Earnings summaries and quarterly performance for CROWN HOLDINGS.

Executive leadership at CROWN HOLDINGS.

Timothy Donahue

Chairman, President and Chief Executive Officer

Adam Dickstein

Senior Vice President, General Counsel and Corporate Secretary

Djalma Novaes Jr.

Executive Vice President and Chief Operating Officer

Gary Gavin

President, Americas Division

Gerard Gifford

Executive Vice President and Chief Administrative Officer

Kevin Clothier

Senior Vice President and Chief Financial Officer

Board of directors at CROWN HOLDINGS.

Research analysts who have asked questions during CROWN HOLDINGS earnings calls.

Anthony Pettinari

Citigroup Inc.

8 questions for CCK

Edlain Rodriguez

Mizuho Securities

8 questions for CCK

George Staphos

Bank of America

8 questions for CCK

Philip Ng

Jefferies

8 questions for CCK

Arun Viswanathan

RBC Capital Markets

7 questions for CCK

Stefan Diaz

Morgan Stanley

7 questions for CCK

Ghansham Panjabi

Robert W. Baird & Co.

6 questions for CCK

Chris Parkinson

Wolfe Research, LLC

5 questions for CCK

Jeffrey Zekauskas

JPMorgan Chase & Co.

5 questions for CCK

Anojja Shah

UBS Group AG

4 questions for CCK

Gabe Hajde

Wells Fargo & Company

4 questions for CCK

Matt Roberts

Raymond James Financial

4 questions for CCK

Mike Roxland

Truist Securities

4 questions for CCK

Christopher Parkinson

Wolfe Research

2 questions for CCK

Josh Spector

UBS Group

2 questions for CCK

Michael Leithead

Barclays

2 questions for CCK

Michael Roxland

Truist Securities

2 questions for CCK

Silke Kueck

JPMorgan Chase & Co.

2 questions for CCK

Andrew Orme

Wolfe Research

1 question for CCK

Joshua Spector

UBS

1 question for CCK

Recent press releases and 8-K filings for CCK.

