Earnings summaries and quarterly performance for e.l.f. Beauty.

Executive leadership at e.l.f. Beauty.

Tarang Amin

Chief Executive Officer

Jennie Laar

Chief Commercial Officer

Josh Franks

Chief Operations Officer

Kory Marchisotto

Chief Marketing Officer

Mandy Fields

Chief Financial Officer

Scott Milsten

General Counsel, Chief People Officer, and Corporate Secretary

Board of directors at e.l.f. Beauty.

Research analysts who have asked questions during e.l.f. Beauty earnings calls.

Anna Lizzul

Bank of America Corporation

6 questions for ELF

Dara Mohsenian

Morgan Stanley

6 questions for ELF

Peter Grom

UBS Group

6 questions for ELF

Andrea Teixeira

JPMorgan Chase & Co.

5 questions for ELF

Susan Anderson

Canaccord Genuity Group

5 questions for ELF

Mark Altschwager

Robert W. Baird & Co.

4 questions for ELF

Olivia Tong Cheang

Raymond James Financial, Inc.

4 questions for ELF

Ashley Helgans

Jefferies

3 questions for ELF

Bill Chappell

Truist Securities

3 questions for ELF

Bonnie Herzog

Goldman Sachs

3 questions for ELF

Korinne Wolfmeyer

Piper Sandler & Co.

3 questions for ELF

Oliver Chen

TD Cowen

3 questions for ELF

Rupesh Parikh

Oppenheimer & Co. Inc.

3 questions for ELF

Steve Powers

Deutsche Bank

3 questions for ELF

Sydney Wagner

Jefferies

3 questions for ELF

Anna Andreeva

Piper Sandler

2 questions for ELF

Filippo Falorni

Citigroup Inc.

2 questions for ELF

Jon Andersen

William Blair & Company

2 questions for ELF

Linda Bolton-Weiser

D.A. Davidson & Co.

2 questions for ELF

Olivia Tong

Raymond James

2 questions for ELF

Mark Astrachan

Stifel

1 question for ELF

Patrice Kanada

Goldman Sachs Group, Inc.

1 question for ELF

Savanna Chaudhary

JPMorgan Chase & Co.

1 question for ELF

Recent press releases and 8-K filings for ELF.

- e.l.f. Beauty highlighted its 28th consecutive quarter of net sales growth, achieving a 23% net sales CAGR over the last decade, significantly outperforming the beauty category. The company also raised its net sales growth outlook for the current year to 22%-23%.

- The company has gained 800 basis points of market share in mass color cosmetics over the past five years and has four brands (e.l.f. Cosmetics, e.l.f. SKIN, Naturium, and rhode) each exceeding $200 million in retail sales.

- e.l.f. Beauty projects it can more than double its net sales in the coming years by expanding its footprint in cosmetics, skincare, and international markets, supported by a 70% gross margin and adjusted EBITDA margin of 20% or more.

- E.L.F. Beauty projects a +22-23% net sales growth for FY 2026, with an outlook of $1.6 billion in net sales, and has achieved 28 consecutive quarters of net sales growth.

- The company anticipates a 70% gross margin and 20% adjusted EBITDA margin for FY 2026.

- E.L.F. Cosmetics has demonstrated significant market share growth, with a +800 basis points change over the past five years in color cosmetics, and holds a 64% share of the primer market in 2025.

- Key E.L.F. Cosmetics franchises, including Halo Glow, Glow Reviver, and Power Grip, each generated $220 million in annual retail sales for the latest 52 weeks ending February 7, 2026.

- Rhode, a brand within E.L.F. Beauty, is projected to achieve $360 million in annualized net sales for FY 2026, representing +70% annualized net sales growth.

- e.l.f. Beauty has demonstrated consistent strong growth, achieving a 23% net sales and adjusted EBITDA CAGR over the last decade and its 28th consecutive quarter of net sales growth. The company also raised its net sales growth outlook for the current year to 22%-23%.

- The company has significantly gained market share, including 800 basis points in color cosmetics over the last five years and 105 basis points annually over the last decade. Its e.l.f. Cosmetics brand is the number one unit share brand in U.S. color cosmetics.

- e.l.f. Beauty sees significant white space for future growth, aiming to more than double its net sales over the coming years across cosmetics, skincare, and international markets. International net sales currently represent 20% of total sales but have grown at a 55% CAGR over the last five years.

- The company maintains a strong financial profile with an outlook for 70% gross margin and 20% or more adjusted EBITDA margin, while keeping net leverage at less than 2 times.

