Earnings summaries and quarterly performance for HARLEY-DAVIDSON.

Executive leadership at HARLEY-DAVIDSON.

Artie Starrs

President and Chief Executive Officer

Jagdish Krishnan

Chief Digital and Operations Officer

Jonathan Root

Chief Financial Officer and President, Commercial

Luke Mansfield

Chief Commercial Officer

Mark Kornetzke

Chief Accounting Officer

Paul Krause

Chief Legal Officer, Chief Compliance Officer, and Corporate Secretary

Tori Termaat

Chief Human Resources Officer

Board of directors at HARLEY-DAVIDSON.

Allan Golston

Director

James Farley Jr

Director

Jared Dourdeville

Director

Jochen Zeitz

Chairman of the Board

Lori Flees

Director

Maryrose Sylvester

Director

Norman Linebarger

Presiding Director

Rafeh Masood

Director

Sara Levinson

Director

Troy Alstead

Director

Research analysts who have asked questions during HARLEY-DAVIDSON earnings calls.

James Hardiman

Citigroup

13 questions for HOG

Robin Farley

UBS

13 questions for HOG

Tristan Thomas-Martin

BMO Capital Markets

13 questions for HOG

Joseph Altobello

Raymond James & Associates, Inc.

11 questions for HOG

Craig Kennison

Robert W. Baird & Co. Incorporated

10 questions for HOG

Jaime Katz

Morningstar

9 questions for HOG

Noah Zatzkin

KeyBanc Capital Markets

9 questions for HOG

Alexander Perry

Bank of America

8 questions for HOG

Frederick Wightman

Wolfe Research, LLC

6 questions for HOG

David Macgregor

Longbow Research

5 questions for HOG

Brandon Rollé

D.A. Davidson

3 questions for HOG

Joseph Nolan

Longbow Research

3 questions for HOG

Stephen Grambling

Morgan Stanley

3 questions for HOG

Megan Christine Alexander

Morgan Stanley

2 questions for HOG

Alex Perry

Bank of America

1 question for HOG

Megan Alexander

Morgan Stanley

1 question for HOG

Tristan Thomas Martin

BMO Capital Markets

1 question for HOG

Recent press releases and 8-K filings for HOG.

