Earnings summaries and quarterly performance for BROWN & BROWN.

Executive leadership at BROWN & BROWN.

J. Powell Brown

Chief Executive Officer and President

Chris L. Walker

Executive Vice President; President – Programs Segment

J. Hyatt Brown

Chairman of the Board

J. Scott Penny

Executive Vice President; Chief Acquisitions Officer

Julie L. Turpin

Executive Vice President; Chief People Officer

R. Andrew Watts

Executive Vice President, Chief Financial Officer and Treasurer

Stephen M. Boyd

Executive Vice President; President – Wholesale Brokerage Segment

Stephen P. Hearn

Executive Vice President and Chief Operating Officer; President – Retail Segment

Board of directors at BROWN & BROWN.

Bronislaw E. Masojada

Director

H. Palmer Proctor, Jr.

Lead Independent Director

James S. Hunt

Director

Jaymin B. Patel

Director

Joia M. Johnson

Director

Kathleen A. Savio

Director

Lawrence L. Gellerstedt III

Director

Paul J. Krump

Director

Theodore J. Hoepner

Director

Timothy R.M. Main

Director

Toni Jennings

Director

Wendell S. Reilly

Director

Research analysts who have asked questions during BROWN & BROWN earnings calls.

Elyse Greenspan

Wells Fargo

8 questions for BRO

Mark Hughes

Truist Securities

8 questions for BRO

Meyer Shields

Keefe, Bruyette & Woods

5 questions for BRO

Michael Zaremski

BMO Capital Markets

5 questions for BRO

Robert Cox

The Goldman Sachs Group, Inc.

5 questions for BRO

Alex Scott

Barclays PLC

4 questions for BRO

Brian Meredith

UBS

4 questions for BRO

C. Gregory Peters

Raymond James

4 questions for BRO

Andrew Andersen

Jefferies

3 questions for BRO

Joshua Shanker

Bank of America Merrill Lynch

3 questions for BRO

Yaron Kinar

Oppenheimer & Co. Inc.

3 questions for BRO

Charles Peters

Raymond James

2 questions for BRO

Charlie Lederer

BMO Capital Markets

2 questions for BRO

Dean (on behalf of Mayer Shields)

Keefe, Bruyette & Woods

2 questions for BRO

Jimmy Bhullar

JPMorgan Chase & Co.

2 questions for BRO

Josh Schenker

Bank of America

2 questions for BRO

Justin (on behalf of Alex Scott)

Barclays

2 questions for BRO

Leandro (on behalf of Brian Meredith)

UBS

2 questions for BRO

Matthew Heimermann

Citi

2 questions for BRO

Mitch (on behalf of Greg Peters)

Raymond James

2 questions for BRO

Rob Cox

Goldman Sachs

2 questions for BRO

Scott Heleniak

RBC Capital Markets

2 questions for BRO

Sid (on behalf of Bob Gianquitti)

Morgan Stanley

2 questions for BRO

Taylor Scott

BofA Securities

2 questions for BRO

Tracy Benguigui

Wolfe Research

2 questions for BRO

Dean Criscitiello

Keefe, Bruyette & Woods

1 question for BRO

Grace Carter

BofA Securities

1 question for BRO

Josh Shanker

Bank of America

1 question for BRO

Mike Zaremski

BMO Capital Markets

1 question for BRO

Mike Zurimski

BMO

1 question for BRO

Recent press releases and 8-K filings for BRO.

- Brown & Brown Dealer Services (BBDS) has acquired the assets of The Protectorate Group Insurance Agency, Inc., doing business as American Adventure Insurance.

- American Adventure specializes in on-the-spot dealership insurance solutions for vehicles including RVs, boats, motorcycles, and offers F&I and commercial insurance products.

- The 1,500-dealership network and American Adventure team will integrate into BBDS nationwide, reporting to BBDS President Mike Neal.

- Buyer-favoring rate conditions emerge as thorough renewal preparation and positive claims history enable more favorable commercial insurance terms.

- Increased capacity and carrier competition create new opportunities, though transportation, hospitality and high-risk regions still face challenging terms.

- The 2025 Risk Strategies acquisition deepens specialist insight across commercial, employee benefits and personal insurance segments.

- Employee benefits emphasize digital health tools for cost control, while personal insurance sees stable underwriting and sustained pricing pressure in catastrophe-exposed areas.

