Earnings summaries and quarterly performance for ServiceNow.

Executive leadership at ServiceNow.

William R. McDermott

Chief Executive Officer

Amit Zavery

President, Chief Product Officer and Chief Operating Officer

Gina Mastantuono

President and Chief Financial Officer

Jacqueline Canney

Chief People and AI Enablement Officer

Nicholas Tzitzon

Vice Chairman

Paul Fipps

President, Global Customer Operations

Russell S. Elmer

General Counsel and Secretary

Board of directors at ServiceNow.

Research analysts who have asked questions during ServiceNow earnings calls.

Samad Samana

Jefferies

8 questions for NOW

Alex Zukin

Wolfe Research LLC

5 questions for NOW

Bradley Sills

Bank of America

5 questions for NOW

Keith Weiss

Morgan Stanley

5 questions for NOW

Mark Murphy

JPMorgan Chase & Co.

5 questions for NOW

Michael Turrin

Wells Fargo

5 questions for NOW

Karl Keirstead

UBS

4 questions for NOW

Kasthuri Rangan

Goldman Sachs

4 questions for NOW

Aleksandr Zukin

Wolfe Research

3 questions for NOW

Brad Zelnick

Credit Suisse

3 questions for NOW

Brian Schwartz

Oppenheimer & Co.

3 questions for NOW

Gregg Moskowitz

Mizuho

3 questions for NOW

Kash Rangan

Goldman Sachs

3 questions for NOW

Patrick Walravens

Citizens JMP

3 questions for NOW

Peter Weed

Bernstein

3 questions for NOW

Raimo Lenschow

Barclays

3 questions for NOW

Arjun Bhatia

William Blair

2 questions for NOW

Craig Turin

Evercore ISI

2 questions for NOW

Gabriela Borges

Goldman Sachs

2 questions for NOW

Grant Sales

Bank of America Securities

2 questions for NOW

James Wood

TD Cowen

2 questions for NOW

Keith Spackman

BMO

2 questions for NOW

Matt Hedberg

RBC

2 questions for NOW

Matthew Hedberg

RBC Capital Markets

2 questions for NOW

Peter Reed

Lion's Spring Team

2 questions for NOW

Ryan Lampson

Morgan Stanley

2 questions for NOW

Sanjit Singh

Morgan Stanley

2 questions for NOW

Tyler Radke

Citigroup Inc.

2 questions for NOW

Derek Wood

TD Cowen

1 question for NOW

Derrick Wood

TD Cowen

1 question for NOW

Keith Bachman

BMO Capital Markets

1 question for NOW

Kylie Towbin

Citigroup Inc.

1 question for NOW

Michael Cikos

Needham & Company

1 question for NOW

Mike Cikos

Needham & Company, LLC

1 question for NOW

Robbie Owens

Piper Sandler

1 question for NOW

S. Kirk Materne

Evercore ISI

1 question for NOW

Recent press releases and 8-K filings for NOW.

- Boomi serves over 30,000 clients worldwide, including more than a quarter of the Fortune 500, achieving a 50% increase in its customer base in just over three years.

- Its AI activation platform now runs over 75,000 agents in production, executing enterprise‐level transactions with high reliability.

- Boomi is the only vendor recognized as a leader in both the Gartner Magic Quadrant for iPaaS (11th consecutive year) and for API Management, and was included in the IDC MarketScape and ISG Buyers Guide leadership categories.

- Strategic acquisitions of Rivery and Thru have enhanced real‐time data integration and enterprise managed file transfer, driving a 270% increase in customer usage post‐acquisition.

- The company expanded its global workforce by 40% over three years, including more than 250 employees in Vancouver, positioning it for the 2026 shift from AI experimentation to activation.

- Boomi’s AI-enabled integration platform has seen customer adoption grow by 50% over three years, serving over 30,000 global clients, including more than 500 Fortune 500 enterprises and powering 75,000+ intelligent agents in production.

- The platform was positioned as a “Leader” in both the Gartner® iPaaS and API Management Magic Quadrants for 11 consecutive reports, and was named a “Major Contender” in the IDC MarketScape: 2025 Worldwide Integration Platform report.

- Boomi became the first provider certified under ISO/IEC 42001 for AI governance, registered in the CSA STAR, earned a 96-point SecurityScorecard, and maintained an average rating above 95 among leading iPaaS suppliers over the past 18 months.

- Strategic acquisitions of Rivery (now Boomi Data Integration) and Thru, Inc. have expanded real-time data ingestion and Managed File Transfer (MFT) capabilities, driving over 270% growth in customer adoption of these services.

