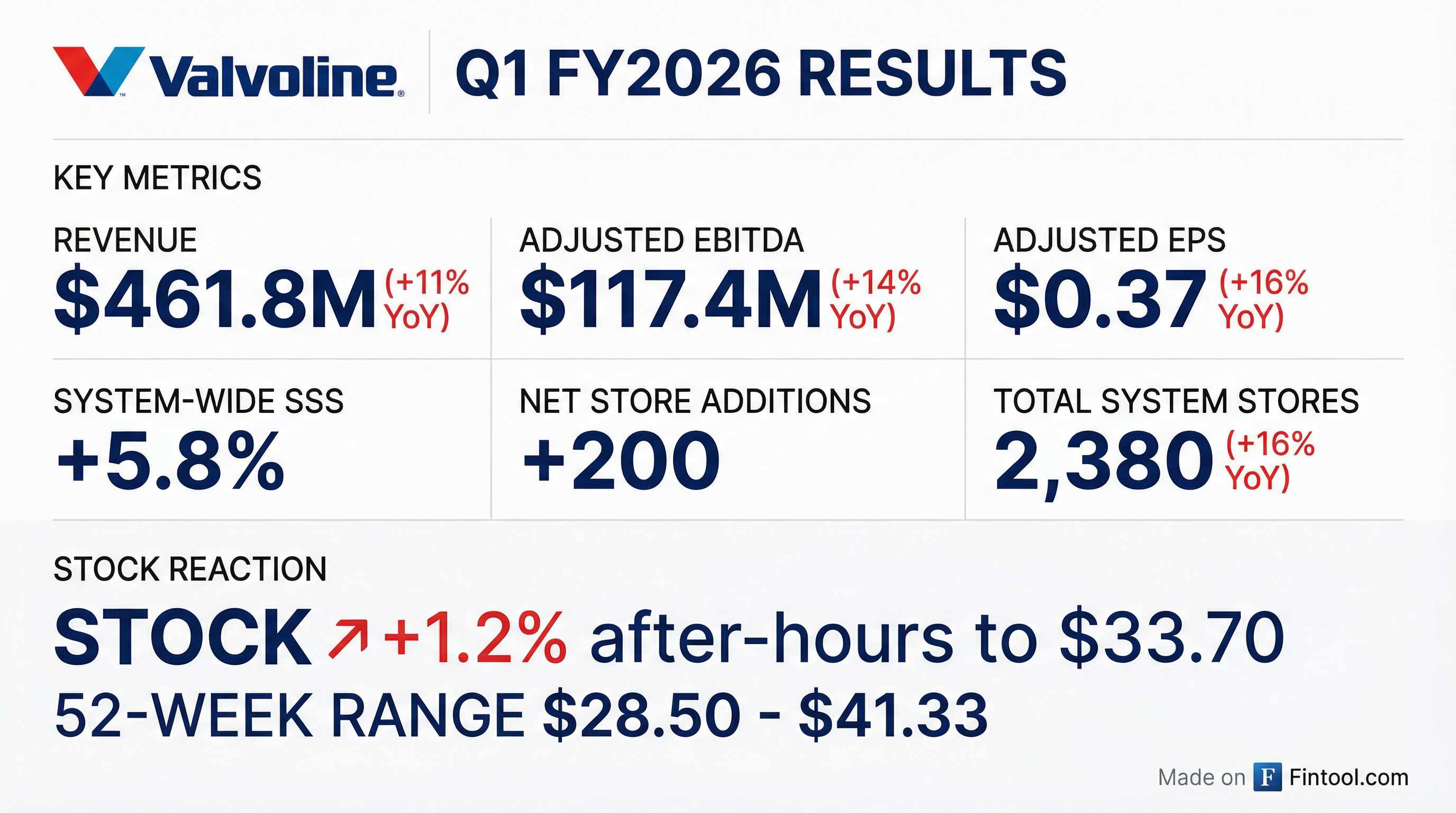

- Valvoline reported a strong Q1 2026, with net sales of $462 million, an 11% increase on a reported basis, and 15% when adjusted for refranchising.

