Earnings summaries and quarterly performance for MGM Resorts International.

Executive leadership at MGM Resorts International.

William J. Hornbuckle

Chief Executive Officer and President

Corey I. Sanders

Chief Operating Officer

Gary Fritz

Chief Commercial Officer and President, MGM Digital

John M. McManus

Chief Legal and Administrative Officer and Secretary

Jonathan S. Halkyard

Chief Financial Officer and Treasurer

Board of directors at MGM Resorts International.

Alexis M. Herman

Director

Barry Diller

Director

Ben Winston

Director

Daniel J. Taylor

Director

Donna Langley

Director

Jan G. Swartz

Director

Joey Levin

Director

Keith A. Meister

Director

Keith Barr

Director

Mary Chris Jammet

Director

Paul Salem

Chair of the Board

Rose McKinney-James

Director

Research analysts who have asked questions during MGM Resorts International earnings calls.

Barry Jonas

Truist Securities

6 questions for MGM

Brandt Montour

Barclays PLC

6 questions for MGM

Chad Beynon

Macquarie

6 questions for MGM

John DeCree

CBRE

6 questions for MGM

Shaun Kelley

Bank of America Merrill Lynch

6 questions for MGM

Stephen Grambling

Morgan Stanley

6 questions for MGM

David Katz

Jefferies Financial Group Inc.

4 questions for MGM

Carlo Santarelli

Deutsche Bank

3 questions for MGM

Daniel Politzer

Wells Fargo

3 questions for MGM

Steven Wieczynski

Stifel

2 questions for MGM

Steve Pizzella

Deutsche Bank

2 questions for MGM

Dan Politzer

Wells Fargo

1 question for MGM

Joseph Greff

JPMorgan Chase & Co.

1 question for MGM

Robin Farley

UBS

1 question for MGM

Recent press releases and 8-K filings for MGM.