- e.l.f. Beauty has demonstrated consistent strong performance, achieving 28 consecutive quarters of net sales growth and a 23% net sales and adjusted EBITDA CAGR over the last decade. The company recently raised its net sales growth outlook for the current year to 22%-23%.

- The company has gained significant market share, including 800 basis points in color cosmetics over the last five years, and maintains strong financial metrics with a projected gross margin of 70% and adjusted EBITDA margin of 20% or more.

- Its brand portfolio includes e.l.f. Cosmetics, the number one unit share brand in U.S. color cosmetics, and successful acquisitions like rhode, which became the number one brand in Sephora North America and is projected to achieve $360 million in net sales this year with 70% growth.

- e.l.f. Beauty identifies a significant "white space" opportunity to more than double its net sales in the coming years across cosmetics, skincare, and international markets, where international sales currently represent only 20% of net sales compared to 70% for global beauty peers.

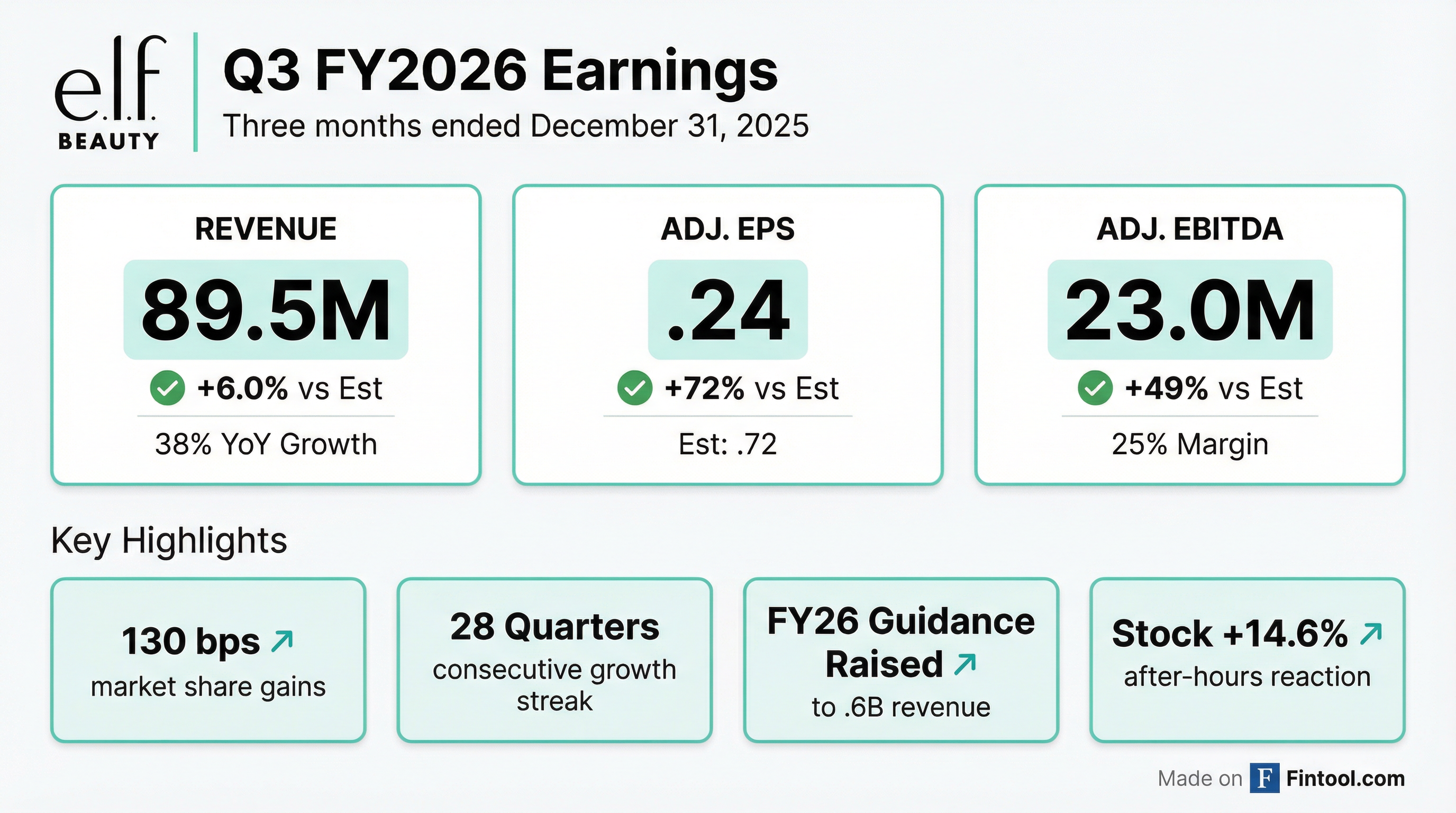

- e.l.f. Beauty reported Q3 2026 net sales growth of 38% and adjusted EBITDA up 79% year-over-year, marking its 28th consecutive quarter of net sales growth.