- System-wide same-store sales grew 5.8%, primarily driven by net price and premiumization, contributing to double-digit growth in both Adjusted EBITDA and EPS.

- The company expanded its network by adding 162 stores from the Breeze transaction, which is expected to contribute approximately $160 million in top line and $31 million in EBITDA for the 10 months of fiscal 2026, despite an anticipated 100 basis point negative impact on EBITDA margin.

- Valvoline is focused on reducing its Leverage Ratio from 3.3 times to 2.5 times to enable future share repurchases and expects to remediate a Material Weakness in internal controls by the end of the fiscal year.

- Valvoline Inc. reported strong first quarter fiscal year 2026 results, with Net Sales of $462 million, an increase of 15%, and Adjusted EBITDA of $117 million, up 18%.

- Adjusted EPS grew 28% to $0.37 for Q1 FY2026, compared to $0.32 in the prior year.

- The company saw robust system-wide growth, with system-wide store sales reaching $924 million, a 13% increase, and system-wide same-store sales growth of 5.8%. Total system locations increased by 200 net store additions to 2,380.

- Free Cash Flow improved significantly to $7.4 million in Q1 FY2026, compared to $(12.2) million in Q1 FY2025.

- Valvoline reaffirmed its FY26 guidance, expecting Net Revenues between $2.0 billion and $2.1 billion, Adjusted EBITDA between $525 million and $550 million, and Adjusted EPS between $1.60 and $1.70.

- Valvoline reported strong Q1 Fiscal 2026 results, with net sales of $462 million, an 11% increase (15% adjusted for refranchising), and double-digit growth in both Adjusted EBITDA and EPS.

- The company achieved system-wide same-store sales growth of 5.8%, primarily driven by net price and premiumization, alongside continued positive transaction growth.

- Network expansion included the addition of 162 stores from the Breeze transaction and 38 net new stores. The Breeze acquisition is projected to add approximately $160 million to top-line and $31 million to EBITDA for the 10 months in fiscal 2026, though it is expected to have a 100 basis point negative impact on EBITDA margin.

- Adjusted EBITDA margin increased 60 basis points to 25.4%, driven by productivity gains in labor and product costs. The company's leverage ratio is 3.3 times net debt to Adjusted EBITDA, with a goal to reach 2.5 times to resume share repurchases.

- Valvoline reported a strong Q1 2026, with net sales increasing 11% to $462 million and Adjusted EBITDA margin expanding 60 basis points to 25.4%.

- The Breeze acquisition added 162 stores and is expected to contribute $160 million in top line and $31 million in EBITDA for the remaining 10 months of fiscal 2026, though it will have a near-term 100 basis points negative impact on EBITDA margin due to immature stores.

- The company's leverage ratio stands at 3.3x, with a commitment to reduce it to 2.5x to enable the resumption of share repurchases.

- Despite a strong start to Q2, Winter Storm Fern has impacted transactions, but Valvoline remains confident in its fiscal year 2026 guidance, expecting to recoup lost volume.

- For the first quarter ended December 31, 2025, Valvoline Inc. reported net revenues of $461.8 million, an 11% increase year-over-year. Adjusted EBITDA grew 14% to $117.4 million, and adjusted diluted earnings per share (EPS) increased 16% to $0.37. The company, however, reported a loss from continuing operations of ($32.2) million and a diluted loss per share of ($0.25), primarily due to the FTC-required divestiture of certain Breeze stores.

- System-wide same store sales (SSS) grew 5.8%, and the company added 200 net stores during the quarter, including 162 from the Breeze acquisition.

- As of December 31, 2025, Valvoline's cash and cash equivalents were $69.9 million, with total debt recorded at $1.7 billion.

- Valvoline Inc. reported sales of $462 million, an 11% increase, and system-wide same store sales (SSS) growth of 5.8% for its first quarter ended December 31, 2025.

- The company achieved Adjusted EBITDA of $117 million, a 14% increase, and Adjusted EPS of $0.37, up 16%.

- Valvoline reported a loss from continuing operations of ($32) million and a diluted loss per share of ($0.25), primarily due to the FTC-required divestiture of certain Breeze stores.

