Earnings summaries and quarterly performance for BRINKER INTERNATIONAL.

Executive leadership at BRINKER INTERNATIONAL.

Kevin Hochman

Chief Executive Officer and President

Aaron White

Executive Vice President, Chief Operating Officer and Chief People Officer

Christopher Caldwell

Senior Vice President and Chief Information Officer

Daniel Fuller

Senior Vice President, Chief Legal Officer and Secretary

Douglas Comings

Senior Vice President and Chief Operating Officer, Chili’s Grill & Bar

George Felix

Senior Vice President and Chief Marketing Officer

James Butler

Senior Vice President, Chief Supply Chain and Corporate Strategy Officer

Michaela Ware

Executive Vice President and Chief Financial Officer

Board of directors at BRINKER INTERNATIONAL.

Cynthia Davis

Director

Frances Allen

Director

Frank Liberio

Director

Harriet Edelman

Director

James Katzman

Director

Joseph DePinto

Chairman of the Board

Prashant Ranade

Director

Ramona Hood

Director

Timothy Johnson

Director

William Giles

Director

Research analysts who have asked questions during BRINKER INTERNATIONAL earnings calls.

Brian Vaccaro

Raymond James Financial, Inc.

8 questions for EAT

David Palmer

Evercore ISI

8 questions for EAT

Dennis Geiger

UBS

8 questions for EAT

Jeffrey Farmer

Gordon Haskett Research Advisors

8 questions for EAT

Andrew Strelzik

BMO Capital Markets

7 questions for EAT

Jeffrey Bernstein

Barclays

7 questions for EAT

Jon Tower

Citigroup

7 questions for EAT

Brian Harbour

Morgan Stanley

6 questions for EAT

Christine Cho

Goldman Sachs Group

5 questions for EAT

Eric Gonzalez

KeyBanc Capital Markets

5 questions for EAT

Alexander Slagle

Jefferies

4 questions for EAT

John Ivankoe

JPMorgan Chase & Co.

4 questions for EAT

Sara Senatore

Bank of America

4 questions for EAT

Chris O'Cull

Stifel

3 questions for EAT

Christopher O'Cull

Stifel, Nicolaus & Company

3 questions for EAT

James Sanderson

Northcoast Research

3 questions for EAT

Chris O'cull

Stifel Financial Corp

2 questions for EAT

Hyun Jin Cho

Goldman Sachs

2 questions for EAT

Jim Sanderson

Northcoast Research

2 questions for EAT

John Ivanko

JPMorgan

2 questions for EAT

Katherine Griffin

Bank of America

2 questions for EAT

Margaret-May Binshtok

Wolfe Research LLC

2 questions for EAT

Brian Mullan

Piper Sandler

1 question for EAT

Isiah Austin

Bank of America

1 question for EAT

Pratik Patel

Barclays

1 question for EAT

Rahul Krotthapalli

JPMorgan Chase & Co.

1 question for EAT

Recent press releases and 8-K filings for EAT.