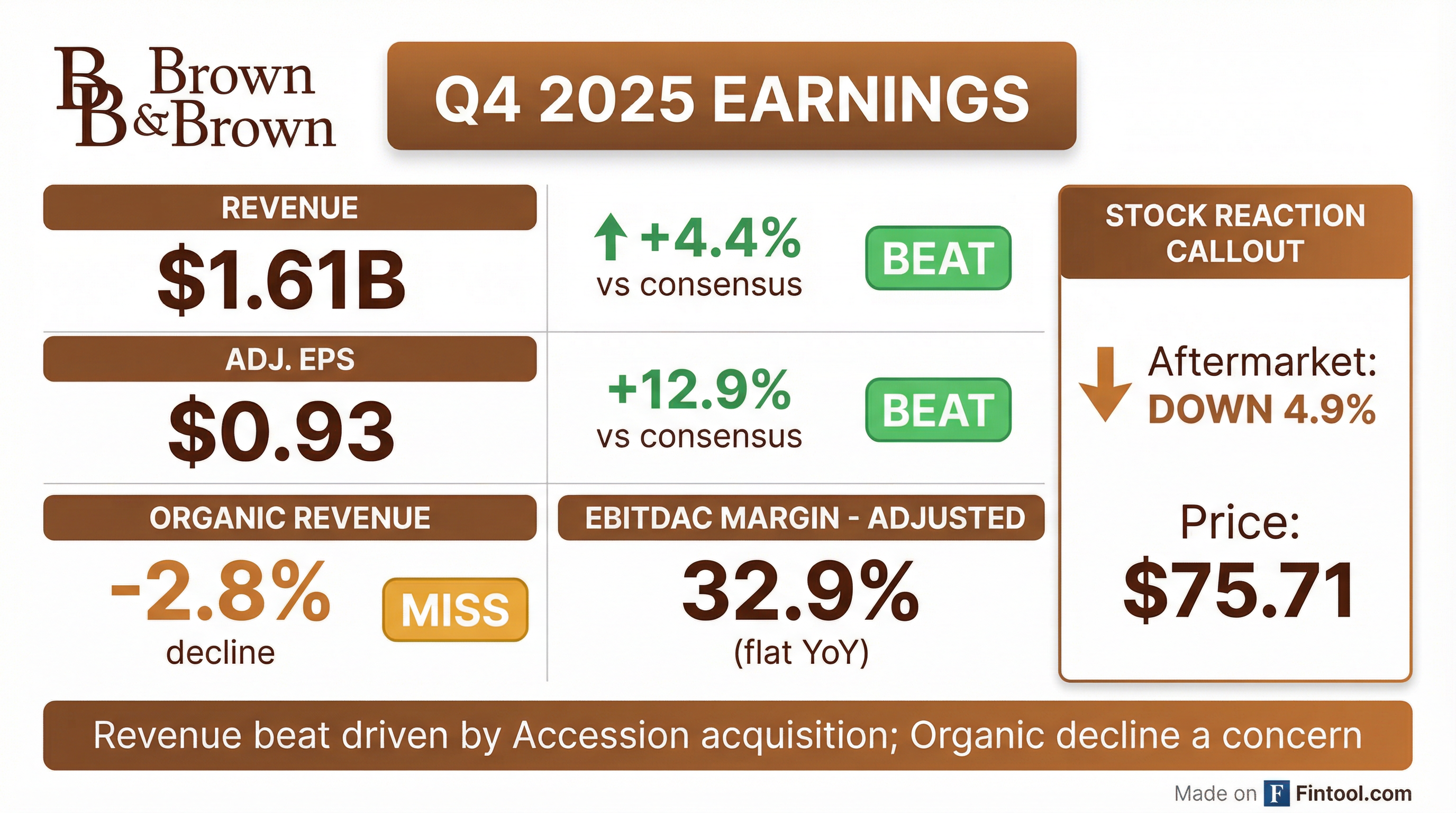

- Brown & Brown delivered Q4 2025 revenues of $1.607 billion (+35.7% y-o-y; organic –2.8%), with an adjusted EBITDAC margin of 32.9% (flat) and adjusted EPS of $0.93 (+8.1%).

- For FY 2025, revenues reached $5.9 billion (+23.0% total; +2.8% organic), adjusted EBITDAC margin was 35.9% (+70 bps), adjusted EPS was $4.26 (+10.9%), and cash flow from operations was $1.45 billion (+23.5%).

- The acquisition of Accession—Brown & Brown’s largest deal—added over 5,000 employees; Q4 revenue from Accession was $405 million, below the $430–450 million guidance, and depressed margins by ~200 bps; 2026 EBITDA synergies are projected at $30–40 million.

- The company obtained an injunction in a legal dispute after 275 former employees joined a startup broker, taking client relationships representing $23 million of annual revenue.

- 2026 outlook includes an effective tax rate of 24–25%, flat legacy margins excluding lower investment income, a long-term adjusted EBITDAC margin target raised to 32–37%, modest retail organic growth and approximately $15 million lower contingent commissions in Specialty Distribution.

- Brown & Brown delivered Q4 revenues of $1.607 billion, up 35.7% YoY, with adjusted EPS of $0.93, up 8.1%, and an EBITDAC margin of 32.9%.

- For full-year 2025, revenue reached $5.9 billion (+23% total, +2.8% organic), adjusted EPS was $4.26 (+10.9%), and operating cash flow grew 23.5% to $1.45 billion (24.6% of revenues).