- During the quarter, Valvoline added 200 net stores system-wide, including 162 from the Breeze acquisition.

- The company ended the quarter with a cash and cash equivalents balance of $70 million and total debt of $1.7 billion.

- Valvoline Inc. reported strong financial performance for FY2025 with Net Revenues of $1.71 billion, Adjusted EBITDA of $467 million, and Adjusted EPS of $1.59.

- The company projects continued growth for FY2026, with Net Revenues guided between $2.0 billion and $2.1 billion, Adjusted EBITDA between $525 million and $550 million, and Adjusted EPS between $1.60 and $1.70.

- Valvoline plans significant network expansion, targeting over 2,900 stores by 2028 from 2,365 in December 2025, and expects to expand its Adjusted EBITDA Margin from 27.3% in 2025 to 28-29+% by 2028.

- The company's medium-term financial commitments (2026-2028) include +3-5% Same Store Sales Growth, +9-11% Net Sales Growth, low to mid-teens Adjusted EBITDA Growth, and mid to high-teens Adjusted EPS Growth.

- Valvoline maintains a disciplined capital allocation strategy focused on high-quality network growth, achieving a target net debt to EBITDA ratio of 1.5-2.5x, and returning excess cash to shareholders primarily through share repurchases.

- Valvoline projects 9-11% net sales growth annually beyond fiscal year 2026, following an expected 20% growth in fiscal year 2026 due to the Breeze acquisition. This growth is supported by anticipated 3-5% same-store sales growth and 7%+ network growth, aiming for over 2,900 stores by the end of 2028.

- The company expects to expand margins by 100-200 basis points, leading to low- to mid-teens EBITDA growth and mid- to high-teens EPS growth (excluding modest FY26 growth).

- Valvoline plans to increase free cash flow from $48 million in fiscal year 2025 to $200-$250 million by fiscal year 2028, a 4-5 times increase.

- Strategic capital allocation includes investing in network expansion, maintaining a strong balance sheet, and returning excess cash to shareholders through share repurchases. The company aims to reduce its net debt to EBITDA leverage from 3.2 times (post-Breeze) to 2.5 times within 18-24 months.

- The Breeze acquisition, involving 162 stores, is expected to more than double EBITDA at maturity, bringing the effective multiple down to approximately 7 times from an initial effective purchase multiple of 13 times.

- Valvoline (VVV) expects to deliver 9-11% net sales growth annually over the next three years, following 20% growth in fiscal 2026 due to the Breeze acquisition. This growth is anticipated from 3-5% medium-term same-store sales growth and over 7% annual network growth, with 50-60% of new unit growth coming from franchise partners.

- The company projects 100-200 basis points in EBITDA margin gains, leading to low- to mid-teens EBITDA growth. Free cash flow is expected to grow 4-5 times from $48 million in fiscal 2025 to $200 million-$250 million by fiscal 2028.

- Mid- to high-teens EPS growth is targeted, supported by profit growth and a disciplined capital allocation strategy that includes maintaining a strong balance sheet and returning excess cash to shareholders through share repurchases.

- The Breeze acquisition, despite FTC-driven divestitures, is expected to more than double EBITDA at maturity, reducing the effective purchase multiple from 13 times to closer to seven times.

- Valvoline projects 9%-11% net sales growth annually over the next three years, following an expected 20% growth in fiscal 2026 due to the Breeze acquisition.

- The company anticipates 100-200 basis points in margin gains over the next few years, driven by an aging car park, operational efficiencies, an improved portfolio mix, and G&A leverage. They ended fiscal 2025 with a 27.3% EBITDA margin.

- Valvoline aims for low to mid-teens EBITDA growth and expects free cash flow to increase to $200-$250 million, which is four to five times the fiscal 2025 delivery.

- The company is committed to expanding its network to 3,500+ stores, expecting to reach over 2,900 by the end of 2028, with unit growth projected at over 7% per year for the next three years.

- Following the Breeze transaction, net debt to EBITDA is approximately 3.2 times, with a target to reduce it to 2.5 times as quickly as possible.

Quarterly earnings call transcripts for VALVOLINE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more