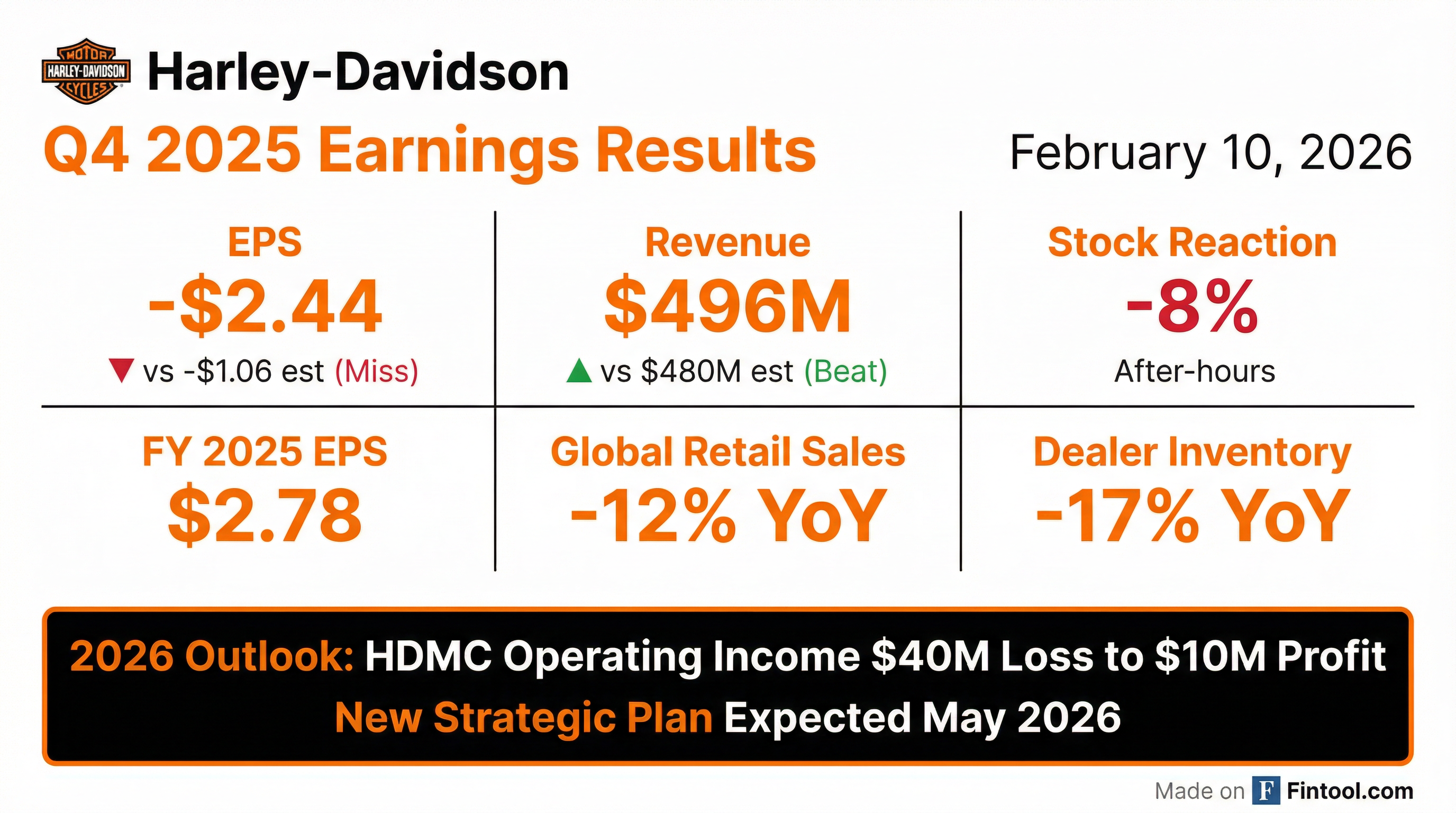

- Harley-Davidson reported a diluted EPS loss of $2.44 for Q4 2025 and diluted EPS of $2.78 for the full year 2025.

- HDMC revenue for Q4 2025 was $379 million, a 10% decrease year-over-year, while full-year 2025 total HDI revenue was $4,473 million, down 14%.

- The company completed a strategic transaction for HDFS in Q4 2025, selling approximately $6 billion of retail finance receivables and a 9.8% equity interest, which facilitated a $1 billion dividend from HDFS to HDI.

- In FY 2025, Harley-Davidson returned $434 million to shareholders through $347 million in discretionary share repurchases and $86 million in dividends.

- For 2026, HDMC projects global motorcycle retail sales and wholesale shipments of 130,000 to 135,000 units and an operating income/(loss) between ($40 million) and $10 million.

- Harley-Davidson reported a challenging Q4 and full year 2025, with consolidated revenue down 28% and 14% respectively, and a Q4 EPS loss of $2.44.

- The company implemented intentional actions to reduce wholesale shipments in Q4 2025, leading to a 17% reduction in dealer inventory by year-end to better align with retail demand.

- The HDFS transaction closed in Q4 2025, transforming it into a capital-light model, which resulted in a Q4 operating loss of $82 million for HDFS due to liability management costs, but also facilitated a $1 billion dividend to HDI.

- For 2026, the company forecasts wholesale and retail units of 130,000-135,000, expects $75 million-$105 million in new or increased tariffs, and anticipates at least $150 million of annual run rate savings from 2027.

- Harley-Davidson reported a 28% decrease in consolidated revenue and an EPS loss of $2.44 for Q4 2025, with full-year 2025 consolidated revenue reaching $4.5 billion, a 14% decline from the prior year.

- The company is positioning 2026 as a transition year, anticipating margins to be under pressure due to production running below wholesale and expecting a $25 million year-over-year headwind from incremental tariffs.

- A strategic partnership for Harley-Davidson Financial Services (HDFS) transformed it into a capital-light model, contributing to record high HDFS operating income of $490 million for full-year 2025 and facilitating a $1 billion dividend to HDI in Q4.

- Harley-Davidson successfully reduced global dealer inventory by 17% by the end of Q4 2025, exceeding its 10% goal, and expects at least $150 million of annual run rate savings from 2027 onwards, primarily from the Motor Company and HDFS.

- Harley-Davidson reported a consolidated revenue decrease of 28% and an EPS loss of $2.44 for Q4 2025, reflecting a challenging year.

- The HDFS transaction closed in Q4 2025, transforming Harley-Davidson Financial Services into a capital-light model, which led to an HDFS operating loss of $82 million in Q4 2025 due to liability management costs, despite record high full-year HDFS operating income of $490 million.

- Strategic actions to reduce elevated dealer inventory, including lower wholesale shipments and promotions, resulted in North American retail sales growth of 5% in Q4 2025, though global retail sales were down 1%.

- For 2026, the company forecasts wholesale and retail units of 130,000-135,000, expecting operating margins to be pressured by deleverage and increased tariffs of $75 million-$105 million.

- Management views 2026 as a transition year to reset the business, focusing on dealer profitability, brand momentum, and cost reduction, with a new strategic plan expected in May.

- Harley-Davidson, Inc. reported a diluted EPS of $2.78 for the full year 2025 and a diluted EPS loss of $2.44 for Q4 2025. Consolidated revenue for the full year 2025 was $4,473 million, down 14%, and Q4 2025 revenue was $496 million, down 28%.