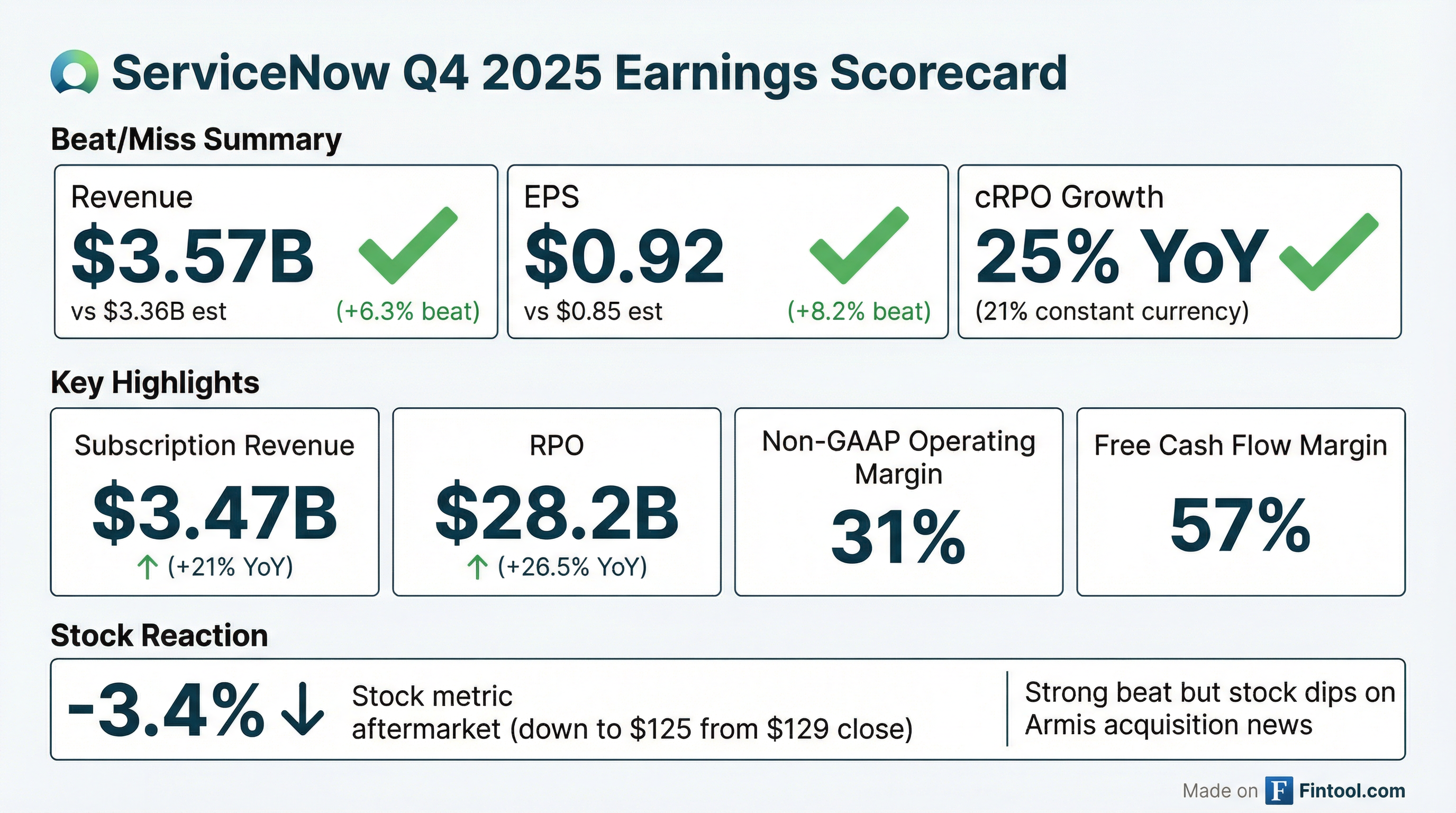

- Q4 subscription revenue of $3.466 billion, up 19.5% YoY in constant currency, exceeded guidance by 150 bps; RPO ended at $28.2 billion (+22.5% CC).

- Non-GAAP operating margin of 31% and free cash flow margin of 57% in Q4; full-year 2025 FCF margin was 35%, 100 bps above guidance.

- Board authorized an incremental $5 billion share buyback and launched a $2 billion accelerated share repurchase program.