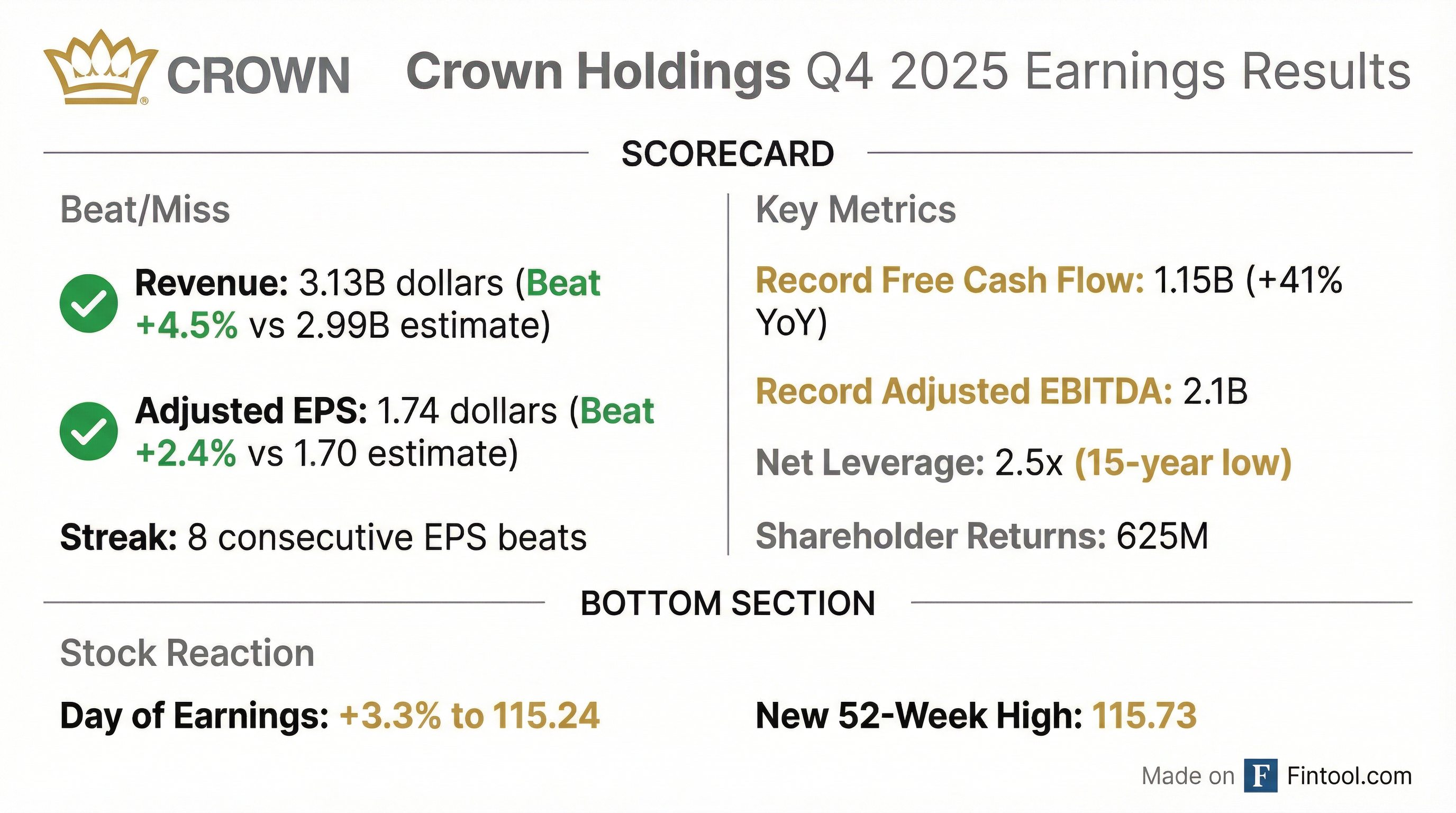

- Crown Holdings reported Q4 2025 adjusted earnings per share of $1.74, a 9% increase year-over-year, with net sales up 8% driven by a 3% increase in global beverage can volumes.

- For the full year 2025, the company achieved record adjusted EBITDA of almost $2.1 billion and record free cash flow of $1,146 million.

- The company returned $625 million to shareholders in 2025 through $505 million in share repurchases and $120 million in dividends, while maintaining a net leverage target of 2.5 times.

- Crown Holdings provided Q1 2026 adjusted EPS guidance of $1.70-$1.80 and full-year 2026 adjusted EPS guidance of $7.90-$8.30, projecting approximately $900 million in free cash flow for the full year.

- Key operational performance included 10% volume growth in European beverage for Q4 and FY 2025, and 5% food can volume growth in North America during Q4 2025. The company is investing in capacity expansions in Brazil, Greece, and Spain, with most volume benefits expected in 2027.

- Crown Holdings reported Q4 2025 adjusted earnings per share of $1.74, an increase of 9% compared to the prior year, with net sales up 8%.

- For the full year 2025, the company achieved record adjusted EBITDA of almost $2.1 billion and record free cash flow of $1,146 million.

- The company returned $625 million to shareholders in 2025 through share repurchases and dividends, and maintained its net leverage target of 2.5 times.

- Crown projects full-year 2026 adjusted earnings per diluted share in the range of $7.90-$8.30 and approximately $900 million in free cash flow, including $550 million for capital spending on capacity expansions in Brazil, Greece, and Spain.

- The company expects North American beverage volume gains of 2%-3% in 2026 but does not foresee a need for new capacity in North America over the next 1-2 years.

- Crown (CCK) reported Q4 2025 adjusted earnings per share of $1.74, an increase of 9% compared to the prior year quarter, with net sales up 8%.

- For the full year 2025, the company achieved record adjusted EBITDA of almost $2.1 billion and record free cash flow of $1,146 million, while reducing net leverage to 2.5 times.

- The company returned $625 million to shareholders in 2025, comprising $505 million in share repurchases and $120 million in dividends.

- Crown projects full-year 2026 adjusted earnings per diluted share in the range of $7.90-$8.30 and approximately $900 million in free cash flow, with $550 million allocated for capital spending.

- Management expects North American volume gains of 2%-3% and European beverage volumes to potentially grow 4%-5% in 2026, with new capacity investments in Brazil, Greece, and Spain primarily contributing to volumes in 2027.