- For the full year 2025, HDMC recorded an operating loss of $29 million, while Harley-Davidson Financial Services (HDFS) achieved a record-high operating income of $490 million following a strategic partnership with KKR and PIMCO, which also resulted in a $1 billion dividend from HDFS to HDI in Q4 2025.

- Global retail motorcycle sales for the full year 2025 decreased 12% to 132,535 units, and HDMC global motorcycle shipments were down 16% to 124,477 units.

- The company provided a 2026 outlook, projecting HDMC global motorcycle retail sales and wholesale shipments between 130,000 to 135,000 units, and HDMC operating income ranging from a $40 million loss to a $10 million profit.

- Harley-Davidson returned $434 million to shareholders in 2025, comprising $347 million in discretionary share repurchases and $86 million in dividends paid.

- Harley-Davidson reported a diluted EPS loss of $2.44 for Q4 2025 and diluted EPS of $2.78 for the full year 2025, with consolidated revenue declining 28% in Q4 and 14% for the full year.

- For the full year 2025, HDMC recorded an operating loss of $29 million, while Harley-Davidson Financial Services (HDFS) achieved a record-high operating income of $490 million, significantly impacted by a strategic transaction that also resulted in a $1 billion dividend to HDI.

- The company provided a 2026 outlook, projecting HDMC global motorcycle retail sales and wholesale shipments between 130,000 to 135,000 units, and HDMC operating income ranging from a $40 million loss to a $10 million profit.

- In 2025, Harley-Davidson returned $434 million of capital to shareholders, comprising $347 million in discretionary share repurchases and $86 million in dividends paid.

- On October 31, 2025, Harley-Davidson Financial Services, Inc. (HDFS) completed the issuance of Class A Common Stock equivalent to 9.8% of its Common Stock (on a fully diluted basis). This issuance was made to KKR Morrow OpCo Aggregator LLC (4.9%) and PIMCO Entities (4.9%), which are assignees of Cavendish LLC.

- Also on October 31, 2025, Harley-Davidson Credit Corp. (HDCC) completed the sale of a portion of its motorcycle promissory notes and security agreements portfolio. The sale was made to KKR Morrow Trust and HDL Trust (assignee of Cavendish) for a purchase price of $4.06 billion.

- Wolverine World Wide, Inc. reported Q3 2025 revenue of $470.3 million, an increase of 6.8% compared to the prior year, with a gross margin of 47.5% and adjusted diluted earnings per share of $0.36.

- For full-year 2025, the company anticipates revenue to be approximately $1.855 billion to $1.870 billion, representing 6.0% to 6.8% growth, and adjusted diluted earnings per share in the range of $1.29 to $1.34.

- During Q3 2025, the company changed its inventory accounting method for certain domestic inventory from last-in, first-out (LIFO) to first-in, first-out (FIFO).

- Inventory at the end of Q3 2025 was $293 million, down approximately 0.7% compared to the prior year, and Net Debt was $543 million, a decrease of approximately 3.6% year-over-year.

- Harley-Davidson (HOG) reported Q3 2025 consolidated revenue up 17% and consolidated operating income of $475 million, leading to earnings per share of $3.10. The consolidated operating income margin significantly improved to 35.4%, primarily driven by the HDFS transaction.

- The company completed a strategic partnership for Harley-Davidson Financial Services (HDFS) with KKR and PIMCO, involving a backbook sale, a forward flow agreement, and the sale of a 9.8% common equity interest. This transaction favorably impacted HDFS operating income by $362 million (472%) in Q3 2025 and is projected to unlock $1.2 to $1.25 billion in discretionary cash through Q1 2026.

- Global retail motorcycle sales were down 6% in Q3 2025, with North America down 5% and international markets down 9%. Despite this, the Softail family grew 9% in North America, and U.S. market share in the large cruiser category increased to 68%. Global dealer motorcycle inventories were down 13% year-over-year at the end of Q3 2025.

- In Q3 2025, Harley-Davidson repurchased 3.4 million shares for $100 million and announced plans for a $200 million Accelerated Share Repurchase as part of a broader $1 billion repurchase plan by the end of 2026.

- Harley-Davidson reported diluted EPS of $3.10 for Q3 2025, with HDMC revenue up 23% and global motorcycle shipments increasing 33% versus the prior year.

- The HDFS transaction, announced on July 30, 2025, is projected to unlock $1.2 – $1.25 billion in discretionary cash through Q1 2026. This transaction significantly impacted HDFS operating income, which reached $439 million in Q3 2025, partly due to a $301 million benefit in the provision for credit losses.

- For 2025, the company updated its guidance, projecting HDFS Operating Income between $525 million and $550 million and Harley-Davidson, Inc. Capital Investment between $175 million and $200 million. Other guidance, including EPS, was withdrawn on May 1, 2025.

Quarterly earnings call transcripts for HARLEY-DAVIDSON.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more