- 2026 outlook: subscription revenues of $15.53 – 15.57 billion (+19.5 – 20% CC), operating margin 32%, and free cash flow margin 36%.

- Q4 subscription revenues of $3.466 billion, up 19.5% year-over-year in constant currency; RPO reached $28.2 billion, a 22.5% increase.

- Non-GAAP operating margin was 31%, 100 bps above guidance; free cash flow margin was 57%, up 950 bps year-over-year, driving $4.6 billion in full-year free cash flow.

- Board authorized an additional $5 billion in share repurchases and initiated a $2 billion accelerated share repurchase, with $1.4 billion remaining authorization.

- 2026 guidance: subscription revenues of $15.53 billion–$15.57 billion (+19.5%–20% CC), operating margin of 32%, and free cash flow margin of 36%.

- Q4 subscription revenue was $3.466 billion, up 19.5% year-over-year in constant currency, exceeding guidance by 150 bps.

- Q4 non-GAAP operating margin was 31% and free cash flow margin was 57%, up 950 bps year-over-year.

- 2026 guidance calls for subscription revenues of $15.53 billion–$15.57 billion (+19.5–20% YoY CC), operating margin of 32%, and free cash flow margin of 36%.

- Board authorized an additional $5 billion share repurchase and a $2 billion accelerated share repurchase program.

- Subscription revenues were $3,466 million (+21% YoY), total revenues were $3,568 million (+20.5%), cRPO was $12.85 billion (+25%), RPO was $28.2 billion (+26.5%).

- The Board authorized an additional $5 billion share repurchase program and announced a $2 billion accelerated share repurchase.

- In Q4, ServiceNow repurchased 3.6 million shares for $597 million, with $1.4 billion remaining available under the program.

- Q4 net new ACV included 244 transactions over $1 million (≈40% YoY growth) and 603 customers with >$5 million ACV (≈20% YoY growth).

- Provided Q1 2026 subscription revenue guidance of $3,650–$3,655 million (+21.5% YoY) and full-year 2026 subscription revenue guidance of $15,530–$15,570 million (20.5–21% YoY).

- ServiceNow and Anthropic will integrate Claude models into the ServiceNow AI Platform to power agentic workflows and enterprise app development via ServiceNow Build Agent.

- Claude is now the default model for Build Agent, deployed to 29,000 employees with early use showing up to a 95% reduction in seller preparation time.

- ServiceNow expects Build Agent traction to quadruple over the next 12 months and aims to cut customer implementation time by 50%, from sales to autonomous deployment.

- The partnership targets mission-critical industries—such as healthcare and life sciences—where AI-assisted workflows could reduce tasks like claims authorization from days to hours.

- Periscope Equity sold brightfin’s ServiceNow-native enterprise business to Silversmith Capital Partners-backed Proven Optics in January 2026.

- The firm reintroduced Mobile Solutions as a standalone platform focused on mid-market mobility and telecom spend optimization, serving 300+ customers.

- Chebem Chukwu, a 15-year mobile telecom veteran, was appointed CEO to lead platform growth and strategic acquisitions.

- Mobile Solutions aims to enhance visibility, automation, and cost control across the full mobility lifecycle for SMB and mid-market organizations.

- ServiceNow announced enhancements to its global Partner Program—introducing a reimagined Build Program, unified investment portfolio, and simplified pricing—to accelerate partner-led AI agent innovation.

- The redesigned Build Program features a modernized tier structure (Registered, Select, Premier, Elite) plus a new Access Tier, enabling 1,000+ partners to start building immediately and transition by March 2026.

- The expanded investment portfolio includes a Market Development Fund with 100% reimbursement, a Strategic Investment Fund, and incentives for sell-through, deployment, and specialization.

- With 2,700+ partners globally, ServiceNow positions its ecosystem to meet growing enterprise demand for AI agents and generative workflow innovation.

- ServiceNow announced a three-year partnership with OpenAI to embed GPT-5.2 models into its enterprise workflow platform, enabling AI agents for IT support, customer service, and operations.

- The agreement features a usage-based revenue commitment to OpenAI, though financial terms were not disclosed.

- ServiceNow frames the deal as part of a broader push to serve as an AI control tower, building on acquisitions like Armis (nearly $8 billion) and Moveworks (~$3 billion).

- The company has faced financial challenges, with shares down by ~41% over the past year and four consecutive quarterly EPS misses; CEO Bill McDermott forecasted about 1.2 million digital agents in enterprises within two years.

Fintool News

In-depth analysis and coverage of ServiceNow.

Quarterly earnings call transcripts for ServiceNow.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more