- The company raised its fiscal 2026 outlook, now projecting net sales growth of 22%-23% (up from 18%-20% previously) and adjusted EBITDA of $323 million-$326 million (up from $302 million-$306 million previously), largely due to Rhode's outperformance, which contributed $128 million to Q3 net sales.

- The e.l.f. Cosmetics brand grew 8% in the U.S. and gained 130 basis points of market share in Q3 2026, while e.l.f. Skin grew 16%.

- Net Sales for Q3 FY 2026 increased by +38% year-over-year, with Adjusted EBITDA growing +79% and Adjusted EPS reaching $1.24.

- The company raised its FY 2026 Net Sales outlook to +22-23% (from +18-20%) and anticipates Adjusted EBITDA growth of +9-10% with a 20% margin.

- e.l.f. Cosmetics US consumption grew +8% and e.l.f. SKIN US consumption grew +16% in Q3 FY 2026, contributing to a 71% Gross Margin.

- Rhode contributed $128 million to net sales in Q3 FY 2026, with an FY 2026 outlook of $260-$265 million.

- The company repurchased $50 million of common stock in Q3 FY 2026, with $400 million remaining under repurchase authorization.

- e.l.f. Beauty reported strong Q3 2026 results, with net sales growing 38% and adjusted EBITDA increasing 79% year-over-year, marking its 28th consecutive quarter of net sales growth.

- The company raised its fiscal 2026 outlook, now expecting net sales growth of 22%-23% (up from 18%-20% previously) and adjusted EBITDA of $323 million-$326 million (up from $302 million-$306 million), primarily driven by the outperformance of the Rhode brand.

- Rhode contributed $128 million to Q3 net sales and is expected to contribute $260 million-$265 million to fiscal 2026 net sales, achieving record-breaking launches in Sephora North America and the U.K..

- e.l.f. Cosmetics consumption grew 8% in the U.S., gaining 130 basis points of market share, while e.l.f. Skin consumption grew 16% in the U.S., and Naturium is expanding its retail presence to Walmart.

- The company repurchased approximately $50 million of its common stock in Q3 and plans significant marketing investments in Q4, including a Super Bowl commercial, alongside investments in team and space expansion.

- e.l.f. Beauty reported strong Q3 2026 results, with net sales growing 38% year-over-year and adjusted EBITDA increasing 79%. Adjusted net income was $74 million, or $1.24 per diluted share.

- The company raised its fiscal 2026 outlook, now expecting net sales growth of 22%-23% (up from 18%-20% previously) and adjusted EBITDA of $323 million-$326 million (up from $302 million-$306 million previously).

- Rhode contributed $128 million to Q3 net sales and is now expected to contribute $260 million-$265 million to fiscal 2026 net sales. The company also highlighted continued market share gains for e.l.f. Cosmetics and e.l.f. Skin.

- During Q3, e.l.f. Beauty repurchased approximately $50 million of common stock, with approximately $400 million remaining under the authorized repurchase program.

- For the three months ended December 31, 2025, e.l.f. Beauty reported net sales of $489.5 million, an increase of 38% year-over-year.

- GAAP diluted earnings per share for Q3 Fiscal 2026 were $0.65, while adjusted diluted earnings per share were $1.24.

- Adjusted EBITDA for the three months ended December 31, 2025, was $123.0 million, or 25% of net sales, marking a 79% increase year-over-year.

- The company raised its Fiscal 2026 outlook, now projecting net sales between $1,600 million and $1,612 million and adjusted diluted earnings per share between $3.05 and $3.10.

- As of December 31, 2025, e.l.f. Beauty held $196.8 million in cash and cash equivalents and had $816.7 million in long-term debt.

- For the three months ended December 31, 2025, e.l.f. Beauty reported net sales of $489.5 million, an increase of 38% year-over-year, and adjusted diluted earnings per share of $1.24.

- For the nine months ended December 31, 2025, net sales increased 21% to $1,187.2 million, with adjusted diluted earnings per share of $2.81.

- The company raised its fiscal 2026 outlook, now projecting net sales between $1,600 million and $1,612 million, Adjusted EBITDA between $323 million and $326 million, and Adjusted diluted earnings per share between $3.05 and $3.10.

- As of December 31, 2025, e.l.f. Beauty held $196.8 million in cash and cash equivalents and had $816.7 million of long-term debt.

Quarterly earnings call transcripts for e.l.f. Beauty.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more