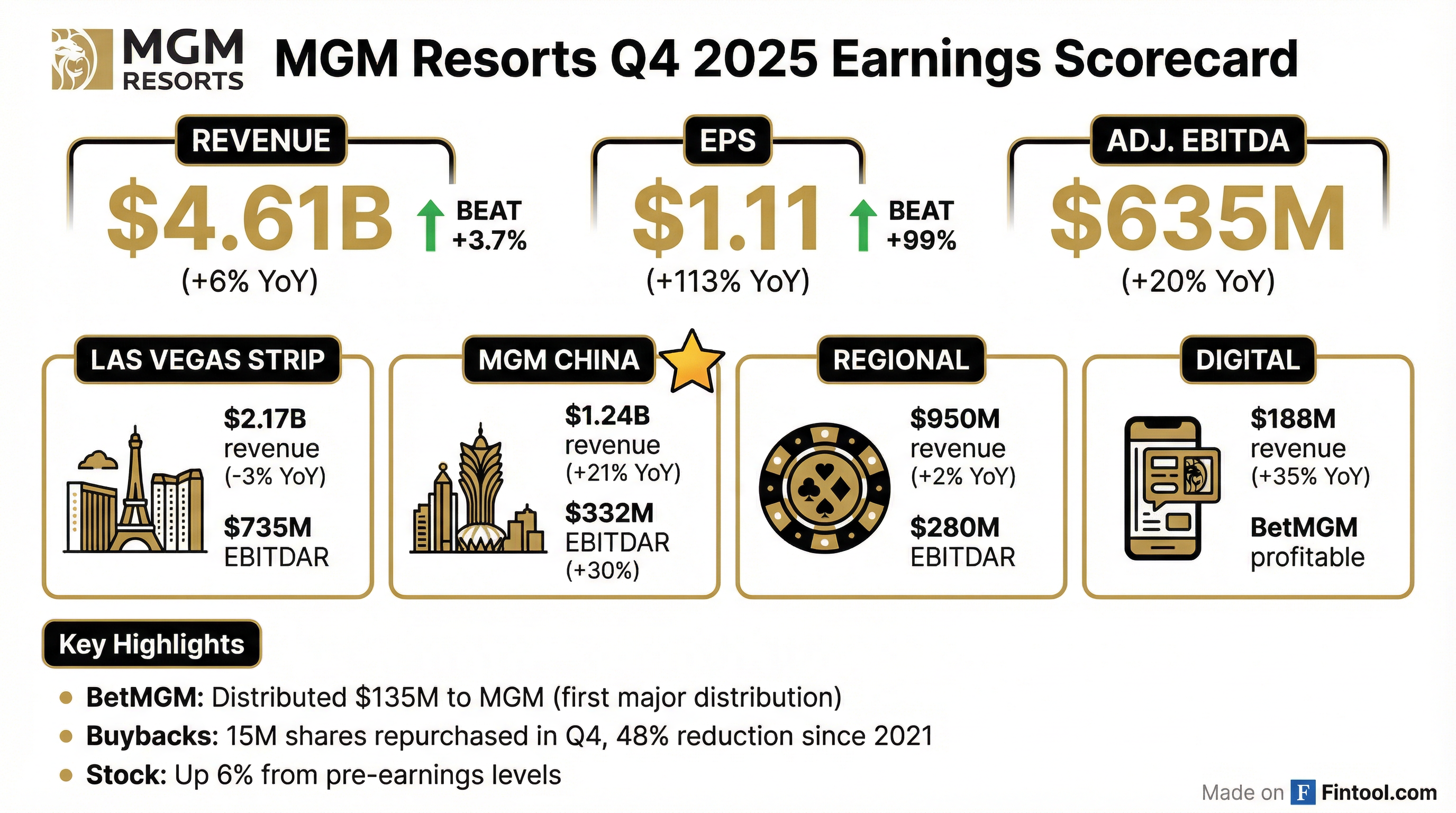

- MGM Resorts achieved record Q4 and full-year EBITDA in Macau while maintaining margins and a 16.5% market share, Las Vegas EBITDA stabilized with a 4% YoY decline, and regional operations recorded their best-ever slot win for Q4 and full year 2025.

- MGM China’s Q4 net revenues rose 21% and segment adjusted EBITDA grew 31% to a record high, sustaining a 16.5% market share for the quarter.

- BetMGM delivered a nearly $470 million EBITDA turnaround in Q4, commenced distributions to its parents, and guided 2026 adjusted EBITDA of $300–$350 million.

- The company repurchased $500 million of shares in Q4—bringing total 2025 buybacks to $37.2 billion at an average price of $32.43—reducing its share count by almost 50% over five years.

- Major 2025 capital projects, including the MGM Grand room renovation, are now complete and will contribute fully in 2026, and the company broke ground on the MGM Osaka integrated resort.

- MGM achieved record Q4 and full-year EBITDA in Macau, supporting consolidated EBITDA growth of 20% in Q4 2025.

- BetMGM delivered a $135 million distribution after a $470 million annual EBITDA turnaround in 2025 and reaffirmed a $500 million Adjusted EBITDA target for 2027.

- MGM China posted 21% net revenue growth and 31% segment adjusted EBITDA growth in Q4, and raised branding fees from 1.75% to 3.5%, adding over $50 million in annual cash flow.

- The company repurchased $500 million of shares in Q4, bringing 2025 buybacks to $37.2 billion, and has cut share count by almost 50% over five years.

- Capital projects, including the MGM Grand room renovation, are now fully operational for 2026, and developments in Dubai (3Q 2028) and MGM Osaka (2030) remain on schedule.

- Management update: Ayesha Molino appointed COO; Kenneth Feng named CEO of MGM China; Tian Han promoted to COO.

- Achieved record Q4 and full-year 2025 EBITDA in Macau, maintaining margins and outsized market share.

- BetMGM delivered a $470 million EBITDA turnaround in 2025, with a $135 million distribution to MGM in Q4; monthly player volumes +24% and active player days +14%.

- Capital allocation: $37.2 billion of share repurchases in 2025 at an average price of $32.43, reducing share count by ~50% over five years.

- 2026 outlook underpinned by stabilizing Las Vegas trends, mid-single-digit group/convention revenue growth, full-year benefit from completed capital projects, and on-schedule developments in Dubai (3Q 2028) and Osaka (2030).

- Consolidated Q4 2025 net revenues of $4.6 billion (+6%), net income attributable of $294 million (+87%) and consolidated Adjusted EBITDA of $635 million (+20%).

- Full year 2025 net revenues of $17.5 billion (+2%), net income attributable of $206 million (vs $747 million in 2024) and consolidated Adjusted EBITDA of $2.4 billion (+1%).

- MGM China segment delivered Q4 net revenues of $1.2 billion (+21%) and segment Adjusted EBITDAR of $332 million (+30%).