- Crown Holdings, Inc. reported record adjusted diluted earnings per share of $7.79 for the full year 2025, marking a 22% increase over 2024, and $1.74 for the fourth quarter of 2025.

- The company generated record adjusted free cash flow of $1,146 million in 2025, returned $625 million to shareholders, and reduced its net leverage ratio to 2.5x from 2.7x at the end of 2024.

- For 2026, Crown Holdings, Inc. expects full year adjusted diluted earnings per share to be in the range of $7.90 to $8.30 and adjusted free cash flow of approximately $900 million.

- Crown Holdings, Inc. reported record adjusted diluted earnings per share of $7.79 for the full year ended December 31, 2025, an increase of 22% over 2024, and adjusted diluted earnings per share of $1.74 for the fourth quarter of 2025.

- The company generated record adjusted free cash flow of $1,146 million in 2025 and returned $625 million to shareholders, while reducing its net leverage ratio to 2.5x from 2.7x at the end of 2024.

- For the full year 2026, Crown Holdings expects adjusted diluted earnings per share in the range of $7.90 - $8.30 and adjusted free cash flow of approximately $900 million.

- Revenues for the third quarter ended October 31, 2025, increased 50.0% year-over-year to $47.3 million, driven by double-digit organic sales momentum and the integration of the Crown 1 acquisition.

- Net income for the quarter rose 31.7% to $0.5 million, with diluted earnings per share at $0.01.

- Adjusted EBITDA increased 118.0% to $3.8 million for the third quarter of fiscal 2026.

- The company completed the acquisition of Crown I Enterprises for $17.5 million, which added $56.8 million in revenue for the 12 months ended June 28, 2025.

- Cash and cash equivalents totaled $18.1 million as of October 31, 2025, compared to $7.2 million as of January 31, 2025.

- Crown Holdings, Inc. (CCK) announced the pricing terms for a cash tender offer by its wholly-owned subsidiary to purchase its 7 3/8% Debentures due 2026.

- The tender offer consideration is $1,036.53 payable for each $1,000 principal amount of Debentures validly tendered.

- The aggregate principal amount outstanding for these Debentures prior to the tender offer was $350,000,000.

- The offer is scheduled to close on November 18, 2025, at 5:00 p.m., New York City time, with settlement expected on November 21, 2025.

- Crown Holdings, Inc. (CCK) announced a cash tender offer to purchase debt securities.

- The offer is for any and all of the outstanding 7 3/8% Debentures due 2026, issued by its wholly-owned subsidiary, Crown Cork & Seal Company, Inc..

- These debentures have an aggregate principal amount outstanding of $350,000,000.

- The tender offer commenced on November 12, 2025, and is scheduled to expire at 5:00 p.m., New York City time, on November 18, 2025.

- Crown Holdings, Inc.'s (CCK) wholly-owned subsidiary, Crown Cork & Seal Company, Inc., has commenced a cash tender offer to purchase any and all of its outstanding 7 3/8% Debentures due 2026.

- The aggregate principal amount outstanding for these Debentures is $350,000,000.

- The Tender Offer will expire on November 18, 2025, at 5:00 p.m., New York City time, with the consideration calculated on the same day at 2:00 p.m., New York City time.

- The expected Settlement Date for validly tendered and accepted Debentures is November 21, 2025.

- Crown Holdings reported Q3 2025 adjusted earnings per share of $2.24, compared to $1.99 in the prior year quarter, with net sales increasing 4.2% and segment income reaching $490 million.

- The company raised its full-year 2025 adjusted EPS guidance to $7.70 to $7.80 and projects Q4 2025 adjusted EPS to be in the range of $1.65 to $1.75.

- Free cash flow for the nine months ended September 30 improved to $887 million, and the company estimates full-year 2025 adjusted free cash flow to be approximately $1 billion after $400 million in capital spending.

- Operational highlights include a 12% increase in European beverage shipments, leading to a 27% rise in European beverage income, while Latin American volumes declined by 5% due to a 15% drop in Brazil and Mexico.

- Crown Holdings repurchased $105 million of common stock in Q3 2025 and $314 million year-to-date, achieving its long-term net leverage target of 2.5 times in September.

Quarterly earnings call transcripts for CROWN HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more