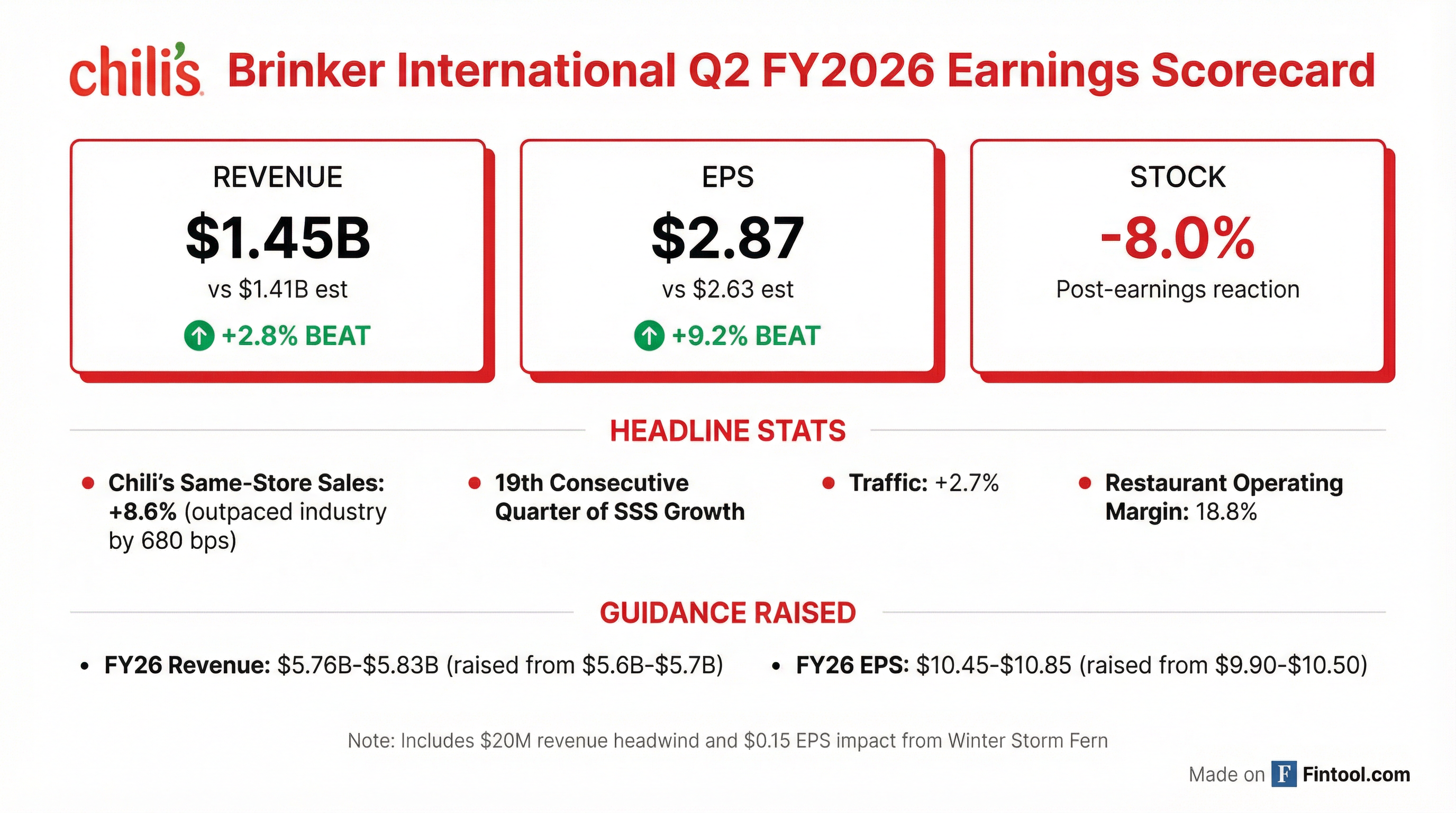

- Brinker International reported Q2 2026 total revenues of $1.45 billion, a 7% increase over the prior year, with consolidated comparable sales of +7.5%, and adjusted diluted EPS of $2.87.

- The company raised its fiscal 2026 guidance, now anticipating annual revenues in the range of $5.76 billion-$5.83 billion and adjusted diluted EPS between $10.45-$10.85.

- Chili's continued its strong performance with +8.6% same-store sales growth in Q2 2026, marking its 19th consecutive quarter of growth and outpacing the casual dining industry by 680 basis points.

- The company repurchased an additional $100 million of common stock and initiated a Chili's reimage program, with 4 reimages completed and plans for 60-80 in fiscal 2027.

- Brinker International reported strong Q2 FY 2026 results, with total revenues of $1.45 billion, a 7% increase year-over-year, and consolidated comparable sales growth of +7.5%. Adjusted diluted EPS for the quarter was $2.87.

- Chili's achieved its 19th consecutive quarter of same-store sales growth at +8.6%, outpacing the casual dining industry, and was recognized as the number one traffic brand in casual dining for 2025.

- The company raised its fiscal 2026 guidance, now projecting annual revenues between $5.76 billion and $5.83 billion and adjusted diluted EPS from $10.45 to $10.85. This guidance incorporates an estimated $20 million reduction in revenues and a $0.15 decrease in adjusted diluted EPS due to Winter Storm Fern.

- Brinker repurchased $100 million of common stock in Q2 FY 2026 and plans to significantly expand its Chili's reimage program to 60-80 units in fiscal 2027, with new unit growth accelerating in fiscal 2028.

- Brinker International reported Total Revenues of $1,452 million for Q2 F26.

- Same-store sales for Brinker increased by 7.5% in Q2 F26, with Chili's growing by 8.6% and Maggiano's experiencing a decline of 2.4%.

- Food cost as a percentage of sales slightly increased to 25.7% in Q2 F26, primarily due to an unfavorable menu mix.

- Labor cost as a percentage of sales decreased to 31.0% in Q2 F26, benefiting from sales leverage.

- Brinker International reported total revenues of $1.45 billion for Q2 FY 2026, marking a 7% increase over the prior year, with adjusted diluted EPS of $2.87.

- Chili's achieved 8.6% same-store sales growth in Q2 FY 2026, its 19th consecutive quarter of growth, driven by 4.4% price, 2.7% positive traffic, and 1.5% positive mix.

- The company raised its fiscal 2026 guidance, projecting annual revenues between $5.76 billion and $5.83 billion and adjusted diluted EPS between $10.45 and $10.85.