- BetMGM North America Venture distributed $135 million to MGM Resorts in Q4 2025, returning over 20% of MGM’s cash investment.

- Repurchased 15 million shares in Q4 2025 (and 37.5 million shares in 2025), reducing shares outstanding by ~48% since 2021.

- In Q4 2025, MGM Resorts achieved $4.6 billion in consolidated net revenues (up 6%), net income attributable to MGM Resorts of $294 million (up 87%), and Consolidated Adjusted EBITDA of $635 million (up 20%), with diluted EPS of $1.11 and Adjusted EPS of $1.60.

- Segment performance included Las Vegas Strip revenues of $2.2 billion (down 3%), Regional Operations revenues of $950 million (up 2%), and MGM China revenues of $1.2 billion (up 21%).

- The BetMGM North America Venture distributed $135 million to MGM Resorts during the quarter, returning over 20% of MGM’s cash investment.

- MGM Resorts repurchased 15 million shares in Q4 and 37.5 million shares in 2025, reducing outstanding share count by approximately 48% since 2021.

- On February 4, 2026, MGM Resorts International inadvertently published preliminary, unaudited financial results for Q4 and FY 2025, subject to completion of closing procedures and not deemed filed with the SEC.

- Q4 2025 revenues were $4.605 billion, with net income attributable to MGM Resorts International of $293.6 million, up from $157.4 million in Q4 2024.

- Q4 2025 Consolidated Adjusted EBITDA was $635.3 million, compared to $528.5 million in Q4 2024; FY 2025 Adjusted EBITDA totaled $2.426 billion.

- BetMGM delivered $2.8 billion in FY 2025 net revenue, up 33% YoY, driven by 24% growth in iGaming and 63% growth in online sports.

- FY 2025 EBITDA was $220 million, up $464 million YoY, enabling a $270 million cash distribution to MGM and Entain in Q4 2025.

- Average monthly actives rose 4% YoY, reflecting stronger player engagement and retention.

- For FY 2026, BetMGM expects net revenue of $3.1–$3.2 billion and Adjusted EBITDA of $300–$350 million, with a path to $500 million Adjusted EBITDA in FY 2027.

- MGM Resorts and MGM China signed a new branding agreement effective January 1, 2026, extending the right to use the “MGM” name through the end of the 2032 concession term, with an automatic extension until the earlier of a new concession’s expiration or December 31, 2045.

- The monthly license fee rate doubles from 1.75% to 3.5% of MGM China’s adjusted consolidated net monthly revenues, subject to an annual cap, with MGM Resorts receiving approximately 66.6% of the fee.

- The agreement removes the need for triennial renegotiations, securing MGM China’s key intangible asset and providing stable compensation to MGM Resorts.

- Since the end of the pandemic, MGM China’s market share has grown from about 9% to approximately 16% as of September 30, 2025, underscoring the value of the MGM brand.

- Total revenues rose 4.4% year-over-year to $1.0 billion in Q3 2025.

- Net income attributable to common stockholders increased 4.0% to $762.0 million (EPS $0.71), while AFFO grew 7.4% to $637.6 million (AFFO per share $0.60).

- Declared a $0.45 quarterly dividend (4.0% increase year-over-year).

- Updated full-year 2025 AFFO guidance to $2,510 million–$2,520 million or $2.36–$2.37 per diluted share.

- Agreed to a new triple-net lease with Clairvest on the MGM Northfield Park property, marking the company’s 14th tenant.

- Las Vegas segment EBITDA was $601 million, down $130 million year-over-year; net revenue declined 7% with a 7% reduction in FTEs amid renovation disruption, lower occupancy and ADR headwinds.

- Regional operations delivered an all-time record slot win, while MGM China achieved record Q3 EBITDA and a 15.5% market share over the first three quarters of 2025.

- BetMGM raised its 2025 EBITDA guidance to $200 million and will initiate at least $100 million in cash distributions to MGM Resorts in Q4; MGM Digital revenue grew 23% with a Q3 EBITDA loss of $23 million and full-year digital EBITDA losses expected to approach $100 million due to Brazil investments.

- The company withdrew its commercial license application in Yonkers and sold Northfield Park for $546 million in cash at a 6.6× multiple; it expects business stabilization in Q4 and growth in 2026, supported by 90% of group and convention bookings already contracted and strong F1 presales.

Quarterly earnings call transcripts for MGM Resorts International.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more