- Completed the largest acquisition in company history—Accession—adding over 5,000 teammates; Q4 Accession revenue was $405 million (below $430-450 million guidance), which reduced margins by 200 bps; expect $30–40 million of 2026 EBITDA synergies.

- 2026 outlook includes modest retail organic growth improvement, partially offset by lower investment income; long-term EBITDAC margin target raised to 32%–37%, effective tax rate of 24%–25%, and contingent commissions down $15 million.

- Consolidated Q4 revenues of $1.607 billion, up 35.7% YoY; Q4 organic revenues were $1.079 billion, down 2.8% YoY.

- Adjusted Q4 net income attributable of $319 million, a 28.6% increase, and adjusted diluted EPS of $0.93, up 8.1%.

- Retail segment Q4 revenues grew 44.4% to $920 million with organic growth of 1.1%; Specialty Distribution revenues rose 27.0% to $678 million despite a 7.8% organic decline.

- Declared Q4 dividend of $0.165 per share, a 10.0% increase; full-year dividend raised to $0.615 per share, up 13.9%.

- Management expects modest moderation in admitted commercial line rate increases, continued strength in employee benefits pricing, and plans to stay active in M&A during 2026.

- Q4 revenue of $1.607 B, up 35.7%; adjusted EBITDAC margin flat at 32.9%; diluted EPS $0.93, +8.1%

- Full-year 2025 revenue of $5.9 B, +23% total and +2.8% organic; adjusted EPS $4.26, +10.9%; generated $1.45 B of cash from operations, +23.5%

- Completed the largest acquisition in company history (Accession, >5,000 teammates), and closed 43 deals adding ~$1.8 B of annual revenue; expect $30–40 M of EBITDA synergies in 2026, with integration to finish by end 2028

- Raised long-term adjusted EBITDAC margin target to 32–37%; anticipate modest retail organic growth improvement in 2026, specialty distribution contingents down ~$15 M, and flat margins excluding lower investment income

- Total revenues of $1.6 billion, up 35.7%, with Organic Revenue down 2.8%.

- Income before income taxes of $321 million, up 16.7%, with a 20.0% pre-tax margin.

- Adjusted EBITDAC of $529 million, up 35.6%, with a 32.9% margin.

- Net income of $264 million, up 25.7%, diluted EPS of $0.59 (–19.2%), and adjusted diluted EPS of $0.93 (+8.1%).

- Total revenues of $1.6 billion, up 35.4% YoY (3.5% organic); adjusted EBITDA margin expanded 170 bps to 36.6% and adjusted EPS grew 15% to $1.05.

- Completed seven acquisitions adding ~$1.7 billion in estimated annual revenues, notably AssuredPartners; Q3 acquisition/integration costs ~$50 million and $8 million mark-to-market escrow charge; AssuredPartners contributed $285 million of stub-period revenue.

- Board increased the quarterly dividend by 10% (32nd consecutive year) and authorized up to $1.5 billion in share repurchases.

- Retail segment delivered 2.7% organic growth; Specialty Distribution (Arrowhead Intermediaries) grew organically 4.6%.

- Outlook: Q4 organic growth expected similar to Q3; admitted rates stable with continued casualty rate increases; active M&A pipeline; targeting debt/EBITDA leverage back to 0–3x range within 12–18 months.

- Brown & Brown delivered $1.6 billion revenue (+35.4% YoY; 3.5% organic growth), 36.6% adjusted EBITDA margin (+170 bps), and $1.05 adjusted EPS (+15%) in Q3 2025.

- Completed 7 acquisitions with annualized revenues of $1.7 billion, led by AssuredPartners, which generated $285 million of stub-period revenue in August–September.

- Board increased dividend by 10% (32nd consecutive annual raise) and authorized up to $1.5 billion in share repurchases.

- Upgraded full-year adjusted EBITDA margin outlook to modest growth; Q4 2025 guidance includes Retail organic growth similar to Q3, Specialty Distribution organic mid-single-digit decline, and AssuredPartners revenues of $430–450 million.

- Total revenues of $1,606 M (+35.4% YoY) and EBITDA margin of 36.6% (+170 bps YoY); EPS of $1.05 (+15.4%)

- Retail segment: revenues +37.8% YoY; organic growth +2.7%

- Specialty distribution: revenues +30% YoY; organic growth +4.6%; EBITDA margin down 110 bps to 43.9%

- AssuredPartners acquisition: Q3 stub revenues of $285 M; acquisition/integration costs of $50 M; escrow mark-to-market charge of $8 M

- Outlook: Q4 Retail organic growth similar to Q3; Specialty distribution organic growth down mid-single digits; Q4 contingent commissions of $30–$40 M; Q4 AssuredPartners revenues of $430–$450 M

Quarterly earnings call transcripts for BROWN & BROWN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more