- Strategic initiatives include the launch of a new super premium chicken sandwich lineup chain-wide in April with a substantial advertising campaign, and plans to ramp up Chili's reimage program to 60-80 locations in fiscal 2027, with new unit growth expected in fiscal 2028.

- Brinker also repurchased an additional $100 million of common stock during the second quarter.

- Brinker International, Inc. reported Q2 Fiscal 2026 net income of $128.5 million and diluted EPS of $2.86, with total revenues of $1,452.2 million for the quarter ended December 24, 2025.

- Company comparable restaurant sales increased by 7.5% in Q2 Fiscal 2026, primarily driven by an 8.6% increase at Chili's.

- The company repurchased $100.0 million of common stock during the quarter.

- Brinker International, Inc. raised its Fiscal 2026 guidance, with updated total revenues projected between $5.76 billion and $5.83 billion and non-GAAP diluted EPS between $10.45 and $10.85. This guidance incorporates a negative impact from Winter Storm Fern, including approximately $20.0 million in reduced revenues and a $0.15 decrease in non-GAAP diluted EPS.

- Brinker International reported strong second quarter fiscal 2026 results, with total revenues of $1,452.2 million and net income per diluted share of $2.86. Company comparable restaurant sales increased 7.5%, driven by an 8.6% increase for Chili's.

- The company raised its fiscal 2026 guidance, now expecting total revenues of $5.76 billion - $5.83 billion and net income per diluted share, excluding special items, of $10.45 - $10.85.

- This updated guidance incorporates an estimated negative impact of $20.0 million in reduced revenues and a $0.15 decrease in net income per diluted share, excluding special items, due to Winter Storm Fern.

- During the quarter, Brinker repurchased $100.0 million of its common stock.

- Brinker delivered strong financial results for Q1 2026, with total revenues of $1.35 billion, an 18.5% increase over the prior year, and adjusted diluted EPS of $1.93, up from $0.95 last year.

- Chili's demonstrated exceptional performance, with same-store sales up 21.4% and traffic up 13% in Q1 2026, outperforming the casual dining industry by 1,650 basis points. The brand is also gaining market share with households earning under $60,000.

- In contrast, Maggiano's reported comp sales of -6.4% for Q1 2026, leading to the implementation of a "Back to Maggiano's" turnaround strategy focused on classic recipes, service, and atmosphere improvements.

- The company reiterated its fiscal 2026 guidance but now anticipates mid-single digit commodity inflation and expects Maggiano's softer performance to impact Q2 EPS by 6% to 8%.

- Brinker repurchased $92 million of common stock under its share repurchase program during the quarter.

- Brinker International reported total revenues of $1.35 billion for Q1 2026, an 18.5% increase over the prior year, with adjusted diluted EPS of $1.93.

- Chili's delivered exceptional performance in Q1 2026, with same-store sales up 21.4% and traffic increases of 13%, marking its 18th consecutive quarter of positive same-store sales growth.

- Maggiano's reported comp sales of -6.4% for the quarter, and its softer results are expected to offset Chili's gains, potentially impacting Q2 EPS by 6% to 8%.

- The company is reiterating its fiscal 2026 guidance, anticipating Chili's same-store sales to normalize to the mid single digit range for the balance of the fiscal year, and commodity inflation (inclusive of tariffs) in the mid single digits.

- Restaurant operating margin for Q1 2026 improved by 270 basis points to 16.2% year-over-year, but the full fiscal year 2026 restaurant margin is now expected to be relatively flat.

- Brinker International reported Q1 2026 total revenues of $1.35 billion, an 18.5% increase over the prior year, with adjusted diluted EPS of $1.93, up from $0.95 last year.

- Chili's delivered strong performance with same-store sales up 21.4%, driven by 13.1% positive traffic, marking its 18th consecutive quarter of positive same-store sales growth and outperforming the casual dining industry.

- While Maggiano's reported -6.4% comp sales for the quarter, the company reiterated its fiscal 2026 guidance, anticipating Chili's gains to be offset by Maggiano's softer results and an updated commodity inflation forecast of mid-single digits. Chili's same-store sales are expected to normalize to the mid-single digit range for the balance of the fiscal year.

- Brinker International repurchased $92 million of common stock under its share repurchase program during the quarter.

- Total Revenues for Q1 F26 reached $1349 million.

- Brinker's same-store sales increased by 18.8% in Q1 F26, with Chili's same-store sales up 21.4%, while Maggiano's same-store sales decreased by 6.4%.

- Food cost as a percentage of sales rose to 25.8% in Q1 F26, primarily due to an unfavorable menu mix.

- Sales leverage contributed to a decrease in both labor cost to 32.3% and restaurant expense to 25.7% in Q1 F26.

Quarterly earnings call transcripts for BRINKER INTERNATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more